268x Filetype XLSX File size 0.03 MB Source: www.lsu.edu

Sheet 1: Instructions

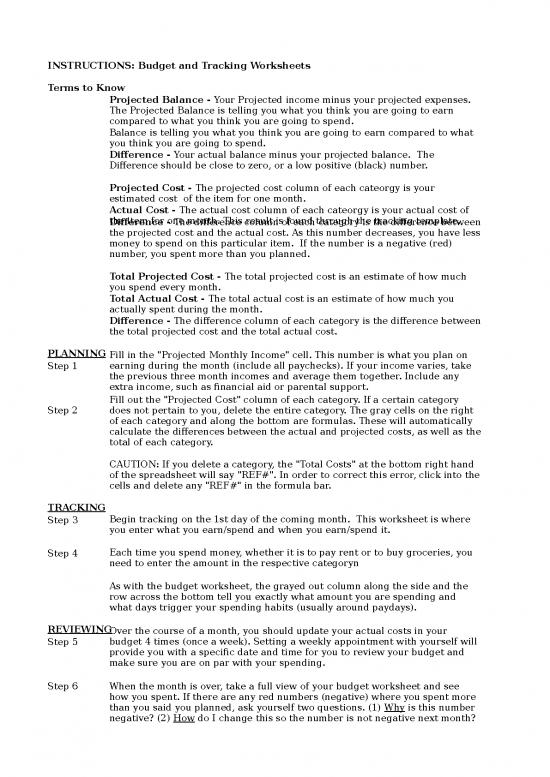

| INSTRUCTIONS: Budget and Tracking Worksheets | ||

| Terms to Know | ||

| Projected Balance - Your Projected income minus your projected expenses. The Projected Balance is telling you what you think you are going to earn compared to what you think you are going to spend. | ||

| Actual Balance - Your Actual income minus your actual expenses. The Actual Balance is telling you what you think you are going to earn compared to what you think you are going to spend. | ||

| Difference - Your actual balance minus your projected balance. The Difference should be close to zero, or a low positive (black) number. | ||

| Projected Cost - The projected cost column of each cateorgy is your estimated cost of the item for one month. | ||

| Actual Cost - The actual cost column of each cateorgy is your actual cost of the item for one month. This result is found through the tracking template. | ||

| Difference - The difference column of each category is the difference between the projected cost and the actual cost. As this number decreases, you have less money to spend on this particular item. If the number is a negative (red) number, you spent more than you planned. | ||

| Total Projected Cost - The total projected cost is an estimate of how much you spend every month. | ||

| Total Actual Cost - The total actual cost is an estimate of how much you actually spent during the month. | ||

| Difference - The difference column of each category is the difference between the total projected cost and the total actual cost. | ||

| PLANNING | ||

| Step 1 | Fill in the "Projected Monthly Income" cell. This number is what you plan on earning during the month (include all paychecks). If your income varies, take the previous three month incomes and average them together. Include any extra income, such as financial aid or parental support. | |

| Step 2 | Fill out the "Projected Cost" column of each category. If a certain category does not pertain to you, delete the entire category. The gray cells on the right of each category and along the bottom are formulas. These will automatically calculate the differences between the actual and projected costs, as well as the total of each category. | |

| CAUTION: If you delete a category, the "Total Costs" at the bottom right hand of the spreadsheet will say "REF#". In order to correct this error, click into the cells and delete any "REF#" in the formula bar. | ||

| TRACKING | ||

| Step 3 | Begin tracking on the 1st day of the coming month. This worksheet is where you enter what you earn/spend and when you earn/spend it. | |

| Step 4 | Each time you spend money, whether it is to pay rent or to buy groceries, you need to enter the amount in the respective categoryn | |

| As with the budget worksheet, the grayed out column along the side and the row across the bottom tell you exactly what amount you are spending and what days trigger your spending habits (usually around paydays). | ||

| REVIEWING | ||

| Step 5 | Over the course of a month, you should update your actual costs in your budget 4 times (once a week). Setting a weekly appointment with yourself will provide you with a specific date and time for you to review your budget and make sure you are on par with your spending. | |

| Step 6 | When the month is over, take a full view of your budget worksheet and see how you spent. If there are any red numbers (negative) where you spent more than you said you planned, ask yourself two questions. (1) Why is this number negative? (2) How do I change this so the number is not negative next month? | |

| Possible solutions could be that you under-estimated the expense and you really spend a higher amount in a certain category. To correct this, you need to reposition some money to cover the extra cost. Another solution is that you are over-spending in a certain category and need to cut back in order to balance your budget. | ||

| Step 7 | To ensure you are transferring numbers correctly from your tracking worksheet to your budgeting worksheet, check the bottom right-hand cell labeled "Total" on the tracking worksheet. This number should be the same as the "Total Actual Cost" cell on the budgeting worksheet. | |

