209x Filetype XLSX File size 0.45 MB Source: corp.fhlbatl.com

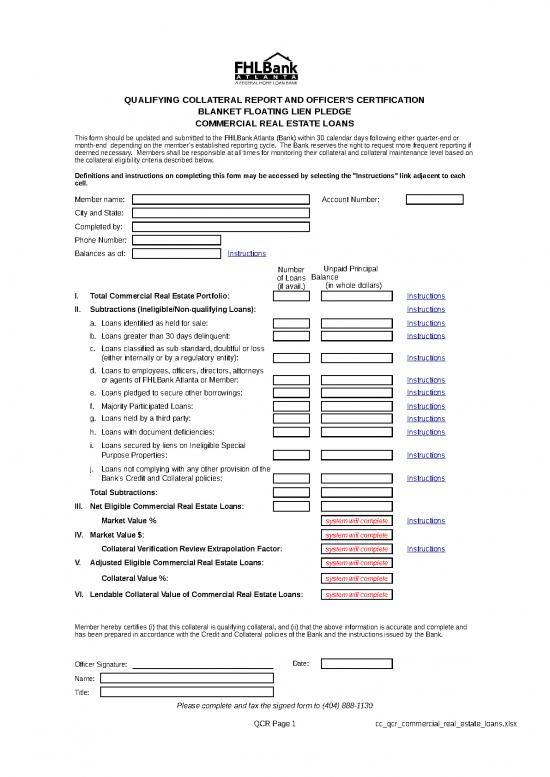

QUALIFYING COLLATERAL REPORT AND OFFICER'S CERTIFICATION

BLANKET FLOATING LIEN PLEDGE

COMMERCIAL REAL ESTATE LOANS

This form should be updated and submitted to the FHLBank Atlanta (Bank) within 30 calendar days following either quarter-end or

month-end depending on the member's established reporting cycle. The Bank reserves the right to request more frequent reporting if

deemed necessary. Members shall be responsible at all times for monitoring their collateral and collateral maintenance level based on

the collateral eligibility criteria described below.

Definitions and instructions on completing this form may be accessed by selecting the "Instructions" link adjacent to each

cell.

Member name: Account Number:

City and State:

Completed by:

Phone Number:

Balances as of: Instructions

Number Unpaid Principal

of Loans Balance

(if avail.) (in whole dollars)

I. Total Commercial Real Estate Portfolio: Instructions

II. Subtractions (Ineligible/Non-qualifying Loans): Instructions

a. Loans identified as held for sale: Instructions

b. Loans greater than 30 days delinquent: Instructions

c. Loans classified as sub-standard, doubtful or loss

(either internally or by a regulatory entity): Instructions

d. Loans to employees, officers, directors, attorneys

or agents of FHLBank Atlanta or Member: Instructions

e. Loans pledged to secure other borrowings: Instructions

f. Majority Participated Loans: Instructions

g. Loans held by a third party: Instructions

h. Loans with document deficiencies: Instructions

i. Loans secured by liens on Ineligible Special

Purpose Properties: Instructions

j. Loans not complying with any other provision of the

Bank's Credit and Collateral policies: Instructions

Total Subtractions:

III. Net Eligible Commercial Real Estate Loans:

Market Value % system will complete Instructions

IV. Market Value $: system will complete

Collateral Verification Review Extrapolation Factor: system will complete Instructions

V. Adjusted Eligible Commercial Real Estate Loans: system will complete

Collateral Value %: system will complete

VI. Lendable Collateral Value of Commercial Real Estate Loans: system will complete

Member hereby certifies (i) that this collateral is qualifying collateral, and (ii) that the above information is accurate and complete and

has been prepared in accordance with the Credit and Collateral policies of the Bank and the instructions issued by the Bank.

Officer Signature: Date:

Name:

Title:

Please complete and fax the signed form to (404) 888-1130

QCR Page 1 cc_qcr_commercial_real_estate_loans.xlsx

Qualifying Collateral Report

Additional Information

Information on this page is required and only complete forms can be processed upon

submission. The percentages entered for any of the three levels must sum to 100% for that

level and should be in whole numbers, e.g., "40" for 40%. For example, if level 3 is reported,

all line items noted as "Level 3" must add up to 100%.

