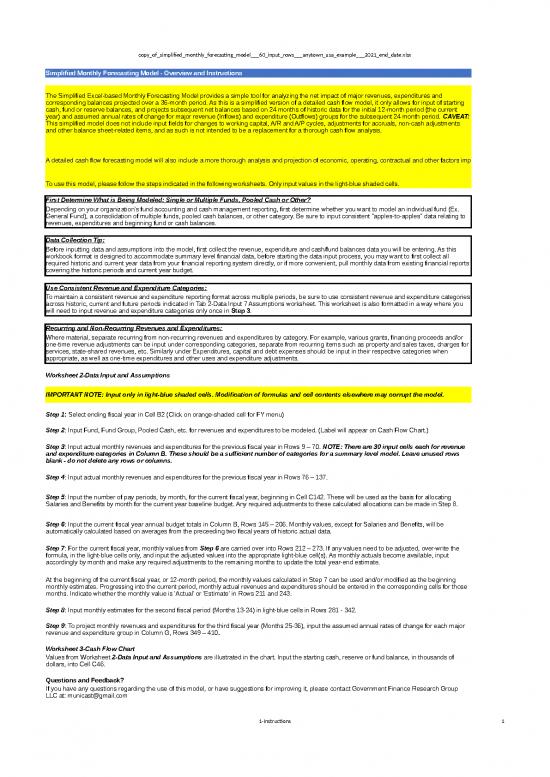

| Simplified Monthly Forecasting Model - Overview and Instructions |

|

| The Simplified Excel-based Monthly Forecasting Model provides a simple tool for analyzing the net impact of major revenues, expenditures and corresponding balances projected over a 36-month period. As this is a simplified version of a detailed cash flow model, it only allows for input of starting cash, fund or reserve balances, and projects subsequent net balances based on 24 months of historic data for the initial 12-month period (the current year) and assumed annual rates of change for major revenue (Inflows) and expenditure (Outflows) groups for the subsequent 24 month period. CAVEAT: This simplified model does not include input fields for changes to working capital, A/R and A/P cycles, adjustments for accruals, non-cash adjustments and other balance sheet-related items, and as such is not intended to be a replacement for a thorough cash flow analysis. |

|

| A detailed cash flow forecasting model will also include a more thorough analysis and projection of economic, operating, contractual and other factors impacting revenues and expenditures, such as capital programs, debt expense and other examples included in the reference chart on the 4-Forecast Indicators worksheet. For an example of a comprehensive Excel-based forecasting model, please see MuniCast.com |

|

| To use this model, please follow the steps indicated in the following worksheets. Only input values in the light-blue shaded cells. |

|

| First Determine What is Being Modeled: Single or Multiple Funds, Pooled Cash or Other? |

| Depending on your organization's fund accounting and cash management reporting, first determine whether you want to model an individual fund (Ex. General Fund), a consolidation of multiple funds, pooled cash balances, or other category. Be sure to input consistent "apples-to-apples" data relating to revenues, expenditures and beginning fund or cash balances. |

|

| Data Collection Tip: |

| Before inputting data and assumptions into the model, first collect the revenue, expenditure and cash/fund balances data you will be entering. As this workbook format is designed to accommodate summary level financial data, before starting the data input process, you may want to first collect all required historic and current year data from your financial reporting system directly, or if more convenient, pull monthly data from existing financial reports covering the historic periods and current year budget. |

|

| Use Consistent Revenue and Expenditure Categories: |

| To maintain a consistent revenue and expenditure reporting format across multiple periods, be sure to use consistent revenue and expenditure categories across historic, current and future periods indicated in Tab 2-Data Input 7 Assumptions worksheet. This worksheet is also formatted in a way where you will need to input revenue and expenditure categories only once in Step 3. |

|

| Recurring and Non-Recurring Revenues and Expenditures: |

| Where material, separate recurring from non-recurring revenues and expenditures by category. For example, various grants, financing proceeds and/or one-time revenue adjustments can be input under corresponding categories, separate from recurring items such as property and sales taxes, charges for services, state-shared revenues, etc. Similarly under Expenditures, capital and debt expenses should be input in their respective categories when appropriate, as well as one-time expenditures and other uses and expenditure adjustments. |

|

| Worksheet 2-Data Input and Assumptions |

|

| IMPORTANT NOTE: Input only in light-blue shaded cells. Modification of formulas and cell contents elsewhere may corrupt the model. |

|

| Step 1: Select ending fiscal year in Cell B2 (Click on orange-shaded cell for FY menu) |

|

| Step 2: Input Fund, Fund Group, Pooled Cash, etc. for revenues and expenditures to be modeled. (Label will appear on Cash Flow Chart.) |

|

| Step 3: Input actual monthly revenues and expenditures for the previous fiscal year in Rows 9 – 70. NOTE: There are 30 input cells each for revenue and expenditure categories in Column B. These should be a sufficient number of categories for a summary level model. Leave unused rows blank - do not delete any rows or columns. |

|

| Step 4: Input actual monthly revenues and expenditures for the previous fiscal year in Rows 76 – 137. |

|

| Step 5: Input the number of pay periods, by month, for the current fiscal year, beginning in Cell C142. These will be used as the basis for allocating Salaries and Benefits by month for the current year baseline budget. Any required adjustments to these calculated allocations can be made in Step 8. |

