265x Filetype XLSX File size 0.11 MB Source: cupfa.org

Sheet 1: Budget

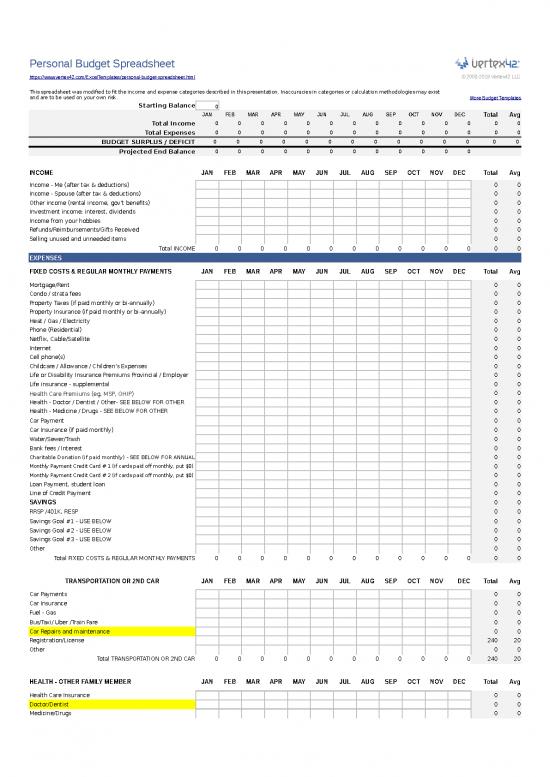

| Personal Budget Spreadsheet | ||||||||||||||||||||||||

| https://www.vertex42.com/ExcelTemplates/personal-budget-spreadsheet.html | © 2008-2019 Vertex42 LLC | |||||||||||||||||||||||

| This spreadsheet was modified to fit the income and expense categories described in this presentation. Inaccuracies in categories or calculation methodologies may exist and are to be used on your own risk. | More Budget Templates | |||||||||||||||||||||||

| Starting Balance | 0 | [42] | ||||||||||||||||||||||

| JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | Total | Avg | |||||||||||

| Total Income | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||

| Total Expenses | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||

| CURRENT SPENDING |

|

0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||

| Projected End Balance | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||

| MONTHLY ACTUAL |

MONTHLY TARGET |

% CHANGE | INCOME | JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | Total | Avg | |||||||

| #VALUE! | Income - Me (after tax & deductions) | 0 | 0 | |||||||||||||||||||||

| #DIV/0! | Income - Spouse (after tax & deductions) | 0 | 0 | |||||||||||||||||||||

| #DIV/0! | Other income (rental income, gov't benefits) | 0 | 0 | |||||||||||||||||||||

| #DIV/0! | Investment income; interest, dividends | 0 | 0 | |||||||||||||||||||||

| #DIV/0! | Income from your hobbies | 0 | 0 | 1 | ||||||||||||||||||||

| #DIV/0! | Refunds/Reimbursements/Gifts Received | 0 | 0 | |||||||||||||||||||||

| #DIV/0! | Selling unused and unneeded items | 0 | 0 | |||||||||||||||||||||

| 0 | 0 | #DIV/0! | Total INCOME | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||

| EXPENSES | Calculator | |||||||||||||||||||||||

| MONTHLY ACTUAL |

MONTHLY TARGET |

% CHANGE | FIXED COSTS & REGULAR MONTHLY PAYMENTS | JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | Total | Avg | Annual | Annual/ 12 mos |

