302x Filetype XLSX File size 0.07 MB Source: www.research.fsu.edu

Sheet 1: Introduction

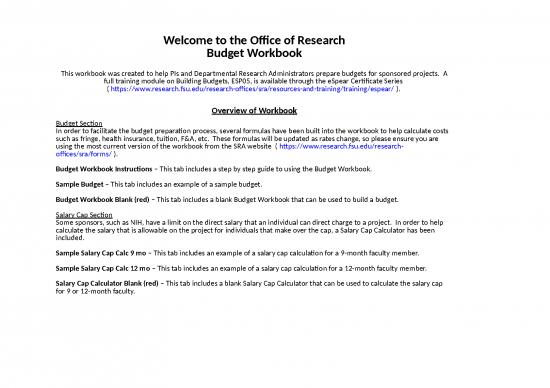

| Welcome to the Office of Research Budget Workbook |

||||||||||||

| This workbook was created to help PIs and Departmental Research Administrators prepare budgets for sponsored projects. A full training module on Building Budgets, ESP05, is available through the eSpear Certificate Series ( https://www.research.fsu.edu/research-offices/sra/resources-and-training/training/espear/ ). |

||||||||||||

| Overview of Workbook | ||||||||||||

| Budget Section In order to facilitate the budget preparation process, several formulas have been built into the workbook to help calculate costs such as fringe, health insurance, tuition, F&A, etc. These formulas will be updated as rates change, so please ensure you are using the most current version of the workbook from the SRA website ( https://www.research.fsu.edu/research-offices/sra/forms/ ). Budget Workbook Instructions – This tab includes a step by step guide to using the Budget Workbook. Sample Budget – This tab includes an example of a sample budget. Budget Workbook Blank (red) – This tab includes a blank Budget Workbook that can be used to build a budget. Salary Cap Section Some sponsors, such as NIH, have a limit on the direct salary that an individual can direct charge to a project. In order to help calculate the salary that is allowable on the project for individuals that make over the cap, a Salary Cap Calculator has been included. Sample Salary Cap Calc 9 mo – This tab includes an example of a salary cap calculation for a 9-month faculty member. Sample Salary Cap Calc 12 mo – This tab includes an example of a salary cap calculation for a 12-month faculty member. Salary Cap Calculator Blank (red) – This tab includes a blank Salary Cap Calculator that can be used to calculate the salary cap for 9 or 12-month faculty. |

||||||||||||

| If you have any questions please contact Jenn Garye, Director of Business Operations at jgarye@fsu.edu or 644-1385. |

| Budget Workbook Instructions | |||||||||

| Cells shaded yellow should be completed. All other cells utilize formulas to calculate the budget. | |||||||||

| General Information | |||||||||

| 1 | In row 1, enter the Project Name | ||||||||

| 2 | In row 3, columns D – H (if applicable) enter the dates for the budget periods. Formulas have been created that recognize if there are dates in these cells to carry the calculations forward. | ||||||||

| Personnel Section | |||||||||

| 3 | Under the Senior Personnel section, list the name and role of the PI, CPI and any other senior personnel in column A (Name, Role) cells. | ||||||||

| 4 | Enter the respective current salary per pay period (annual salary ÷ 26.1 for 12 month faculty/staff or annual salary ÷ 19.5 for 9 month faculty) in column C. | ||||||||

| 5 | Enter the number of pay periods the personnel will be appointed per year in column C. | ||||||||

| If the number of pay periods per year for the personnel will vary the formulas in columns E-H will have to be modified. | |||||||||

| 6 | Select the fringe benefit rate & health insurance plan from the respective drop down menus in column B. | ||||||||

| 7 | Under the Other Personnel section, enter any non-senior personnel working on the project, including their name and role. | ||||||||

| 8 | Enter the respective current salary per pay period (annual salary ÷ 26.1 for 12 month faculty/staff or annual salary ÷ 19.5 for 9 month faculty) in column C. | ||||||||

| 9 | Enter the number of pay periods the personnel will be appointed per year in column C. | ||||||||

| If the number of pay periods per year for the personnel will vary the formulas in columns E-H will have to be modified. | |||||||||

| 10 | Select the fringe benefit rate & health insurance plan from the respective drop down menus in column B. | ||||||||

| 11 | For Post Docs, Graduate Students and Undergraduate students utilize their respective section under Other Personnel. | ||||||||

