324x Filetype XLSX File size 0.02 MB Source: www.mla.com.au

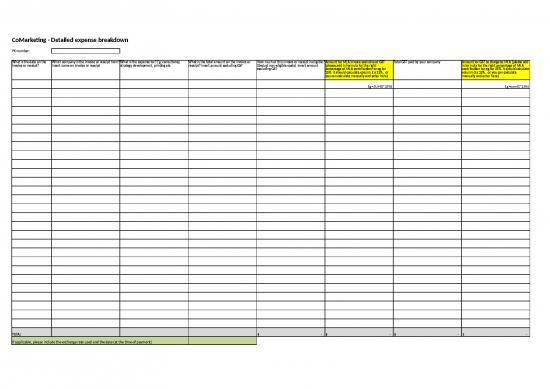

CoMarketing - Detailed expense breakdown

PO number :

What is the date on the Which company is the invoice or receipt from? What is the expense for? Eg: consultancy, What is the total amount on the invoice or How much of this invoice or receipt is eligible? Amount for MLA invoice exclusive of GST Total GST paid by your company Amount for GST to charge to MLA (please add

invoice or receipt? Insert name on invoice or receipt strategy development, printing etc. receipt? Insert amount excluding GST (Deduct non-eligible costs). Insert amount (please add in formula for the right in formula for the right percentage of MLA

excluding GST percentage of MLA contribution for eg.for contribution for eg.for 25% it should calculate

25% it should calculate column E x 25%, or column G x 25%, or you can calculate

you can calculate manually and enter here) manually and enter here)

Eg =SUM(E*25%) Eg =sum(G*25%)

TOTAL $ - $ - $ - $ -

If applicable, please include the exchange rate used and the date (at the time of payment)

no reviews yet

Please Login to review.