261x Filetype XLSX File size 0.74 MB Source: assets.publishing.service.gov.uk

Sheet 1: Instructions

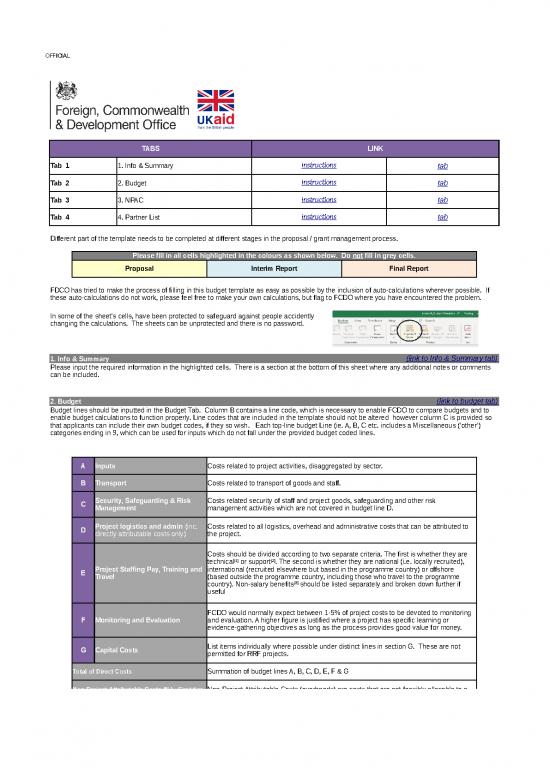

| TABS | LINK | |||||||||||||||||||

| Tab 1 | 1. Info & Summary | instructions | tab | |||||||||||||||||

| Tab 2 | 2. Budget | instructions | tab | |||||||||||||||||

| Tab 3 | 3. NPAC | instructions | tab | |||||||||||||||||

| Tab 4 | 4. Partner List | instructions | tab | |||||||||||||||||

| Different part of the template needs to be completed at different stages in the proposal / grant management process. | ||||||||||||||||||||

| Please fill in all cells highlighted in the colours as shown below. Do not fill in grey cells. | ||||||||||||||||||||

| Proposal | Interim Report | Final Report | ||||||||||||||||||

| FDCO has tried to make the process of filling in this budget template as easy as possible by the inclusion of auto-calculations wherever possible. If these auto-calculations do not work, please feel free to make your own calculations, but flag to FCDO where you have encountered the problem. | ||||||||||||||||||||

| In some of the sheet’s cells, have been protected to safeguard against people accidently changing the calculations. The sheets can be unprotected and there is no password. | ||||||||||||||||||||

| 1. Info & Summary | (link to Info & Summary tab) | |||||||||||||||||||

| Please input the required information in the highlighted cells. There is a section at the bottom of this sheet where any additional notes or comments can be included. | ||||||||||||||||||||

| 2. Budget | (link to budget tab) | |||||||||||||||||||

| Budget lines should be inputted in the Budget Tab. Column B contains a line code, which is necessary to enable FCDO to compare budgets and to enable budget calculations to function properly. Line codes that are included in the template should not be altered however column C is provided so that applicants can include their own budget codes, if they so wish. Each top-line budget Line (ie. A, B, C etc. includes a Miscellaneous (‘other’) categories ending in 9, which can be used for inputs which do not fall under the provided budget coded lines. | ||||||||||||||||||||

| A | Inputs | Costs related to project activities, disaggregated by sector. | ||||||||||||||||||

| B | Transport | Costs related to transport of goods and staff. | ||||||||||||||||||

| C | Security, Safeguarding & Risk Management | Costs related security of staff and project goods, safeguarding and other risk management activities which are not covered in budget line D. | ||||||||||||||||||

| D | Project logistics and admin (inc. directly attributable costs only) | Costs related to all logistics, overhead and administrative costs that can be attributed to the project. | ||||||||||||||||||

| E | Project Staffing Pay, Training and Travel | Costs should be divided according to two separate criteria. The first is whether they are technical[1] or support[2]. The second is whether they are national (i.e. locally recruited), international (recruited elsewhere but based in the programme country) or offshore (based outside the programme country, including those who travel to the programme country). Non-salary benefits[3] should be listed separately and broken down further if useful | ||||||||||||||||||

