242x Filetype XLSX File size 0.11 MB Source: www.moneyunder30.com

Sheet 1: budget

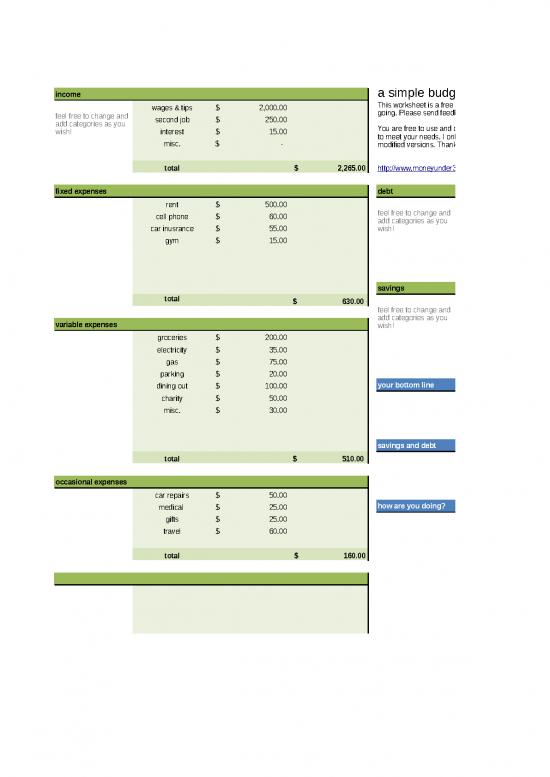

| income |

|

a simple budgeting spreadsheet. | |||||||

| feel free to change and add categories as you wish! | wages & tips | $2,000.00 | This worksheet is a free and easy budget spreadsheet to help you track where your money is going. Please send feedback to david@moneyunder30.com. You are free to use and distribute this budgeting tool as you wish. You may even modify the sheet to meet your needs. I only ask that if you do modify this worksheet, you do not distribute any modified versions. Thank you, and enjoy! |

||||||

| second job | $250.00 | ||||||||

| interest | $15.00 | ||||||||

| misc. | $- | ||||||||

| total | $2,265.00 | http://www.moneyunder30.com | |||||||

| fixed expenses |

|

debt |

|

||||||

| rent | $500.00 | feel free to change and add categories as you wish! | student loan | $75.00 | |||||

| cell phone | $60.00 | car payment | $175.00 | ||||||

| car inusrance | $55.00 | visa | $35.00 | ||||||

| gym | $15.00 | amex | $- | ||||||

| total | $285.00 | ||||||||

| savings |

|

||||||||

| total | $630.00 | feel free to change and add categories as you wish! | emergency fund | $100.00 | |||||

| retirement | $50.00 | ||||||||

| variable expenses |

|

other savings | $- | ||||||

| groceries | $200.00 | ||||||||

| electricity | $35.00 | ||||||||

| gas | $75.00 | total | $150.00 | ||||||

| parking | $20.00 | ||||||||

| dining out | $100.00 | your bottom line | |||||||

| charity | $50.00 | income | $2,265.00 | ||||||

| misc. | $30.00 | expenses | $1,735.00 | ||||||

| remaining | $530.00 | ||||||||

| savings and debt | |||||||||

| total | $510.00 | savings ratio | 7% | ||||||

| debt-to-income ratio | 13% | ||||||||

| occasional expenses |

|

||||||||

| car repairs | $50.00 | ||||||||

| medical | $25.00 | how are you doing? | |||||||

| gifts | $25.00 | Overall: Nice job! You have a plan to spend less than you're bringing in. Consider using your extra money to pay down debt or build up savings. | |||||||

| travel | $60.00 | ||||||||

| total | $160.00 | Saving: A good starting savings goal is 10% of your income. As you get better at saving, shoot for 25%! | |||||||

| Debt: Your debt-to-income ratio is in an accetable range, but it's still a little high. Try to pay down your non-mortgage debt so that monthly payments account for less than 10% of your income. | |||||||||

| a simple budgeting spreadsheet. | starting balance | |||||||||||||

| http://www.moneyunder30.com | your variable expense budget |

|

||||||||||||

| january | groceries | electricity | gas | parking | dining out | charity | misc. | total |