All percentages calculated on this page must be expressed as a percentage of the unpaid principal

balance (UPB) entered on page 1 in the row labeled "III.Net Eligible Commercial Real Estate Loans". For

example, the percentage in row 13 below would be calculated as: Current UPB of Loans Maturing in

Less Than 3 Years / the UPB on line "III. Net Eligible Commercial Real Estate Loans" on page 1 of

this QCR.

Asset Classification Required

1Standard (Level 1) %

2Special Purpose (Level 1) %

3Standard CLTV < 60 (Level 2 & 3) %

4Standard CLTV 60 - 80 (Level 2 & 3) %

5Standard CLTV 81 - 85 (Level 2 & 3) %

6Special Purpose CLTV < 60 (Level 2 &3) %

7Special Purpose CLTV 60 - 80 (Level 2 & 3) %

8Special Purpose CLTV 81 -85 (Level 2 & 3) %

Debt Service Coverage Ratio (Level 3 Only)

9DSCR greater than or equal to 1 %

10DSCR less than 1 %

Remaining Maturity (Level 3 Only)

11Greater than 7 years %

12Greater than or equal to 3 years and less than or equal to 7 years %

QCR Page 2 cc_qcr_commercial_real_estate_loans.xlsx

Qualifying Collateral Report

Additional Information

Required information on this page must be completed for the Qualifying Collateral Report to be processed. The percentages in each

category must sum to 100%, unless otherwise indicated, and should be in whole numbers, e.g., "40" for 40%. You will receive a

prompt if your answers do not sum to 100% when required, and you will be asked to re-enter the information before you can submit

the OCR. You can save your information at any time and finish later or you can click "Clear All" to clear the screen.

If loans reported for the Mitigated Environmental Risk category are > 0% but less than 1%, report as 1%. If there are no reported loans

of this property type, report 0%.

1. LIBOR Reporting * Required

LIBOR-indexed adjustable rate loans that mature on or before 12/31/21 %

LIBOR-indexed adjustable rate loans that mature on or after 1/1/22 %

All other loans (adjustable with non-LIBOR index, or fixed) %

2. LIBOR Fallback Language - for loans that mature on or after 1/1/22 * Optional

Preferred %

Non-preferred %

To be determined %

3. COVID-19 * Required

Loans currently under forbearance related to COVID-19 %

Loans that have been modified or have received payment deferrals related to COVID-19 %

Loans without COVlD-19 related modifications, payment deferrals or forbearance %

4. Mitigated Environmental Risk Loans Required

Reported loans secured by properties with potential environmental risk, and that have a related %

clean or resolved Phase 1 environmental report

* Items within this category must total 100%, unless the Category is optional and reporting is not being submitted

QCR Page 3 cc_qcr_commercial_real_estate_loans.xlsx

INSTRUCTIONS FOR COMPLETING QUALIFYING COLLATERAL REPORT ("QCR") AND OFFICER'S CERTIFICATION -

COMMERCIAL REAL ESTATE LOANS

This form should be updated and submitted to the FHLBank Atlanta (Bank) within 30 calendar days following either quarter-end or month-end

depending on the member's established reporting cycle. The Bank reserves the right to request more frequent reporting if deemed necessary.

Members shall be responsible at all times for monitoring their collateral and collateral maintenance level based on the collateral eligibility criteria

described below.

Select the "Return to QCR" link to return to the appropriate data entry cell for each instruction item.

Balances as of: This date should coincide with the date of the Loan Trial Balance used on the QCR form. This date should

not be more than 30 days prior to the submittal by the Member to the Bank.

Return to QCR

I. Total Commercial Real Estate The beginning balance is the entire portfolio of whole, fully-disbursed first mortgage loans secured by a

Loans: perfected first lien as evidenced by mortgages and other liens on qualifying office, retail, hotel/motel or

industrial/warehouse properties. This figure should not include construction/land loans,

commercial/industrial loans, or revolving lines of credit. For Call Reports, reference Schedule RC-C, Part I,

Line 1.e. For Thrift Financial Reports, reference Schedule SC, line 260.

