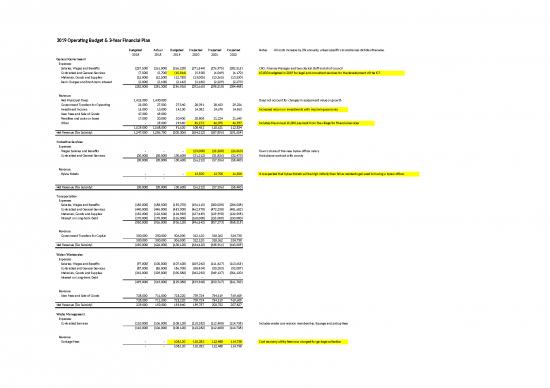

| 2019 Operating Budget & 3-Year Financial Plan |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Budgeted |

Actual |

Budgeted |

Projected |

Projected |

Projected |

|

Notes |

All costs increase by 2% annually, unless specific circumstances dictate otherwise. |

|

|

|

|

|

|

|

|

|

2018 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

|

|

|

|

|

|

|

|

|

| General Government |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries, Wages and Benefits |

(257,500) |

(261,000) |

(266,220) |

(271,544) |

(276,975) |

(282,515) |

|

CAO, Finance Manager and two clerical staff and all of council |

|

|

|

|

|

|

|

|

|

| Contracted and General Services |

(7,500) |

(5,700) |

(15,814) |

(5,930) |

(6,049) |

(6,170) |

|

10,000 budgeted in 2019 for legal and consultant services for the development of the ICF |

|

| Materials, Goods and Supplies |

(15,000) |

(12,500) |

(12,750) |

(13,005) |

(13,265) |

(13,530) |

|

|

|

|

|

|

|

|

|

|

|

| Bank Charges and Short-term interest |

(2,000) |

(2,100) |

(2,142) |

(2,185) |

(2,229) |

(2,273) |

|

|

|

|

(282,000) |

(281,300) |

(296,926) |

(292,665) |

(298,518) |

(304,488) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

aleks.nelson:

Does not include ASFF or Foundation requisitions

Net Municipal Taxes |

1,425,000 |

1,430,000 |

|

|

|

|

|

Does not account for changes in assessment value or growth |

|

|

|

|

| Government Transfers for Operating |

25,000 |

27,000 |

27,540 |

28,091 |

28,653 |

29,226 |

|

|

|

|

|

|

|

|

|

|

|

| Investment Income |

15,000 |

13,000 |

14,100 |

14,382 |

14,670 |

14,963 |

|

Increased return on investments with improving economy |

|

|

|

|

| User Fees and Sale of Goods |

47,000 |

49,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Penalties and costs on taxes |

17,000 |

20,000 |

20,400 |

20,808 |

21,224 |

21,649 |

|

|

|

|

|

|

|

|

|

|

|

| Other |

- |

29,000 |

29,580 |

45,172 |

46,075 |

46,997 |

|

Includes the annual 15,000 payment from the village for financial services |

|

|

|

|

1,529,000 |

1,568,000 |

91,620 |

108,452 |

110,621 |

112,834 |

|

|

|

|

|

|

|

|

|

|

|

| Net Revenue (Tax Subsidy) |

1,247,000 |

1,286,700 |

(205,306) |

(184,212) |

(187,896) |

(191,654) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Protective Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Wages Salaries and Benefits |

- |

- |

- |

(25,000) |

(25,500) |

(26,010) |

|

Town's share of the new bylaw officer salary |

|

|

|

|

|

|

|

|

|

| Contracted and General Services |

(30,000) |

(30,000) |

(30,600) |

(31,212) |

(31,836) |

(32,473) |

|

Ambulance contract with county |

|

|

|

|

|

|

|

|

|

|

(30,000) |

(30,000) |

(30,600) |

(56,212) |

(57,336) |

(58,483) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bylaw tickets |

- |

- |

- |

13,500 |

13,700 |

11,500 |

|

It is expected that bylaw tickets will be high initially then fall as residents get used to having a bylaw officer. |

|

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Revenue (Tax Subsidy) |

(30,000) |

(30,000) |

(30,600) |

(56,212) |

(57,336) |

(58,483) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Transportation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries, Wages and Benefits |

