206x Filetype XLSX File size 0.24 MB Source: srinivesh.in

Sheet 1: Instructions

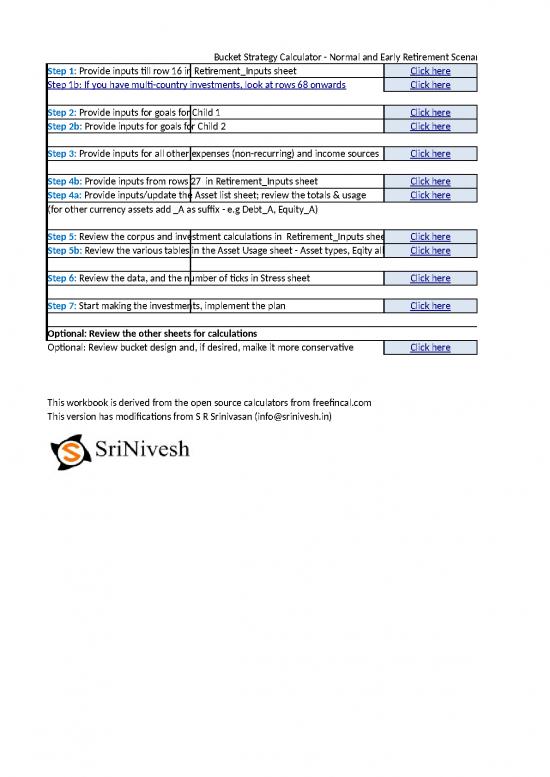

| Bucket Strategy Calculator - Normal and Early Retirement Scenario ver 4.8; July 2020 | ||||||||

| Step 1: Provide inputs till row 16 in Retirement_Inputs sheet | Click here | |||||||

| Step 1b: If you have multi-country investments, look at rows 68 onwards | Click here | |||||||

| Step 2: Provide inputs for goals for Child 1 | Click here | |||||||

| Step 2b: Provide inputs for goals for Child 2 | Click here | |||||||

| Step 3: Provide inputs for all other expenses (non-recurring) and income sources | Click here | |||||||

| Step 4b: Provide inputs from rows 27 in Retirement_Inputs sheet | Click here | |||||||

| Step 4a: Provide inputs/update the Asset list sheet; review the totals & usage | Click here | |||||||

| (for other currency assets add _A as suffix - e.g Debt_A, Equity_A) | ||||||||

| Step 5: Review the corpus and investment calculations in Retirement_Inputs sheet | Click here | |||||||

| Step 5b: Review the various tables in the Asset Usage sheet - Asset types, Eqity allocation, Funds | Click here | |||||||

| Step 6: Review the data, and the number of ticks in Stress sheet | Click here | |||||||

| Step 7: Start making the investments, implement the plan | Click here | |||||||

| Optional: Review the other sheets for calculations | ||||||||

| Optional: Review bucket design and, if desired, maike it more conservative | Click here | |||||||

| This workbook is derived from the open source calculators from freefincal.com | ||||||||

| This version has modifications from S R Srinivasan (info@srinivesh.in) | ||||||||

| The Low-stess Retirement and All Goals Calculator - Consolidated Version | (Sample user) | Consolidated => Retirement, Other goals | These are used to drive the values in the first two columns… | Base Country | Other country | ||||||||||||||||||||||||||||||

| Enter data only in green cells | Version with buckets beginning on retirement | (copy the appropriate values into AC and AD) | INR | USD | INR | USD | AUD | EUR | UKP | ||||||||||||||||||||||||||

| Estimate of monthly expenses at Financial Freedom | 50,000 | Your estimate for the living expenses, at current cost. Use the goal planner sheet to enter all other goals. | Terms 'Retirment' and 'Financial Freedom' used interchngeably | Estimate of monthly expenses at Financial Freedom | ₹ 123,123,123 | $ 123.123,123 | $ 1231.231,231 | £ 1.231,231 | £ | ||||||||||||||||||||||||||

| Annual expenses that would persist in retirement | 100,000 | 2020 | Annual expenses that would persist in retirement | $ 123,123 | |||||||||||||||||||||||||||||||

| Total average monthly expenses | 58,333 | 700,000 | 62416.6666666667 | 749,000.0 | Total average monthly expenses | 0 | |||||||||||||||||||||||||||||

| If you expect income from other sources In retirement, please use row 72 in Planner sheet | |||||||||||||||||||||||||||||||||||

