257x Filetype XLSX File size 0.14 MB Source: www.tdbank.com

Sheet 1: Create Your Budget

| BUDGET TRACKING WORKSHEET | |||||||

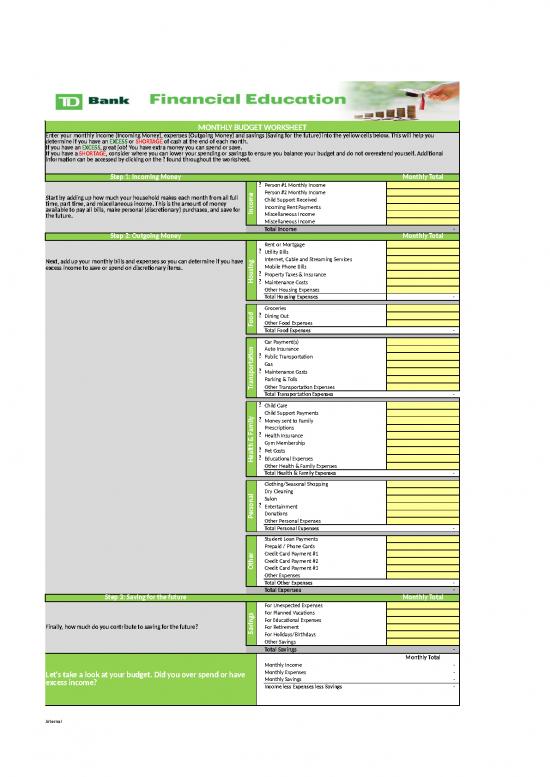

| Enter your actual monthly income (Incoming Money), expenses (Outgoing Money) and savings (Saving for the future) into the yellow cells below. This will help you determine how well you are managing your budget. Your Budget will automatically be populated from the "Create Your Budget" tab. |

|||||||

| Step 1: Incoming Money | Description | Budget | Actual | Over / Under Budget |

|||

| Start by adding up how much your household makes each month from all full time, part time, and miscellaneous income. This is the amount of money available to pay all bills, make personal (discretionary) purchases, and save for the future. | Income | Person #1 Monthly Income | - | - | |||

| Person #2 Monthly Income | - | - | |||||

| Child Support Received | - | - | |||||

| Incoming Rent Payments | - | - | |||||

| Miscellaneous Income | - | - | |||||

| Miscellaneous Income | - | - | |||||

| Total Income | - | - | - | ||||

| Over / Under Budget |

|||||||

| Step 2: Outgoing Money | Description | Budget | Actual | Budget | |||

Next, add up your monthly bills and expenses so you can determine if you have excess income to save or spend on discretionary items. |

Housing | Rent or Mortgage | - | - | |||

| Utility Bills | - | - | |||||

| Internet, Cable and Streaming Services | - | - | |||||

| Mobile Phone Bills | - | - | |||||

| Property Taxes & Insurance | - | - | |||||

| Maintenance Costs | - | - | |||||

| Other Housing Expenses | - | - | |||||

| Total Housing Expenses | - | - | - | ||||

| Food | Groceries | - | - | ||||

| Dining Out | - | - | |||||

| Other Food Expenses | - | - | |||||

| Total Food Expenses | - | - | - | ||||

| Transportation | Car Payment(s) | - | - | ||||

| Auto Insurance | - | - | |||||

| Public Transportation | - | - | |||||

| Gas | - | - | |||||

| Maintenance Costs | - | - | |||||

| Parking & Tolls | - | - | |||||

| Other Transportation Expenses | - | - | |||||

| Total Transportation Expenses | - | - | - | ||||

| Health & Family | Child Care | - | - | ||||

| Child Support Payments | - | - | |||||

| Money sent to Family | - | - | |||||

| Prescriptions | - | - | |||||

| Health Insurance | - | - | |||||

| Gym Membership | - | - | |||||

| Pet Costs | - | - | |||||

| Educational Expenses | - | - | |||||

| Other Health & Family Expenses | - | - | |||||

| Total Health & Family Expenses | - | - | - | ||||

| Personal | Clothing/Seasonal Shopping | - | - | ||||

| Dry Cleaning | - | - | |||||

| Salon | - | - | |||||

| Entertainment | - | - | |||||

| Donations | - | - | |||||

| Other Personal Expenses | - | - | |||||

| Total Personal Expenses | - | - | - | ||||

| Other | Student Loan Payments | - | - | ||||

| Prepaid / Phone Cards | - | - | |||||

| Credit Card Payment #1 | - | - | |||||

| Credit Card Payment #2 | - | - | |||||

| Total Other Expenses | - | - | - | ||||

| Total Expenses | - | - | - | ||||

| Over / Under |

|||||||

| Step 3: Saving for the future | Description | Budget | Actual | Budget | |||

| Finally, how much did you contribute to saving for the future? | Savings | For Unexpected Expenses | - | - | |||

| For Planned Vacations | - | - | |||||

| For Educational Expenses | - | - | |||||

| For Retirement | - | - | |||||

| For Holidays/Birthdays | - | - | |||||

| Other Savings | - | - | |||||

| Total Savings | - | - | - | ||||

| Let's take a look at how well you managed your budget… | Over / Under Budget |

||||||

| Budget | Actual | ||||||

| Monthly Income | - | - | MET | ||||

| Monthly Expenses | - | - | MET | ||||

| Monthly Savings | - | - | MET | ||||

| Income less Expenses less Savings | - | - | MET | ||||

| This tab can be used to track your debt; credit cards, auto loans, home loans, etc. | ||||||||||||

| Debt Breakdown | Debt Type | Lender/Payee | Loan/Debt Start Date | Annual Percentage Rate | Original Amt. Borrowed/Owed | Current Balance | Min Mthly. Payment | Actual Mthly. Payment | ||||

| Enter debt currently owed, including lender, interest charged, original amount borrowed/owed, current balance and payment information. | Debt | |||||||||||

| Total | - | - | - | - | ||||||||

no reviews yet

Please Login to review.