| 12 | Enter the total number of post docs to be appointed per year in row 40 for each year. Enter the total number of grad students to be appointed per year in row 45 for each year. Enter the total number of undergrad students to be appointed per year in row 50 for each year. | ||||||||

| 13 | Enter the annual salary per post doc/grad student/undergrad student in column C. | ||||||||

| 14 | Select the Health Insurance Plan from the respective drop down menus for post docs and/or grad students in column C. | ||||||||

| Equipment Section | |||||||||

| 15 | In columns D – H, enter the respective amount of equipment (>$5,000) that is requested each year. | ||||||||

| Travel Section | |||||||||

| 16 | In columns D – H, enter the respective amount of travel, separated as domestic and foreign travel, that is requested each year. | ||||||||

| Other Direct Costs Section | |||||||||

| 17 | In row 68, column B (cell B68), select the number of tuition hours that needs to be included annually per graduate student. | ||||||||

| If you wish to allocate an amount of tuition that is not available in row 68 use line 69 to include a custom amount of tuition | |||||||||

| 18 | In rows 69 – 72, enter the respective amount by category requested for Materials and Supplies, Publication Costs, Consultant Services and ADP/Computer Services for each year. | ||||||||

| 19 | In row 72, enter the first $25,000 of each subaward contract requested. If a subrecipient will receive funds in multiple years of the project, only the first $25,000 needs to be included in this row. If there are multiple subrecipients, the first $25,000 of each subcontract should be included in this row. | ||||||||

| 20 | In row 73, enter the remaining amount beyond $25,000 for each subaward contract requested. | ||||||||

| For example, if you have one subrecipient and you are subbing them $10,000 in year 1, $15,000 in year 2 and $15,000 in years 3 – 5, you would include $10,000 in year 1 in row 72 and $15,000 in year 2 in row 72, and the remaining $15,000 in years 3 – 5 in row 73. | |||||||||

| If you have two subrecipients and you are subbing each of them $25,000 in year 1 and $10,000 each additional year, you would include $50,000 in year 1 in row 72 and the remaining $20,000 each additional year in row 73. | |||||||||

| 21 | In rows 75 – 76 enter the respective amount by category requested for Alterations & Renovations and Rent for each year. | ||||||||

| 22 | Rows 77 – 79 can be used to enter amounts for any additional budget items that do not fit in the aforementioned categories. In column B, include a brief description of the cost category. | ||||||||

| Total Direct & Indirect Costs | |||||||||

| 23 | Row 81 will automatically total all direct costs for the project. | ||||||||

| 24 | In row 82, column C (cell C82), select your Direct Cost Base from the drop down menu – MTDC for Modified Total Direct Cost or TDC for Total Direct Cost. The remainder of row 82 will automatically calculate based on your direct cost base selection. | ||||||||

| 25 | In row 83, column C (cell C83), enter the F&A or Indirect Cost Rate for the project. The remainder of row 83 will automatically calculate based on your Direct Cost Base and F&A rate. | ||||||||

| 26 | Row 84 will automatically total all of the direct costs and indirect costs for the project. | ||||||||

| Funding Cap Section | |||||||||

| If your funding solicitation includes a cap on funds (direct, indirect or total) the Funding Cap Calculations section can be utilized to help with calculating the correct amount to budget for the project. Please make sure that all of the work being proposed can be completed within the respective budget. | |||||||||

| 27 | In row 87, enter the Direct Cost Allowed per year. Row 88 will automatically calculate if the current proposed budget is Over (negative number) or Under (positive number) the funding cap. | ||||||||

| 28 | In row 90, enter the Indirect Cost Allowed per year. Row 91 will automatically calculate if the current proposed budget is Over (negative number) or Under (positive number) the funding cap. | ||||||||

| 29 | In row 93, enter the Total Cost Allowed per year. Row 94 will automatically calculate if the current proposed budget is Over (negative number) or Under (positive number) the funding cap. | ||||||||

| Note: these three funding cap calculations are setup to work independently to accommodate different types of funding caps, therefore the direct cost and indirect cost formulas due not calculate a total cost allowed. |

| Sample Budget Workbook | Project Budget | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Cumulative | |||

| (Enter Project Dates Here -->) | 1/1/18-12/31/18 | 1/1/19-12/31/29 | 1/1/20-12/31/20 | 1/1/21-12/31/21 | 1/1/22-12/31/22 | |||

| SENIOR PERSONNEL | ||||||||

| (Name, Role) | Current Salary / PP | 5,000.00 | $11,000 | $11,330 | $11,670 | $12,020 | $12,381 | $58,400 |