|

| Step 6: Input the current fiscal year annual budget totals in Column B, Rows 145 – 206. Monthly values, except for Salaries and Benefits, will be automatically calculated based on averages from the preceeding two fiscal years of historic actual data. |

|

| Step 7: For the current fiscal year, monthly values from Step 6 are carried over into Rows 212 – 273. If any values need to be adjusted, over-write the formula, in the light-blue cells only, and input the adjusted values into the appropriate light-blue cell(s). As monthly actuals become available, input accordingly by month and make any required adjustments to the remaining months to update the total year-end estimate. |

|

| At the beginning of the current fiscal year, or 12-month period, the monthly values calculated in Step 7 can be used and/or modified as the beginning monthly estimates. Progressing into the current period, monthly actual revenues and expenditures should be entered in the corresponding cells for those months. Indicate whether the monthly value is 'Actual' or 'Estimate' in Rows 211 and 243. |

|

| Step 8: Input monthly estimates for the second fiscal period (Months 13-24) in light-blue cells in Rows 281 - 342. |

|

| Step 9: To project monthly revenues and expenditures for the third fiscal year (Months 25-36), input the assumed annual rates of change for each major revenue and expenditure group in Column G, Rows 349 – 410. |

|

| Worksheet 3-Cash Flow Chart |

| Values from Worksheet 2-Data Input and Assumptions are illustrated in the chart. Input the starting cash, reserve or fund balance, in thousands of dollars, into Cell C46. |

|

| Questions and Feedback? |

| If you have any questions regarding the use of this model, or have suggestions for improving it, please contact Government Finance Research Group LLC at: municast@gmail.com |

| DATA INPUT WORKSHEET |

↓CLICK ON CELL↓ |

|

NOTE: INPUT IN BLUE-SHADED CELLS ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

| 1. SELECT ENDING FISCAL YEAR > |

Click on cell for menu

DEC-2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2. INPUT FUND, FUNDS, OR OTHER > |

GENERAL FUND |

|

|

|

|

|

|

|

|

|

|

|

|

|

| INSTRUCTIONS: FOLLOW STEPS 3 - 9 BELOW |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| STEP 3: INPUT REVENUE/EXPENSE CATEGORIES AND LAST FISCAL YEAR'S ACTUAL DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL-2019 |

JAN-2019 |

FEB-2019 |

MAR-2019 |

APR-2019 |

MAY-2019 |

JUN-2019 |

JUL-2019 |

AUG-2019 |

SEP-2019 |

OCT-2019 |

NOV-2019 |

DEC-2019 |

|

|

| REVENUES (SOURCES): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PROPERTY TAX |

547,422,147 |

2,260,847 |

1,582,383 |

10,478,025 |

117,476,757 |

152,910,160 |

5,688,776 |

3,968,857 |

5,642,148 |

46,482,535 |

191,427,805 |

4,753,929 |

4,749,925 |

|

|

| SALES & USE TAX |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

| FEES & PERMITS |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

| FISCAL DISPARITIES |

99,653,142 |

- |

|

|

|

|

49,826,571 |

|

|

|

|

49,826,571 |

|

|

|

| BUSINESS LICENSE TAXES |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

| INTRAGOVT SVC CHARGES |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

| INTERGOVT REVENUES |

239,927,511 |

11,213,514 |

29,971,265 |

15,312,989 |

12,599,735 |

21,256,262 |

27,711,694 |

27,795,974 |

23,062,163 |

15,477,242 |

14,929,560 |

18,459,027 |

22,138,086 |

|

|

| REIMBURSEMENTS |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

| DONATIONS/CONTRIBS/ INV INCOME |

7,036,993 |

659,975 |

809,671 |

359,175 |

245,455 |

345,587 |

513,543 |

737,040 |

1,008,912 |

402,038 |

400,930 |

844,019 |

710,648 |

|

|

| FINES & FORFEITURES |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

| USE OF MONEY & PROPERTY |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES / INV MATURITIES |

71,767,799 |

21,013,356 |

14,443,781 |

- |

2,767,213 |

- |

- |

1,097,664 |

3,612,528 |

4,939,313 |

2,734,438 |

14,974,101 |

6,185,406 |

|

|

| TRANSIT TAX |

12,601,073 |

1,030,800 |

1,114,514 |

891,995 |

805,100 |

1,004,304 |

1,018,534 |

1,079,437 |

1,107,756 |

1,224,723 |

1,131,095 |

1,107,699 |

1,085,116 |

|

|

| PARK |

4,479,670 |

218,517 |

118,091 |

105,958 |

142,873 |

305,978 |

767,017 |

1,390,685 |

957,643 |

270,555 |

106,112 |

17,769 |

78,472 |

|

|

| LIBRARY |

667,388 |

47,473 |

25,479 |

84,816 |

71,574 |

26,870 |

25,494 |

32,629 |

83,755 |

137,590 |

66,452 |

28,100 |

37,156 |

|

|

| FINANCING PROCEEDS |

8,787,057 |

|

|

|

|

|

|

|

|

|

|

|

8,787,057 |

|

|

| OTHER NON-RECURRING SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL SOURCES > |

