230x Filetype XLSX File size 0.19 MB Source: d3ciwvs59ifrt8.cloudfront.net

Sheet 1: Inputs

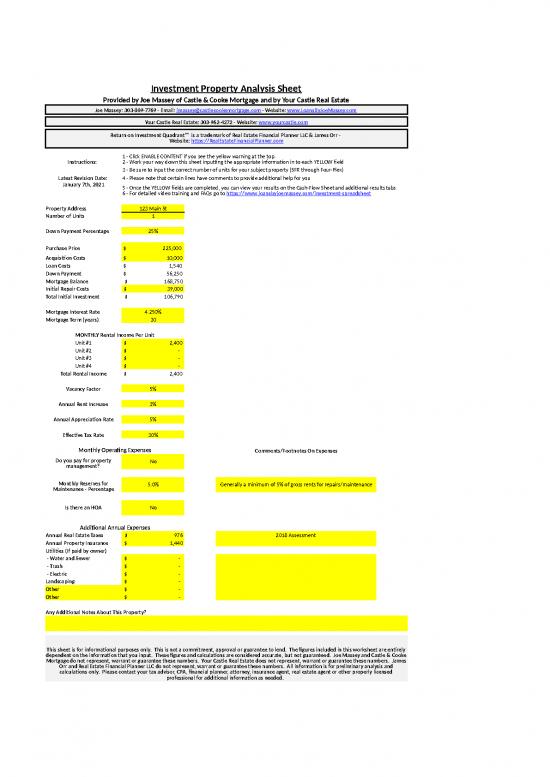

| Investment Property Analysis Sheet | 1 | |||||||||||

| Provided by Joe Massey of Castle & Cooke Mortgage and by Your Castle Real Estate | 2 | |||||||||||

| Joe Massey: 303-809-7769 - Email: jmassey@castlecookemortgage.com - Website: www.LoansByJoeMassey.com | 3 | HIDE BEFORE DISTRIBUTION | ||||||||||

| 4 | ||||||||||||

| Your Castle Real Estate: 303-962-4272 - Website: www.yourcastle.com | ||||||||||||

| Return on Investment Quadrant™ is a trademark of Real Estate Financial Planner LLC & James Orr - Website: https://RealEstateFinancialPlanner.com |

||||||||||||

| Instructions: | 1 - Click ENABLE CONTENT if you see the yellow warning at the top. 2 - Work your way down this sheet inputting the appropriate information in to each YELLOW field |

|||||||||||

| 3 - Be sure to input the correct number of units for your subject property (SFR through Four-Plex) | ||||||||||||

| Latest Revision Date: | 4 - Please note that certain lines have comments to provide additional help for you | |||||||||||

| January 7th, 2021 | 5 - Once the YELLOW fields are completed, you can view your results on the Cash-Flow Sheet and additional results tabs 6 - For detailed video training and FAQs go to https://www.loansbyjoemassey.com/investment-spreadsheet |

|||||||||||

| Property Address | 123 Main St | afg | ||||||||||

| Number of Units | 1 | |||||||||||

| Down Payment Percentage | 25% | |||||||||||

| Purchase Price | $225,000 | |||||||||||

| Acquisition Costs | $10,000 | |||||||||||

| Loan Costs | $1,540 | |||||||||||

| Down Payment | $56,250 | |||||||||||

| Mortgage Balance | $168,750 | |||||||||||

| Initial Repair Costs | $39,000 | |||||||||||

| Total Initial Investment | $106,790 | |||||||||||

| Mortgage Interest Rate | 4.250% | |||||||||||

| Mortgage Term (years) | 30 | |||||||||||

| Mortgage Insurance | $- | HIDE BEFORE DISTRIBUTION | ||||||||||

| MONTHLY Rental Income Per Unit | ||||||||||||

| Unit #1 | $2,400 | |||||||||||

| Unit #2 | $- | |||||||||||

| Unit #3 | $- | |||||||||||

| Unit #4 | $- | |||||||||||

| Total Rental Income | $2,400 | |||||||||||

| Vacancy Factor | 5% | |||||||||||

| Annual Rent Increase | 3% | |||||||||||

| Annual Appreciation Rate | 5% | |||||||||||

| Effective Tax Rate | 30% | |||||||||||

| Monthly Operating Expenses | Comments/Footnotes On Expenses | |||||||||||

| Do you pay for property management? | No | Yes | Hide before distribution | |||||||||

