216x Filetype XLSX File size 0.06 MB Source: tea.texas.gov

Sheet 1: Instructions

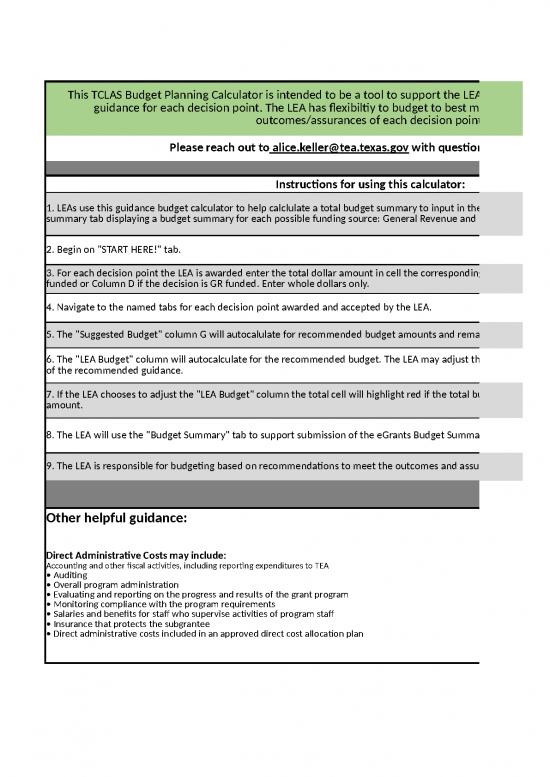

| This TCLAS Budget Planning Calculator is intended to be a tool to support the LEA in meeting budget requirements and guidance for each decision point. The LEA has flexibiltiy to budget to best meet the needs of the LEA and the outcomes/assurances of each decision point. | |||||||

| Please reach out to alice.keller@tea.texas.gov with questions about this tool. | |||||||

| Instructions for using this calculator: | |||||||

| 1. LEAs use this guidance budget calculator to help calclulate a total budget summary to input in the eGrants system. This tool will flow to a final summary tab displaying a budget summary for each possible funding source: General Revenue and ESSER III | |||||||

| 2. Begin on "START HERE!" tab. | |||||||

| 3. For each decision point the LEA is awarded enter the total dollar amount in cell the corresponding cells in Column C if the decision is ESSER funded or Column D if the decision is GR funded. Enter whole dollars only. | |||||||

| 4. Navigate to the named tabs for each decision point awarded and accepted by the LEA. | |||||||

| 5. The "Suggested Budget" column G will autocalulate for recommended budget amounts and remain uneditable. | |||||||

| 6. The "LEA Budget" column will autocalculate for the recommended budget. The LEA may adjust this column to meet its needs while being mindful of the recommended guidance. | |||||||

| 7. If the LEA chooses to adjust the "LEA Budget" column the total cell will highlight red if the total budgeted amount does not equal the award amount. | |||||||

| 8. The LEA will use the "Budget Summary" tab to support submission of the eGrants Budget Summary | |||||||

| 9. The LEA is responsible for budgeting based on recommendations to meet the outcomes and assurances aligned to each decision point. | |||||||

| Other helpful guidance: | |||||||

| Direct Administrative Costs may include: Accounting and other fiscal activities, including reporting expenditures to TEA • Auditing • Overall program administration • Evaluating and reporting on the progress and results of the grant program • Monitoring compliance with the program requirements • Salaries and benefits for staff who supervise activities of program staff • Insurance that protects the subgrantee • Direct administrative costs included in an approved direct cost allocation plan |

|||||||

| Fill this tab with award amounts for each decision point. If a decision point was not selected or awarded, leave the zero in place. | ||

| ESSER Award Amount | GR Award Amount | |

| Decision 1b | $0 | |

| Decision 2a.1&2a.2 | $0 | |

| Decision 2b | $0 | |

| Decision 2c | $0 | |

| Decision 3b | $0 | |

| Decision 3e | $0 | |

| Decision 4a | $0 | |

| Decision 4b | $0 | |

| Decision 4c | $0 | |

| Decision 5a | $0 | |

| Decision 5b | $0 | |

| Decision 6 | $0 | |

| Decision 7a | $0 | |

| Decision 7b | $0 | |

| Decision 7c | $0 | |

| Decision 8b | $0 | |

| Decision 8c | $0 | |

| Decision 9a | $0 | |

| Decision 9b | $0 | |

| Decision 9c | $0 | |

| Decisions 10a&10b | $0 | |

| Total Award Amount | $0 | $0 |

| Decision 1b | |||||||

| Funded From | ESSER III | ||||||

| This page of the budget calculator autocalculates to split the expense of the Data Fellow FTE between 6100 and 6200 budget object codes. Please be aware that an LEA may choose to budget the entirity of the Data Fellow FTE in either 6100-Payroll for staff members or 6200-Professional and Contracted Services as needed by the LEA to best meet the outcomes and assurances of the decision point. | |||||||

| Grant Funds Awarded | $0 | ||||||

| Budget Object Code | Suggested General Guidance | Suggested Budget Amount | Suggested Budget | LEA Budget | |||

| 6100 - Payroll | LEA must pay salaries or stipends; excess funds must support Data Fellow FTE's responsibilities | Allowable to at leasta 60% of allotment if using a staff member as Data Fellow FTE for decision point | $0 | $0 | |||

| 6200 - Professional and Contracted Services | LEA may contract with partner for Data Fellow FTE (still responsible for meeting all assurances) | Allowable to at least 60% of allotment if using a subcontracted partner as Data Fellow FTE for decision point | $0 | $0 | |||

| 6300 - Supplies and Materials | Any technology or data resources aligned to responsibilities as Data Fellow | Up to 25% of decision point allotment | $0 | $0 | |||

| 6400 - Other Operating Costs | Up to 25% of decision point allotment | $0 | $0 | ||||

| 6600 - Capital Outlay | Not allowable | ||||||

| Direct Administrative Costs | Not allowable | ||||||

| Total | $0 | $0 | |||||

no reviews yet

Please Login to review.