992,342,779 |

36,444,482 |

48,065,184 |

27,232,958 |

134,108,707 |

175,849,161 |

85,551,629 |

36,102,286 |

35,474,905 |

68,933,996 |

210,796,392 |

90,011,215 |

43,771,866 |

|

|

| EXPENSES (USES): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SALARIES & WAGES |

117,236,289 |

8,831,472 |

8,876,802 |

9,022,020 |

8,806,756 |

13,579,815 |

9,171,215 |

9,165,626 |

9,168,544 |

8,984,505 |

8,862,399 |

13,934,817 |

8,832,318 |

|

|

| BENEFITS |

23,936,769 |

1,789,341 |

1,830,912 |

1,857,119 |

1,819,461 |

2,730,092 |

1,826,730 |

1,851,883 |

1,869,634 |

1,832,930 |

1,856,661 |

2,731,713 |

1,940,293 |

|

|

| CONTRACTUAL SERVICES |

238,247,691 |

21,701,752 |

14,416,862 |

17,759,051 |

19,383,103 |

17,385,870 |

17,318,399 |

27,084,916 |

23,940,412 |

25,429,817 |

23,057,585 |

16,703,168 |

14,066,756 |

|

|

| UTILITIES |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MAINTENANCE AND REPAIRS |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

| FISCAL DISPARITIES |

67,195,744 |

- |

|

|

|

|

33,597,872 |

|

|

|

|

33,597,872 |

|

|

|

| CAPITAL |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

| GRANTS |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

| TRANSFERS/OTHER |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MTGE/DEED/TAXES/FEES |

15,298,075 |

1,187,772 |

956,772 |

771,964 |

1,215,764 |

1,105,191 |

2,168,911 |

7,458 |

2,282,124 |

1,655,441 |

1,623,811 |

2,287,115 |

35,752 |

|

|

| DEBT PYMTS |

25,067,587 |

224,138 |

21,286,252 |

- |

- |

132,507 |

- |

19,838 |

1,806,264 |

- |

- |

- |

1,598,588 |

|

|

| TAX DISTRIBUTION PYMTS |

410,674,494 |

3,792,141 |

|

|

|

47,300,000 |

68,385,000 |

102,384,266 |

|

|

41,980,500 |

44,268,436 |

102,564,151 |

|

|

| INVESTMENT PURCHASES |

(72,656,716) |

(7,182,742) |

|

|

(3,121,107) |

(8,354,290) |

(3,933,601) |

(4,629,055) |

(9,150,042) |

(11,934,703) |

(8,783,404) |

(5,819,736) |

(9,748,036) |

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL USES > |

824,999,933 |

30,343,874 |

47,367,600 |

29,410,154 |

28,103,977 |

73,879,185 |

128,534,526 |

135,884,932 |

29,916,936 |

25,967,990 |

68,597,552 |

107,703,385 |

119,289,822 |

|

|

| NET > |

167,342,846 |

6,100,608 |

697,584 |

(2,177,196) |

106,004,729 |

101,969,976 |

(42,982,897) |

(99,782,646) |

5,557,969 |

42,966,006 |

142,198,839 |

(17,692,170) |

(75,517,956) |

|

|

| STEP 4: INPUT PREVIOUS FISCAL YEAR'S ACTUAL DATA (PRIOR TO LAST FISCAL YEAR) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL-2018 |

JAN-2018 |

FEB-2018 |

MAR-2018 |

APR-2018 |

MAY-2018 |

JUN-2018 |

JUL-2018 |

AUG-2018 |

SEP-2018 |

OCT-2018 |

NOV-2018 |

DEC-2018 |

|

|

| REVENUES (SOURCES): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PROPERTY TAX |

510,278,023 |

4,874,893 |

2,174,518 |

6,165,571 |

113,619,655 |

137,923,971 |

5,306,350 |

4,101,379 |

4,904,301 |

42,420,741 |

178,092,610 |

6,786,339 |

3,907,695 |

|

|

| SALES & USE TAX |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FEES & PERMITS |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FISCAL DISPARITIES |

96,723,908 |

|

|

|

|

|

46,010,008 |

2,351,951 |

|

|

|

48,361,949 |

|

|

|

| BUSINESS LICENSE TAXES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INTRAGOVT SVC CHARGES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INTERGOVT REVENUES |

241,047,547 |

20,136,183 |

21,389,532 |

21,109,779 |

16,466,065 |

24,482,830 |

12,380,904 |

31,619,512 |

21,470,254 |

13,025,048 |

15,475,140 |

22,869,297 |

20,623,003 |

|

|

| REIMBURSEMENTS |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DONATIONS/CONTRIBS/ INV INCOME |

5,633,100 |

318,688 |

590,185 |

229,270 |

312,372 |

395,999 |

638,576 |

309,180 |

683,454 |

275,252 |

426,092 |

599,481 |

854,551 |

|

|

| FINES & FORFEITURES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| USE OF MONEY & PROPERTY |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES / INV MATURITIES |

