284x Filetype XLSX File size 0.25 MB Source: nomoredebts.org

Sheet 1: Budget Calculator Spreadsheet

| Welcome! Start by entering your name and indicate your responses to the areas highlighted in green. | Version 1.61 | ||||||||||||||||||||||||||

| Budget Calculator Spreadsheet | |||||||||||||||||||||||||||

| What is your name? | First Name | Do you have a spouse or partner? | No | ||||||||||||||||||||||||

| First Name | |||||||||||||||||||||||||||

| What kind of a budget would you like to create? | - Select - | ||||||||||||||||||||||||||

| How many people will be supported by this budget? | 0 | << Make sure this number is correct. Include all | |||||||||||||||||||||||||

| children and adults who live in the home and depend on this budget. |

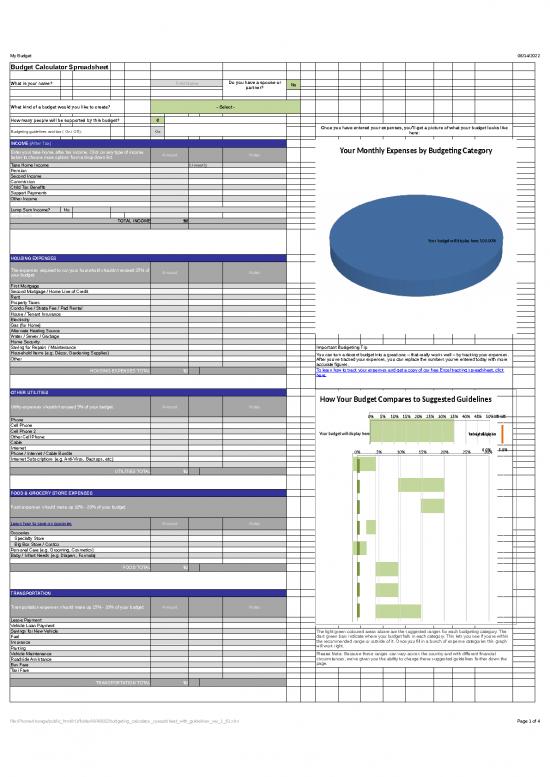

Once you have entered your expenses, you'll get a picture of what your budget looks like here: | ||||||||||||||||||||||||||

| Budgeting guidelines and tips ( On / Off ): | On | ||||||||||||||||||||||||||

| INCOME (After Tax) | |||||||||||||||||||||||||||

| Enter your take-home, after tax income. Click on any type of income below to choose more options from a drop down list. | Amount | Select | Notes | ||||||||||||||||||||||||

| Take Home Income | bi-weekly | ||||||||||||||||||||||||||

| Pension | monthly | ||||||||||||||||||||||||||

| Second Income | bi-weekly | ||||||||||||||||||||||||||

| Commission | monthly | ||||||||||||||||||||||||||

| Child Tax Benefits | monthly | ||||||||||||||||||||||||||

| Support Payments | monthly | ||||||||||||||||||||||||||

| Other Income | monthly | ||||||||||||||||||||||||||

| monthly | |||||||||||||||||||||||||||

| Lump Sum Income? | No | Amount | Needs to last | Withdrawal Frequency | |||||||||||||||||||||||

| Lump Sum | $0 | 0 | months | monthly | |||||||||||||||||||||||

| TOTAL INCOME | $0 | ||||||||||||||||||||||||||

| HOUSING EXPENSES | |||||||||||||||||||||||||||

| The expenses required to run your household shouldn’t exceed 35% of your budget. | Amount | Select | Notes | ||||||||||||||||||||||||

| First Mortgage | monthly | ||||||||||||||||||||||||||

| Second Mortgage / Home Line of Credit | monthly | ||||||||||||||||||||||||||

| Rent | monthly | ||||||||||||||||||||||||||

| Property Taxes | monthly | ||||||||||||||||||||||||||

| Condo Fee / Strata Fee / Pad Rental | monthly | ||||||||||||||||||||||||||

| House / Tenant Insurance | monthly | ||||||||||||||||||||||||||

| Electricity | monthly | ||||||||||||||||||||||||||

| Gas (for Home) | monthly | ||||||||||||||||||||||||||

| Alternate Heating Source | every 2 months | ||||||||||||||||||||||||||

| Water / Sewer / Garbage | monthly | ||||||||||||||||||||||||||

| Home Security | monthly | ||||||||||||||||||||||||||

| Saving for Repairs / Maintenance | monthly | Important Budgeting Tip | |||||||||||||||||||||||||

