212x Filetype XLSX File size 0.08 MB Source: dhcd.maryland.gov

Sheet 1: CDA Form 101

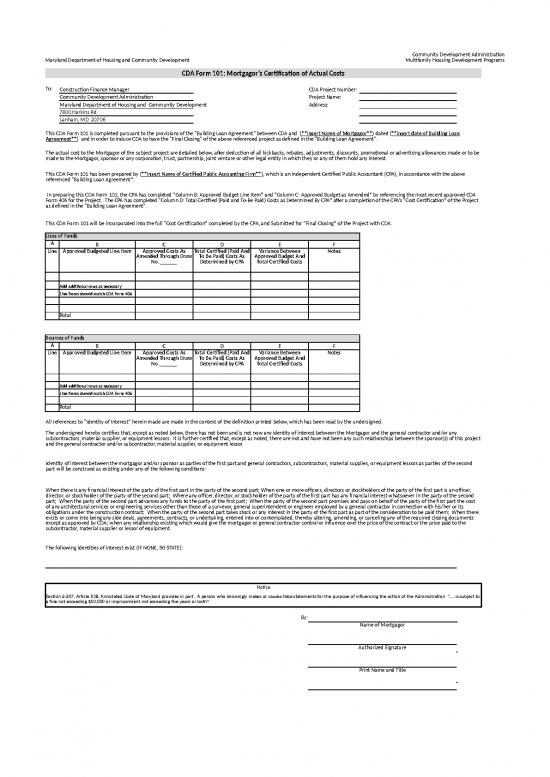

| CDA Form 101: Mortgagor’s Certification of Actual Costs | |||||||||||

| To: | Construction Finance Manager | CDA Project Number: | |||||||||

| Community Development Administration | Project Name: | ||||||||||

| Maryland Department of Housing and Community Development | Address: | ||||||||||

| 7800 Harkins Rd. | |||||||||||

| Lanham, MD 20706 | |||||||||||

| This CDA Form 101 is completed pursuant to the provisions of the "Building Loan Agreement" between CDA and (**Insert Name of Mortgagor**) dated (**insert date of Building Loan Agreement**) and in order to induce CDA to have the "Final Closing" of the above referenced project as defined in the "Building Loan Agreement". |

|||||||||||

| The actual cost to the Mortgagor of the subject project are detailed below, after deduction of all kickbacks, rebates, adjustments, discounts, promotional or advertising allowances made or to be made to the Mortgagor, sponsor or any corporation, trust, partnership, joint venture or other legal entity in which they or any of them hold any interest. | |||||||||||

| This CDA Form 101 has been prepared by (**Insert Name of Certified Public Accounting Firm**), which is an independent Certified Public Accountant (CPA), in accordance with the above referenced “Building Loan Agreement”. | |||||||||||

| In preparing this CDA Form 101, the CPA has completed “Column B: Approved Budget Line Item” and “Column C: Approved Budget as Amended” by referencing the most recent approved CDA Form 406 for the Project. The CPA has completed “Column D: Total Certified (Paid and To-Be Paid) Costs as Determined By CPA” after a completion of the CPA’s “Cost Certification” of the Project as defined in the "Building Loan Agreement". | |||||||||||

| This CDA Form 101 will be incorporated into the full “Cost Certification” completed by the CPA, and Submitted for “Final Closing” of the Project with CDA. | |||||||||||

| Uses of Funds | |||||||||||

| A | B | C | D | E | F | ||||||

| Line | Approved Budgeted Line Item | Approved Costs As Amended Through Draw No. ______ | Total Certified (Paid And To Be Paid) Costs As Determined by CPA | Variance Between Approved Budget And Total Certified Costs | Notes | ||||||

| Add additional rows as necessary | |||||||||||

| Line items should match CDA Form 406 | |||||||||||

| Total | |||||||||||

| Sources of Funds | |||||||||||

| A | B | C | D | E | F | ||||||

| Line | Approved Budgeted Line Item | Approved Costs As Amended Through Draw No. ______ | Total Certified (Paid And To Be Paid) Costs As Determined by CPA | Variance Between Approved Budget And Total Certified Costs | Notes | ||||||

| Add additional rows as necessary | |||||||||||

| Line items should match CDA Form 406 | |||||||||||

| Total | |||||||||||

| All references to "Identity of Interest" herein made are made in the context of the definition printed below, which has been read by the undersigned. | |||||||||||

| The undersigned hereby certifies that, except as noted below, there has not been and is not now any identity of interest between the Mortgagor and the general contractor and/or any subcontractors, material supplier, or equipment lessors. It is further certified that, except as noted, there are not and have not been any such relationships between the sponsor(s) of this project and the general contractor and/or subcontractor, material supplier, or equipment lessor. | |||||||||||

| Identity of interest between the mortgagor and/or sponsor as parties of the first part and general contractors, subcontractors, material supplies, or equipment lessors as parties of the second part will be construed as existing under any of the following conditions: | |||||||||||