72,473,335 |

20,909,320 |

1,650,047 |

252,606 |

2,741,738 |

- |

27,924,346 |

958,376 |

6,843,121 |

1,371,329 |

1,965,701 |

7,856,751 |

- |

|

|

| TRANSIT TAX |

11,692,376 |

1,012,141 |

956,036 |

909,765 |

772,930 |

960,511 |

891,835 |

1,008,025 |

806,274 |

1,269,096 |

1,053,798 |

1,015,431 |

1,036,534 |

|

|

| PARK |

4,628,261 |

218,192 |

103,933 |

96,827 |

112,968 |

370,512 |

749,156 |

1,354,006 |

1,020,234 |

337,369 |

149,610 |

33,466 |

81,988 |

|

|

| LIBRARY |

604,126 |

28,219 |

23,508 |

87,588 |

71,119 |

34,747 |

27,319 |

30,154 |

48,336 |

24,404 |

126,236 |

72,910 |

29,586 |

|

|

| FINANCING PROCEEDS |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER NON-RECURRING SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL SOURCES > |

943,080,676 |

47,497,636 |

26,887,759 |

28,851,406 |

134,096,847 |

164,168,570 |

93,928,494 |

41,732,583 |

35,775,974 |

58,723,239 |

197,289,187 |

87,595,624 |

26,533,357 |

|

|

| EXPENSES (USES): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SALARIES & WAGES |

113,980,179 |

8,828,889 |

8,268,207 |

8,702,812 |

8,943,280 |

8,480,934 |

13,098,474 |

9,169,164 |

8,837,393 |

8,665,040 |

8,587,387 |

13,804,801 |

8,593,798 |

|

|

| BENEFITS |

22,977,569 |

1,730,342 |

1,778,476 |

1,813,627 |

1,782,040 |

1,767,301 |

2,561,479 |

1,808,028 |

1,755,245 |

1,745,417 |

1,735,134 |

2,624,252 |

1,876,228 |

|

|

| CONTRACTUAL SERVICES |

212,241,208 |

21,971,496 |

15,998,766 |

16,106,945 |

17,865,209 |

16,751,881 |

17,161,068 |

18,125,968 |

22,695,896 |

16,751,684 |

18,035,018 |

18,182,048 |

12,595,229 |

|

|

| UTILITIES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MAINTENANCE AND REPAIRS |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FISCAL DISPARITIES |

66,691,562 |

|

|

|

|

|

31,724,107 |

1,621,674 |

|

|

|

33,345,781 |

|

|

|

| CAPITAL |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GRANTS |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TRANSFERS/OTHER |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MTGE/DEED/TAXES/FEES |

15,406,464 |

1,003,709 |

1,212,467 |

1,052,071 |

927,382 |

1,066,976 |

2,512,983 |

7,470 |

1,855,569 |

1,538,588 |

1,304,628 |

1,711,139 |

1,213,482 |

|

|

| DEBT PYMTS |

15,908,810 |

223,281 |

13,642,392 |

- |

- |

129,542 |

- |

1,881,252 |

- |

- |

- |

32,343 |

- |

|

|

| TAX DISTRIBUTION PYMTS |

386,218,436 |

1,406,940 |

- |

612,567 |

- |

43,425,000 |

72,978,000 |

92,095,084 |

- |

- |

38,382,000 |

137,318,845 |

- |

|

|

| INVESTMENT PURCHASES |

(112,132,631) |

(19,961,168) |

(10,000,000) |

(3,000,000) |

(10,000,000) |

(12,214,740) |

(21,916,518) |

(7,975,675) |

(1,147,611) |

- |

(18,080,450) |

|

(7,836,469) |

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL USES > |

721,291,597 |

15,203,489 |

30,900,308 |

25,288,022 |

19,517,911 |

59,406,894 |

118,119,593 |

116,732,965 |

33,996,492 |

28,700,729 |

49,963,717 |

207,019,209 |

16,442,268 |

|

|

| NET > |

221,789,079 |

32,294,147 |

(4,012,549) |

3,563,384 |

114,578,936 |

104,761,676 |

(24,191,099) |

(75,000,382) |

1,779,482 |

30,022,510 |

147,325,470 |

(119,423,585) |

10,091,089 |

|

|

| STEPS 5 & 6: INPUT CURRENT YEAR ANNUAL BUDGET OR ESTIMATE AND PAY-PERIODS BY MONTH; MONTHLY BUDGET VALUES AUTOMATICALLY CALCULATED BASED ON HISTORIC MONTHLY DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL-2020 |

JAN-2020 |

FEB-2020 |

MAR-2020 |

APR-2020 |

MAY-2020 |

JUN-2020 |

JUL-2020 |

AUG-2020 |

SEP-2020 |

OCT-2020 |

NOV-2020 |

DEC-2020 |

|

|

|

5. ENTER PAY PERIODS BY MONTH > |

2 |

2 |

2 |

2 |

3 |

2 |

2 |

2 |

2 |

3 |

2 |

2 |

26 |

< SHOULD EQUAL TOTAL PAY PERIODS |

|

PAY PERIOD FACTOR > |

0.077 |

0.077 |

0.077 |

0.077 |

0.115 |

0.077 |

0.077 |

0.077 |

0.077 |

0.115 |

0.077 |

0.077 |

1.000 |

< SHOULD EQUAL 1.000 |

| REVENUES (SOURCES): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PROPERTY TAX |