| Household Items (e.g. Décor, Gardening Supplies) | annually | You can turn a decent budget into a great one – that really works well – by tracking your expenses. After you’ve tracked your expenses, you can replace the numbers you've entered today with more accurate figures. | |||||||||||||||||||||||||

| Other | monthly | ||||||||||||||||||||||||||

| monthly | |||||||||||||||||||||||||||

| HOUSING EXPENSES TOTAL | $0 | To learn how to track your expenses and get a copy of our free Excel tracking spreadsheet, click here. | |||||||||||||||||||||||||

| OTHER UTILITIES | |||||||||||||||||||||||||||

| Utility expenses shouldn't exceed 5% of your budget. | Amount | Select | Notes | ||||||||||||||||||||||||

| Phone | monthly | ||||||||||||||||||||||||||

| Cell Phone | monthly | 100.0% | |||||||||||||||||||||||||

| Cell Phone 2 | monthly | ||||||||||||||||||||||||||

| Other Cell Phone | monthly | ||||||||||||||||||||||||||

| Cable | monthly | ||||||||||||||||||||||||||

| Internet | monthly | ||||||||||||||||||||||||||

| Phone / Internet / Cable Bundle | monthly | ||||||||||||||||||||||||||

| Internet Subscriptions (e.g. Anti-Virus, Backups, etc.) | monthly | ||||||||||||||||||||||||||

| monthly | |||||||||||||||||||||||||||

| UTILITIES TOTAL | $0 | ||||||||||||||||||||||||||

| FOOD & GROCERY STORE EXPENSES | |||||||||||||||||||||||||||

| Food expenses should make up 10% - 20% of your budget. | |||||||||||||||||||||||||||

| Learn how to save on groceries | Amount | Select | Notes | ||||||||||||||||||||||||

| Groceries | monthly | ||||||||||||||||||||||||||

| Specialty Store | monthly | ||||||||||||||||||||||||||

| Big Box Store / Costco | monthly | ||||||||||||||||||||||||||

| Personal Care (e.g. Grooming, Cosmetics) | weekly | ||||||||||||||||||||||||||

| Baby / Infant Needs (e.g. Diapers, Formula) | monthly | ||||||||||||||||||||||||||

| monthly | |||||||||||||||||||||||||||

| FOOD TOTAL | $0 | ||||||||||||||||||||||||||

| TRANSPORTATION | |||||||||||||||||||||||||||

| Transportation expenses should make up 15% - 20% of your budget. | Amount | Select | Notes | ||||||||||||||||||||||||

| Lease Payment | monthly | ||||||||||||||||||||||||||

| Vehicle Loan Payment | monthly | ||||||||||||||||||||||||||

| Savings for New Vehicle | monthly | The light green coloured areas above are the suggested ranges for each budgeting category. The dark green bars indicate where your budget falls in each category. This lets you see if you're within the recommended range or outside of it. Once you fill in a bunch of expense categories this graph will work right. | |||||||||||||||||||||||||

| Fuel | monthly | ||||||||||||||||||||||||||

| Insurance | monthly | ||||||||||||||||||||||||||

| Parking | monthly | ||||||||||||||||||||||||||

| Vehicle Maintenance | monthly | Please Note: Because these ranges can vary across the country and with different financial circumstances, we've given you the ability to change these suggested guidelines further down the page. | |||||||||||||||||||||||||

| Roadside Assistance | monthly | ||||||||||||||||||||||||||

| Bus Fare | monthly | ||||||||||||||||||||||||||

| Taxi Fare | monthly | ||||||||||||||||||||||||||

| monthly | |||||||||||||||||||||||||||

| TRANSPORTATION TOTAL | $0 | ||||||||||||||||||||||||||

| CLOTHING | |||||||||||||||||||||||||||

| It's a good idea to allocate 3% - 5% of your budget for clothing. | Amount | Select | Notes | ||||||||||||||||||||||||