|

remaining | ||||

| 1 | $510.00 | |||||||||||||

| 2 | $510.00 | |||||||||||||

| 3 | $510.00 | |||||||||||||

| 4 | $510.00 | |||||||||||||

| 5 | $510.00 | |||||||||||||

| 6 | $510.00 | |||||||||||||

| 7 | $510.00 | |||||||||||||

| 8 | $510.00 | |||||||||||||

| 9 | $510.00 | |||||||||||||

| 10 | $510.00 | |||||||||||||

| 11 | $510.00 | |||||||||||||

| 12 | $510.00 | |||||||||||||

| 13 | $510.00 | |||||||||||||

| 14 | $510.00 | |||||||||||||

| 15 | $510.00 | |||||||||||||

| 16 | $510.00 | |||||||||||||

| 17 | $510.00 | |||||||||||||

| 18 | $510.00 | |||||||||||||

| 19 | $510.00 | |||||||||||||

| 20 | $510.00 | |||||||||||||

| 21 | $510.00 | |||||||||||||

| 22 | $510.00 | |||||||||||||

| 23 | $510.00 | |||||||||||||

| 24 | $510.00 | |||||||||||||

| 25 | $510.00 | |||||||||||||

| 26 | $510.00 | |||||||||||||

| 27 | $510.00 | |||||||||||||

| 28 | $510.00 | |||||||||||||

| 29 | $510.00 | |||||||||||||

| 30 | $510.00 | |||||||||||||

| 31 | $510.00 | |||||||||||||

| spent | ||||||||||||||

|

|

$200.00 | $35.00 | $75.00 | $20.00 | $100.00 | $50.00 | $30.00 | $0.00 | $0.00 | $0.00 | $510.00 | |||

| left to spend | $200.00 | $35.00 | $75.00 | $20.00 | $100.00 | $50.00 | $30.00 | $0.00 | $0.00 | $0.00 | $510.00 | |||

| groceries | electricity | gas | parking | dining out | charity | misc. | ||||||||

| fixed expenses | debt | occasional expenses | savings | |||||||||||

| rent | $500.00 | student loan | $75.00 | car repairs | $50.00 | emergency fund | $100.00 | |||||||

| cell phone | $60.00 | car payment | $175.00 | medical | $25.00 | retirement | $50.00 | |||||||

| car inusrance | $55.00 | visa | $35.00 | gifts | $25.00 | other savings | ||||||||

| gym | $15.00 | amex | travel | $60.00 | ||||||||||

| total | $630.00 | total | $285.00 | total | $160.00 | total | $150.00 | |||||||

| budget | $630.00 | budget | $285.00 | budget | $160.00 | budget | $150.00 | |||||||

| difference | $0.00 | difference | $0.00 | difference | $0.00 | difference | $0.00 | |||||||

| a simple budgeting spreadsheet. | starting balance | |||||||||||||

| http://www.moneyunder30.com | your variable expense budget |

|

||||||||||||

| february | groceries | electricity | gas | parking | dining out | charity | misc. | total |

|

remaining | ||||

| 1 | $510.00 | |||||||||||||

| 2 | $510.00 | |||||||||||||

| 3 | $510.00 | |||||||||||||

| 4 | $510.00 | |||||||||||||

| 5 | $510.00 | |||||||||||||

| 6 | $510.00 | |||||||||||||

| 7 | $510.00 | |||||||||||||

| 8 | $510.00 | |||||||||||||

| 9 | $510.00 | |||||||||||||

| 10 | $510.00 | |||||||||||||

| 11 | $510.00 | |||||||||||||

| 12 | $510.00 | |||||||||||||

| 13 | $510.00 | |||||||||||||

| 14 | $510.00 | |||||||||||||

| 15 | $510.00 | |||||||||||||

| 16 | $510.00 | |||||||||||||

| 17 | $510.00 | |||||||||||||

| 18 | $510.00 | |||||||||||||

| 19 | $510.00 | |||||||||||||

| 20 | $510.00 | |||||||||||||

| 21 | $510.00 | |||||||||||||

| 22 | $510.00 | |||||||||||||

| 23 | $510.00 | |||||||||||||

| 24 | $510.00 | |||||||||||||

| 25 | $510.00 | |||||||||||||

| 26 | $510.00 | |||||||||||||

| 27 | $510.00 | |||||||||||||

| 28 | $510.00 | |||||||||||||

| 29 | $510.00 | |||||||||||||

| 30 | $510.00 | |||||||||||||

| 31 | $510.00 | |||||||||||||

| spent | ||||||||||||||

|

|

$200.00 | $35.00 | $75.00 | $20.00 | $100.00 | $50.00 | $30.00 | $0.00 | $0.00 | $0.00 | $510.00 | |||

| left to spend | $200.00 | $35.00 | $75.00 | $20.00 | $100.00 | $50.00 | $30.00 | $0.00 | $0.00 | $0.00 | $510.00 | |||

| groceries | electricity | gas | parking | dining out | charity | misc. | ||||||||

| fixed expenses | debt | occasional expenses | savings | |||||||||||

| rent | $500.00 | student loan | $75.00 | car repairs | $50.00 | emergency fund | $100.00 | |||||||

| cell phone | $60.00 | car payment | $175.00 | medical | $25.00 | retirement | $50.00 | |||||||

| car inusrance | $55.00 | visa | $35.00 | gifts | $25.00 | other savings | ||||||||

| gym | $15.00 | amex | travel | $60.00 | ||||||||||

| total | $630.00 | total | $285.00 | total | $160.00 | total | $150.00 | |||||||

| budget | $630.00 | budget | $285.00 | budget | $160.00 | budget | $150.00 | |||||||

| difference | $0.00 | difference | $0.00 | difference | $0.00 | difference | $0.00 | |||||||

no reviews yet

Please Login to review.