553,918,994 |

3,736,997 |

1,967,494 |

8,716,273 |

121,025,500 |

152,310,223 |

5,758,162 |

4,226,393 |

5,523,189 |

46,558,765 |

193,518,336 |

6,043,654 |

4,534,007 |

|

|

| SALES & USE TAX |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| FEES & PERMITS |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| FISCAL DISPARITIES |

102,628,560 |

- |

- |

- |

- |

- |

50,085,130 |

1,229,153 |

- |

- |

- |

51,314,277 |

- |

|

|

| BUSINESS LICENSE TAXES |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| INTRAGOVT SVC CHARGES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| INTERGOVT REVENUES |

246,121,980 |

16,042,099 |

26,282,072 |

18,638,064 |

14,873,395 |

23,405,363 |

20,515,969 |

30,403,774 |

22,787,890 |

14,585,039 |

15,558,530 |

21,148,309 |

21,881,475 |

|

|

| REIMBURSEMENTS |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| DONATIONS/CONTRIBS/ INV INCOME |

5,674,163 |

438,284 |

626,910 |

263,529 |

249,817 |

332,111 |

515,964 |

468,538 |

757,908 |

303,317 |

370,373 |

646,456 |

700,957 |

|

|

| FINES & FORFEITURES |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| USE OF MONEY & PROPERTY |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER SOURCES / INV MATURITIES |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| TRANSIT TAX |

12,000,000 |

1,009,132 |

1,022,770 |

889,998 |

779,484 |

970,541 |

943,646 |

1,031,123 |

945,455 |

1,231,848 |

1,079,250 |

1,048,742 |

1,048,011 |

|

|

| PARK |

4,862,081 |

233,128 |

118,523 |

108,253 |

136,575 |

361,130 |

809,378 |

1,465,197 |

1,055,849 |

324,528 |

136,512 |

27,351 |

85,658 |

|

|

| LIBRARY |

643,597 |

38,313 |

24,796 |

87,265 |

72,226 |

31,188 |

26,732 |

31,779 |

66,860 |

81,996 |

97,532 |

51,128 |

33,783 |

|

|

| FINANCING PROCEEDS |

11,548,502 |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

11,548,502 |

|

|

| OTHER NON-RECURRING SOURCES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER SOURCES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER SOURCES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER SOURCES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER SOURCES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER SOURCES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER SOURCES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER SOURCES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER SOURCES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER SOURCES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER SOURCES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER SOURCES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER SOURCES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER SOURCES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| TOTAL SOURCES > |

937,397,877 |

21,497,952 |

30,042,564 |

28,703,381 |

137,136,998 |

177,410,557 |

78,654,982 |

38,855,957 |

31,137,151 |

63,085,492 |

210,760,533 |

80,279,916 |

39,832,394 |

|

|

| EXPENSES (USES): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SALARIES & WAGES |

115,492,000 |

8,884,000 |

8,884,000 |

8,884,000 |

8,884,000 |

13,326,000 |

8,884,000 |

8,884,000 |

8,884,000 |

8,884,000 |

13,326,000 |

8,884,000 |

8,884,000 |

|

< NOTE: APPLIES PAY PERIOD FACTOR |

| BENEFITS |

23,712,000 |

1,824,000 |

1,824,000 |

1,824,000 |

1,824,000 |

2,736,000 |

1,824,000 |

1,824,000 |

1,824,000 |

1,824,000 |

2,736,000 |

1,824,000 |

1,824,000 |

|

< NOTE: APPLIES PAY PERIOD FACTOR |

| CONTRACTUAL SERVICES |

237,661,628 |

23,040,424 |

16,046,184 |

17,866,473 |

19,650,860 |

18,009,841 |

18,190,118 |

23,851,625 |

24,603,627 |

22,253,432 |

21,678,969 |

18,404,177 |

14,065,898 |

|

|

| UTILITIES |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| MAINTENANCE AND REPAIRS |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| FISCAL DISPARITIES |

69,982,347 |

- |

- |

- |

- |

- |

34,143,531 |

847,642 |

- |

- |

- |

34,991,174 |

- |

|

|

| CAPITAL |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| GRANTS |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| TRANSFERS/OTHER |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| MTGE/DEED/TAXES/FEES |

15,723,917 |

1,122,266 |

1,110,876 |

934,096 |

1,097,514 |

1,112,375 |

2,397,617 |

7,645 |

2,118,929 |

1,635,675 |

1,499,665 |

2,047,522 |

639,738 |

|

|

| DEBT PYMTS |

16,061,980 |

175,380 |

13,691,374 |

- |

- |

102,718 |

- |

745,192 |

708,022 |

- |

- |

12,678 |

626,617 |

|

|

| TAX DISTRIBUTION PYMTS |

409,462,482 |

2,671,411 |

- |

314,751 |

- |

46,616,656 |

72,635,661 |

99,928,101 |

- |

- |

41,292,158 |

93,303,850 |

52,699,893 |

|

|

| INVESTMENT PURCHASES |

28,633,628 |

4,206,025 |

1,549,528 |

464,858 |

2,033,152 |

3,187,229 |

4,005,549 |

1,953,138 |

1,595,650 |

1,849,316 |

4,162,630 |

901,784 |

2,724,768 |

|

|

| OTHER EXPENSES/USES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER EXPENSES/USES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER EXPENSES/USES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER EXPENSES/USES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER EXPENSES/USES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER EXPENSES/USES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER EXPENSES/USES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER EXPENSES/USES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER EXPENSES/USES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER EXPENSES/USES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER EXPENSES/USES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER EXPENSES/USES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER EXPENSES/USES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER EXPENSES/USES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER EXPENSES/USES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER EXPENSES/USES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER EXPENSES/USES |