|||||

| #DIV/0! | Mortgage/Rent | 0 | 0 | 0 | 0 | |||||||||||||||||||

| #DIV/0! | Condo / strata fees | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Property Taxes (if paid monthly or bi-annually) | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Property Insurance (if paid monthly or bi-annually) | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Heat / Gas / Electricity | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Phone (Residential) | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Netflix, Cable/Satellite | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Internet | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Cell phone(s) | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Childcare / Allowance / Children’s Expenses | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Life or Disability Insurance Premiums Provincial / Employer | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Life insurance - supplemental | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Health Care Premiums (eg. MSP, OHIP) | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Health - Doctor / Dentist / Other - SEE BELOW FOR OTHER | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Health - Medicine / Drugs - SEE BELOW FOR OTHER | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Car Payment | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Car Insurance (if paid monthly) | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Water/Sewer/Trash | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Bank fees / Interest | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Charitable Donation (if paid monthly) - SEE BELOW FOR ANNUAL | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Monthly Payment Credit Card # 1 (if cards paid off monthly, put $0) | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Monthly Payment Credit Card # 2 (if cards paid off monthly, put $0) | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Loan Payment, student loan | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Line of Credit Payment | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | SAVINGS | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | RRSP /401K, RESP | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Savings Goal #1 - USE BELOW | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Savings Goal #2 - USE BELOW | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Savings Goal #3 - USE BELOW | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Other | 0 | 0 | 0 | ||||||||||||||||||||

| 0 | 0 | #DIV/0! | Total FIXED COSTS & REGULAR MONTHLY PAYMENTS | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||

| Calculator | ||||||||||||||||||||||||

| MONTHLY ACTUAL |

MONTHLY TARGET |

% CHANGE | TRANSPORTATION OR 2ND CAR | JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | Total | Avg | Annual | Annual/ 12 mos |

|||||

| #DIV/0! | Car Payments | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Car Insurance | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Fuel - Gas | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Bus/Taxi/ Uber /Train Fare | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Car Repairs and maintenance | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Registration/License | 240 | 20 | 0 | ||||||||||||||||||||

| #DIV/0! | Other | 0 | 0 | 0 | ||||||||||||||||||||

| 0 | 0 | #DIV/0! | Total TRANSPORTATION OR 2ND CAR | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 240 | 20 | 0 | 0 | |||||

| Calculator | ||||||||||||||||||||||||

| MONTHLY ACTUAL |

MONTHLY TARGET |

% CHANGE | HEALTH - OTHER FAMILY MEMBER | JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | Total | Avg | Annual | Annual/ 12 mos |

|||||

| #DIV/0! | Health Care Insurance | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Doctor/Dentist | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Medicine/Drugs | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Gym / Health Club Dues | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Life Insurance | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Veterinarian/Pet Care | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Other | 0 | 0 | 0 | ||||||||||||||||||||

| 0 | 0 | Total HEALTH - OTHER FAMILY MEMBER | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||

| Calculator | ||||||||||||||||||||||||

| MONTHLY ACTUAL |

MONTHLY TARGET |

% CHANGE | CHARITY/GIFTS ANNUAL | JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | Total | Avg | Annual | Annual/ 12 mos |

|||||

| #DIV/0! | Gifts Given | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Charitable Donations | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Religious Donations | 0 | 0 | 0 | ||||||||||||||||||||

| #DIV/0! | Other | 0 | 0 | 0 | ||||||||||||||||||||

| 0 | 0 | #DIV/0! | Total CHARITY/GIFTS ANNUAL | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||

| MONTHLY EXPENSES - SOME ARE VARIABLE | Calculator | |||||||||||||||||||||||

| MONTHLY ACTUAL |

MONTHLY TARGET |

% CHANGE | MONTHLY EXPENSES | JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | Total | Avg | Annual | Annual/ 12 mos |

|||||

| Groceries | 0 | 0 | 0 | |||||||||||||||||||||

| Personal Supplies/Vitamins | 0 | 0 | 0 | |||||||||||||||||||||

| Pet Food & treats | 0 | 0 | 0 | |||||||||||||||||||||

| Personal Salon/Barber/Estitician | 0 | 0 | 0 | |||||||||||||||||||||

| Gas | 0 | 0 | 0 | |||||||||||||||||||||

| Snacks, Lunches at work, Coffees | 0 | 0 | 0 | |||||||||||||||||||||

| Entertainment - USE BELOW CATEGORY FOR BREAKDOWN | 0 | 0 | 0 | |||||||||||||||||||||