| Plan year | 2021 | Plan year | 2020 | ||||||||||||||||||||||||||||||||

| Inflation before retirement | 7.0% | This is a conservative estimate. Recent inflation trend has been downward, but it helps to conservative. | Inflation before retirement | 7.0% | 7.0% | 3.0% | |||||||||||||||||||||||||||||

| Age, at the end of current year | 34 | Age, at the end of current year | 38 | ||||||||||||||||||||||||||||||||

| Age you wish to achieve Financial Independence | 47 | You would build your corpus till this time | Age you wish to achieve Financial Independence | 53 | |||||||||||||||||||||||||||||||

| Age when you start to withdraw from the corpus for living expenses (if you plan to have 'CoastFI' period) | 47 | For the intervening period, your income would support living expenses; while your corpus will fund large expenses | Age when you start to withdraw from the corpus for living expenses (if you plan to have 'CoastFI' period) | 53 | |||||||||||||||||||||||||||||||

| No of years you expect to live! (90 years for the lady) | 93 | That is life expectancy of younger spouse. Do not underestimate! | No of years you expect to live! (90 years for the lady) | 93 | |||||||||||||||||||||||||||||||

| Years to Financial Freedom | 13 | You don't add to the corpus after this | Years to Financial Freedom | 15 | |||||||||||||||||||||||||||||||

| Years to passive income | 13 | You use the corpus for living expenses after this | Years to passive income | 15 | |||||||||||||||||||||||||||||||

| Monthly expenses in first year of retirement | 140,574 | 1,686,892 | Monthly expenses in first year of retirement | 0 | |||||||||||||||||||||||||||||||

| Years in retirement | 46 | This is how long you need to be financially independent | The calculator has a default setting of 55 for cells B11+B14 | Years in retirement | 40 | ||||||||||||||||||||||||||||||

| Inflation during retirement | 8.0% | Again not less than 8%. Nothing will change in India in the future! | Inflation during retirement | 8.0% | 8.0% | 3.5% | |||||||||||||||||||||||||||||

| Post-tax average return expected from retirement corpus | 8.0% | Return expected when you invest your retirement corpus in a single bucket | Note: If this is not less than inflation, you may not need this calculator | Post-tax average return expected from retirement corpus | 8% | 8% | 3% | ||||||||||||||||||||||||||||

| Check out posts on post-retirement investment strategies to optimise this. For now set it to a low number. Not more than the inflation expected | Check out posts on post-retirement investment strategies to optimise this. For now set it to a low number. Not more than the inflation expected | ||||||||||||||||||||||||||||||||||

| Total Corpus required with constant post retirement return | 108,498,117 | This is the output of conventional retirement calculators | 39,894,532 | Total Corpus required with constant post retirement return | |||||||||||||||||||||||||||||||

| Total Corpus required if the bucket strategy is used | 96,768,993 | In this case the money will grow in buckets of varying risk-reward profiles. | 35,581,758 | Total Corpus required if the bucket strategy is used | |||||||||||||||||||||||||||||||

| Present day value of the future corpus | 35,581,758 | A lumpsum investment of this amount can meet your goals | Present day value of the future corpus | ||||||||||||||||||||||||||||||||

| With bucket strategy, the corpus requirement has reduced by | 11% | Please see row 70 if you have multi-country investments | With bucket strategy, the corpus requirement has reduced by | ||||||||||||||||||||||||||||||||

| Post-tax Rate of return (to be used for current and future investments) | The values below are used for building the corpus. See the income ladder sheet for returns during retirement. | Post-tax Rate of return (to be used for current and future investments) | |||||||||||||||||||||||||||||||||

| Post-tax Rate of return expected from equity investments | 10.0% | Recommend 10%. Set this higher and your stress will increase! | Post-tax Rate of return expected from equity investments | 10.0% | 10.0% | 7.0% | |||||||||||||||||||||||||||||

| Post-rax Rate of return expected from taxable debt holdings | 6.0% | Recommended 6% (post-tax FD return for highest tax slab) | Post-rax Rate of return expected from taxable debt holdings | 6.0% | 6.0% | 3.5% | |||||||||||||||||||||||||||||

| Rate of return expected from tax-free debt holdings (PPF, SSY) | 7.0% | Recommended 7.5% or less | Rate of return expected from tax-free debt holdings (PPF, SSY) | 7.0% | 7.0% | 4.0% | |||||||||||||||||||||||||||||