| EXAMPLE: | ||

| You PROJECTED you would earn $500 in income and you would spend $500 for your expenses. Your projected balance (Projected income minus expenses) is $0 ($500 - $500). Then you ACTUALLY earn $500, but you only spend $400. Your actual balance (Actual income minus expenses) would be a positive $100 ($500 - $400). Your (total) Difference would be a positive $100 ( $100 from Actual Balance minus $0 from Projected Balance). | ||

| PROJECTED BALANCE (Projected income minus expenses) | $0 | |

| ACTUAL BALANCE (Actual income minus expenses) | $100 | |

| DIFFERENCE (Actual minus projected) | $100 | |

| My Personal Monthly Budget | ||||||||||

| PROJECTED MONTHLY INCOME | Income 1 | $0 | PERSONAL CARE | Projected Cost | Actual Cost | Difference | ||||

| Extra income | $0 | Medical/Dental | $0 | $0 | $0 | |||||

| Total monthly income | $0 | Hair/nails | $0 | $0 | $0 | |||||

| Clothing/shoes | $0 | $0 | $0 | |||||||

| ACTUAL MONTHLY INCOME | Income 1 | $0 | Health club | $0 | $0 | $0 | ||||

| Extra income | $0 | Organization dues or fees | $0 | $0 | $0 | |||||

| Total monthly income | $0 | Other | $0 | $0 | $0 | |||||

| Subtotals | $0 | $0 | $0 | |||||||

| FINANCIAL GOALS | Projected Cost | Actual Cost | Difference | ENTERTAINMENT | Projected Cost | Actual Cost | Difference | |||

| Other | $0 | $0 | $0 | Netflix/Hulu/Streaming | $0 | $0 | $0 | |||

| Other | $0 | $0 | $0 | Movies/Concerts/Sporting | $0 | $0 | $0 | |||

| Subtotals | $0 | $0 | $0 | Books/Magazines | $0 | $0 | $0 | |||

| Other | $0 | $0 | $0 | |||||||

| SAVINGS | Projected Cost | Actual Cost | Difference | Other | $0 | $0 | $0 | |||

| Savings | $0 | $0 | $0 | Subtotals | $0 | $0 | $0 | |||

| Emergency | $0 | $0 | $0 | |||||||

| Retirement | $0 | $0 | $0 | LOANS TO PAY BACK | Projected Cost | Actual Cost | Difference | |||

| Subtotals | $0 | $0 | $0 | Student | $0 | $0 | $0 | |||

| Credit card 1 | $0 | $0 | $0 | |||||||

| HOUSING | Projected Cost | Actual Cost | Difference | Credit card 2 | $0 | $0 | $0 | |||

| Rent/Mortgage/Housing | $0 | $0 | $0 | Other | $0 | $0 | $0 | |||

| Internet/Cable | $0 | $0 | $0 | Subtotals | $0 | $0 | $0 | |||

| Cell phone | $0 | $0 | $0 | |||||||

| Utilities (Electricity, etc.) | $0 | $0 | $0 | SCHOOL EXPENSES | Projected Cost | Actual Cost | Difference | |||

| Other | $0 | $0 | $0 | Tuition | $0 | $0 | $0 | |||

| Subtotals | $0 | $0 | $0 | Books/Supplies | $0 | $0 | $0 | |||

| Other | $0 | $0 | $0 | |||||||

| TRANSPORTATION | Projected Cost | Actual Cost | Difference | Subtotals | $0 | $0 | $0 | |||

| Vehicle payment | $0 | $0 | $0 | |||||||

| Insurance | $0 | $0 | $0 | GIFTS AND DONATIONS | Projected Cost | Actual Cost | Difference | |||

| Fuel | $0 | $0 | $0 | Gifts/Presents | $0 | $0 | $0 | |||

| Maintenance/Inspection | $0 | $0 | $0 | Church/Charity | $0 | $0 | $0 | |||

| Other | $0 | $0 | $0 | Subtotals | $0 | $0 | $0 | |||

| Subtotals | $0 | $0 | $0 | |||||||

| OTHER | Projected Cost | Actual Cost | Difference | |||||||

| INSURANCE | Projected Cost | Actual Cost | Difference | Pets | $0 | $0 | $0 | |||

| Renters/Home | $0 | $0 | $0 | Other | $0 | $0 | $0 | |||

| Health/Dental/Vision | $0 | $0 | $0 | Other | $0 | $0 | $0 | |||

| Other | $0 | $0 | $0 | Subtotals | $0 | $0 | $0 | |||

| Subtotals | $0 | $0 | $0 | |||||||

| TOTAL PROJECTED COST | $0 | |||||||||

| FOOD | Projected Cost | Actual Cost | Difference | |||||||

| Groceries | $0 | $0 | $0 | TOTAL ACTUAL COST | $0 | |||||

| Fast food/Dining Out | $0 | $0 | $0 | |||||||

| Coffee | $0 | $0 | $0 | TOTAL DIFFERENCE | $0 | |||||

| Subtotals | $0 | $0 | $0 | |||||||

no reviews yet

Please Login to review.