249x Filetype XLSX File size 0.06 MB Source: www.ndsu.edu

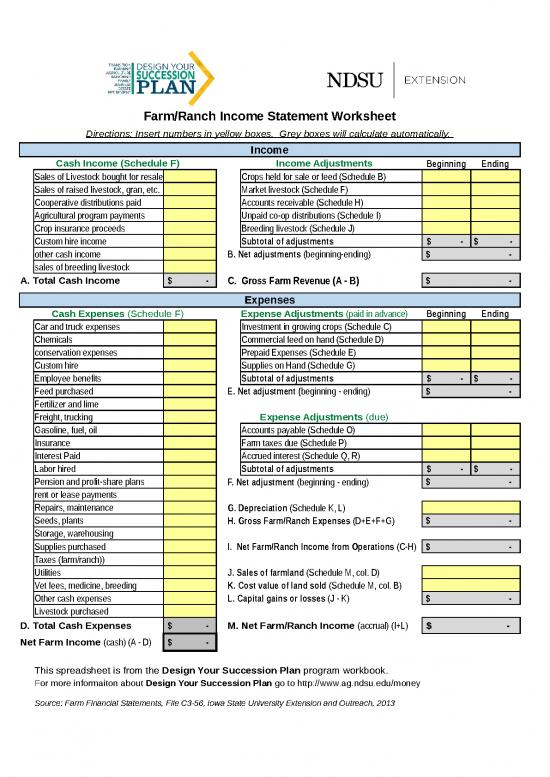

Farm/Ranch Income Statement Worksheet

Directions: Insert numbers in yellow boxes. Grey boxes will calculate automatically.

Income

Cash Income (Schedule F) Income Adjustments Beginning Ending

Sales of Livestock bought for resale Crops held for sale or feed (Schedule B)

Sales of raised livestock, gran, etc. Market livestock (Schedule F)

Cooperative distributions paid Accounts receivable (Schedule H)

Agricultural program payments Unpaid co-op distributions (Schedule I)

Crop insurance proceeds Breeding livestock (Schedule J)

Custom hire income Subtotal of adjustments $ - $ -

other cash income B. Net adjustments (beginning-ending) $ -

sales of breeding livestock

A. Total Cash Income $ - C. Gross Farm Revenue (A - B) $ -

Expenses

Cash Expenses (Schedule F) Expense Adjustments (paid in advance) Beginning Ending

Car and truck expenses Investment in growing crops (Schedule C)

Chemicals Commercial feed on hand (Schedule D)

conservation expenses Prepaid Expenses (Schedule E)

Custom hire Supplies on Hand (Schedule G)

Employee benefits Subtotal of adjustments $ - $ -

Feed purchased E. Net adjustment (beginning - ending) $ -

Fertilizer and lime

Freight, trucking Expense Adjustments (due)

Gasoline, fuel, oil Accounts payable (Schedule O)

Insurance Farm taxes due (Schedule P)

Interest Paid Accrued interest (Schedule Q, R)

Labor hired Subtotal of adjustments $ - $ -

Pension and profit-share plans F. Net adjustment (beginning - ending) $ -

rent or lease payments

Repairs, maintenance G. Depreciation (Schedule K, L)

Seeds, plants H. Gross Farm/Ranch Expenses (D+E+F+G) $ -

Storage, warehousing

Supplies purchased I. Net Farm/Ranch Income from Operations (C-H) $ -

Taxes (farm/ranch))

Utilities J. Sales of farmland (Schedule M, col. D)

Vet fees, medicine, breeding K. Cost value of land sold (Schedule M, col. B)

Other cash expenses L. Capital gains or losses (J - K) $ -

Livestock purchased

D. Total Cash Expenses $ - M. Net Farm/Ranch Income (accrual) (I+L) $ -

Net Farm Income (cash) (A - D) $ -

This spreadsheet is from the Design Your Succession Plan program workbook.

For more informaiton about Design Your Succession Plan go to http://www.ag.ndsu.edu/money

Source: Farm Financial Statements, File C3-56, Iowa State University Extension and Outreach, 2013

no reviews yet

Please Login to review.