| No | ||||||||||||

| Monthly Reserves for Maintenance - Percentage | 5.0% | Generally a minimum of 5% of gross rents for repairs/maintenance | ||||||||||

| Annual Reserves for Maintenance | $1,440.00 | HIDE BEFORE DISTRIBUTION | ||||||||||

| Is there an HOA | No | |||||||||||

| Additional Annual Expenses | ||||||||||||

| Annual Real Estate Taxes | $976 | 2018 Assessment | ||||||||||

| Annual Property Insurance | $1,440 | |||||||||||

| Utilities (If paid by owner) | ||||||||||||

| - Water and Sewer | $- | |||||||||||

| - Trash | $- | |||||||||||

| - Electric | $- | |||||||||||

| Landscaping | $- | |||||||||||

| Other | $- | |||||||||||

| Other | $- | |||||||||||

| Any Additional Notes About This Property? | ||||||||||||

| This sheet is for informational purposes only. This is not a commitment, approval or guarantee to lend. The figures included in this worksheet are entirely dependent on the information that you input. These figures and calculations are considered accurate, but not guaranteed. Joe Massey and Castle & Cooke Mortgage do not represent, warrant or guarantee these numbers. Your Castle Real Estate does not represent, warrant or guarantee these numbers. James Orr and Real Estate Financial Planner LLC do not represent, warrant or guarantee these numbers. All information is for preliminary analysis and calculations only. Please contact your tax advisor, CPA, financial planner, attorney, insurance agent, real estate agent or other properly licensed professional for additional information as needed. | ||||||||||||

| Cash Flow Analysis of | 123 Main St | |||||||||

| Number of Units | 1 | |||||||||

| Cash Investment Breakdown | ||||||||||

| Purchase Price | $225,000 | |||||||||

| Mortgage | $168,750 | |||||||||

| Down Payment | $56,250 | |||||||||

| Estimated Finance and Acquisition Costs | $11,540 | |||||||||

| Repair Costs | $39,000 | |||||||||

| Total Cash Investment | $106,790 | |||||||||

| Annual Cash Flow Statement | ||||||||||

| Annual Income | ||||||||||

| Annual Rental Income | $28,800 | $2,400 | per month | |||||||

| - Vacancy | 5% | $(1,440) | ||||||||

| Expected Annual Rental Income | $27,360 | |||||||||

| Annual Expenses | Comments/Footnotes | |||||||||

| Reserves for Repairs and Maintenance | $1,440 | Generally a minimum of 5% of gross rents for repairs/maintenance | ||||||||

| Real Estate Taxes | $976 | 2018 Assessment | ||||||||

| Property Insurance | $1,440 | - | ||||||||

| Utilities (If paid by owner) | ||||||||||

| - Water and Sewer | $- | - | ||||||||

| - Trash | $- | - | ||||||||

| - Electric | $- | - | ||||||||

| Landscaping | $- | - | ||||||||

| Other | $- | 0 | ||||||||

| Other | $- | 0 | ||||||||

| Total Annual Expenses | $3,856 | |||||||||

| Net Operating Income | $23,504 | |||||||||

| Less: Annual Mortgage Payments | $(9,962) | $168,750 | @ | 4.250% | = | $830.15 | per month | |||