(185,000) |

(188,500) |

(192,270) |

(196,115) |

(200,038) |

(204,038) |

|

|

|

|

|

|

|

|

|

|

|

| Contracted and General Services |

(440,000) |

(445,000) |

(453,900) |

(462,978) |

(472,238) |

(481,682) |

|

|

|

|

|

|

|

|

|

|

|

| Materials, Goods and Supplies |

(155,000) |

(122,500) |

(124,950) |

(127,449) |

(129,998) |

(132,598) |

|

|

|

|

|

|

|

|

|

|

|

| Interest on Long-term Debt |

(170,000) |

(170,000) |

(165,000) |

(160,000) |

(155,000) |

(150,000) |

|

|

|

|

|

|

|

|

|

|

|

|

(950,000) |

(926,000) |

(936,120) |

(946,542) |

(957,273) |

(968,319) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Government Transfers for Capital |

300,000 |

300,000 |

306,000 |

312,120 |

318,362 |

324,730 |

|

|

|

|

|

|

|

|

|

|

|

|

300,000 |

300,000 |

306,000 |

312,120 |

318,362 |

324,730 |

|

|

|

|

|

|

|

|

|

|

|

| Net Revenue (Tax Subsidy) |

(650,000) |

(626,000) |

(630,120) |

(634,422) |

(638,911) |

(643,589) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Water/Wastewater |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries, Wages and Benefits |

(97,000) |

(105,000) |

(107,100) |

(109,242) |

(111,427) |

(113,655) |

|

|

|

|

|

|

|

|

|

|

|

| Contracted and General Services |

(87,000) |

(85,000) |

(86,700) |

(88,434) |

(90,203) |

(92,007) |

|

|

|

|

|

|

|

|

|

|

|

| Materials, Goods and Supplies |

(315,000) |

(329,000) |

(335,580) |

(342,292) |

(349,137) |

(356,120) |

|

|

|

|

|

|

|

|

|

|

|

| Interest on Long-term Debt |

- |

- |

- |

- |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

(499,000) |

(519,000) |

(529,380) |

(539,968) |

(550,767) |

(561,782) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| User Fees and Sale of Goods |

728,000 |

711,000 |

725,220 |

739,724 |

754,519 |

769,609 |

|

|

|

|

|

|

|

|

|

|

|

|

728,000 |

711,000 |

725,220 |

739,724 |

754,519 |

769,609 |

|

|

|

|

|

|

|

|

|

|

|

| Net Revenue (Tax Subsidy) |

229,000 |

192,000 |

195,840 |

199,757 |

203,752 |

207,827 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Waste Management |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Contracted Services |

(110,000) |

(106,000) |

(108,120) |

(110,282) |

(112,488) |

(114,738) |

|

Includes waste commission membership, tippage and pickup fees |

|

|

|

|

|

|

|

|

|

|

(110,000) |

(106,000) |

(108,120) |

(110,282) |

(112,488) |

(114,738) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Garbage Fees |

- |

- |

108,120 |

110,282 |

112,488 |

114,738 |

|

Cost recovery utility fees now charged for garbage collection |

|

|

|

|

|

- |

- |

108,120 |

110,282 |

112,488 |

114,738 |

|

|

|

|

|

|

|

|

|

|

|

| Net Revenue (Tax Subsidy) |

(110,000) |

(106,000) |

- |

- |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Planning and Development |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries, Wages and Benefits |

(44,500) |

(47,000) |

(47,940) |

(48,899) |

(49,877) |

(50,874) |

|

|

|

|

|

|

|

|

|

|

|

| Contracted and General Services |

(61,000) |

(99,500) |

(116,490) |

(108,520) |

(105,590) |

(107,702) |

|

15,000 increase in 2019 and 5,000 in 2020 for consultant fees related to the development of an IDP |

| Materials, Goods and Supplies |

(11,500) |

(10,500) |

(10,710) |

(10,924) |

(11,143) |

(11,366) |

|

|

|

|

|

|

|

|

|

|

|

| |

(117,000) |

(157,000) |

(175,140) |

(168,343) |

(166,610) |

(169,942) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Development Levies |

