217x Filetype XLS File size 0.06 MB Source: www.hmm21.com

Sheet 1: BaseInformation

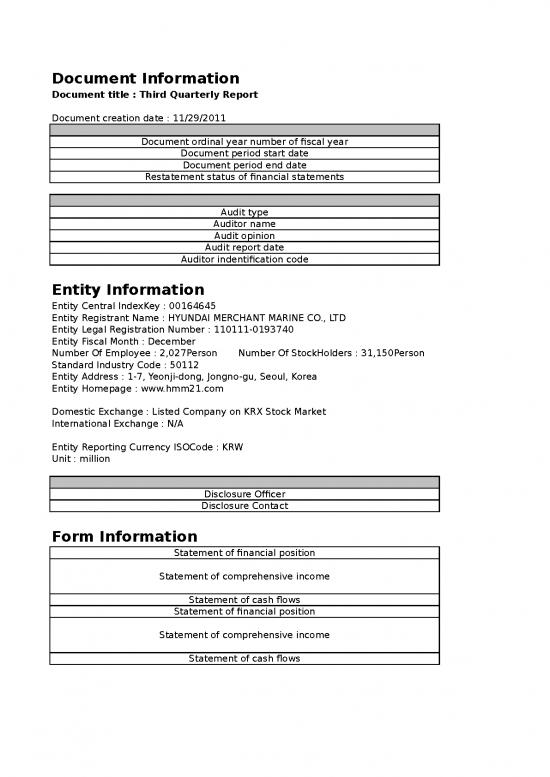

| Document Information | |||||

| Document title : Third Quarterly Report | Amendment : No | ||||

| Document creation date : 11/29/2011 | Restatement of comparative financial statements : Yes | ||||

| Current Fiscal Year (Quarter or Half-Year) | Quarter (or Half-Year) of Last Fiscal Year | Last Fiscal Year | the Year Before Last Fiscal Year | ||

| Document ordinal year number of fiscal year | 36 | 35 | 35 | 34 | |

| Document period start date | 2011-01-01 | 2010-01-01 | 2010-01-01 | 2009-01-01 | |

| Document period end date | 2011-09-30 | 2010-09-30 | 2010-12-31 | 2009-12-31 | |

| Restatement status of financial statements | No | No | No | No | |

| Current Fiscal Year (Quarter or Half-Year) | Quarter (or Half-Year) of Last Fiscal Year | Last Fiscal Year | the Year Before Last Fiscal Year | ||

| Audit type | Review | Review | Audit | Audit | |

| Auditor name | Deloitte Anfin LLC | Deloitte Anfin LLC | Deloitte Anfin LLC | Deloitte Anfin LLC | |

| Audit opinion | No Exception | No Exception | Unqualified Opinion | Unqualified Opinion | |

| Audit report date | 2011-11-28 | 2010-11-03 | 2011-03-17 | 2010-03-11 | |

| Auditor indentification code | 00260082 | 00260082 | 00260082 | 00260082 | |

| Entity Information | |||||

| Entity Central IndexKey : 00164645 | |||||

| Entity Registrant Name : HYUNDAI MERCHANT MARINE CO., LTD | |||||

| Entity Legal Registration Number : 110111-0193740 | |||||

| Entity Fiscal Month : December | |||||

| Number Of Employee : 2,027Person Number Of StockHolders : 31,150Person | |||||

| Standard Industry Code : 50112 | |||||

| Entity Address : 1-7, Yeonji-dong, Jongno-gu, Seoul, Korea | |||||

| Entity Homepage : www.hmm21.com | |||||

| Domestic Exchange : Listed Company on KRX Stock Market | |||||

| International Exchange : N/A | |||||

| Entity Reporting Currency ISOCode : KRW | |||||

| Unit : million | |||||

| Author Name | Author Title | TelephoneNumber | FAX | ||

| Disclosure Officer | Yong chan, Sohn | Vice President | 02-3706-5898 | 02-723-2193 | yc.sohn@hmm21.com |

| Disclosure Contact | Je gap, Mun | Assistant Manager | 02-3706-5874 | 02-723-2193 | jg.mun@hmm21.com |

| Form Information | |||||

| Statement of financial position | Statement of financial position, current/non-current | ||||

| Statement of comprehensive income | A Form for Comprehensive Income | ||||

| By function of expense | |||||

| the Other comprehensive Income After Tax | |||||

| Statement of cash flows | Statement of cash flows, direct method | ||||

| Statement of financial position | Statement of financial position, current/non-current | ||||

