257x Filetype XLSX File size 0.14 MB Source: 2os2f877tnl1dvtmc3wy0aq1-wpengine.netdna-ssl.com

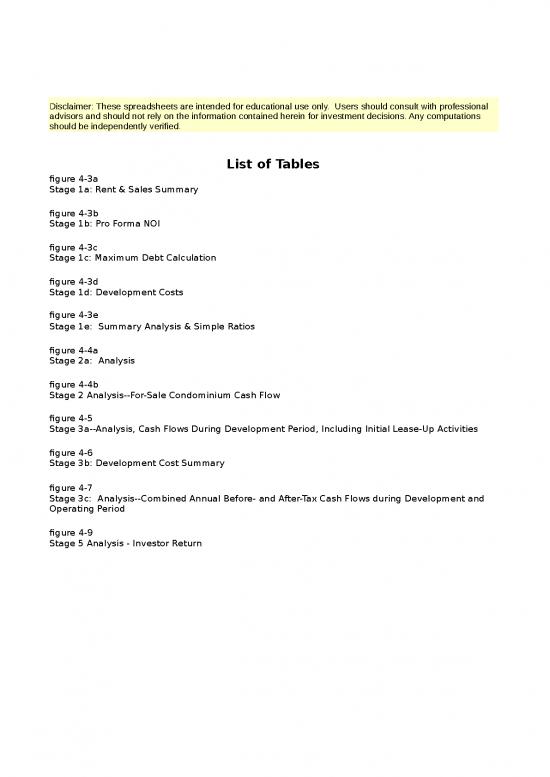

Sheet 1: List of Tables

| Disclaimer: These spreadsheets are intended for educational use only. Users should consult with professional advisors and should not rely on the information contained herein for investment decisions. Any computations should be independently verified. |

| List of Tables |

| figure 4-3a Stage 1a: Rent & Sales Summary |

| figure 4-3b Stage 1b: Pro Forma NOI |

| figure 4-3c Stage 1c: Maximum Debt Calculation |

| figure 4-3d Stage 1d: Development Costs |

| figure 4-3e |

| Stage 1e: Summary Analysis & Simple Ratios |

| figure 4-4a Stage 2a: Analysis |

| figure 4-4b Stage 2 Analysis--For-Sale Condominium Cash Flow |

| figure 4-5 Stage 3a--Analysis, Cash Flows During Development Period, Including Initial Lease-Up Activities |

| figure 4-6 Stage 3b: Development Cost Summary |

| figure 4-7 Stage 3c: Analysis--Combined Annual Before- and After-Tax Cash Flows during Development and Operating Period |

| figure 4-9 Stage 5 Analysis - Investor Return |

| figure 4-3a Stage 1a - Rental and Sales Revenue Summary |

||||||

| Apartment Unit Types | No. of Units | Rent/Ft2 | Area/Unit (ft2) | Total Ft2 | Rent/Month/Unit | Total Annual Rent |

| 1 Bedroom, 1 Bath | 10 | $1.13 | 800 | 8,000 | $900 | $108,000 |

| 1 Bedroom, 1.5 Bath | 27 | $1.10 | 956 | 25,800 | $1,053 | $341,100 |

| 2 Bedroom, 1 Bath | 8 | $1.03 | 1,138 | 9,100 | $1,169 | $112,200 |

| 2 Bedroom, 2 Bath | 6 | $1.21 | 1,450 | 8,700 | $1,750 | $126,000 |

| 2 Bedroom, 2 Bath, Den | 2 | $1.02 | 2,450 | 4,900 | $2,495 | $59,880 |

| Total Apartment Rental Revenue | 53 | $1.10 | 1,066 | 56,500 | $1,175 | $747,180 |

| Total Retail Rental Revenue (see below) | 4 | $1.31 | 1,981 | 7,925 | $2,592 | $124,437 |

| Other Rental Revenuea | $18,300 | |||||

| Other Miscellaneous Revenueb | $2,400 | |||||

| Total Rental Revenue | 57 | $1.15 | 1,130 | 64,425 | $3,767 | $892,317 |

| Retail Tenants | No. of Units | Rent/Ft2 | Area/Unit (ft2) | Total Ft2 | Rent/Month/Unit | Total Annual Rent |

| Restaurant | 3 | $1.25 | 2,333 | 6,998 | $2,916 | $104,970 |

| Dry Cleaners | 1 | $1.75 | 927 | 927 | $1,622 | $19,467 |

| Total Rental Revenue | 4 | $1.31 | 1,981 | 7,925 | $2,592 | $124,437 |

| Condominium Homes | No. of Units | Sales/Ft2 | Area/Unit (ft2) | Total Ft2 | Sales/Unit | Total Annual Sales |

| Condominium Homes | 3 | $162.50 | 2,000 | 6,000 | $325,000 | $975,000 |

| Total Sales Revenue | 3 | $162.50 | 2,000 | 6,000 | $325,000 | $975,000 |

| aOther Rental Revenue includes additional revenue derived from leasing space at the property. Examples of Other Rental Revenue include leases for parking, rooftop telecommunication devices, storage space, and billboards. | ||||||

| bOther Miscellaneous Revenue includes additional revenue as a result of conducting daily business activities. Examples of Other Miscellaneous Revenue include late fees and penalties, forfeiture of deposits, and lost key fees. Specific to this case, miscellaneous revenue from participation in the tax increment financing program accounts for the majority of the line item amount. | ||||||

| figure 4-3b Stage 1b - Pro Forma NOI |

|||

| Factor | Annual Revenue/Cost | ||

| Revenue | |||

| Gross Potential Revenuea | $892,317 | ||

| Less: Vacancy | 5.00% | ($44,616) | |

| Less: Bad Debt | 0.50% | ($4,462) | |

| Effective Gross Revenue | $843,240 | ||

| Expensesb | |||

| Property Management | 3.00% | of Effective Gross Revenue | $25,297 |

| Controllable Costsc | $1,950 | per unit | $103,350 |

| Real Estate Taxes | 1.36% | of estimated total project cost | $135,000 |

| Insurance | $400 | per unit | $21,200 |

| Utilities | $500 | per unit | $26,500 |

| Replacement Reserve | $150 | per unit | $7,950 |

| Total Expenses | $319,297 | ||

| Net Operating Income | $523,942 | ||

| = link from another sheet | |||

| aGross Potential Revenue is provided by the prior Rental and Sales Revenue Summary exhibit. Vacancy and Bad Debt are customary charges against gross revenue. | |||

| bCustomary expense items have been shown. In the pro forma, per-unit expense items are applied against 53 units. For expenses based on project cost, the total project cost used to estimate expenses is $9,900,000, which accounts for the apartment and retail portions only before application of any subsidies. | |||

| cControllable costs typically include salary, administrative, marketing, and maintenance expenses. | |||

no reviews yet

Please Login to review.