15,000 |

9,000 |

9,180 |

9,364 |

9,551 |

9,742 |

|

|

|

|

|

|

|

|

|

|

|

| Licences and Permits |

8,000 |

10,000 |

10,200 |

10,404 |

10,612 |

10,824 |

|

|

|

|

|

|

|

|

|

|

|

|

23,000 |

19,000 |

19,380 |

19,768 |

20,163 |

20,566 |

|

|

|

|

|

|

|

|

|

|

|

| Net Revenue (Tax Subsidy) |

(94,000) |

(138,000) |

(155,760) |

(148,575) |

(146,447) |

(149,376) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Recreation and Culture (including FCSS) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries, Wages and Benefits |

(57,000) |

(55,000) |

(56,100) |

(57,222) |

(58,366) |

(59,534) |

|

|

|

|

|

|

|

|

|

|

|

| Contracted and General Services |

(119,000) |

(121,500) |

(123,930) |

(126,409) |

(128,937) |

(131,516) |

|

|

|

|

|

|

|

|

|

|

|

| Materials, Goods and Supplies |

(24,000) |

(26,500) |

(27,030) |

(27,571) |

(28,122) |

(28,684) |

|

|

|

|

|

|

|

|

|

|

|

|

(200,000) |

(203,000) |

(207,060) |

(211,201) |

(215,425) |

(219,734) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Government Transfers for Operating |

17,000 |

17,000 |

17,340 |

17,687 |

18,041 |

18,401 |

|

|

|

|

|

|

|

|

|

|

|

| User Fees |

15,000 |

17,000 |

17,340 |

17,687 |

18,041 |

18,401 |

|

|

|

|

|

|

|

|

|

|

|

| Camp Ground Revenue |

27,000 |

29,000 |

29,580 |

30,172 |

30,775 |

31,391 |

|

|

|

|

|

|

|

|

|

|

|

| Transfers from County |

- |

- |

- |

63,360 |

64,628 |

65,920 |

|

30% funding of operating costs from County |

|

|

|

|

|

|

|

|

|

|

59,000 |

63,000 |

64,260 |

128,906 |

131,484 |

134,113 |

|

|

|

|

|

|

|

|

|

|

|

| Net Revenue (Tax Subsidy) |

(141,000) |

(140,000) |

(142,800) |

(82,296) |

(83,942) |

(85,620) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

(400,000) |

(463,725) |

(470,000) |

(479,400) |

(488,988) |

(498,768) |

|

|

|

|

|

|

|

|

|

|

|

| Net Revenue (Tax Subsidy) |

(400,000) |

(463,725) |

(470,000) |

(479,400) |

(488,988) |

(498,768) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Revenue |

2,639,000 |

2,661,000 |

1,314,600 |

1,419,252 |

1,447,637 |

1,476,590 |

|

|

|

|

|

|

|

|

|

|

|

| Total Expenditures |

(2,588,000) |

(2,686,025) |

(2,753,346) |

(2,804,613) |

(2,847,405) |

(2,896,253) |

|

|

|

|

|

|

|

|

|

|

|

| Excess Revenue (Shortfall) |

51,000 |

(25,025) |

(1,438,746) |

(1,385,361) |

(1,399,768) |

(1,419,663) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tax Required to Balance Budget |

51,000 |

(25,025) |

1,438,746 |

1,385,361 |

1,399,768 |

1,419,663 |

|

|

|

|

|

|

|

|

|

|

|

| Add: Debt Principle Payments |

113,000 |

113,000 |

113,000 |

168,500 |

168,500 |

55,500 |

|

Annual payments of $113,000 for previous wastewater distribution upgrades ending 2021 and $55,500 for arena upgrades beginning 2019 ending 2023 |

|

|

|

|

|

|

|

|

|

| Add: Surplus for future plans |

|

|

250,000 |

250,000 |

250,000 |

250,000 |

|

Estimated amount to ensure capital plan is funded. Amount set via policy with the establishment of 10 year plan |

|

|

|

| Subtract: Amortization Expense |

400,000 |

463,725 |

(470,000) |

(479,400) |

(488,988) |

(498,768) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Cash Requirements (for Tax Bylaw) |

|

|

1,331,746 |

1,324,461 |

1,329,280 |

1,226,395 |

|

|

| 5-Year Capital Plan Worksheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Planned Capital Additions |