| F | Monitoring and Evaluation | FCDO would normally expect between 1-5% of project costs to be devoted to monitoring and evaluation. A higher figure is justified where a project has specific learning or evidence-gathering objectives as long as the process provides good value for money. | ||||||||||||||||||

| G | Capital Costs | List items individually where possible under distinct lines in section G. These are not permitted for RRF projects. | ||||||||||||||||||

| Total of Direct Costs | Summation of budget lines A, B, C, D, E, F & G | |||||||||||||||||||

| Non-Project-Attributable Costs (%) - First tier partner/s | Non-Project Attributable Costs (overheads) are costs that are not feasibly allocable to a single project (NPAC). | |||||||||||||||||||

| Localisation Support & Admin. Cost (LSAC) | In order for downstream partners to be able to manage project -related risks effectively, and to strengthen their ability to provide essential services to the communities they support, it is essential that they have access to indirect costs. | |||||||||||||||||||

| [1] E.g. doctor, nurse, WASH expert, public health expert. | ||||||||||||||||||||

| [2] E.g. programme manager, security guard, driver, regional manager. | ||||||||||||||||||||

| [3] E.g. housing, medical insurance, etc. | ||||||||||||||||||||

| For each line select the cost ‘type’ in Column E from the drop-down menu. The cost type ‘Regular payments’ is often useful for listing staff salaries. Where several people have the same position and salary, they can be combined into a single budget line. It is also possible to include just a fraction of a person’s time, using decimals. The level of disaggregation that is appropriate will depend on the timeline for budget planning, and to some extent on the overall scale of the project. Where advance budget estimates are created in a rapid onset emergency, the level of disaggregation is likely to be broad. In this case, more detailed budget lines should be left in place, but estimates included only at a higher level of aggregation . These lines can then be populated for the final report, and a meaningful comparison between estimates and actual spend will remain possible, with disaggregation to an appropriate level at each stage. |

||||||||||||||||||||

| Modalities of Implementation & Multiple Donors For the budget template to be completed correctly, applicants are required to provide information related to the value of funds that are distributed, as directly as possible, through Cash & Voucher Assistance (CVA), Women Led and Women’s Rights Organisation, Organizations of persons with disabilities (OPDs) and through national and local partners . This includes funds which are transferred by the FCDO directly to the applicant and funds that are passed from the lead organisation or consortium partners to downstream partners. Information on CVA assistance needs to be entered manually in the lines directly below the Total Costs in the Budget tab. Information on partners is then calculated from information inputted in the Partners tab of the budget template. |

||||||||||||||||||||

| Non-FCDO Funding & Cost Per Persons Supported At the bottom of the budget tab there are two additional rows must be completed manual. The Non FCDO Funding line allows the applicant to state other funds which have been used for this project. If the applicant requires FCDO to fully fund the project enter 0 in this cell. Once the total number of Persons Support the Cost per direct benefit (Persons Supported) is automatically calculated. |

||||||||||||||||||||

| NPAC The NPAC for lead organisations or consortium partners is calculated using the template in Tab 3. See further instructions in below. |

||||||||||||||||||||

| LSAC In order for downstream partners to be able to manage project -related risks effectively, and to strengthen their ability to provide essential services to the communities they support, it is essential that they have access to indirect costs. For RRF funding and for other funding mechanism using these guidelines the LSAC is calculation requires that the lead partner must pass on their own NPAC rate to all local and national downstream partners, or use a rate of 10%, whichever is highest. Where NPAC rates have been calculated collectively for a consortium, then the joint consortium rate, should be used rather than the lead organisations rate. If local and national actors are consortium partners, they can either use their own NPAC or a rate of 10%. |

||||||||||||||||||||

| 3. NPAC | (link to NPAC tab) | |||||||||||||||||||

| FDCO's approach to Non-Project Attributable Costs (NPAC) | ||||||||||||||||||||

| • Where an NGO partner has an NPAC rate that has been used in an Accountable Grant with a FCDO country team/office using FCDO's new NPAC template (tab 3), this rate can be used for your proposal. • You should tell us the programme name and code in your proposal and we will not interrogate the NPAC calculation at the outset of a response, but may follow-up in slower time for any supporting material from the FCDO team and/or the partner. • Where an NGO partner does not have a recent NPAC rate (based on the above) or would like to recalculate their NPAC for this proposal this guidance will assist you in completing the NPAC worksheet. It explains how to calculate an appropriate share of all relevant support services and other overheads, defined as ‘non-programme/project-attributable costs’ or ‘NPAC’. |