| Clothing for Adult 1 | monthly | ||||||||||||||||||||||||||

| Clothing for Adult 2 | monthly | ||||||||||||||||||||||||||

| Shoes for Adult 1 | monthly | ||||||||||||||||||||||||||

| Shoes for Adult 2 | monthly | ||||||||||||||||||||||||||

| Special / Professional Clothing | monthly | ||||||||||||||||||||||||||

| Clothing for Kids | monthly | ||||||||||||||||||||||||||

| Shoes for Kids | monthly | ||||||||||||||||||||||||||

| monthly | |||||||||||||||||||||||||||

| CLOTHING TOTAL | $0 | ||||||||||||||||||||||||||

| MEDICAL | Important Note | ||||||||||||||||||||||||||

| In Canada, you can expect medical expenses to be around 3% of your income. | Amount | Select | Notes | Please keep in mind that the suggestions we are offering you in this tool are limited to the information you have provided here and are intended only as general guidance, not specific advice. Only you can decide what is best for you and your family. | |||||||||||||||||||||||

| Health Expenses | |||||||||||||||||||||||||||

| Provincial Medical Premiums | monthly | If you have medical expenses that you need to pay for out of your own pocket, these budgeting expense guidelines may not apply to you. Make sure you follow your health care provider's advice. Your health and well being should be your highest priority in putting together your budget, and if that means disregarding or changing these budgeting guidelines, then that's what you need to do. | |||||||||||||||||||||||||

| Specialists (e.g. Massage, Chiropractor, Physiotherapy) | monthly | ||||||||||||||||||||||||||

| Eye Care | monthly | ||||||||||||||||||||||||||

| Prescriptions | monthly | ||||||||||||||||||||||||||

| Dental / Orthodontist | monthly | ||||||||||||||||||||||||||

| Over-the-Counter | monthly | ||||||||||||||||||||||||||

| Deductibles / Out-of-pocket | monthly | ||||||||||||||||||||||||||

| Other | monthly | ||||||||||||||||||||||||||

| Insurance | |||||||||||||||||||||||||||

| Life Insurance | monthly | ||||||||||||||||||||||||||

| Disability | monthly | ||||||||||||||||||||||||||

| Extended Health | monthly | ||||||||||||||||||||||||||

| Other (e.g. Critical Illness, Payment Protection) | monthly | ||||||||||||||||||||||||||

| Vet Bills / Pet Insurance | monthly | ||||||||||||||||||||||||||

| monthly | |||||||||||||||||||||||||||

| MEDICAL TOTAL | $0 | ||||||||||||||||||||||||||

| PERSONAL EXPENSES | |||||||||||||||||||||||||||

| It's usually a good idea to allocate 5% to 10% of your budget for personal expenses. | |||||||||||||||||||||||||||

| WORK EXPENSES | Amount | Select | Notes | ||||||||||||||||||||||||

| Daycare | monthly | ||||||||||||||||||||||||||

| Work Lunches / Breaks (Person 1) | monthly | ||||||||||||||||||||||||||

| Work Lunches / Breaks (Person 2) | monthly | ||||||||||||||||||||||||||

| Work License Fees / Professional Dues | monthly | ||||||||||||||||||||||||||

| Work Supplies (e.g. Tools, Classroom Supplies) | monthly | ||||||||||||||||||||||||||

| monthly | |||||||||||||||||||||||||||

| LIVING EXPENSES | Amount | Select | Notes | ||||||||||||||||||||||||

| Eating Out | monthly | ||||||||||||||||||||||||||

| Buying Coffee / Snacks / Drinks | monthly | ||||||||||||||||||||||||||

| Tobacco / Vaping / Cannabis | monthly | ||||||||||||||||||||||||||

| Alcohol | monthly | ||||||||||||||||||||||||||

| Entertainment (e.g. Movies, Event Tickets, Social Activities) | monthly | ||||||||||||||||||||||||||

| iTunes / Music / Online Services | monthly | ||||||||||||||||||||||||||

| Babysitting | monthly | ||||||||||||||||||||||||||

| Recreation (e.g. Sports Equipment & Fees, Activities) | monthly | ||||||||||||||||||||||||||

