271x Filetype XLSX File size 0.13 MB Source: www.consumercredit.com

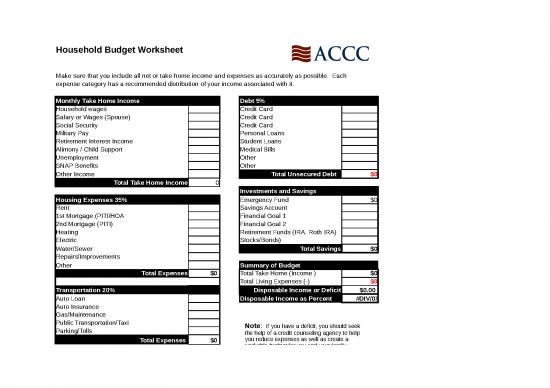

Household Budget Worksheet

Make sure that you include all net or take-home income and expenses as accurately as possible. Each

expense category has a recommended distribution of your income associated with it.

Monthly Take Home Income Debt 5%

Household wages Credit Card

Salary or Wages (Spouse) Credit Card

Social Security Credit Card

Military Pay Personal Loans

Retirement Interest Income Student Loans

Alimony / Child Support Medical Bills

Unemployment Other

SNAP Benefits Other

Other Income Total Unsecured Debt $0

Total Take Home Income 0

Investments and Savings

Housing Expenses 35% Emergency Fund $0

Rent Savings Account

1st Mortgage (PITI/HOA Financial Goal 1

2nd Mortgage (PITI) Financial Goal 2

Heating Retirement Funds (IRA, Roth IRA)

Electric Stocks/Bonds)

Water/Sewer Total Savings $0

Repairs/Improvements

Other Summary of Budget

Total Expenses $0 Total Take Home (Income ) $0

Total Living Expenses (-) $0

Transportation 20% Disposable Income or Deficit $0.00

Auto Loan Disposable Income as Percent #DIV/0!

Auto Insurance

Gas/Maintenance

Public Transportation/Taxi Note: If you have a deficit, you should seek

Parking/Tolls the help of a credit counseling agency to help

Total Expenses $0 you reduce expenses as well as create a

workable budget for you and your family.

This budget is a recommendation based on the

Financial Community Guideline. Every

situation is different. These guidlines are just

one tool to help keep your finances healthy.

For more information

about managing your

finances call

800-769-3571

to speak to a credit

counselor today.

Note: If you have a deficit, you should seek

the help of a credit counseling agency to help

you reduce expenses as well as create a

workable budget for you and your family.

Other Living Expenses 20% This budget is a recommendation based on the

Financial Community Guideline. Every

Groceries situation is different. These guidlines are just

Eating Out (snacks, meals etc) one tool to help keep your finances healthy.

Household Items

Clothing For more information

Personal Care (toiletries, haircuts, etc)

Education (tuition, supplies, activities) about managing your

Entertainment finances call

Prescriptions 800-769-3571

Medical (co-pays, non-insured bills)

Contributions/Donations/Gifts to speak to a credit

Other counselor today.

Other

Total Other Living Expenses $0

no reviews yet

Please Login to review.