| Statement of comprehensive income | A Form for Comprehensive Income | ||||

| By function of expense | |||||

| the Other comprehensive Income After Tax | |||||

| Statement of cash flows | Statement of cash flows, direct method |

| Consolidated Statement of Financial Position | ||

| FY 2011 09/30/2011 Current | ||

| FY 2010 12/31/2010 Current | ||

| (Unit : million, KRW) | ||

| FY 2011 | FY 2010 | |

| Assets | ||

| Current assets | 2,768,411 | 2,792,186 |

| Cash and cash equivalents | 834,311 | 1,289,989 |

| Trade and other current receivables | 850,461 | 685,247 |

| Amounts due from customers under construction contracts | 15,111 | 15,934 |

| Inventories | 432,574 | 272,452 |

| Financial asset at fair value through profit or loss | 1,404 | 10,638 |

| financial lease-receivables(current) | 124,948 | 104,919 |

| Current tax assets | 7,752 | 8,654 |

| Other current financial assets | 376,433 | 16,509 |

| Other Current Assets | 125,417 | 387,844 |

| Non-current assets | 6,426,732 | 6,080,191 |

| Long-term trade and other non-current receivables, gross | 31,078 | 28,871 |

| Property, plant and equipment | 4,165,598 | 3,902,552 |

| Investment property | 76,558 | 74,393 |

| Intangible assets | 151,545 | 154,542 |

| Non-current available-for-sale financial assets | 277,466 | 376,932 |

| Investments in associates | 736,460 | 700,316 |

| Investments in joint ventures | 20,218 | 31,825 |

| financial lease-receivables(Non current) | 930,001 | 766,141 |

| Deferred tax assets | 2,006 | 771 |

| Other non-current financial assets | 317 | 584 |

| Other Non-current Assets | 35,485 | 43,264 |

| Total assets | 9,195,143 | 8,872,377 |

| Liabilities | ||

| Current liabilities | 1,896,253 | 1,623,481 |

| Trade and other current payables | 566,735 | 538,185 |

| Short-term borrowings | 66,225 | 14,575 |

| Current Portion of Long-term Liabilities | 1,225,725 | 1,031,730 |

| Financial liability at fair value through profit or loss | 3,209 | 3,245 |

| Current tax liabilities | 3,036 | 4,337 |

| unearned construction revenue | 8,074 | 6,212 |

| Other current liabilities | 23,249 | 25,197 |

| Non-current liabilities | 5,174,272 | 4,661,037 |

| Long-term borrowings, gross | 2,892,253 | 2,263,903 |

| Bonds | 1,795,553 | 1,946,941 |

| provisions | 2,557 | 2,869 |

| Post-employment benefit obligations | 59,694 | 49,068 |

| financial lease liabilities | 259,642 | 257,881 |

| Deferred tax liabilities | 2,775 | 1,834 |

| Financial liability at fair value through profit or loss | 28,434 | 9,592 |

| Other non-current financial liabilities | 131,860 | 127,468 |

| Other non-current liabilities | 1,504 | 1,481 |

| Total liabilities | 7,070,525 | 6,284,518 |

| Equity | ||

| Equity attributable to owners of parent | 2,085,740 | 2,538,058 |

| Issued capital | 816,366 | 816,366 |

| Other paid-in capital | 830,362 | 871,554 |

| Retained earnings | 510,465 | 794,083 |

| Other equity interest | (71,453) | 56,055 |

| Non-controlling interests | 38,878 | 49,801 |

| Total equity | 2,124,618 | 2,587,859 |

| Total equity and liabilities | 9,195,143 | 8,872,377 |

| Consolidated Statement of Comprehensive Income | ||||

| FY 2011 3 Quarterly From 01/01/2011 To 09/30/2011 | ||||

| FY 2010 3 Quarterly From 01/01/2010 To 09/30/2010 | ||||

| (Unit : million, KRW) | ||||

| FY 2011 3 Quarterly | FY 2010 3 Quarterly | |||

| 3 months | 9 months | 3 months | 9 months | |

| Sales Revenue | 1,891,606 | 5,445,757 | 2,216,987 | 6,052,633 |

| Cost of sales | 1,889,805 | 5,340,709 | 1,851,941 | 5,369,179 |

| Gross profit | 1,801 | 105,048 | 365,046 | 683,454 |

| Other income | 52 | 3,216 | 1,342 | 4,824 |

| Other expense | 33 | 35,408 | 114 | 148 |

| Selling general administrative expenses | 100,547 | 276,295 | 89,377 | 267,456 |

| Operating Income(Loss) | (98,727) | (203,439) | 276,897 | 420,674 |

| Finance income | 34,896 | 99,676 | 28,306 | 79,430 |

| Finance costs | 82,095 | 249,883 | 82,753 | 255,025 |

| Gains on Valuation of Equity Method Securities | (12,040) | 52,006 | 27,438 | 45,169 |

| Gains (losses) on disposal of Investments | 1,346 | 11,748 | 0 | 0 |

| Other Profits (Losses) | 155,622 | 93,306 | (111,692) | (23,670) |

| Profit (loss) before tax | (998) | (196,586) | 138,196 | 266,578 |

| Income tax expense | 11,703 | 22,507 | 5,957 | 18,197 |

| Profit (loss) | (12,701) | (219,093) | 132,239 | 248,381 |

| Other comprehensive income | 9,372 | (129,996) | (37,401) | (63,024) |

| gains (losses) on valuation of available-for-sale financial assets | (84,181) | (98,552) | 21,135 | (26,379) |

| Gain on Valuation of Equity Method Securities | (11,845) | (50,991) | 4,605 | (2,392) |

| Cumulative effect of foreign currency translation | 9,785 | 1,903 | (4,279) | (1,368) |

| Translation of Currency Denomination Differences | 95,290 | 20,146 | (55,459) | (28,846) |

| Gains(losses) on actuarial valuation | 224 | (2,598) | (3,403) | (4,039) |

| Others | 99 | 96 | 0 | 0 |

| Total comprehensive income | (3,329) | (349,089) | 94,838 | 185,357 |

| Profit (loss), attributable to | ||||

| Profit (loss), attributable to owners of parent | (5,256) | (210,336) | 131,219 | 255,405 |

| Profit (loss), attributable to non-controlling interests | (7,445) | (8,757) | 1,020 | (7,024) |

| Comprehensive income attributable to | ||||

| Comprehensive income, attributable to owners of parent | 3,728 | (340,425) | 94,005 | 192,551 |

| Comprehensive income, attributable to non-controlling interests | (7,057) | (8,664) | 833 | (7,194) |

| Earnings per share | ||||

| Basic earnings (loss) per share | 0 | 0 | 0 | 0 |

| Diluted earnings (loss) per share | 0 | 0 | 0 | 0 |

no reviews yet

Please Login to review.