|

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| TOTAL USES > |

916,729,982 |

41,923,506 |

43,105,962 |

30,288,178 |

33,489,526 |

85,090,820 |

142,080,475 |

138,041,343 |

39,734,228 |

36,446,423 |

84,695,422 |

160,369,185 |

81,464,913 |

|

|

| NET > |

20,667,895 |

(20,425,554) |

(13,063,398) |

(1,584,797) |

103,647,472 |

92,319,737 |

(63,425,493) |

(99,185,386) |

(8,597,077) |

26,639,069 |

126,065,111 |

(80,089,269) |

(41,632,519) |

|

|

| STEP 7: IF APPLICABLE, ADJUST CURRENT FISCAL YEAR (MONTHS 1-12) VALUES FROM STEP 6 IN SHADED CELLS BELOW (NOTE: THESE VALUES WILL APPEAR IN THE FIRST 12 MONTHS OF THE CASH FLOW CHART) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL-2020 |

JAN-2020 |

FEB-2020 |

MAR-2020 |

APR-2020 |

MAY-2020 |

JUN-2020 |

JUL-2020 |

AUG-2020 |

SEP-2020 |

OCT-2020 |

NOV-2020 |

DEC-2020 |

|

|

| REVENUES (SOURCES): |

STEP 8 > |

ACTUAL |

ACTUAL |

ACTUAL |

ESTIMATE |

ESTIMATE |

ESTIMATE |

ESTIMATE |

ESTIMATE |

ESTIMATE |

ESTIMATE |

ESTIMATE |

ESTIMATE |

|

< INPUT ACTUAL OR ESTIMATE |

| PROPERTY TAX |

558,213,162 |

2,548,064 |

1,966,335 |

4,604,963 |

121,001,100 |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

|

|

| SALES & USE TAX |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FEES & PERMITS |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FISCAL DISPARITIES |

#NAME? |

|

|

|

- |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

|

|

| BUSINESS LICENSE TAXES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INTRAGOVT SVC CHARGES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INTERGOVT REVENUES |

#NAME? |

13,130,657 |

28,198,346 |

15,790,165 |

12,725,700 |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

|

|

| REIMBURSEMENTS |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DONATIONS/CONTRIBS/ INV INCOME |

5,674,163 |

715,183 |

1,226,834 |

355,793 |

250,917 |

264,418 |

377,588 |

306,589 |

843,205 |

515,642 |

226,787 |

240,028 |

351,179 |

|

|

| FINES & FORFEITURES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| USE OF MONEY & PROPERTY |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES / INV MATURITIES |

58,198,891 |

16,872,000 |

11,085,000 |

6,371,000 |

1,945,000 |

3,000,000 |

2,000,000 |

1,244,000 |

2,470,000 |

6,166,891 |

5,000,000 |

450,000 |

1,595,000 |

|

|

| TRANSIT TAX |

#NAME? |

1,056,355 |

1,203,091 |

944,257 |

870,000 |

602,600 |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

|

|

| PARK |

#NAME? |

260,399 |

114,912 |

67,965 |

127,200 |

#NAME? |

515,000 |

647,400 |

346,050 |

179,025 |

81,975 |

#NAME? |

#NAME? |

|

|

| LIBRARY |

#NAME? |

41,143 |

163,570 |

17,104 |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

|

|

| FINANCING PROCEEDS |

11,548,502 |

11,548,502 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER NON-RECURRING SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL SOURCES > |

#NAME? |

46,172,303 |

43,958,088 |

28,151,247 |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

|

|

| EXPENSES (USES): |

STEP 8 > |

ACTUAL |

ACTUAL |

ACTUAL |

ESTIMATE |

ESTIMATE |

ESTIMATE |

ESTIMATE |

ESTIMATE |

ESTIMATE |

ESTIMATE |

ESTIMATE |

ESTIMATE |

|

< INPUT ACTUAL OR ESTIMATE |

| SALARIES & WAGES |

116,122,286 |

9,058,597 |

8,998,198 |

8,915,491 |

8,915,000 |

13,372,500 |

8,915,000 |

8,915,000 |

8,915,000 |

8,915,000 |

13,372,500 |

8,915,000 |

8,915,000 |

|

|

| BENEFITS |

24,579,921 |

1,852,765 |

1,948,512 |

1,888,644 |

1,889,000 |

2,833,500 |

1,889,000 |

1,889,000 |

1,889,000 |

1,889,000 |

2,833,500 |

1,889,000 |

1,889,000 |

|

|

| CONTRACTUAL SERVICES |

#NAME? |

19,274,995 |

19,291,908 |

16,940,376 |

19,964,600 |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

|

|

| UTILITIES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MAINTENANCE AND REPAIRS |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FISCAL DISPARITIES |