| Cleaning | 0 | 0 | 0 | |||||||||||||||||||||

| Alcohol (beer/wine) or Cigarettes | 0 | 0 | 0 | |||||||||||||||||||||

| Furnishings/Appliances | 0 | 0 | 0 | |||||||||||||||||||||

| Other | 0 | 0 | 0 | |||||||||||||||||||||

| 0 | 0 | #DIV/0! | Total MONTHLY EXPENSES | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||

| Calculator | ||||||||||||||||||||||||

| MONTHLY ACTUAL |

MONTHLY TARGET |

% CHANGE | ENTERTAINMENT - MONTLY BREAKDOWN | JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | Total | Avg | Annual | Annual/ 12 mos |

|||||

| Dining/Eating Out | 0 | 0 | 0 | |||||||||||||||||||||

| Activities | 0 | 0 | 0 | |||||||||||||||||||||

| Books | 0 | 0 | 0 | |||||||||||||||||||||

| Games | 0 | 0 | 0 | |||||||||||||||||||||

| Fun Stuff | 0 | 0 | 0 | |||||||||||||||||||||

| Hobbies | 0 | 0 | 0 | |||||||||||||||||||||

| Media | 0 | 0 | 0 | |||||||||||||||||||||

| Outdoor Recreation | 0 | 0 | 0 | |||||||||||||||||||||

| Sports | 0 | 0 | 0 | |||||||||||||||||||||

| Toys/Gadgets | 0 | 0 | 0 | |||||||||||||||||||||

| Vacation/Travel | 0 | 0 | 0 | |||||||||||||||||||||

| Other | 0 | 0 | 0 | |||||||||||||||||||||

| SUBSCRIPTIONS | 0 | 0 | 0 | |||||||||||||||||||||

| Newspaper, magazines, online | 0 | 0 | 0 | |||||||||||||||||||||

| Apps, Amazon prime, etc | 0 | 0 | 0 | |||||||||||||||||||||

| Other/Spotify / Apple | 0 | 0 | 0 | |||||||||||||||||||||

| 0 | 0 | #DIV/0! | Total ENTERTAINMENT - MONTLY BREAKDOWN | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||

| Calculator | ||||||||||||||||||||||||

| MONTHLY ACTUAL |

MONTHLY TARGET |

% CHANGE | LUMP SUM AND ANNUAL EXPENSES | JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | Total | Avg | Annual | Annual/ 12 mos |

|||||

| Property Taxes (if paid annually) | 0 | 0 | 0 | |||||||||||||||||||||

| Property Insurance (if paid annually) | 0 | 0 | 0 | |||||||||||||||||||||

| Home repairs / renovations | 0 | 0 | 0 | |||||||||||||||||||||

| Car Repairs and Maintenance | 0 | 0 | 0 | |||||||||||||||||||||

| Car Insurance (if paid annually) | 0 | 0 | 0 | |||||||||||||||||||||

| Car registration, license, repairs | 0 | 0 | 0 | |||||||||||||||||||||

| Medical & Dental | 0 | 0 | 0 | |||||||||||||||||||||

| Clubs/Dues/Professional Memberships | 0 | 0 | 0 | |||||||||||||||||||||

| Gifts - Birthdays, Christmas, other | 0 | 0 | 0 | |||||||||||||||||||||

| Charity / annual - SEE BELOW | 0 | 0 | 0 | |||||||||||||||||||||

| Children’s Activities and/or Hobbies | 0 | 0 | 0 | |||||||||||||||||||||

| Computer/Electronics supplies and equipment | 0 | 0 | 0 | |||||||||||||||||||||