| Travel / Vacations | monthly | ||||||||||||||||||||||||||

| Hobbies | monthly | ||||||||||||||||||||||||||

| Lottery / Gaming | monthly | ||||||||||||||||||||||||||

| Hair Cuts & Services | monthly | ||||||||||||||||||||||||||

| Salon Services (e.g. Tanning, Aesthetics) | monthly | ||||||||||||||||||||||||||

| Fitness Memberships | monthly | ||||||||||||||||||||||||||

| Magazines / Newspapers / Books | monthly | ||||||||||||||||||||||||||

| Education (Tuition & Supplies) | monthly | ||||||||||||||||||||||||||

| Gifts / Special Occasions | monthly | ||||||||||||||||||||||||||

| Donations / Charitable / Planned Giving | monthly | Select | |||||||||||||||||||||||||

| Annual Memberships (Store, Online, Family, etc.) | monthly | ||||||||||||||||||||||||||

| Bank Fees / Safety Deposit Box | monthly | 10% | |||||||||||||||||||||||||

| Storage Locker | monthly | ||||||||||||||||||||||||||

| Laundry / Dry Cleaning | monthly | ||||||||||||||||||||||||||

| Pet Food | monthly | ||||||||||||||||||||||||||

| monthly | |||||||||||||||||||||||||||

| CHILDREN | Amount | Select | Notes | ||||||||||||||||||||||||

| Allowance | monthly | ||||||||||||||||||||||||||

| Lessons / Activities | monthly | ||||||||||||||||||||||||||

| School Supplies / Fees | monthly | ||||||||||||||||||||||||||

| Gifts | monthly | ||||||||||||||||||||||||||

| Other | monthly | ||||||||||||||||||||||||||

| monthly | |||||||||||||||||||||||||||

| PERSONAL EXPENSES TOTAL | $0 | ||||||||||||||||||||||||||

| SAVINGS (Money for Spending Later) | |||||||||||||||||||||||||||

| It's wise to save 5% to 10% of your income for expenses that don't occur every month, as well as for your future. Then you'll have a little extra available when you need it. | |||||||||||||||||||||||||||

| Where to find money to save each month | Payroll Deduction | Amount | Select | Notes | |||||||||||||||||||||||

| Tax Free Savings Account (TFSA) | monthly | ||||||||||||||||||||||||||

| Registered Retirement Savings Plan (RRSP) | monthly | ||||||||||||||||||||||||||

| Registered Education Savings Plan (RESP) | monthly | ||||||||||||||||||||||||||

| Emergency Savings | monthly | ||||||||||||||||||||||||||

| Other Savings | monthly | ||||||||||||||||||||||||||

| Income Tax (Additional) | monthly | ||||||||||||||||||||||||||

| monthly | |||||||||||||||||||||||||||

| SAVINGS TOTAL | $0 | ||||||||||||||||||||||||||

| DEBT PAYMENTS | |||||||||||||||||||||||||||

| A manageable level of debt payments can take up 5% to 15% of your budget. | Amount | Select | Notes | ||||||||||||||||||||||||

| Line of Credit | monthly | ||||||||||||||||||||||||||

| Overdraft | monthly | ||||||||||||||||||||||||||

| Personal Loan | monthly | ||||||||||||||||||||||||||

| Student Loan | monthly | ||||||||||||||||||||||||||

| Credit Card 1 | monthly | ||||||||||||||||||||||||||

| Credit Card 2 | monthly | ||||||||||||||||||||||||||

| Credit Card 3 | monthly | ||||||||||||||||||||||||||

| Credit Card 4 | monthly | ||||||||||||||||||||||||||

| Credit Card 5 | monthly | ||||||||||||||||||||||||||

| Money Owed to Family or Friends | monthly | ||||||||||||||||||||||||||

| Child / Spousal Support | monthly | ||||||||||||||||||||||||||

| Other Debt Payment | monthly | ||||||||||||||||||||||||||

| Income Tax Deductions | monthly | ||||||||||||||||||||||||||

| Other Loan | monthly | ||||||||||||||||||||||||||

| monthly | |||||||||||||||||||||||||||

| DEBT PAYMENTS TOTAL | $0 | ||||||||||||||||||||||||||

| TOTAL MONTHLY EXPENSES | $0 | ||||||||||||||||||||||||||

| Have you finished your budget, or do you need some help balancing your budget? If you think you're done, or if you'd like some help, select 'Yes': | |||||||||||||||||||||||||||