| When there is any financial interest of the party of the first part in the party of the second part; When one or more officers, directors or stockholders of the party of the first part is an officer, director, or stockholder of the party of the second part; Where any officer, director, or stockholder of the party of the first part has any financial interest whatsoever in the party of the second part; When the party of the second part advances any funds to the party of the first part; When the party of the second part promises and pays on behalf of the party of the first part the cost of any architectural services or engineering services other than those of a surveyor, general superintendent or engineer employed by a general contractor in connection with his/her or its obligations under the construction contract; When the party of the second part takes stock or any interest in the party of the first part as part of the consideration to be paid them; When there exists or come into being any side deals, agreements, contracts, or undertaking, entered into or contemplated, thereby altering, amending, or canceling any of the required closing documents except as approved by CDA; when any relationship existing which would give the mortgagor or general contractor control or influence over the price of the contract or the price paid to the subcontractor, material supplier or lessor of equipment. | |||||||||||

| The following identities of interest exist (IF NONE, SO STATE): | |||||||||||

| Notice | |||||||||||

| Section 2-207, Article 83B, Annotated Code of Maryland provides in part: A person who knowingly makes or causes false statements for the purpose of influencing the action of the Administration “…..is subject to a fine not exceeding $50,000 or imprisonment not exceeding five years or both”. | |||||||||||

| By: | |||||||||||

| Name of Mortgagor | |||||||||||

| Authorized Signature | |||||||||||

| Print Name and Title | |||||||||||

| Date | |||||||||||

| MARYLAND DEPARTMENT OF | COMMUNITY DEVELOPMENT ADMINISTRATION | |||||||

| ECONOMIC & COMMUNITY DEVELOPMENT | DEVELOPMENT FINANCE PROGRAM | |||||||

| DATE, 2017 | ||||||||

| CONTRACTOR'S CERTIFICATE OF ACTUAL COSTS | ||||||||

| MORTGAGOR: | PROJECT NOs: | |||||||

| CONTRACTOR: | BUILDING NUMBER: | |||||||

| NAME OF PROJECT: | LOCATION: | |||||||

| Gentlemen: | ||||||||

| This Certificate is made pursuant to the provision of the Construction Contract, entered into by and between us under date of March 30, 2016 and it is understood and agreed by the undersigned that this Certificate is to be submitted by you to the Assistant Director for Development Finance in order to induce the commissioner to induce CDA to finally close the mortgage. | ||||||||

| The actual cost incurred in the completion of construction under the above Construction Contract and accepted construction changes exclusive of all kick-backs, rebates and discounts received in connection with the construction of the project is itemized below. | ||||||||

| PAID | TO BE PAID | NAME OF PAYEE | ||||||

| DIV | TRADE ITEM | IN CASH | IN CASH | TOTAL | SUBCONTRACTOR | LINE | ||

| 010-00 | General Requirements Total | $- | $- | $- | 1 | |||

| 021-00 | Earthwork Total | - | - | - | 2 | |||

| 022-00 | Site Utilities Total | - | - | - | 3 | |||

| 023-00 | Roads and Walks Total | - | - | - | 4 | |||

| 024-00 | Site Improvements Total | - | - | - | 5 | |||

| 025-00 | Lawns and Planting Total | - | - | - | 6 | |||

| 028-00 | Demolition Total | - | - | - | 7 | |||

| 030-00 | Concrete Total | - | - | - | 8 | |||

| 040-00 | Masonry Total | - | - | - | 9 | |||

| 060-00 | Carpentry Total | - | - | - | 10 | |||

| 071-00 | Waterproofing Total | - | - | - | 11 | |||

| 072-00 | Insulation Total | - | - | - | 12 | |||

| 073-00 | Roofing Total | - | - | - | 13 | |||

| 074-00 | Sheet Metal Total | - | - | - | 14 | |||

| 081-00 | Doors Total | - | - | - | 15 | |||

| 082-00 | Windows Total | - | - | - | 16 | |||

| 092-00 | Drywall Total | - | - | - | 17 | |||

| 093-00 | Tile Work Total | - | - | - | 18 | |||

| 095-00 | Flooring Total | - | - | - | 19 | |||

| 096-00 | Painting and Decorating Total | - | - | - | 20 | |||

| 100-00 | Specialties Total | - | - | - | 21 | |||

| 112-00 | Appliances Total | - | - | - | 22 | |||

| 121-00 | Draperies and Shades Total | - | - | - | 23 | |||

| 122-00 | Carpeting Total | - | - | - | 24 | |||

| 151-00 | Plumbing Total | - | - | - | 25 | |||

| 152-00 | HVAC Total | - | - | - | 26 | |||

| 160-00 | Electrical Total | - | - | - | 27 | |||

| CDA Form 101A 5/79 Page 1 of 2 | ||||||||

| PAID | TO BE PAID | NAME OF PAYEE | ||||||

| DIV | TRADE ITEM | IN CASH | IN CASH | TOTAL | SUBCONTRACTOR | LINE | ||

| 190-00 | Net Construction Costs | - | - | - | 28 | |||

| 200-00 | Builder's General Overhead | - | - | - | 29 | |||

| 210-00 | Bond Premium | - | - | - | 30 | |||

| 220-00 | Builder's Profit | - | - | - | 31 | |||

| 010-00 | General Requirements (from page 1) | - | - | - | ||||

| 250-00 | Total Construction Costs | $- | $- | $- | ||||

| NOTICE | ||||||||

| Section 266DD-7, Article 41, Annotated Code of Maryland provides in part: "A person who knowingly makes or causes false statements for the purpose of influencing the action of the Administration ... is subject to a fine not exceeding $50,000 or imprisonment not exceeding five years or both." | ||||||||