||||||||||||||||||||

| The following principles apply: 1. Refer to the department’s eligible cost guidance to ensure the costs included are eligible for inclusion (see link below). 2. Enter values in local currency. Note that total grant amount should be agreed in Great British Pounds (GBP) on the Accountable Grant. 3. Enter costs inclusive of non-recoverable taxes but exclusive of reclaimable input tax. 4. Do not include match funding. If this is required it will be by exception. 5. Enter or select information within yellow cells. 6. Do not enter information in greyed or blank cells. 7. Do not alter formula. If there is an error, contact the department. 8. If ‘other’ is selected in any category enter details in the notes section. 9. Budget monthly in year one and annually thereafter, using resource accounting. 10. Budget for inflation where appropriate (additional details in department’s eligible cost guidance – see link below). 11. If your organisational structure does not fit the audited accounts structure, please use the notes section to provide detail of how you have accounted for this within the template. • The tab allows you to set out how your organisation’s NPAC may be shared across your organisation’s funded projects. Sharing your NPAC among projects on a fair and reasonable basis means: * Each project’s share of the NPAC is appropriate given the nature and extent of its activities (i.e. a project does not receive a share of overheads that it does not incur). * After calculating your project’s share of the NPAC you should consider if the results appear reasonable. * The approach to calculating NPAC for Accountable Grant bids is via the Direct Project Expenditure method. The NPAC tab has been pre-populated to guide you through this method and Tables 1 – 6 will guide you through the process: |

||||||||||||||||||||

| Table 1: | For information only. | |||||||||||||||||||

| Table 2: | Calculate a 3-year rolling average of eligible direct costs for the whole organisation from the previous three years’ accounts. Remove ineligible historical items (e.g. one-off costs that would be unlikely to re-occur in the future) from the figures entered in columns C to E, and use column G to adjust for future costs that might come on-stream. | |||||||||||||||||||

| Table 3: | Calculate a 3-year rolling average of NPAC for the whole organisation, adopting the same approach as set out for direct costs in table 2. | |||||||||||||||||||

| Table 4: | Breakdown of Eligible ORGANISATIONAL NPAC costs in Year 3 for reference (agrees to Table 3 above) | |||||||||||||||||||

| Table 5: | CONSORTIUM MEMBER ANNUAL TOTALS FOR THE PROJECT - This table will autopopulate if you are the sole lead partner. For consortia the lead partner (the one liaising with FCDO) must manually enter the NPAC % for consortium partners in D79 - G79 as required. Downstream partner NPAC should not be entered into this table. | |||||||||||||||||||

| 4. Partner List | (link to Partner List tab) | |||||||||||||||||||

| Applicants are required to list all downstream partners who are sub-granted to implement parts of the project, in Column E of the Partner List Tab. Each new grant signed with a downstream partner must be entered in a separate line (so that the length of each sub-contracted grant can be calculated). The direct costs of each sub-grant should be inputted in Column G and the LSAC rate (see above) in Column H. The information produced from this table provides information on the total LSAC cost for the project, as well as the information for the Modalities of Distribution, except for information related to CVAs. LSAC should be included for all local and national downstream partners, although only funds passed directly from the FCDO or from a Tier 1 partner will be included in the totals for the modalities of distribution. It is understood that applicants may not have identified or agreed terms with all partners at the time of proposal submission. In such case the tab should be completed based on the best information possible. All partners should be identified as belonging to one of the categories in the drop-down menus (also outlined below). |

||||||||||||||||||||

| Categories | Details | |||||||||||||||||||

| INGO (int.) | International Non-Government Organisation | |||||||||||||||||||

| Local INGO Affliate (int.) | Locally registered organisation that is affiliated to an INGO. These are not considered local organisations by FCDO. | |||||||||||||||||||

| Multi-Lateral (int.) | Multi-lateral organisations such as UN Agencies and the ICRC & IFRC | |||||||||||||||||||

| N/L Gov (nat.) | Any entity that is publicly funded | |||||||||||||||||||

| NNGO (nat.) | National Non-Government Organisation who governance and branding is independent from any international organisation | |||||||||||||||||||

