198x Filetype XLSX File size 0.03 MB Source: www.oppex.org

Sheet 1: Child Tuition Data

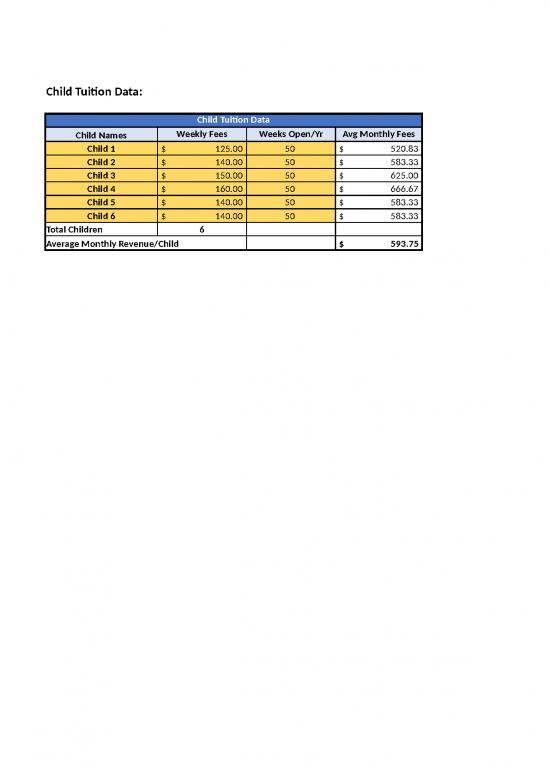

| Child Tuition Data: | Enter Data in Yellow Cells: | |||||||

| Child Tuition Data | ||||||||

| Child Names | Weekly Fees | Weeks Open/Yr | Avg Monthly Fees | |||||

| Child 1 | $125.00 | 50 | $520.83 | |||||

| Child 2 | $140.00 | 50 | $583.33 | |||||

| Child 3 | $150.00 | 50 | $625.00 | |||||

| Child 4 | $160.00 | 50 | $666.67 | |||||

| Child 5 | $140.00 | 50 | $583.33 | |||||

| Child 6 | $140.00 | 50 | $583.33 | |||||

| Total Children | 6 | |||||||

| Average Monthly Revenue/Child | $593.75 | |||||||

| Monthly Forecast | Enter Data in Yellow Cells: | ||||||||

| Month | Children | Avg Tuition/Month | Total Tuition | ||||||

| Jan | 4 | $593.75 | $2,375.00 | ||||||

| Feb | 4 | $593.75 | $2,375.00 | ||||||

| Mar | 4 | $593.75 | $2,375.00 | ||||||

| Apr | 3 | $593.75 | $1,781.25 | ||||||

| May | 4 | $593.75 | $2,375.00 | ||||||

| Jun | 5 | $593.75 | $2,968.75 | ||||||

| Jul | 6 | $593.75 | $3,562.50 | ||||||

| Aug | 6 | $593.75 | $3,562.50 | ||||||

| Sep | 6 | $593.75 | $3,562.50 | ||||||

| Oct | 6 | $593.75 | $3,562.50 | ||||||

| Nov | 6 | $593.75 | $3,562.50 | ||||||

| Dec | 6 | $593.75 | $3,562.50 | ||||||

| Total | $35,625.00 | ||||||||

| Total Household Expense | Schedule C Business Income | Cash Business Profit | Enter Data in Yellow Cells: | |||||||

| Income | ||||||||||

| Contributions and Grants | $- | $- | Bad Debt Write-Offs as % of Tuition Revenue: | 5% | ||||||

| Tuition | $35,625.00 | $35,625.00 | ||||||||

| Fees | $500.00 | $500.00 | ||||||||

| Food Program Income | $5,000.00 | $5,000.00 | ||||||||

| Total Income | $41,125.00 | $41,125.00 | ||||||||

| Expenses (Per IRS Schedule C) | ||||||||||

| COST OF GOOD SOLD | ||||||||||

| Food | $4,500.00 | $4,500.00 | ||||||||

| Educational Supplies | $300.00 | $300.00 | ||||||||

| TOTAL COST OF GOODS SOLD | $4,800.00 | $4,800.00 | ||||||||

| OTHER EXPENSES | ||||||||||

| Advertising | $400.00 | $400.00 | ||||||||

| Car and Truck Expenses | $500.00 | $500.00 | ||||||||

| Contract Labor | $100.00 | $100.00 | ||||||||

| Business Liability Insurance | $300.00 | $300.00 | ||||||||

| Interest Expense | $50.00 | $50.00 | ||||||||

| Legal & Accounting Services | $200.00 | $200.00 | ||||||||

| Office Supplies | $175.00 | $175.00 | ||||||||

| Retirement Conributions | $400.00 | $400.00 | ||||||||

| Equipment Lease & Maintenance | $- | $- | ||||||||

| Bad Debt | $1,781.25 | $1,781.25 | ||||||||

| Dues & Memberships | $100.00 | $100.00 | ||||||||

| Professional Development | $100.00 | $100.00 | ||||||||

| Travel/Meals | $100.00 | $100.00 | ||||||||

| Depreciation | $500.00 | $- | ||||||||

| Taxes, Licenses & Permits | $100.00 | $100.00 | ||||||||

| Other Business Expenses | $200.00 | $200.00 | ||||||||

| Rent/Mortgage* | $8,000.00 | $2,819.63 | $- | |||||||

| Property Tax* | $1,500.00 | $528.68 | $- | |||||||

| Cleaning Supplies* | $400.00 | $140.98 | $140.98 | |||||||

| Maintenance & Repair* | $500.00 | $176.23 | $176.23 | |||||||

| Utilities* | $2,000.00 | $704.91 | $- | |||||||

| Homeowner's Insurance* | $1,500.00 | $528.68 | $- | |||||||

| Phone* | $1,200.00 | $422.95 | $- | |||||||

| TOTAL OTHER EXPENSES | $10,328.31 | $4,823.46 | ||||||||

| Total Expenses | $15,128.31 | $9,623.46 | ||||||||

| Profit/Loss | $25,996.69 | $31,501.54 | ||||||||

| *Calculated based upon Time-Space Percentages | 35% | |||||||||

no reviews yet

Please Login to review.