| Furniture / Appliances / durable goods | 0 | 0 | 0 | |||||||||||||||||||||

| Self-Improvement | 0 | 0 | 0 | |||||||||||||||||||||

| Clubs & Memberships | 0 | 0 | 0 | |||||||||||||||||||||

| Professional / Accounting Fees | 0 | 0 | 0 | |||||||||||||||||||||

| Travel & Vacations | 0 | 0 | 0 | |||||||||||||||||||||

| Other | 0 | 0 | 0 | |||||||||||||||||||||

| 0 | 0 | #DIV/0! | Total LUMP SUM AND ANNUAL EXPENSES | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||

| Calculator | ||||||||||||||||||||||||

| MONTHLY ACTUAL |

MONTHLY TARGET |

% CHANGE | OBLIGATIONS- ANNUAL EXPENSES | JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | Total | Avg | Annual | Annual/ 12 mos |

|||||

| Student Loans | 0 | 0 | 0 | |||||||||||||||||||||

| Other Loans | 0 | 0 | 0 | |||||||||||||||||||||

| Alimony/Child Support | 0 | 0 | 0 | |||||||||||||||||||||

| Federal Taxes | 0 | 0 | 0 | |||||||||||||||||||||

| State/Local Taxes | 0 | 0 | 0 | |||||||||||||||||||||

| Other | 0 | 0 | 0 | |||||||||||||||||||||

| 0 | 0 | #DIV/0! | Total OBLIGATIONS- ANNUAL EXPENSES | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||

| HELP | |||||

| https://www.vertex42.com/ExcelTemplates/personal-budget-spreadsheet.html | © 2010-2019 Vertex42 LLC | ||||

| Intro | This personal budget spreadsheet is meant to help you create a budget for an entire year. Doing this will help you make predictions about your future finances. This is especially useful when making major life changes like moving or changing jobs. | ||||

| Step 1: | Define Budget Categories | ||||

| Each major category is a separate Excel Table. You can edit the sub-categories as needed. If you add or remove a major category (an entire Table), you will need to edit the formulas in the Budget Summary table. | |||||

| To add a new sub-category to a table, right-click in the table and go to Insert > Table Rows Above. To remove a sub-category from a table, right-click in the table and go to Delete > Table Rows. | |||||

| Step 2: | Enter Your Beginning Balance | ||||

| Add the balances in your spending accounts (cash, checking) to come up with your starting balance. Enter your balance at the top of the worksheet. | |||||

| Can can start with a month other than January by editing the column labels. For example, enter "Mar" in place of "Jan," then copy that cell to the right to automatically enter the other month labels. | |||||

| Step 3: | Define Your Budget | ||||

| Using income and expense data from past receipts, balance statements, bills, pay stubs, and other information that you know about the coming year, fill in the budget amounts for each of the categories. | |||||

| Fixed Expenses | |||||

| For fixed expenses, such as rent or mortgage payments, enter the same amount in each month. | |||||

| Variable Expenses | |||||

| For variable expenses such as utility bills, groceries, and birthday gifts, you can enter the estimated amounts in the months that they occur. Or, you can enter an estimated monthly average. | |||||

| Add Cell Comments | |||||

| Add cell comments as needed to help explain costs. For example, you might include the names of Birthdays in comments for the Gifts Given category | |||||

| Step 4: | Analyze Your Projected End Balance | ||||

| If your projected end balance is increasing over time, you might consider contributing more to your savings goals. | |||||

| If your projected end balance drops below what you consider a comfortable cushion, then you may need to cut back on some of your expenses. | |||||

| Take the Next Step | |||||

| This worksheet is a simple way to create a monthly budget, but when you are ready to move on to a more advanced budgeting tool, try our Money Management Template listed below. | |||||

| Related Templates and Resources | |||||

| ► Income and Expense Worksheet | |||||

| ► Money Management Template | |||||

| ► How to Make a Budget with a Spreadsheet | |||||

| ► 12 Principles of Personal Finance | |||||

no reviews yet

Please Login to review.