| Annual Cash Flow Before Taxes | $13,542 | |||||||||

| 1st Year Returns | ||||||||||

| Cash-on-Cash Rate of Return | 12.7% | $13,542 | ÷ | $106,790 | = | 13% | ||||

| CAP Rate | 8.9% | $23,504 | ÷ | $264,000 | = | 8.9% | ||||

| GRM - Gross Rent Multiplier | 110.0 | $264,000 | ÷ | $2,400 | = | 110.0 | ||||

| 1st Year Return On Investment QuadrantTM (ROIQ) | ||||||||||

| Appreciation | 10.5% | $11,250 | ||||||||

| Cash Flow | 12.7% | $13,542 | ||||||||

| Debt Paydown | 2.7% | $2,845 | ||||||||

| Cash Flow From Depreciation | 2.0% | $2,086 | ||||||||

| Total ROI | 27.8% | $29,723 | ||||||||

| **Return On Investment QuadrantTM is a trademark of Real Estate Financial Planner, LLC | ||||||||||

| This sheet is for informational purposes only. This is not a commitment, approval or guarantee to lend. The figures included in this worksheet are entirely dependent on the information that you input. These figures and calculations are considered accurate, but not guaranteed. Joe Massey and Castle & Cooke Mortgage do not represent, warrant or guarantee these numbers. Your Castle Real Estate does not represent, warrant or guarantee these numbers. James Orr and Real Estate Financial Planner LLC do not represent, warrant or guarantee these numbers. All information is for preliminary analysis and calculations only. Please contact your tax advisor, CPA, financial planner, attorney, insurance agent, real estate agent or other properly licensed professional for additional information as needed. | ||||||||||

| Cash Flow Analysis for | 123 Main St | Cash Investment Breakdown | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Purchase Price | $225,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of Units | 1 | Mortgage | $168,750 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Down Payment | $56,250 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Rent Increase | 3% | Estimated Finance and Acquisition Costs | $11,540 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Repair Costs | $39,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Cash Flow Statement | Total Cash Investment | $106,790 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Income | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 10 | Year 15 | Year 20 | Year 25 | Year 30 | Year 31 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Rental Income | $28,800 | $29,664 | $30,554 | $31,471 | $32,415 | $37,577 | $43,563 | $50,501 | $58,544 | $67,869 | $69,905 | ||||||||||||||||||||||||||||||||||||||||||||||||

| - Vacancy | 5% | $(1,440) | $(1,483) | $(1,528) | $(1,574) | $(1,621) | $(1,879) | $(2,178) | $(2,525) | $(2,927) | $(3,393) | $(3,495) | |||||||||||||||||||||||||||||||||||||||||||||||

| Expected Annual Rental Income | $27,360 | $28,181 | $29,026 | $29,897 | $30,794 | $35,699 | $41,384 | $47,976 | $55,617 | $64,476 | $66,410 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Expenses | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reserves for Repairs and Maintenance | $1,440 | $1,483 | $1,528 | $1,574 | $1,621 | $1,879 | $2,178 | $2,525 | $2,927 | $3,393 | $3,495 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Real Estate Taxes | $976 | $1,005 | $1,035 | $1,067 | $1,098 | $1,273 | $1,476 | $1,711 | $1,984 | $2,300 | $2,369 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Property Insurance | $1,440 | $1,483 | $1,528 | $1,574 | $1,621 | $1,879 | $2,178 | $2,525 | $2,927 | $3,393 | $3,495 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Utilities (If paid by owner) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| - Water and Sewer | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | ||||||||||||||||||||||||||||||||||||||||||||||||

| - Trash | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | ||||||||||||||||||||||||||||||||||||||||||||||||

| - Electric | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | ||||||||||||||||||||||||||||||||||||||||||||||||

| Landscaping | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | ||||||||||||||||||||||||||||||||||||||||||||||||

| Other | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | ||||||||||||||||||||||||||||||||||||||||||||||||

| Other | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | ||||||||||||||||||||||||||||||||||||||||||||||||

