222x Filetype PPT File size 0.14 MB Source: www.blackwellpublishing.com

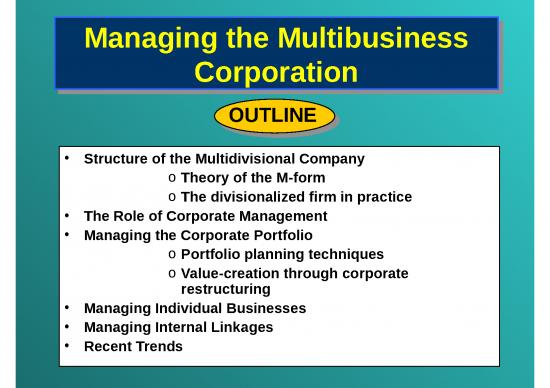

The Multidivisional Structure: Theory of the M-Form

The Multidivisional Structure: Theory of the M-Form

Efficiency advantages of the multidivisional firm:

• Recognizes bounded rationality—top management has limited

decision-making capacity

• Divides decision-making according to frequency:

—high-frequency operating decisions at divisional level

—low-frequency strategic decisions at corporate level

• Reduces costs of communication and coordination: business

level decisions confined to divisional level (reduces decision

making at the top)

• Global, rather than local optimization:- functional organizations

encourage functional goals. M-form structure encourages focus

on profitability.

• Efficient allocation of resources through internal capital and labor

markets

• Resolves agency problem-- corporate management an interface

between shareholders and business-level managers.

The Divisionalized Firm in Practice

The Divisionalized Firm in Practice

• Constraints upon decentralization.

– Difficult to achieve clear division of decision making between

corporate and divisional levels.

– On-going dialogue and conflict between corporate and divisional

managers over both strategic and operational issues.

• Standardization of divisional management

– Despite potential for divisions to develop distinctive strategies and

structures—corporate systems may impose uniformity.

• Managing divisional inter-relationships

– Requires more complex structures, e.g. matrix structures where

functional and/or geographical structure is imposed on top of a

product/market structure.

– Added complexity undermines the efficiency advantages of the M-

form

The Functions of Corporate Management

The Functions of Corporate Management

Managing the —Decisions over diversification, acquisition,

Corporate divestment

Portfolio —Resource allocation between businesses.

Managing the — Business strategy formulation

individual —Monitoring and controlling business

businesses performance

Managing

linkages —Sharing and transferring resources and

between capabilities

businesses

The Development of Strategic Planning Techniques:

The Development of Strategic Planning Techniques:

General Electric in the 1970’s

General Electric in the 1970’s

Late 1960’s: GE encounters problems of direction,

coordination, control, and profitability

Corporate planning responses:

Portfolio Planning Models —matrix-based frameworks

for evaluating business unit performance, formulating

business strategies, and allocating resources

Strategic Business Units —GE reorganized around

SBUs (business comprising a strategically-distinct

group of closely-related products

PIMS —a database which quantifies the impact of

strategy on performance. Used to appraise SBU

performance and guide business strategy formulation

Portfolio Planning Models: Their

Portfolio Planning Models: Their

Uses in Strategy Formulation

Uses in Strategy Formulation

• Allocating resources-- the analysis indicates both the

investment requirements of different businesses and their

likely returns

• Formulating business-unit strategy-- the analysis yields

simple strategy recommendations (e.g..: “build”, “hold”, or

“harvest”)

• Setting performance targets-- the analysis indicates likely

performance outcomes in terms of cash flow and ROI

• Portfolios balance-- the analysis can assist in corporate

goals such as a balanced cash flow and balance of growing

and declining businesses.

no reviews yet

Please Login to review.