2019 |

|

2020 |

2021 |

2022 |

2023 |

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Council |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Council Chamber Renewal |

|

|

|

|

25,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Administration |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Photocopier |

|

|

|

7,000 |

|

|

|

|

|

|

|

|

|

|

| Server |

|

|

|

|

30,000 |

|

|

|

|

|

|

|

|

|

| Computer Replacement |

|

|

|

15,000 |

|

|

20,000 |

|

|

|

|

|

|

|

| Asset Management Software |

10,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Public Works |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pickup Truck |

|

|

|

|

|

50,000 |

|

|

|

|

|

|

|

|

| Shop Energy Efficiency Upgrades |

|

|

|

21,000 |

|

|

|

|

|

|

|

|

|

|

| Grader |

|

|

|

|

285,000 |

|

|

|

|

|

|

|

|

|

| Public Works Roof |

|

|

|

|

|

|

100,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Water/Wastewater |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lagoon Dredging |

|

|

250,000 |

|

|

|

|

|

|

|

|

|

|

|

| 50 Street Water Line |

75,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 50 Avenue Water Line |

|

|

80,000 |

|

|

|

|

|

|

|

|

|

|

|

| 51 Street Water Line |

|

|

|

90,000 |

|

|

|

|

|

|

|

|

|

|

| 51 Avenue Water Line |

|

|

|

|

100,000 |

|

|

|

|

|

|

|

|

|

| 49 Street Water Line |

|

|

|

|

|

110,000 |

|

|

|

|

|

|

|

|

| 49 Avenue Water Line |

|

|

|

|

|

|

120,000 |

|

|

|

|

|

|

|

| Water Reservoir Construction |

|

|

|

|

|

1,500,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Streets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 50 Street Paving |

200,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 50 Avenue Paving |

|

|

225,000 |

|

|

|

|

|

|

|

|

|

|

|

| 51 Street Paving |

|

|

|

250,000 |

|

|

|

|

|

|

|

|

|

|

| 51 Avenue Paving |

|

|

|

|

275,000 |

|

|

|

|

|

|

|

|

|

| 49 Street Paving |

|

|

|

|

|

300,000 |

|

|

|

|

|

|

|

|

| 49 Avenue Paving |

|

|

|

|

|

|

325,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Recreation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mower |

|

|

|

|

30,000 |

|

|

|

|

|

|

|

|

|

| Curling Rink |

|

|

800,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Planned Capital Additions |

285,000 |

|

1,355,000 |

383,000 |

745,000 |

1,960,000 |

565,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Funding Sources |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Beginning Reserve Balance |

530,000 |

|

864,000 |

928,000 |

1,164,000 |

1,047,000 |

756,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MSI Capital Grant |

319,000 |

|

319,000 |

319,000 |

319,000 |

319,000 |

319,000 |

|

|

|

|

|

|

|

| FGTF Grant |

50,000 |

|

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

|

|

|

|

|

|

|

| Water For Life Grant |

|

|

|

|

|

750,000 |

|

|

|

|

|

|

|

|

| Total Grant Funds Used |

369,000 |

|

369,000 |

369,000 |

369,000 |

1,119,000 |

369,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| County Transfers |

|

|

225,000 |

|

9,000 |

|

|

The agreed upon 30% of municipal recreation capital costs |

|

|

|

|

|

|

| Donated and Contributed Funding |

|

|

50,000 |

|

|

|

|

Funds raised and donated by the curling club for roof replacement |

|

|

|

|

|

|

| Capital Reserve Contribution from Budget |

250,000 |

|

250,000 |

250,000 |

250,000 |

250,000 |

250,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Borrowing |

|

|

525,000 |

|

|

300,000 |

|

Borrowing for curling rink upgrades (2020) and water reservoir (2023) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Planned Capital Additions |

285,000 |

|

1,355,000 |

383,000 |

745,000 |

1,960,000 |

565,000 |

|

|

|

|

|

|

|

| Ending Reserve Balance |

864,000 |

|

928,000 |

1,164,000 |

1,047,000 |

756,000 |

810,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Notes and Assumptions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MSI Capital - $319,000/yr |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FGTF is $50,000/yr |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Council policy requires $750,000 in reserves at all times |

|

|

|

|

|

|

|

|

|

|

|

|

|

|