| Select | |||||||||||||||||||||||||||

| Scroll down to edit Budgeting Guidelines | |||||||||||||||||||||||||||

| Select | |||||||||||||||||||||||||||

| For more budgeting help, visit MyMoneyCoach.ca | |||||||||||||||||||||||||||

| Budgeting Guidelines | |||||||||||||||||||||||||||

| The Credit Counselling Society developed the budgeting guidelines used in this spreadsheet based on information from thousands of budgeting sessions with Canadian consumers. However, these guidelines are only meant as a starting point to help people get started in the budgeting process. Based on where you live in Canada, your financial situation, or your personal goals and priorities, you may need to adjust the guideline percentages. Adjust the guidelines to suit your particular situation. For this early release of the tool, you can only modify four categories at this time. Any percentages you modify here will change the alerts that appear in your budget above. Below we've provided you with the ability to move the some of the goal posts and adjust the guidelines to suit your particular situation (for this early release of this tool, you can only modify three categories). Any numbers you modify here will change when warnings appear in your budget above. |

|||||||||||||||||||||||||||

| Expense Category | Guideline | Guideline | Your Budget | ||||||||||||||||||||||||

| Minimum | Maximum | ||||||||||||||||||||||||||

| HOUSING EXPENSES | Not Applicable | 35% | |||||||||||||||||||||||||

| OTHER UTILITIES | Not Applicable | 5% | |||||||||||||||||||||||||

| FOOD & GROCERY STORE EXPENSES | 10% | 20% | |||||||||||||||||||||||||

| TRANSPORTATION | 15% | 20% | |||||||||||||||||||||||||

| CLOTHING | 3% | 5% | |||||||||||||||||||||||||

| MEDICAL | Not Applicable | 3% | |||||||||||||||||||||||||

| PERSONAL EXPENSES | 5% | 10% | |||||||||||||||||||||||||

| SAVINGS | 5% | 10% | |||||||||||||||||||||||||

| DEBT PAYMENTS | 5% | 15% | |||||||||||||||||||||||||

| Suggestions | |||||||||||||||||||||||||||

| If you notice anything wrong with this spreadsheet or have any suggestions for how we can improve it, please email us at | |||||||||||||||||||||||||||

| suggestions@mymoneycoach.ca | |||||||||||||||||||||||||||

| 0 | 0 | ||||||||||||||||||||||||||

| 0 | 0 | 0 | |||||||||||||||||||||||||

| 0 | 0 | 0 | |||||||||||||||||||||||||

| 0 | 0 | 0 | |||||||||||||||||||||||||

| 0 | 0 | 0 | |||||||||||||||||||||||||

| 0 | 0 | 0 | |||||||||||||||||||||||||

| 0 | 0 | 0 | |||||||||||||||||||||||||

| 0 | 0 | 0 | |||||||||||||||||||||||||

| 0 | 0 | 0 | |||||||||||||||||||||||||

| 0 | 0 | 0 | |||||||||||||||||||||||||

| 0 | 0 | 0 | |||||||||||||||||||||||||

| 0 | 0 | 0 | |||||||||||||||||||||||||

| 0 | 0 | 0 | |||||||||||||||||||||||||

| 0 | 0 | 0 | |||||||||||||||||||||||||

| 0 | 0 | 0 | |||||||||||||||||||||||||

| 0 | 0 | 0 | |||||||||||||||||||||||||

| 0 | 0 | 0 | |||||||||||||||||||||||||

| 0 | 0 | 0 | |||||||||||||||||||||||||

| 0 | 0 | 0 | |||||||||||||||||||||||||

| 0 | 0 | 0 | |||||||||||||||||||||||||

| What You're Spending on Food | $0 | 0 | |||||||||||||||||||||||||

| What the Average Canadian Household Your Size Spends on Food | $0 | ||||||||||||||||||||||||||

| Spending Higher Than Average | $0 | ||||||||||||||||||||||||||

| Curtains - Values below are the curtains on the Food for Thought chart | |||||||||||||||||||||||||||

| 1 | |||||||||||||||||||||||||||

| 1 | |||||||||||||||||||||||||||

no reviews yet

Please Login to review.