| (PPF, SSY) | muni bond | ||||||||||||||||||||||||||||||||||

| Present Value of investments (derived from AssetUsage sheet) | Estimated Value at the time of Financial Freedom | These would keep growing till you actually withdraw | Present Value of investments (derived from AssetUsage sheet) | ||||||||||||||||||||||||||||||||

| Value of current equity invesments, with suggested changes | 4,200,000 | 14,499,539 | Value of current equity invesments, with suggested changes | 0 | 99.0% | ||||||||||||||||||||||||||||||

| Value of current taxable debt investments (FD, debt fund etc.), with suggested changes | 2,200,000 | 4,692,442 | Value of current taxable debt investments (FD, debt fund etc.), with suggested changes | 0 | |||||||||||||||||||||||||||||||

| Value of current tax-free debt investments (PPF, SSY) etc. not EPF or NPS | 1,250,000 | 3,012,306 | Value of current tax-free debt investments (PPF, SSY) etc. not EPF or NPS | 0 | |||||||||||||||||||||||||||||||

| Lump sum expected at the time of retirement (gratuity, asset sale proceeds, etc.) | 1,400,000 | 1,400,000 | Lump sum expected at the time of retirement (gratuity, asset sale proceeds, etc.) | 0 | |||||||||||||||||||||||||||||||

| 1 | EPF or NPS | 401(k) | |||||||||||||||||||||||||||||||||

| Current balance (please get latest value) in EPF or NPS | 1,508,945 | Current balance (please get latest value) in EPF or NPS | |||||||||||||||||||||||||||||||||

| Current monthly mandatory contribution | 23,000 | Include employee and employer contributions | 0 | Current monthly mandatory contribution | |||||||||||||||||||||||||||||||

| Annual increase in this contribution (be realistic) | 5.0% | With current balance, future EPF contributions will grow to | Annual increase in this contribution (be realistic) | 5.0% | 5.0% | ||||||||||||||||||||||||||||||

| Expected rate of return for EPF or NPS | 8.5% | 12,933,238 | Note: You can withdraw entire PF amount after 2 months of no employment | Expected rate of return for EPF or NPS | 8.5% | 8.5% | 6.0% | ||||||||||||||||||||||||||||

| Percentage of equity in this product, if not zero | 0% | Percentage of equity in this product, if not zero | 0% | 0% | 50% | ||||||||||||||||||||||||||||||

| Net Corpus to be accumulated with constant post-retirement return | 71,960,591 | Equity shortfall: -3,20,90,355 | |||||||||||||||||||||||||||||||||

| Net Corpus to be accumulated with bucket strategy | 60,231,468 | Notice the reduction. | Debt shortfall: -2,95,41,113 | ||||||||||||||||||||||||||||||||

| You will need to invest some amount each month to attain this corpus | (positive numbers denote excess) | ||||||||||||||||||||||||||||||||||

| What percentage of this monthly investment would you: | |||||||||||||||||||||||||||||||||||

| 1) allocate to equity | 70% | Typical max recommendation is 80% no matter how far retirement is | |||||||||||||||||||||||||||||||||

| 2) allocate to taxable debt instruments | 30% | Effective equity percentage, including PF, PPF, etc, is: 57% | |||||||||||||||||||||||||||||||||

| 3) allocate to tax-free debt instruments | Enter amount below | ||||||||||||||||||||||||||||||||||

| Annual increase in total monthly investment | 5% | Decide depending on future annual income excluding bonuses | |||||||||||||||||||||||||||||||||

| Net rate of return (this is an approximation) | 8.80% | Future investments are assumed to begin simultaneously | |||||||||||||||||||||||||||||||||

| Monthly investment required with constant post-retirement return | 193,324 | ||||||||||||||||||||||||||||||||||

| Monthly investment required with bucket strategy | 162,508 | ||||||||||||||||||||||||||||||||||

| Stress reduction = | 16% | ||||||||||||||||||||||||||||||||||

| With Bucket strategy, allocate Initial Monthly investment as below: | Future value if invested as per investment schedule | Extra: Imbalance between required and actual AA | |||||||||||||||||||||||||||||||||

| Equity | 105,006 | 43,429,166 | 52,706,767 | ||||||||||||||||||||||||||||||||

| Taxable Debt | 45,002 | 14,155,040 | |||||||||||||||||||||||||||||||||

| Total (equity+taxable debt) | 57,584,205 | Handle PPF differently…. | |||||||||||||||||||||||||||||||||

| Tax-free Debt (excludes EPF or NPS) - kept constant | 12,500 | 3,134,462 | |||||||||||||||||||||||||||||||||

| Total including tax-free debt | 60,718,668 | ||||||||||||||||||||||||||||||||||

