265x Filetype XLSX File size 0.05 MB Source: caliberretailproperties.com

Sheet 1: Seller's ROE

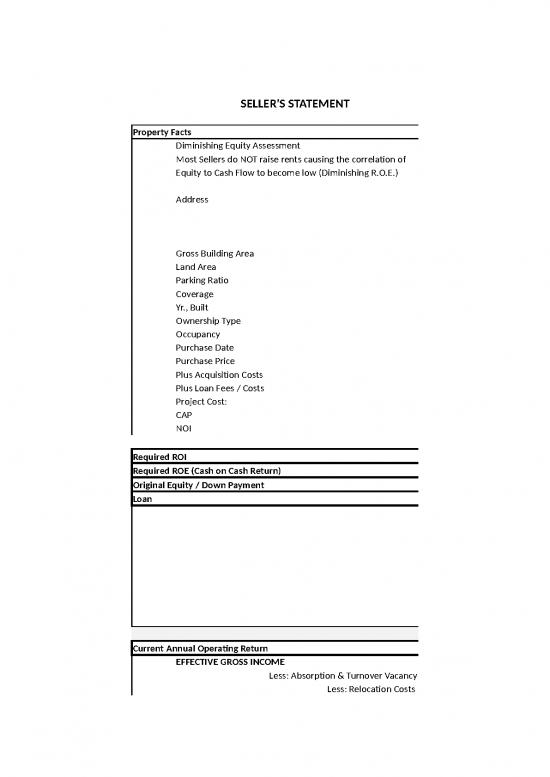

| SELLER'S STATEMENT | |||||||||||||||||||||

| Property Facts | Sitting on Money is losing money | ||||||||||||||||||||

| Diminishing Equity Assessment | Need a table to easily show the comparison situation to demonstrate higher rate of return utilizing appropriate leverage | ||||||||||||||||||||

| Most Sellers do NOT raise rents causing the correlation of | Leveraging wit lower interest rates will give investor better return | ||||||||||||||||||||

| Equity to Cash Flow to become low (Diminishing R.O.E.) | |||||||||||||||||||||

| Address | |||||||||||||||||||||

| 33 Cooler Way | |||||||||||||||||||||

| City, Ca | |||||||||||||||||||||

| Gross Building Area | |||||||||||||||||||||

| Land Area | |||||||||||||||||||||

| Parking Ratio | |||||||||||||||||||||

| Coverage | |||||||||||||||||||||

| Yr., Built | |||||||||||||||||||||

| Ownership Type | |||||||||||||||||||||

| Occupancy | |||||||||||||||||||||

| Purchase Date | 6/1/2005 | ||||||||||||||||||||

| Purchase Price | $3,500,000 | Maximum Purchase Price = Max. Equity Investment + Max. Loan Amount. | |||||||||||||||||||

| Plus Acquisition Costs | |||||||||||||||||||||

| Plus Loan Fees / Costs | |||||||||||||||||||||

| Project Cost: | |||||||||||||||||||||

| CAP | SEE CCIM TOOLS | ||||||||||||||||||||

| NOI | |||||||||||||||||||||

| Required ROI | 10.0% | Return on Investment = NOI / Project Cost | |||||||||||||||||||

| Required ROE (Cash on Cash Return) | 7.5% | Return on Equity = Cash Flow / Maximum Equity Investment | |||||||||||||||||||

| Original Equity / Down Payment | Maximum Equity Investment = CF (before taxes) / Reqd. ROE | ; ROE aka Cash On Cash | |||||||||||||||||||

| Loan | |||||||||||||||||||||

| LTV | 7.5% | ||||||||||||||||||||

| DCR | 1.25% | DCR = NOI / Max. ADS | |||||||||||||||||||

| Amort. Schedule | 25 | ||||||||||||||||||||

| Max. Loan Amt. | Maximum Loan Amount = ADS / Constant | ||||||||||||||||||||

| Term | 10 Years | ||||||||||||||||||||

| Interest | 4.65% | ||||||||||||||||||||

| Constant | 4.03% | Constant = ADS / Loan Amount | |||||||||||||||||||

| Ann. Debt Service (ADS) | Maximum Annual Debt Service = NOI / DCR | ||||||||||||||||||||

| Mo. Pmt. | |||||||||||||||||||||

| Current Annual Operating Return | |||||||||||||||||||||

| EFFECTIVE GROSS INCOME | $250,000 | ||||||||||||||||||||

| Less: Absorption & Turnover Vacancy | |||||||||||||||||||||

| Less: Relocation Costs | |||||||||||||||||||||

| Less: Downtime, Concession, Base Rent Abatements | |||||||||||||||||||||

| Scheduled Gross Income | |||||||||||||||||||||

| Plus: Percentage Rent(s) Revenue | |||||||||||||||||||||

| Plus: Misc. Revenue - Parking, Mon. Sign, Wall Sign, ATM, Cell Tower, Charging Station, Kiosk, etc. | |||||||||||||||||||||

