256x Filetype XLSX File size 0.02 MB Source: am.jpmorgan.com

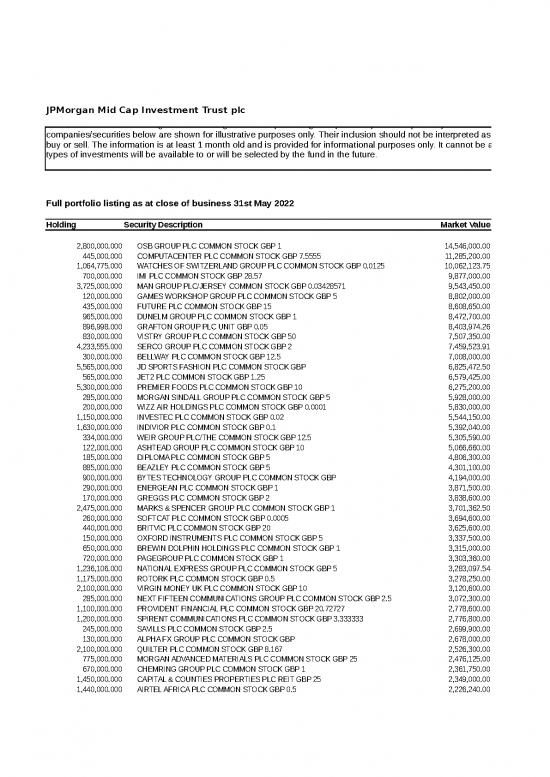

JPMorgan Mid Cap Investment Trust plc

basis, and as such, J.P. Morgan Asset Management accepts no legal responsibility or liability for any such data manipulation. The

companies/securities below are shown for illustrative purposes only. Their inclusion should not be interpreted as a recommendation to

buy or sell. The information is at least 1 month old and is provided for informational purposes only. It cannot be assumed that these

types of investments will be available to or will be selected by the fund in the future.