Return to QCR

II. Subtractions (Ineligible/Non-Qualifying Loans):

The Bank has determined that certain types of commercial real estate loans are not eligible as collateral to secure outstanding advances. The items

listed in this section are to be subtracted if included as part of the figure indicated above for "Total Commercial Real Estate Loans."

Return to QCR

a. Loans identified as held for sale: This should include any loans designated as "held for sale" on the Member's Call Report or Thrift Financial

Report.

Return to QCR

b. Loans greater than 30 days This line should include loans that are more than 30 days past due or are in nonaccrual status as of the

delinquent: report date.

Return to QCR

c. Loans classified as substandard, Subtract all loans currently classified as substandard, doubtful or loss, either internally or by the Member's

doubtful or loss: regulatory agency.

Return to QCR

d. Loans to employees, officers, Self-explanatory.

directors, attorneys or agents of

FHLBank Atlanta or Member:

Return to QCR

e. Loans pledged to secure other Subtract all loans that have been pledged to secure other borrowings with any other lending institution (e.g.,

borrowings: Federal Reserve or corporate credit union). The Member should notify the Bank of any agreements that

Return to QCR involve commercial real estate loans as collateral to prevent double pledging of collateral.

f. Majority Participated Loans: This total includes any loans in which the Member owns less than 51% interest in the loan, and in which the

Member is not the lead lender and does not possess or control the original legal documents (i.e., note and

mortgage/deed of trust). This amount should also include any loans transferred to a REIT or similar entity

Return to QCR or affiliate of the member.

g. Loans held by a third party: This total should include any loans in which the original legal documents (i.e., note and mortgage/deed of

Return to QCR trust) are not in the possession of or under the control of the Member. This does not include loans serviced

by a third party or original documents held by a third party custodian under an agreement with the Member.

h. Loans with document deficiencies:This total includes any commercial real estate loans for which some or all of the legal documents are

missing or demonstrate inconsistencies, errors or omissions that could impact the Bank's ability to perfect its

Return to QCR security interest in the collateral.

i. Loans secured by liens on Ineligible Special Purpose properties are those types of properties identified as "ineligible Special Purpose

ineligible Special Purpose Properties" in the "Expansion of Commercial Real Estate Eligibility" document posted on the Bank's public

Properties: web site: http://www.fhlbatl.com/docs/cc/cc-definition-special-purpose-property.pdf.

Return to QCR

j. Loans not complying with any This includes all other loans not complying with any other provision of the Bank's Credit and Collateral

other provision of the Bank's Policies.

Credit and Collateral policies:

Return to QCR

III. Market Value %:

Market Value is based on the information provided by the member on page 2 of the QCR and is calculated automatically when QCR is submitted.

The market value percent is applied to eligible collateral to determine market value dollars. The extrapolation factor and discount percentage are both

applied to the market value of the collateral to determine lendable collateral value.

Return to QCR

IV. Collateral Verification Review Extrapolation Factor:

On a periodic basis, each Member relying upon pledged mortgage collateral is required to undergo a "Collateral Verification Review" verifying

compliance with the Bank's Collateral Policy requirements. The purpose of the review is to ensure that each Member is adequately monitoring its

reported loan collateral to ensure that no ineligible loans are reported to secure outstanding advances. The "exception rate" (i.e., the number of loans

in the review sample demonstrating exceptions to policy) noted during the Collateral Verification Review will be extrapolated to the pool of loan

collateral identified by the Member as eligible, thereby reducing the eligible pool of loans by the exception rate percentage. The extrapolation review

factor to be entered on this line will be provided to the Member by the Bank, and will remain in effect until the Member's next Collateral Verification

Review.

Return to QCR

Questions? Please contact your Collateral Relationship Specialist at (800) 536-9650

Page 1 Instructions cc_qcr_commercial_real_estate_loans.xlsx

no reviews yet

Please Login to review.