295x Filetype XLSX File size 0.10 MB Source: victoryspirits.com

Sheet 1: Start

| Investment Tracker | Investment Tracker | |||||||||||

| Portfolio | Portfolio | |||||||||||

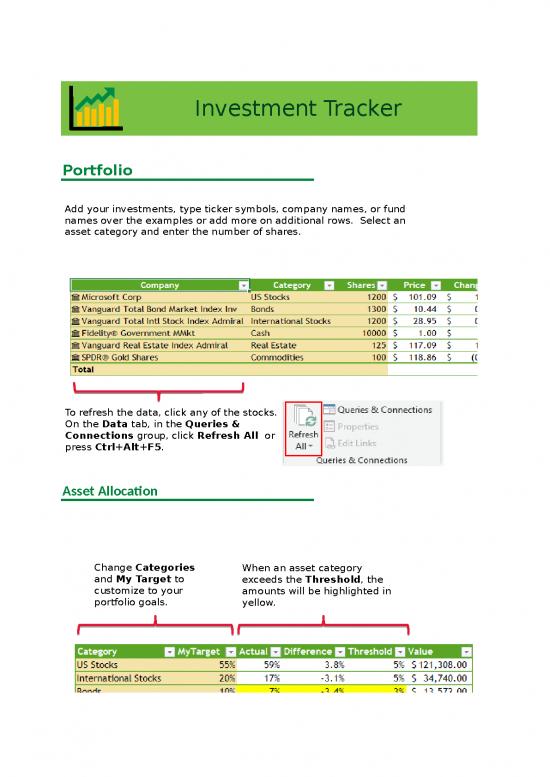

| Add your investments, type ticker symbols, company names, or fund names over the examples or add more on additional rows. Select an asset category and enter the number of shares. | ||||||||||||

| Click the Add Column button to add additional columns like Ticker Symbol or Exchange. | ||||||||||||

| To refresh the data, click any of the stocks. On the Data tab, in the Queries & Connections group, click Refresh All or press Ctrl+Alt+F5. | ||||||||||||

| Asset Allocation | Asset Allocation | |||||||||||

| Change Categories and My Target to customize to your portfolio goals. | ||||||||||||

| When an asset category exceeds the Threshold, the amounts will be highlighted in yellow. | ||||||||||||

| Investment Tracker | Investment Tracker | ||||||||

| Portfolio | Major Indexes and Select Company Stock 2017-2020 | ||||||||

| There is a table with existing stocks in cells B5:I11, and a total row on row 12. Enter a company name in cells B5:B11, then go to Data > Refresh, or press Ctrl+Alt+F5. | Company | Category | Shares | 17 Price | 20 Price | Change (%) | Cost Basis | Value | Gain |

| Add your investments, type ticker symbols, company names, or fund names over the examples or add more on additional rows. Select an asset category and enter the number of shares. | Vanguard Total International Stock Index Fund | US Stocks | 213 | $117.59 | $192.63 | 63.81% | $25,000.00 | $40,953.74 | $15,953.74 |

| Click the Add Column button to add additional columns like Ticker Symbol or Exchange. | #VALUE! | Real Estate | 906 | $27.58 | $27.98 | 1.45% | $25,000.00 | $25,362.58 | $362.58 |

| To refresh the data, click any of the stocks. On the Data tab, in the Queries & Connections group, click Refresh All or press Ctrl+Alt+F5. | SPDR Gold Shares (SPDR:GLD) | Commodities | 219 | $114.13 | $175.67 | 53.92% | $25,000.00 | $38,480.24 | $13,480.24 |

| Total | $75,000.00 | $104,796.56 | $29,796.56 | ||||||

| *Purchase price as of January 1, 2017* | |||||||||

| *Current price as of December 1, 2020* | |||||||||

| Bourbon Bond Fund | |||||||||

| Company | Category | Shares | Expense | Avg Sale Price | Change (%) | Cost Basis | Value | Gain | |

| 2 Years Matured | $1,000.00 | $1,900.00 | 90.00% | $25,000.00 | $47,500.00 | $22,500.00 | |||

| 3 Years Matured | $1,102.00 | $2,466.67 | 123.84% | $25,000.00 | $55,958.94 | $30,958.94 | |||

| 4 Years Matured | $1,212.00 | $2,966.67 | 144.77% | $25,000.00 | $61,193.69 | $36,193.69 | |||

| Total | $75,000.00 | $164,652.63 | $89,652.63 | ||||||

| (excluding broker at sale) | |||||||||

| U.S. American Whiskey Supplier Revenues 2017-2019 | |||||||||

| Company | Category | Shares | 17 Price | 19 Price | Change (%) | Cost Basis | Value | Gain | |

| Value | $224.00 | $224.00 | 0.00% | $25,000.00 | $25,000.00 | $- | |||

| Premium | $628.00 | $739.00 | 17.68% | $25,000.00 | $29,418.79 | $4,418.79 | |||

| High End Premium | $1,965.00 | $2,212.00 | 12.57% | $25,000.00 | $28,142.49 | $3,142.49 | |||

| Super Premium | $551.00 | $804.00 | 45.92% | $25,000.00 | $36,479.13 | $11,479.13 | |||

| Total | $100,000.00 | $119,040.41 | $19,040.41 |

no reviews yet

Please Login to review.