228x Filetype XLSX File size 0.11 MB Source: www.acsa.asn.au

Sheet 1: Fee Calculator

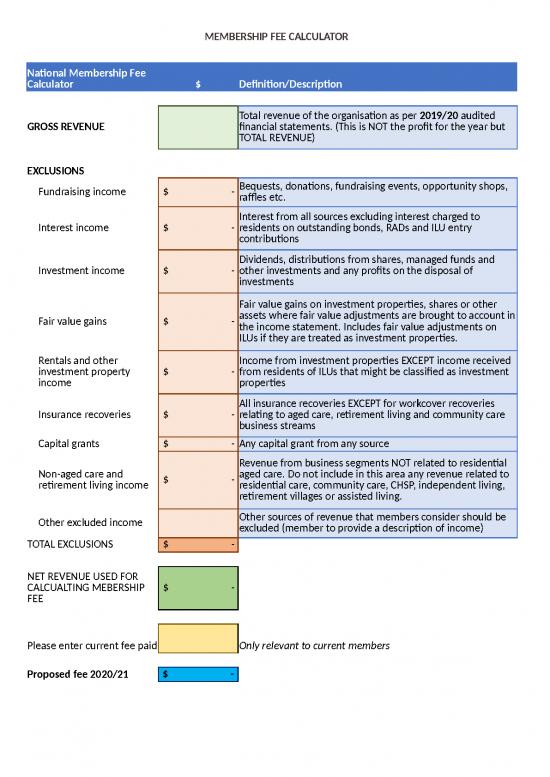

| National Membership Fee Calculator | $ | Definition/Description |

| GROSS REVENUE | Total revenue of the organisation as per 2019/20 audited financial statements. (This is NOT the profit for the year but TOTAL REVENUE) | |

| EXCLUSIONS | ||

| Fundraising income | $- | Bequests, donations, fundraising events, opportunity shops, raffles etc. |

| Interest income | $- | Interest from all sources excluding interest charged to residents on outstanding bonds, RADs and ILU entry contributions |

| Investment income | $- | Dividends, distributions from shares, managed funds and other investments and any profits on the disposal of investments |

| Fair value gains | $- | Fair value gains on investment properties, shares or other assets where fair value adjustments are brought to account in the income statement. Includes fair value adjustments on ILUs if they are treated as investment properties. |

| Rentals and other investment property income | $- | Income from investment properties EXCEPT income received from residents of ILUs that might be classified as investment properties |

| Insurance recoveries | $- | All insurance recoveries EXCEPT for workcover recoveries relating to aged care, retirement living and community care business streams |

| Capital grants | $- | Any capital grant from any source |

| Non-aged care and retirement living income | $- | Revenue from business segments NOT related to residential aged care. Do not include in this area any revenue related to residential care, community care, CHSP, independent living, retirement villages or assisted living. |

| Other excluded income | Other sources of revenue that members consider should be excluded (member to provide a description of income) | |

| TOTAL EXCLUSIONS | $- | |

| NET REVENUE USED FOR CALCUALTING MEBERSHIP FEE | $- | |

| Please enter current fee paid | Only relevant to current members | |

| Proposed fee 2020/21 | $- |

no reviews yet

Please Login to review.