| The total future value will be a little more than the corpus required (B36). Ignore this! | |||||||||||||||||||||||||||||||||||

| Corpus back calculation from total monthly investments (for excel enthusiasts only!) | 73,583,949 | This is only for the constant post-retirement return | |||||||||||||||||||||||||||||||||

| This sheet is derived from the open source calculators from freefincal.com | |||||||||||||||||||||||||||||||||||

| This version has modifications from S R Srinivasan (info@srinivesh.in) | |||||||||||||||||||||||||||||||||||

| Calculations for CoastFI - At time of FI | |||||||||||||||||||||||||||||||||||

| Net Corpus to be accumulated with constant post-retirement return | 71,960,591 | ||||||||||||||||||||||||||||||||||

| Net Corpus to be accumulated with bucket strategy | 60,231,468 | ||||||||||||||||||||||||||||||||||

| Goal planner for | Education and Marriage planner for first child | Enter data only in green cells | |||||||||||||||||||||

| Child 1 | Undergraduate Education 4-5 years | Postgraduation | Marriage | We recommend that you enter all the goals, and use the 'Include in Plan' flag for scenarios | |||||||||||||||||||

| Enter year of entry into UG degree | |||||||||||||||||||||||

| 1st Year | 2nd Year | 3rd Year | 4th Year | 1st Year | 2nd Year | Comment: Assumed college based on current age of children - 4 and 1 | |||||||||||||||||

| Year | 2034 | 2035 | 2036 | 2037 | 2038 | 2039 | 2043 | 3 | |||||||||||||||

| Years to goal | 13 | 14 | 15 | 16 | 17 | 18 | 22 | ||||||||||||||||

| Reserved | 605000 | 385000 | 385000 | 385000 | 550000 | 550000 | 1050000 | ||||||||||||||||

| Include in plan (1 for Yes) | 1 | 1 | 1 | 1 | 1 | 1 | 0 | ||||||||||||||||

| Unused max equity investing years | 12 | 13 | 14 | 15 | 16 | 17 | 22 | ||||||||||||||||

| Present cost | 550,000 | 350,000 | 350,000 | 350,000 | 500,000 | 500,000 | 1,000,000 | ||||||||||||||||

| inflation | 10.0% | 10.0% | 10.0% | 10.0% | 10.0% | 10.0% | 5.0% | ||||||||||||||||

| Unused - Net Roi | 9.20% | ||||||||||||||||||||||

| Future Cost | 1,898,749 | 1,329,124 | 1,462,037 | 1,608,241 | 2,527,235 | 2,779,959 | 0 | ||||||||||||||||

| Amt invested so far | Ignore rows 14-20 if you are using the retirement calculator | ||||||||||||||||||||||

| RoI of current invest. | 7.00% | 7.00% | 10.00% | 10.00% | 12.00% | 12.00% | 13.00% | ||||||||||||||||

| Future value of curr. Inv. | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||

| Annual inc. in monthly invest. % | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||

| initial mon. invest. reqd. | 7,109 | 8,520 | 8,703 | 8,935 | 13,163 | 13,627 | 0 | ||||||||||||||||

| postpone investment (years) | |||||||||||||||||||||||

| if postponed, pm invest. | 7,109 | 8,520 | 8,703 | 8,935 | 13,163 | 13,627 | 0 | ||||||||||||||||

| 1st Year | 2nd Year | 3rd Year | 4th Year | 1st Year | 2nd Year | Marriage | |||||||||||||||||

| Goal planner for | Education and Marriage planner for second child | ||||||||||||||||||||||

| Child 2 | Undergraduate Education 4-5 years | Postgraduation | Marriage | ||||||||||||||||||||

| Enter year of entry into UG degree | Enter year of entry | ||||||||||||||||||||||

| 1st Year | 2nd Year | 3rd Year | 4th Year | 1st Year | 2nd Year | ||||||||||||||||||

| Year | 2037 | 2038 | 2039 | 2040 | 2041 | 2042 | 2046 | ||||||||||||||||

| Years to goal | 16 | 17 | 18 | 19 | 20 | 21 | 25 | ||||||||||||||||

| Reserved | 605000 | 385000 | 385000 | 385000 | 550000 | 550000 | 1050000 | ||||||||||||||||

| Include in plan (1 for Yes) | 1 | 1 | 1 | 1 | 1 | 1 | 0 | ||||||||||||||||

| Unused max equity investing years | 15 | 16 | 17 | 18 | 19 | 20 | 25 | ||||||||||||||||