| Plus: Recoverable Operating Expenses | |||||||||||||||||||||

| Potential Gross Income | |||||||||||||||||||||

| Less: Vacancy Reserve | 0.05 | (12,500) | ref. Property Mgmt.. Financial Reports | ||||||||||||||||||

| GROSS OPERATING INCOME | 237,500 | ||||||||||||||||||||

| Less: Operating Expenses | 0.35 | (87,500) | ref. Property Mgmt.. Financial Reports | Monitor exclusions: | Real Estate Taxes - Property Insurance - CAM Charges - Mgmt. Fee | ||||||||||||||||

| Less: Taxes | |||||||||||||||||||||

| NET OPERATING INCOME | 150,000 | Off Site Mgmt. - Payroll - Expenses / Benefits - Taxes / Workers Comp. | |||||||||||||||||||

| Less: Leasing & Capital Improvement Expenses | Equipment - Repairs & Maint.. - Utilities - Security - Covid Expenses | ||||||||||||||||||||

| Less: Debt Service | (43,449) | ref. Owner's Mortgage Stmt. | Accounting & Legal - Licenses & Permits - Advertising - Supplies | ||||||||||||||||||

| Pre-Tax Cash Flow | 106,551 | NOI / DCR = Maximum Annual Debt Service | Personal Property Taxes - Misc. Contract Services | ||||||||||||||||||

| Tax (Payable) / Receivable | (12,262) | DCR = NOI / Annual Debt Service | |||||||||||||||||||

| After Tax Cash Flow | 94,289 | ||||||||||||||||||||

| Equity Build-Up (Principal Reduction) | 6,890 | ref. Owner's Mortgage Stmt. | |||||||||||||||||||

| Total After Tax Return | 101,179 | ||||||||||||||||||||

| Gross Operating Income | 237,500 | ||||||||||||||||||||

| Loan Interest | -36,560 | ref. Owner's Mortgage Stmt. | |||||||||||||||||||

| Expenses | (87,500) | ||||||||||||||||||||

| Depreciation | -76282 | ||||||||||||||||||||

| Taxable Income (Loss) | 37,158 | ||||||||||||||||||||

| Tax Bracket Assumed | 0.33 | Owner input | |||||||||||||||||||

| Tax (Payable) / Receivable | 12,262 | ||||||||||||||||||||

| Seller's Net Proceeds | |||||||||||||||||||||

| CASH GENERATED FROM SALE | $5,000,000 | ||||||||||||||||||||

| New Loan Balance | 0.5 | $2,500,000 | Value based upon current market rentals and cap rates - Lease Survey | ||||||||||||||||||

| Existing Loan Balance | $402,434 | ref. Owner's Mortgage Stmt. | |||||||||||||||||||

| Net Loan Funds Generated | $2,097,566 | ||||||||||||||||||||

| Interest in Advance at COE | 0 | ||||||||||||||||||||

| Cash Down Payment | 0.3 | $1,500,000 | |||||||||||||||||||

| Other | |||||||||||||||||||||

| TOTAL CASH GENERATED FROM SALE | $3,597,566 | ||||||||||||||||||||

| EXPENSE OF SALE | If 1 M | If 5 M | |||||||||||||||||||

| Title Policy | 0.04 | ($5,000) | 3,500 | 7,500 | |||||||||||||||||

| Escrow Fee | 0.02 | ($2,500) | 2,500 | 5,000 | split 50/50 between buyer and seller | ||||||||||||||||

| Commission | 0.04 | ($200,000) | |||||||||||||||||||

| Other | 1,000 | 2500 | |||||||||||||||||||

| TOTAL EXPENSE OF SALE | ($207,500) | ||||||||||||||||||||

| NET CASH TO SELLER | $3,390,066 | ||||||||||||||||||||

| NOTES RECEIVABLE | |||||||||||||||||||||

| TOTAL INTEREST RECEIVED FROM NOTE | |||||||||||||||||||||

| TOTAL NET PROCEEDS TO SELLER (Not including Note Interest) | |||||||||||||||||||||