| OPD (int.) | Organisations of Persons with Disabilities' (OPDs) refers to organisations that are led by persons with disabilities, committed to the UN Convention on the Rights of Persons with Disabilities (CRPD), and have a majority of members who are persons with disabilities. These may work at the international (int.) level or national / local level (nat.) | |||||||||||||||||||

| OPD (nat.) | ||||||||||||||||||||

| WLO or WRO (int.) | ‘Women-Led Organisations’ (WLOs) and ‘Women’s Rights Organisations’ (WROs) refer to organisations that are led or predominantly composed of women in leadership positions, and who work towards advancing gender equality and supporting the needs of women and girls. These may work at the international (int.) level or national / local level (nat.) | |||||||||||||||||||

| WLO or WRO (nat.) | ||||||||||||||||||||

| Other (nat.) | Acedemic institutions, red cross national societies etc. | |||||||||||||||||||

| Other (int.) | ||||||||||||||||||||

| to Info & Summary instructions | |||||||||||||||

| INFO | |||||||||||||||

| Lead Partner Organisation | insert name | ||||||||||||||

| Type of Organisation | select | ||||||||||||||

| Project name | |||||||||||||||

| Project number | |||||||||||||||

| Project start date | 1/1/2019 | ||||||||||||||

| Project end date | 12/31/2020 | ||||||||||||||

| Total project cost | |||||||||||||||

| Project country | |||||||||||||||

| Thematic sector/s | |||||||||||||||

| Budget version | |||||||||||||||

| Date of budget revision | |||||||||||||||

| This is a summary table filled in automatically | |||||||||||||||

| Line Code | Buget Line | % Breakdown* | Proposal | Int. Rep. (1) | Final Report | ||||||||||

| Proposal | |||||||||||||||

| A | Inputs | - | - | - | - | ||||||||||

| A.1 | Health | - | - | - | - | ||||||||||

| A.2 | WASH | - | - | - | - | ||||||||||

| A.3 | Food & Nutrition | - | - | - | - | ||||||||||

| A.4 | Livelihoods | - | - | - | - | ||||||||||

| A.5 | Shelter & NFIs | - | - | - | - | ||||||||||

| A.6 | Protection & GBV | - | - | - | - | ||||||||||

| A.7 | Education | - | - | - | - | ||||||||||

| A.8 | Multi-purpose Cash | - | - | - | - | ||||||||||

| A.9 | Others | - | - | - | - | ||||||||||

| B | Transport | - | - | - | - | ||||||||||

| C | Security, Safeguarding & Risk Management | - | - | - | - | ||||||||||

| D | Project logistics and admin (Note: include directly attributable costs only) | - | - | - | - | ||||||||||

| E | Project Staffing Pay, Training and Travel | - | - | - | - | ||||||||||

| F | Monitoring and Evaluation | - | - | - | - | ||||||||||

| G | Capital Costs (not allowed for RRF projects) | - | - | - | - | ||||||||||

| Total of Direct Costs | - | - | - | - | |||||||||||

| Non-Project-Attributable Costs (%) - First tier partner/s | - | - | - | - | |||||||||||

| Localisation Support & Admin. Cost (LSAC) | - | - | - | - | |||||||||||

| Total | - | - | - | - | |||||||||||

| *Breakdown shown as a % of total costs | |||||||||||||||

| MODALITIES of DISTRIBUTION (funds transferred directly from FCDO or through just one intermediary) | |||||||||||||||

| Localisation: value of funds transferred to national & local actors | - | - | - | - | |||||||||||

| Disability Inclusion: value of funds transferred to Organisations of Persons with Disabilities (OPDs) | - | - | - | - | |||||||||||

| Women’s Empowerment: value of funds transferred to WLO & WROs | - | - | - | - | |||||||||||

| CVA: value of funds delivered by cash: | - | - | - | - | |||||||||||

| CVA: value of funds delivered to vouchers: | - | - | - | - | |||||||||||

| ADDITIONAL NOTES | |||||||||||||||

| Ref / Heading | Notes | ||||||||||||||

| Ref / Heading | Notes | ||||||||||||||

| Ref / Heading | Notes | ||||||||||||||

no reviews yet

Please Login to review.