| Present cost | 550,000 | 350,000 | 350,000 | 350,000 | 500,000 | 500,000 | 1,000,000 | ||||||||||||||||

| inflation | 10.0% | 10.0% | 10.0% | 10.0% | 10.0% | 10.0% | 5.0% | ||||||||||||||||

| Net Roi | |||||||||||||||||||||||

| Future Cost | 2,527,235 | 1,769,065 | 1,945,971 | 2,140,568 | 3,363,750 | 3,700,125 | 0 | ||||||||||||||||

| Amt invested so far | Ignore rows 36-42 if you are using the retirement calculator | ||||||||||||||||||||||

| RoI of current invest. | 10.00% | 10.00% | 12.00% | 12.00% | 12.00% | 12.00% | 8.00% | ||||||||||||||||

| Future value of curr. Inv. | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||

| Annual inc. in monthly invest. % | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||

| initial mon. invest. reqd. | 14,040 | 9,214 | 9,539 | 9,910 | 14,753 | 15,417 | 0 | ||||||||||||||||

| postpone investment (years) | |||||||||||||||||||||||

| if postponed, pm invest. | 14,040 | 9,214 | 9,539 | 9,910 | 14,753 | 15,417 | 0 | ||||||||||||||||

| 1st Year | 2nd Year | 3rd Year | 4th Year | 1st Year | 2nd Year | Marriage | |||||||||||||||||

| Planner for other goals | (if you need more than 15 entries, please extend the table accordingly) | For sporadic income, e.g insurance policies, use -ve values and set inflation to zero | |||||||||||||||||||||

| Goal planner for other goals | Periodic Large Expenses | ||||||||||||||||||||||

| Current Year | 2021 | ||||||||||||||||||||||

| Year | 2043 | 2021 | 2022 | 2031 | 2027 | 2040 | 2050 | 2029 | 2030 | 2031 | 2050 | 2050 | 2050 | 2050 | 2050 | 2039 | 2050 | 2050 | 2050 | 2050 | |||

| Years to goal | 22 | 0 | 1 | 10 | 6 | 19 | 29 | 8 | 9 | 10 | 29 | 29 | 29 | 29 | 29 | 18 | 29 | 29 | 29 | 29 | |||

| Reserved | 0 | 515000 | 500000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||

| Include in plan (1 for Yes) | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||

| Unused max equity investing years | 21 | -1 | 0 | 9 | 5 | 18 | 28 | 7 | 8 | 9 | 28 | 28 | 28 | 28 | 28 | 17 | 28 | 28 | 28 | 28 | |||

| Present cost | 500,000 | 500,000 | |||||||||||||||||||||

| inflation | 3.0% | 3.0% | 0.0% | 2.0% | 3.0% | 3.0% | 3.0% | 10.0% | 10.0% | 10.0% | 0.0% | 3.0% | 3.0% | 3.0% | 3.0% | 10.0% | 3.0% | 3.0% | 3.0% | 3.0% | |||

| Net Roi | |||||||||||||||||||||||

| Futire Cost | 0 | 500,000 | 500,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||

| Expense Head | Home Purchase | Car | Gift | Car | Vacation | Vacation | Vacation | Sample | Sample | Sample | Vacation | Vacation | Vacation | Vacation | Vacation | Vacation | Vacation | Vacation | Vacation | Vacation | |||

| 2043 | 2021 | 2022 | 2031 | 2027 | 2040 | 2050 | 2029 | 2030 | 2031 | 2050 | 2050 | 2050 | 2050 | 2050 | 2039 | 2050 | 2050 | 2050 | 2050 | ||||

| We recommend that you enter all the goals, and use the 'Include in Plan' flag for scenarios | |||||||||||||||||||||||

| Post-retirement Income sources (Include rental income and other mandated payments) |

Rent | Superannuation Annuity | Other Annuity | School Fees | Please proide post-tax values | ||||||||||||||||||

| Expected yrly inc | 5% | 0% | 0% | 10% | |||||||||||||||||||

| Monthly Income in first year | - | - | - | Use negative values for expenses | |||||||||||||||||||

| Start year (leave blank if before or with retirement) | 2034 | ||||||||||||||||||||||

| End year (leave bank if no end date) | 2060 | 2036 | |||||||||||||||||||||

| Actual start | 2034 | 2034 | 2034 | 2034 | |||||||||||||||||||

| Actual end | 2080 | 2080 | 2060 | 2036 |

no reviews yet

Please Login to review.