| Total Annual Expenses | $3,856 | $3,972 | $4,091 | $4,214 | $4,340 | $5,031 | $5,833 | $6,762 | $7,838 | $9,087 | $9,360 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Net Operating Income | $23,504 | $24,209 | $24,935 | $25,683 | $26,454 | $30,667 | $35,552 | $41,214 | $47,779 | $55,389 | $57,050 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Less: Annual Mortgage Payments | $(9,962) | $(9,962) | $(9,962) | $(9,962) | $(9,962) | $(9,962) | $(9,962) | $(9,962) | $(9,962) | $(9,962) | $- | ||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Cash Flow Before Taxes | $13,542 | $14,247 | $14,974 | $15,722 | $16,492 | $20,706 | $25,590 | $31,253 | $37,817 | $45,427 | $57,050 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Property Value at End of Year | $236,250 | $248,063 | $260,466 | $273,489 | $287,163 | $366,501 | $467,759 | $596,992 | $761,930 | $972,437 | $1,021,059 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Mortgage Balance at End of Year | $165,905 | $162,937 | $159,840 | $156,609 | $153,238 | $134,060 | $110,351.24 | $81,039 | $44,801 | $0.0 | $- | ||||||||||||||||||||||||||||||||||||||||||||||||

| Total Equity | $70,345 | $85,126 | $100,626 | $116,880 | $133,925 | $232,441 | $357,408 | $515,952 | $717,129 | $972,437 | $1,021,059 | ||||||||||||||||||||||||||||||||||||||||||||||||

| ROI QuadrantTM | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Appreciation | $11,250 | 10.5% | $11,813 | 11.1% | $12,403 | 11.6% | $13,023 | 12.2% | $13,674 | 12.8% | $17,452 | 16.3% | $22,274 | 20.9% | $28,428 | 26.6% | $36,282 | 34.0% | $46,307 | 43.4% | $48,622 | 45.5% | |||||||||||||||||||||||||||||||||||||

| Cash Flow | $13,542 | 12.7% | $14,247 | 13.3% | $14,974 | 14.0% | $15,722 | 14.7% | $16,492 | 15.4% | $20,706 | 19.4% | $25,590 | 24.0% | $31,253 | 29.3% | $37,817 | 35.4% | $45,427 | 42.5% | $57,050 | 53.4% | |||||||||||||||||||||||||||||||||||||

| Debt Paydown | $2,845 | 2.7% | $2,968 | 2.8% | $3,097 | 2.9% | $3,231 | 3.0% | $3,371 | 3.2% | $4,168 | 3.9% | $5,152 | 4.8% | $6,370 | 6.0% | $7,875 | 7.4% | $9,736 | 9.1% | $0 | 0.0% | |||||||||||||||||||||||||||||||||||||

| Cash Flow From Depreciation | $2,086 | 2.0% | $2,086 | 2.0% | $2,086 | 2.0% | $2,086 | 2.0% | $2,086 | 2.0% | $2,086 | 2.0% | $2,086 | 2.0% | $2,086 | 2.0% | $2,086 | 2.0% | $0 | 0.0% | $0 | 0.0% | |||||||||||||||||||||||||||||||||||||

| Total Return on Investment | $29,723 | 27.8% | $31,114 | 29.1% | $32,560 | 30.5% | $34,062 | 31.9% | $35,624 | 33.4% | $44,412 | 41.6% | $55,103 | 51.6% | $68,137 | 63.8% | $84,061 | 78.7% | $101,470 | 95.0% | $105,672 | 99.0% | |||||||||||||||||||||||||||||||||||||

| This sheet is for informational purposes only. This is not a commitment, approval or guarantee to lend. The figures included in this worksheet are entirely dependent on the information that you input. These figures and calculations are considered accurate, but not guaranteed. Joe Massey and Castle & Cooke Mortgage do not represent, warrant or guarantee these numbers. Your Castle Real Estate does not represent, warrant or guarantee these numbers. James Orr and Real Estate Financial Planner LLC do not represent, warrant or guarantee these numbers. All information is for preliminary analysis and calculations only. Please contact your tax advisor, CPA, financial planner, attorney, insurance agent, real estate agent or other properly licensed professional for additional information as needed. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $(106,790) | $9,480 | $9,973 | $10,482 | $11,005 | $107,218 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $11,545 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $267,061.92 | Net Future value after 7% sales cost | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $113,823.93 | Pre Tax Terminal Value | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $92,601.92 | Capital Gain Base | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $18,149.98 | Capital Gains Tax at 19.6% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $95,673.95 | After Tax Terminal Value | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

no reviews yet

Please Login to review.