| Pay Periods (1 month = 2.2) | 2.20 | |||||||

| Fringe Rate (select rate type) | FRS | 21.46% | $2,361 | $2,431 | $2,504 | $2,579 | $2,657 | $12,533 |

| Health Insurance (select ins. type) | None | $- | $- | $- | $- | $- | $- | $- |

| (Name, Role) | Current Salary / PP | 5,200.00 | $22,880 | $23,566 | $24,273 | $25,002 | $25,752 | $121,473 |

| Pay Periods (1 month = 2.2) | 4.4 | |||||||

| Fringe Rate (select rate type) | ORP | 18.93% | $4,331 | $4,461 | $4,595 | $4,733 | $4,875 | $22,995 |

| Health Insurance (select ins. type) | Individual | $342.00 | $1,505 | $1,505 | $1,505 | $1,505 | $1,505 | $7,524 |

| (Name, Role) | Current Salary / PP | 5,300.00 | $34,980 | $36,029 | $37,110 | $38,224 | $39,370 | $185,714 |

| Pay Periods (1 month = 2.2) | 6.6 | |||||||

| Fringe Rate (select rate type) | FRS | 21.46% | $7,507 | $7,732 | $7,964 | $8,203 | $8,449 | $39,854 |

| Health Insurance (select ins. type) | Family | $737.00 | $4,864 | $4,864 | $4,864 | $4,864 | $4,864 | $24,321 |

| Total Senior Personnel Salary | $68,860 | $70,926 | $73,054 | $75,245 | $77,503 | $365,587 | ||

| Total Senior Personnel Fringe, including Health | $20,567 | $20,993 | $21,432 | $21,884 | $22,350 | $107,227 | ||

| Total Senior Personnel | $89,427 | $91,919 | $94,486 | $97,129 | $99,852 | $472,814 | ||

| OTHER PERSONNEL | ||||||||

| (Name, Role) | Current Salary / PP | 2,500.00 | $5,500 | $5,665 | $5,835 | $6,010 | $6,190 | $29,200 |

| Pay Periods (1 month = 2.2) | 2.2 | |||||||

| Fringe Rate (select rate type) | ORP | 18.93% | $1,041 | $1,072 | $1,105 | $1,138 | $1,172 | $5,528 |

| Health Insurance (select ins. type) | Spouse | $406.00 | $893 | $893 | $893 | $893 | $893 | $4,466 |

| (Name, Role) | Current Salary / PP | 2,600.00 | $11,440 | $11,783 | $12,137 | $12,501 | $12,876 | $60,737 |

| Pay Periods (1 month = 2.2) | 4.4 | |||||||

| Fringe Rate (select rate type) | FRS | 21.46% | $2,455 | $2,529 | $2,605 | $2,683 | $2,763 | $13,034 |

| Health Insurance (select ins. type) | Family | $737.00 | $3,243 | $3,243 | $3,243 | $3,243 | $3,243 | $16,214 |

| (Name, Role) | Current Salary / PP | 2,800.00 | $18,480 | $19,034 | $19,605 | $20,194 | $20,799 | $98,113 |

| Pay Periods (1 month = 2.2) | 6.6 | |||||||

| Fringe Rate (select rate type) | DROP | 28.15% | $5,202 | $5,358 | $5,519 | $5,684 | $5,855 | $27,619 |

| Health Insurance (select ins. type) | TBD | $539.00 | $3,557 | $3,557 | $3,557 | $3,557 | $3,557 | $17,787 |

| Post Docs | # of Post Docs per Year | 1 | 1 | 1 | 1 | 1 | 5 | |

| Post Docs Annual Salary | 48,659.00 | $48,659 | $48,659 | $48,659 | $48,659 | $48,659 | $243,295 | |

| Post Doc Fringe | 1.85% | $900 | $900 | $900 | $900 | $900 | $4,501 | |

| Post Doc Health Insurance (select ins. type) | Family | $737.00 | $17,688 | $17,688 | $17,688 | $17,688 | $17,688 | $88,440 |

| Grad Students | # of Grad Students per Year | 1 | 1 | 1 | 1 | 1 | $5 | |

| Grad Students Annual Salary | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $100,000 | |

| Grad Student Fringe | 0.40% | $80 | $80 | $80 | $80 | $80 | $400 | |

| Grad Student Insurance per GA per year | Domestic | 1,883.00 | $1,883 | $1,883 | $1,883 | $1,883 | $1,883 | $9,415 |

