234x Filetype XLSX File size 0.33 MB Source: lewishardinginvest.com

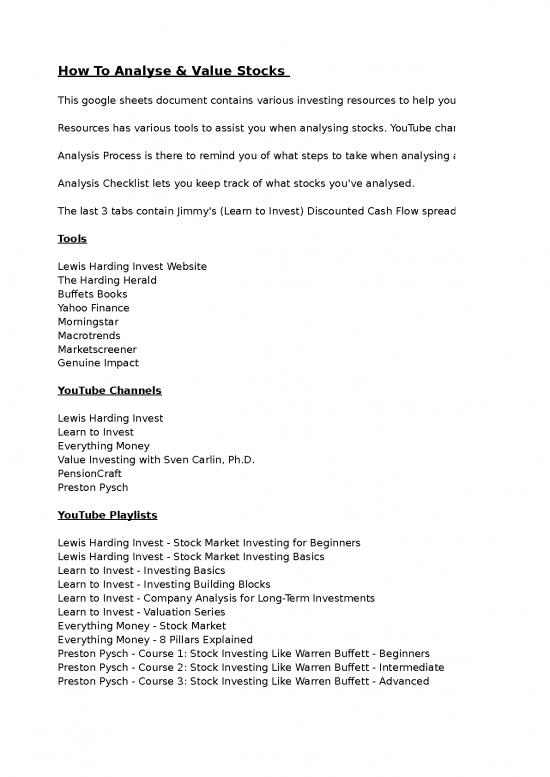

Sheet 1: Resources

| Analysis Process | ||||||||||

| Warren Buffet's rules for investing | Tom Gaynor's 4 pillars of investing | |||||||||

| Vigilant Leadership & Managment | Profitable & high returns on capital using low leverage to do it (More leverage means more fragile) | |||||||||

| Long term prospects | People managing the company with equal measures of talent & integrity | |||||||||

| The company is stable & understanbable | Reinvestment opportunities & room to grow. Acquisitions, dividends & share repurchases | |||||||||

| Buy a business at a very attractive price | Buy at a fair price | |||||||||

| Fundamental Analysis | ||||||||||

| Profit & Loss | ||||||||||

| NP% > 10% consistently | ||||||||||

| All margins higher than competitors | ||||||||||

| Revenue Growth | ||||||||||

| Profit Growth | ||||||||||

| Balance Sheet | ||||||||||

| Overall Retained Earnings growth over the past 10+ years | ||||||||||

| Return on Equity > 15% | ||||||||||

| ROE% higher than competitors | ||||||||||

| Long Term Debt / Equity < 50% | ||||||||||

| Companies with no to little long term debt - can pay all LTD with 4 years of previous net income | ||||||||||

| Current Ratio > 1 | ||||||||||

| Decreasing Share Count | ||||||||||

| Dividend Growth | ||||||||||

| Previous Acquisitions | ||||||||||

| Cash Flow Statement | ||||||||||

| Capex/Net icome <25%/<50% | Look what the company is using the money for - e.g. growing the business | |||||||||

| Free Cashflow Growth | ||||||||||

| MOS | ||||||||||

| Also, you must determine how much of a margin of safety you'll require before buying a stock. If the firm is not very risky, you could be content with a 15%-20% discount to its fair value. If the firm is riskier than average, you may demand a 30%-40% discount. Ultimately, it's your decision. | The beauty of fat-pitch investing is that it has two built-in factors that help offset the risk that your fair value estimate is wrong. First, by requiring a margin of safety, you've given yourself some "error cushion," just in case your estimate was too high. Second, by purchasing wide-moat companies, chances are high that the firm will increase in value over time. Thus, even if your estimates were way off, the firm--and its stock price--will likely appreciate in value, eventually catching up to your fair value estimate. In effect, by buying wide-moat companies, you have another margin of safety built into your investment. | |||||||||

| Ongoing analysis | ||||||||||

| Once you have bought the company, put the earnings dates in my google calendar with reminders | ||||||||||

| Read the 10Q's every quarter and then the 10K (Annual report) every year | ||||||||||

| When to sell? | ||||||||||

| When a company may lose it's competitive advantage | ||||||||||

| Crazy bull market - P/E > 40 | ||||||||||

| Analysis Checklist | |||||||||||||||||

| Stock Symbol | NASDAQ:GOOGL | ||||||||||||||||

| Company Name | Alphabet Inc Class A | ||||||||||||||||

| Information | |||||||||||||||||

| Market Cap | 1555.6B | ||||||||||||||||

| Current Price | 2299.93 | ||||||||||||||||

| Earnings per share | 62.55 | ||||||||||||||||

| Price/Earnings Ratio | 36.77 | ||||||||||||||||

| Earnings Yield | 2.72% | ||||||||||||||||

| Pillar 1 - Profitable & high returns on capital using low leverage | |||||||||||||||||

| Net Profit Margin > 10% | Yes | ||||||||||||||||

| Return on Equity > 15% | Yes | ||||||||||||||||

| Long Term Debt/Equity < 50% | Yes | ||||||||||||||||

| Current Ratio > 1 | Yes | ||||||||||||||||

| Pillar 2 - People managing the company with equal measure of talent & integrity | |||||||||||||||||

| Length of Tenure | Yes | ||||||||||||||||

| Strategy & Goals | Yes | ||||||||||||||||

| Inside Buying | Yes | ||||||||||||||||

| Compensation | Yes | ||||||||||||||||

| Pillar 3 - Reinvestment opportunities & room to grow. Acquisitions, dividends & share buybacks | |||||||||||||||||

| Revenue Growth | Yes | ||||||||||||||||

| Free Cashflow Growth | Yes | ||||||||||||||||

| Profit Growth | Yes | ||||||||||||||||

| Retained Earnings Growth | Yes | ||||||||||||||||

| Decreasing Share Count | Yes | ||||||||||||||||

| Dividend Growth | No | ||||||||||||||||

| Previous Acquisitions | Yes | ||||||||||||||||

| Pillar 4 - Buy at a fair price! | |||||||||||||||||

| PE Ratio < 20 | No | ||||||||||||||||

| P/CF Ratio < 20 | No | ||||||||||||||||

| DCF calculation - 10% return | 1,494 | ||||||||||||||||

| Margin of safety - Percentage | 0% | ||||||||||||||||

| Margin of safety - Amount | 0.00 | ||||||||||||||||

| Entry price | 1,493 | ||||||||||||||||

| Price Needs To Fall By - Amount | -807 | ||||||||||||||||

| Price Needs To Fall By - % | -35% |

no reviews yet

Please Login to review.