Full portfolio listing as at close of business 31st May 2022

Holding Security Description Market Value

2,800,000.000 OSB GROUP PLC COMMON STOCK GBP 1 14,546,000.00

445,000.000 COMPUTACENTER PLC COMMON STOCK GBP 7.5555 11,285,200.00

1,064,775.000 WATCHES OF SWITZERLAND GROUP PLC COMMON STOCK GBP 0.0125 10,062,123.75

700,000.000 IMI PLC COMMON STOCK GBP 28.57 9,877,000.00

3,725,000.000 MAN GROUP PLC/JERSEY COMMON STOCK GBP 0.03428571 9,543,450.00

120,000.000 GAMES WORKSHOP GROUP PLC COMMON STOCK GBP 5 8,802,000.00

435,000.000 FUTURE PLC COMMON STOCK GBP 15 8,608,650.00

965,000.000 DUNELM GROUP PLC COMMON STOCK GBP 1 8,472,700.00

896,998.000 GRAFTON GROUP PLC UNIT GBP 0.05 8,403,974.26

830,000.000 VISTRY GROUP PLC COMMON STOCK GBP 50 7,507,350.00

4,233,555.000 SERCO GROUP PLC COMMON STOCK GBP 2 7,459,523.91

300,000.000 BELLWAY PLC COMMON STOCK GBP 12.5 7,008,000.00

5,565,000.000 JD SPORTS FASHION PLC COMMON STOCK GBP 6,825,472.50

565,000.000 JET2 PLC COMMON STOCK GBP 1.25 6,579,425.00

5,300,000.000 PREMIER FOODS PLC COMMON STOCK GBP 10 6,275,200.00

285,000.000 MORGAN SINDALL GROUP PLC COMMON STOCK GBP 5 5,928,000.00

200,000.000 WIZZ AIR HOLDINGS PLC COMMON STOCK GBP 0.0001 5,830,000.00

1,150,000.000 INVESTEC PLC COMMON STOCK GBP 0.02 5,544,150.00

1,630,000.000 INDIVIOR PLC COMMON STOCK GBP 0.1 5,392,040.00

334,000.000 WEIR GROUP PLC/THE COMMON STOCK GBP 12.5 5,305,590.00

122,000.000 ASHTEAD GROUP PLC COMMON STOCK GBP 10 5,066,660.00

185,000.000 DIPLOMA PLC COMMON STOCK GBP 5 4,806,300.00

885,000.000 BEAZLEY PLC COMMON STOCK GBP 5 4,301,100.00

900,000.000 BYTES TECHNOLOGY GROUP PLC COMMON STOCK GBP 4,194,000.00

290,000.000 ENERGEAN PLC COMMON STOCK GBP 1 3,871,500.00

170,000.000 GREGGS PLC COMMON STOCK GBP 2 3,838,600.00

2,475,000.000 MARKS & SPENCER GROUP PLC COMMON STOCK GBP 1 3,701,362.50

260,000.000 SOFTCAT PLC COMMON STOCK GBP 0.0005 3,694,600.00

440,000.000 BRITVIC PLC COMMON STOCK GBP 20 3,625,600.00

150,000.000 OXFORD INSTRUMENTS PLC COMMON STOCK GBP 5 3,337,500.00

650,000.000 BREWIN DOLPHIN HOLDINGS PLC COMMON STOCK GBP 1 3,315,000.00

720,000.000 PAGEGROUP PLC COMMON STOCK GBP 1 3,303,360.00

1,236,106.000 NATIONAL EXPRESS GROUP PLC COMMON STOCK GBP 5 3,283,097.54

1,175,000.000 ROTORK PLC COMMON STOCK GBP 0.5 3,278,250.00

2,100,000.000 VIRGIN MONEY UK PLC COMMON STOCK GBP 10 3,120,600.00

285,000.000 NEXT FIFTEEN COMMUNICATIONS GROUP PLC COMMON STOCK GBP 2.5 3,072,300.00

1,100,000.000 PROVIDENT FINANCIAL PLC COMMON STOCK GBP 20.72727 2,778,600.00

1,200,000.000 SPIRENT COMMUNICATIONS PLC COMMON STOCK GBP 3.333333 2,776,800.00

245,000.000 SAVILLS PLC COMMON STOCK GBP 2.5 2,699,900.00

130,000.000 ALPHA FX GROUP PLC COMMON STOCK GBP 2,678,000.00

2,100,000.000 QUILTER PLC COMMON STOCK GBP 8.167 2,526,300.00

775,000.000 MORGAN ADVANCED MATERIALS PLC COMMON STOCK GBP 25 2,476,125.00

670,000.000 CHEMRING GROUP PLC COMMON STOCK GBP 1 2,361,750.00

1,450,000.000 CAPITAL & COUNTIES PROPERTIES PLC REIT GBP 25 2,349,000.00

1,440,000.000 AIRTEL AFRICA PLC COMMON STOCK GBP 0.5 2,226,240.00

565,000.000 HARBOUR ENERGY PLC GBP 2,169,035.00

155,000.000 HILL & SMITH HOLDINGS PLC COMMON STOCK GBP 25 2,160,700.00

390,000.000 MARSHALLS PLC COMMON STOCK GBP 25 2,084,550.00

130,000.000 INTERMEDIATE CAPITAL GROUP PLC COMMON STOCK GBP 26.25 2,046,850.00

65,000.000 CLARKSON PLC COMMON STOCK GBP 25 2,011,750.00

1,150,000.000 URBAN LOGISTICS REIT PLC REIT GBP 1 1,995,250.00

580,000.000 CMC MARKETS PLC COMMON STOCK GBP 25 1,835,700.00

160,000.000 LIONTRUST ASSET MANAGEMENT PLC COMMON STOCK GBP 1 1,779,200.00

835,000.000 888 HOLDINGS PLC COMMON STOCK GBP 0.5 1,756,840.00

65,000.000 4IMPRINT GROUP PLC COMMON STOCK GBP 38.45999 1,738,750.00

235,000.000 HOWDEN JOINERY GROUP PLC COMMON STOCK GBP 10 1,602,700.00

650,000.000 CLS HOLDINGS PLC REIT GBP 2.5 1,482,000.00

760,000.000 ALPHAWAVE IP GROUP PLC COMMON STOCK GBP 0.01 1,337,600.00

35,000.000 DECHRA PHARMACEUTICALS PLC COMMON STOCK GBP 1 1,270,500.00

810,000.000 DEVOLVER DIGITAL INC COMMON STOCK GBP 1,117,800.00

207,446.000 EASYJET PLC COMMON STOCK GBP 27.28571 1,073,325.60

158,136.000 NINETY ONE PLC COMMON STOCK GBP 356,438.54

216,307.000 REACH PLC COMMON STOCK GBP 10 263,245.62

Total portfolio 270,020,629.22

Actual gearing as at 31st May 2022

basis, and as such, J.P. Morgan Asset Management accepts no legal responsibility or liability for any such data manipulation. The

companies/securities below are shown for illustrative purposes only. Their inclusion should not be interpreted as a recommendation to

buy or sell. The information is at least 1 month old and is provided for informational purposes only. It cannot be assumed that these

types of investments will be available to or will be selected by the fund in the future.

% of FundSecurity No.

5.39% BLDRH36

4.18% BV9FP30

3.73% BJDQQ87

3.66% BGLP8L2

3.53% BJ1DLW9

3.26% 371847

3.19% BYZN904

3.14% B1CKQ73

3.11% B00MZ44

2.78% 185929

2.76% 797379

2.60% 90498

2.53% BM8Q5M0

2.44% B1722W1

2.32% B7N0K05

2.20% 808561

2.16% BN574F9

2.05% B17BBQ5

2.00% BRS65X6

1.96% 946580

1.88% 53673

1.78% 182663

1.59% BYQ0JC6

1.55% BMH18Q1

1.43% BG12Y04

1.42% B63QSB3

1.37% 3127489

1.37% BYZDVK8

1.34% B0N8QD5

1.24% 665045

1.23% 176581

1.22% 3023231

1.22% 621520

1.21% BVFNZH2

1.16% BD6GN03

1.14% 3002605

1.03% B1Z4ST8

1.03% 472609

1.00% B135BJ4

0.99% BF1TM59

0.94% BNHSJN3

0.92% 602729

0.87% B45C9X4

0.87% B62G9D3

0.82% BKDRYJ4

0.80% BMBVGQ3

0.80% 427030

0.77% B012BV2

0.76% BYT1DJ1

0.75% 201836

0.74% BYV8MN7

0.68% B14SKR3

0.66% 738840

0.65% B0L4LM9

0.64% 664097

0.59% 557681

0.55% BF04459

0.50% BNDRMJ1

0.47% 963318

0.41% BPBLXY1

0.40% B7KR2P8

0.13% BJHPLV8

0.10% 903994

100.00%

5.4%

no reviews yet

Please Login to review.