| Seller's Rate of Return On New Equity | |||||||||||||||||||||

| Price | $5,000,000 | ||||||||||||||||||||

| Equity (NET of Selling Expense) | $3,390,066 | ||||||||||||||||||||

| Amount | Type | Rate of Return | |||||||||||||||||||

| 106,551 | PRE - TAX CASH FLOW | 3.14% | |||||||||||||||||||

| 94,289 | AFTER TAX CASH FLOW | 2.78% | |||||||||||||||||||

| 6,890 | EQUITY BUILD-UP (Principal Reduction) | 0.20% | |||||||||||||||||||

| 101,179 | TOTAL AFTER - TAX RETURN (R.O.E.) | 2.98% | |||||||||||||||||||

| BUYER'S STATEMENT | ||||||||

| Buyer ROI Analysis | ||||||||

| Current Rents | Market Rents | 20 % Down / Seller Carry 2nd | ||||||

| KNOW | ||||||||

| GSI | ||||||||

| Price | ||||||||

| Interest Rate | ||||||||

| Debt Service | ||||||||

| Pre-Tax Cash Flow | ||||||||

| ACQUISITION COSTS | ||||||||

| GRM | ||||||||

| Cap Rate | ||||||||

| Purchase Price | ||||||||

| Studies | ||||||||

| Legal | ||||||||

| Closing Costs | ||||||||

| INVESTMENT INFORMATION | ||||||||

| Down Payment | ||||||||

| DCR | ||||||||

| 1st TD | ||||||||

| 2nd TD | ||||||||

| Total Pmts. | ||||||||

| INCOME, EXPENSES, CASH FLOW | ||||||||

| Scheduled Gross Income | ||||||||

| Less: Vacancy Reserve | ||||||||

| Gross Operating Income | ||||||||

| Less: Operating Expenses | ||||||||

| Net Operating Income | ||||||||

| Less: Debt Service | ||||||||

| Debt Cov. Ratio | ||||||||

| Pre-Tax Cash Flow | ||||||||

| Tax (Payable) / Receivable | ||||||||

| After Tax Cash Flow | ||||||||

| Equity Build-Up (Principal Reduction) | ||||||||

| Total After Tax Return | ||||||||

| Gross Operating Income | ||||||||

| Loan Interest | ||||||||

| Expenses | ||||||||

| Depreciation | ||||||||

| Taxable Income (Loss) | ||||||||

| Tax Bracket Assumed | ||||||||

| Tax (Payable) / Receivable | ||||||||

| FINANCIAL INDICATORS |

| Deminishing Return on Equity Analysis (Why Refinance & Acquire # 2?) | ||||||||||||||||

| Address | ||||||||||||||||

| City,State | ||||||||||||||||

| Gross Building Area | 6,000 | |||||||||||||||

| Land Area | ||||||||||||||||

| Parking Ratio | ||||||||||||||||

| Coverage | ||||||||||||||||

| Yr., Built | ||||||||||||||||

| Ownership Type | ||||||||||||||||

| Occupancy | ||||||||||||||||

| Purchase Date | ||||||||||||||||

| Purchase Price | ||||||||||||||||

| Plus Acquisition Costs | ||||||||||||||||

| Plus Loan Fees / Costs | ||||||||||||||||

| Project Cost: | ||||||||||||||||

| CAP | ||||||||||||||||

| NOI | ||||||||||||||||

| Deminishing Return on Equity Analysis (Why Refinance & Acquire # 2?) | ||||||||||||||||

| Subject Property Year of Purchase | Subject Property Today | Subject Property With 65% Leverage | Refinance Subject Property Acquisition # 2 | |||||||||||||

| Estimated Property Value | $1,000,000 | $1,500,000 | $1,500,000 | $1,000,000 | ||||||||||||

| Loan Amount | 600,000 | 502,000 | 800,000 | 700,000 | ||||||||||||

| Cap Rate | 7.00% | 6.50% | 6.50% | 6.50% | ||||||||||||

| Loan To Value % | 60% | 33% | 65% | 70% | ||||||||||||

| Equity | 400,000 | 998,000 | 700,000 | 298,000 | ||||||||||||

| Closing Costs / Rehab | N/A | 0 | 0 | 0 | ||||||||||||

| Interest Rate | 6.00% | 6.00% | 4.50% | 4.50% | ||||||||||||

| Amortization | 360 | 360 | 360 | 360 | ||||||||||||

| Net Operating Income | 75,000 | 100,000 | 100,000 | 75,000 | ||||||||||||

| Debt Service | 43,168 | 43,168 | 48,642 | 42,562 | ||||||||||||

| Pre-Tax Cash Flow | 31,832 | 56,832 | 51,358 | 32,438 | ||||||||||||

| ROE % (Cash on Cash ) | 7.96% | 5.69% | 7.34% | 10.89% | ||||||||||||

| Equity to Pursue Exchange or additional Investment | 298,000 | |||||||||||||||

| COMMENTS | ||||||||||||||||

| Subject: | ||||||||||||||||

| Refinance # 1 | ||||||||||||||||

| Refinance / Acquisition # 2 | ||||||||||||||||

no reviews yet

Please Login to review.