| Undergraduate Students | # of Undergrad Students per Year | 1 | 1 | 1 | 1 | 1 | 5 | |

| Undergraduate Students Annual Salary | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $25,000 | |

| Undergraduate Student Fringe | 0.40% | $20 | $20 | $20 | $20 | $20 | $100 | |

| Total OPS Salary | $109,079 | $110,142 | $111,236 | $112,363 | $113,525 | $556,345 | ||

| Total OPS Fringe, including Health | $36,963 | $37,224 | $37,493 | $37,769 | $38,055 | $187,503 | ||

| Total OPS | $146,042 | $147,365 | $148,729 | $150,133 | $151,579 | $743,848 | ||

| Total Salary | $177,939 | $181,067 | $184,290 | $187,609 | $191,027 | $921,932 | ||

| Total Fringe | $57,530 | $58,217 | $58,925 | $59,654 | $60,404 | $294,730 | ||

| Total Senior Personnel and OPS | $235,469 | $239,285 | $243,214 | $247,262 | $251,431 | $1,216,662 | ||

| EQUIPMENT | $10,000 | $15,000 | $12,000 | $20,000 | $25,000 | $82,000 | ||

| TRAVEL | ||||||||

| Domestic Travel | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $7,500 | ||

| Foreign Travel | $1,900 | $1,900 | $1,900 | $1,900 | $1,900 | $9,500 | ||

| Total Travel | $3,400 | $3,400 | $3,400 | $3,400 | $3,400 | $17,000 | ||

| OTHER DIRECT COSTS | ||||||||

| Tuition | 9 hrs. In-St | $3,668.00 | $3,668 | $3,705 | $3,741 | $3,778 | $3,815 | $18,707 |

| Tuition - CUSTOM (use if allocating a different number of credit hours than available on row 68) | $- | $- | $- | $- | $- | $- | ||

| Materials and Supplies | $10 | $10 | $10 | $10 | $10 | $50 | ||

| Publication Costs | $10 | $10 | $10 | $10 | $10 | $50 | ||

| Consultant Services | $10 | $10 | $10 | $10 | $10 | $50 | ||

| ADP/Computer Services | $10 | $10 | $10 | $10 | $10 | $50 | ||

| Subawards (first $25k of each subaward included in MTDC) | $15,000 | $10,000 | $- | $- | $- | $25,000 | ||

| Subawards (>$25k of each subaward excluded from MTDC) | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $50,000 | ||

| Alterations & Renovations | $10 | $10 | $10 | $10 | $10 | $50 | ||

| Rent | $10 | $10 | $10 | $10 | $10 | $50 | ||

| Other 1 | Auxiliary Services | $10 | $10 | $10 | $10 | $10 | $50 | |

| Other 2 | Auxiliary Services 2 | $10 | $10 | $10 | $10 | $10 | $50 | |

| Other 3 | Auxiliary Services 3 | $10 | $10 | $10 | $10 | $10 | $50 | |

| Total Other Direct Costs | $28,758 | $23,795 | $13,831 | $13,868 | $13,905 | $94,157 | ||

| TOTAL DIRECT COSTS | $277,627 | $281,479 | $272,446 | $284,530 | $293,736 | $1,409,819 | ||

| Direct Cost Base | TDC | $273,959 | $277,775 | $268,704 | $280,752 | $289,921 | $1,391,112 | |

| Indirect Costs | 54% | $147,938.06 | $149,998 | $145,100 | $151,606 | $156,557 | $751,200 | |

| TOTAL DIRECT AND INDIRECT COSTS | $425,565 | $431,478 | $417,546 | $436,136 | $450,293 | $2,161,019 | ||

| FUNDING CAP CALCULATIONS (if needed) | ||||||||

| Total Direct Cost Allowed | $300,000 | $300,000 | $300,000 | $300,000 | $300,000 | $1,500,000 | ||

| Remaining Direct Cost Available - (Over)/Under | $22,373 | $18,521 | $27,554 | $15,470 | $6,264 | $90,181 | ||

| Total Indirect Cost Allowed | $- | |||||||

| Remaining Indirect Cost Available (Over)/Under | NA | NA | NA | NA | NA | $- | ||

| Total Cost Allowed | $- | |||||||

| Total Cost Remaining (Over)/Under | NA | NA | NA | NA | NA | $- | ||

no reviews yet

Please Login to review.