#NAME? |

|

|

|

- |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

|

|

| CAPITAL |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GRANTS |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TRANSFERS/OTHER |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MTGE/DEED/TAXES/FEES |

#NAME? |

601,669 |

1,011,668 |

1,077,626 |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

|

|

| DEBT PYMTS |

33,978,715 |

229,838 |

31,711,544 |

282,333 |

|

|

|

15,000 |

1,740,000 |

|

|

|

|

|

|

| TAX DISTRIBUTION PYMTS |

#NAME? |

3,963,493 |

|

|

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

|

|

| INVESTMENT PURCHASES |

28,633,628 |

2,249,086 |

6,020,624 |

20,363,918 |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL USES > |

956,430,885 |

37,230,443 |

68,982,454 |

49,468,388 |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

|

|

| NET > |

#NAME? |

8,941,860 |

(25,024,366) |

(21,317,141) |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

|

|

| BUDGET VS. ACTUAL > |

|

29,367,414 |

(11,960,968) |

(19,732,344) |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

|

|

| CUMULATIVE > |

|

29,367,414 |

17,406,446 |

(2,325,898) |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

#NAME? |

|

|

| STEP 8: INPUT MONTHLY ESTIMATES FOR YEAR 2 OF THE FORECAST (NOTE: THESE VALUES WILL APPEAR IN MONTHS 13-24 OF THE CASH FLOW CHART) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL-2021 |

JAN-2021 |

FEB-2021 |

MAR-2021 |

APR-2021 |

MAY-2021 |

JUN-2021 |

JUL-2021 |

AUG-2021 |

SEP-2021 |

OCT-2021 |

NOV-2021 |

DEC-2021 |

|

|

| REVENUES (SOURCES): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PROPERTY TAX |

553,918,994 |

3,736,997 |

1,967,494 |

8,716,273 |

121,025,500 |

152,310,223 |

5,758,162 |

4,226,393 |

5,523,189 |

46,558,765 |

193,518,336 |

6,043,654 |

4,534,007 |

|

|

| SALES & USE TAX |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| FEES & PERMITS |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| FISCAL DISPARITIES |

102,628,560 |

- |

- |

- |

- |

- |

50,085,130 |

1,229,153 |

- |

- |

- |

51,314,277 |

- |

|

|

| BUSINESS LICENSE TAXES |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| INTRAGOVT SVC CHARGES |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| INTERGOVT REVENUES |

248,583,200 |

16,202,520 |

26,544,893 |

18,824,444 |

15,022,129 |

23,639,417 |

20,721,129 |

30,707,812 |

23,015,769 |

14,730,890 |

15,714,116 |

21,359,792 |

22,100,290 |

|

|

| REIMBURSEMENTS |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| DONATIONS/CONTRIBS/ INV INCOME |

4,376,965 |

310,127 |

907,608 |

306,422 |

235,580 |

271,341 |

320,284 |

233,799 |

738,039 |

267,045 |

233,853 |

268,482 |

284,385 |

|

|

| FINES & FORFEITURES |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| USE OF MONEY & PROPERTY |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| OTHER SOURCES / INV MATURITIES |

43,937,000 |

8,447,000 |

12,355,000 |

11,245,000 |

- |

- |

2,000,000 |

2,475,000 |

965,000 |

- |

- |

6,000,000 |

450,000 |

|

|

| TRANSIT TAX |

12,000,000 |

1,009,132 |

1,022,770 |

889,998 |

779,484 |

970,541 |

943,646 |

1,031,123 |

945,455 |

1,231,848 |

1,079,250 |

1,048,742 |

1,048,011 |

|

|

| PARK |

5,007,943 |

240,122 |

122,079 |

111,500 |

140,673 |

371,964 |

833,659 |

1,509,153 |

1,087,524 |

334,264 |

140,607 |

28,171 |

88,228 |

|

|

| LIBRARY |

662,905 |

39,462 |

25,539 |

89,883 |

74,393 |

32,124 |

27,534 |

32,732 |

68,866 |

84,456 |

100,458 |

52,662 |

34,796 |

|

|

| FINANCING PROCEEDS |

11,548,502 |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

11,548,502 |

|

|

| OTHER NON-RECURRING SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER SOURCES |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| TOTAL SOURCES > |

982,664,069 |

29,985,359 |

42,945,382 |

40,183,521 |

137,277,760 |

177,595,610 |

80,689,545 |

41,445,165 |

32,343,842 |

63,207,266 |

210,786,620 |

86,115,780 |

40,088,219 |

|

|

| EXPENSES (USES): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SALARIES & WAGES |

121,266,600 |

9,328,200 |

9,328,200 |

9,328,200 |

9,328,200 |

13,992,300 |

9,328,200 |

9,328,200 |

9,328,200 |

9,328,200 |

13,992,300 |

9,328,200 |

9,328,200 |

|

|

| BENEFITS |

24,897,600 |

1,915,200 |

1,915,200 |

1,915,200 |

1,915,200 |

2,872,800 |

1,915,200 |

1,915,200 |

1,915,200 |

1,915,200 |

2,872,800 |

1,915,200 |

1,915,200 |

|

|

| CONTRACTUAL SERVICES |

244,791,477 |

23,731,637 |

16,527,569 |

18,402,467 |

20,240,386 |

18,550,136 |

18,735,822 |

24,567,174 |

25,341,736 |

22,921,035 |

22,329,338 |

18,956,302 |

14,487,875 |

|

|

| UTILITIES |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| MAINTENANCE AND REPAIRS |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| FISCAL DISPARITIES |

69,982,347 |

- |

- |

- |

- |

- |

34,143,531 |

847,642 |

- |

- |

- |

34,991,174 |

- |

|

|

| CAPITAL |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| GRANTS |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| TRANSFERS/OTHER |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

|

| MTGE/DEED/TAXES/FEES |

15,723,917 |

1,122,266 |

1,110,876 |

934,096 |

1,097,514 |

1,112,375 |

2,397,617 |

7,645 |

2,118,929 |

1,635,675 |

1,499,665 |

2,047,522 |

639,738 |

|

|

| DEBT PYMTS |

16,061,980 |

175,380 |

13,691,374 |

- |

- |

102,718 |

- |

745,192 |

708,022 |

- |

- |

12,678 |

626,617 |

|

|

| TAX DISTRIBUTION PYMTS |

421,746,356 |

2,751,553 |

- |

324,194 |

- |

48,015,156 |

74,814,731 |

102,925,944 |

- |

- |

42,530,923 |

96,102,966 |

54,280,889 |

|

|

| INVESTMENT PURCHASES |

22,413,216 |

- |

- |

- |

2,033,152 |

3,187,229 |

4,005,549 |

1,953,138 |

1,595,650 |

1,849,316 |

4,162,630 |

901,784 |

2,724,768 |

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER EXPENSES/USES |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL USES > |

936,883,494 |

39,024,236 |

42,573,219 |

30,904,157 |

34,614,452 |

87,832,715 |

145,340,649 |

142,290,135 |

41,007,737 |

37,649,426 |

87,387,656 |

164,255,825 |

84,003,287 |

|

|

| NET > |

45,780,575 |

(9,038,877) |

372,163 |

9,279,364 |

102,663,307 |

89,762,895 |

(64,651,104) |

(100,844,970) |

(8,663,895) |

25,557,840 |

123,398,964 |

(78,140,046) |

(43,915,067) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| STEP 9: INPUT ANNUAL RATE OF CHANGE FOR FORECAST MONTHS 13 - 36 (SHOWN ON CASH FLOW CHART) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL-2018 |

TOTAL-2019 |

TOTAL-2020 |

TOTAL-2021 |

AVG. RATE |

INPUT 2022 |

TOTAL-2022 |

N O T E S |

|

|

| REVENUES (SOURCES): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PROPERTY TAX |

510,278,023 |

547,422,147 |

558,213,162 |

553,918,994 |

2.8% |

3.0% |

570,536,564 |

|

|

|

|

|

|

|

|

| SALES & USE TAX |

- |

- |

- |

- |

0.0% |

0.0% |

- |

|

|

|

|

|

|

|

|

| FEES & PERMITS |

- |

- |

- |

- |

0.0% |

0.0% |

- |

|

|

|

|

|

|

|

|

| FISCAL DISPARITIES |

96,723,908 |

99,653,142 |

#NAME? |

102,628,560 |

0.0% |

0.0% |

102,628,560 |

|

|

|

|

|

|

|

|

| BUSINESS LICENSE TAXES |

- |

- |

- |

- |

0.0% |

0.0% |

- |

|

|

|

|

|

|

|

|

| INTRAGOVT SVC CHARGES |

- |

- |

- |

- |

0.0% |

0.0% |

- |

|

|

|

|

|

|

|

|

| INTERGOVT REVENUES |

241,047,547 |

239,927,511 |

#NAME? |

248,583,200 |

0.0% |

1.0% |

251,069,032 |

|

|

|

|

|

|

|

|

| REIMBURSEMENTS |

- |

- |

- |

- |

0.0% |

0.0% |

- |

|

|

|

|

|

|

|

|

| DONATIONS/CONTRIBS/ INV INCOME |

5,633,100 |

7,036,993 |

5,674,163 |

4,376,965 |

-5.8% |

-15.0% |

3,720,420 |

|

|

|

|

|

|

|

|

| FINES & FORFEITURES |

- |

- |

- |

- |

0.0% |

0.0% |

- |

|

|

|

|

|

|

|

|

| USE OF MONEY & PROPERTY |

- |

- |

- |

- |

0.0% |

0.0% |

- |

|

|

|

|

|

|

|

|

| OTHER SOURCES / INV MATURITIES |

72,473,335 |

71,767,799 |

58,198,891 |

43,937,000 |

-14.8% |

0.0% |

43,937,000 |

|

|

|

|

|

|

|

|

| TRANSIT TAX |

11,692,376 |

12,601,073 |

#NAME? |

12,000,000 |

0.0% |

0.0% |

12,000,000 |

|

|

|

|

|

|

|

|

| PARK |

4,628,261 |

4,479,670 |

#NAME? |

5,007,943 |

0.0% |

3.0% |

5,158,182 |

|

|

|

|

|

|

|

|

| LIBRARY |

604,126 |

667,388 |

#NAME? |

662,905 |

0.0% |

3.0% |