| The undersigned hereby certifies that: (check one) __ There has not been and is not now any identity of interest between mortgagor and/or general contractor on the one hand and any subcontractor, material supplier or equipment lessor on the other. __ Attached to and made a part of this certificate is a signed statement fully describing any identities of interest as set forth in the previous sentence. | ||||||||

| All amounts shown have been reduced to give effect to the amount(s) of any kickbacks, rebates, adjustments, discounts, or any other devices which had the effect of reducing the actual cost, and all amounts shown above as "to be paid in cash" will be so paid within 45 days after final closing. | ||||||||

| By: | Date: | |||||||

| Contractor | ||||||||

| NOTE: | This certificate must be supported by a certification as to actual cost by an independent Certified Public Accountant as required by CDA Forms cc 108A, and cc 109 or cc 109A. | |||||||

| CDA Form 101A 5/79 Page 2 of 2 | ||||||||

| MARYLAND DEPARTMENT OF | COMMUNITY DEVELOPMENT ADMINISTRATION | ||||||||

| HOUSING & COMMUNITY DEVELOPMENT | DEVELOPMENT FINANCE PROGRAM | ||||||||

| MORTGAGORS DRAW REQUISITION | |||||||||

| Project Name | Loan No. | Requisition No. | |||||||

| Mortgagor | |||||||||

| Total Estimated Development Cost .................................................................................. | $ | ||||||||

| The undersigned Mortgagor hereby requests payment in the amount of | covering advances provided for by the Building Loan | ||||||||

| Agreement. As indicated by the total amount of the individual payments set forth in the schedule below. | |||||||||

| A | B | C | D | E | F | G | H | ||

| Line | Item | Development Budget | Change Orders | Revised Budget | Previous Draws | This Request | Total to Date | Percent Complete | Amount Approved |

| 1 | Construction Cost | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 2 | Construction Contingency | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 3 | Architect's Design | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 4 | Arch Supervision & Reimb | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 5 | Architect's Reimbursables | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 6 | Real Estate Attorney | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 7 | Boundary/Topo Survey | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 8 | Engineering | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 9 | Appraisal | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 10 | Market Study | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 11 | Environmental | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 12 | Zoning/Site Plan Fees/PNA | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 13 | FF&E | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 14 | Construction Interest | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 15 | Construction Inspection Fees | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 16 | Green Building Consultant | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 17 | Title and Recording | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 18 | Financing (Soft Cost) Cont. | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 19 | CDA Administrative Fee | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 20 | CDA Closing Fee | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 21 | Permanent Loan Fees | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 22 | Permanent Loan Legal | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 23 | Relocation Costs | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 24 | Land & Building Acquisition | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 25 | Acquisition Legal | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 26 | Developer's Fee | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 27a | Syndication Legal/Due Dil | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 27b | Additional Syndication Legal | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 28 | Partnership Organizational Fee | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 29 | Partnership Management Fee | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 30 | Tax Credit Application Fee | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 31 | Tax Credit Allocation Fee | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 32 | Tax Credit Reservation Fee | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 33 | Accounting/Auditing Fee | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 34 | Lease Up/Marketing Reserve | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 35 | Operating Reserve | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 36 | O & M Holdback Reserve | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 37 | Services Escrow | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 38 | Real Estate Taxes Paid at Closing | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 39 | Guarantee Fee | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 40 | TOTAL Development Costs | $0 | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 |

| $0 | |||||||||

| 41 | SOURCES | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 42 | Equity RJTCF | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 43 | CDA HOME | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 44 | Bonneville Mortgage 538 Loan | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 45 | Deferred Developer's Fee | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 46 | Dev Equity RH Holdback & OM Res | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 47 | Income from Operations | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 | |

| 48 | Services Escrow | $0 | |||||||

| 49 | TOTAL FUNDING SOURCES | $0 | $0 | $0 | $0 | $0 | $0 | #DIV/0! | $0 |

| NOTE: Append rider listing payees, nature of expenditure, and dates paid. | |||||||||

| The Undersigned hereby certifies that all of the above items, except interest and any sum identified as " Contractor's Requisition" No._____ | |||||||||

| have been paid, and we hand you herewith full receipts and the contractor's draw requisition certified by the supervising architect covering | |||||||||

| such items enumerated. With respect to any item of interest enumerated above, we herewith authorize you to advance same and charge | |||||||||

| our account herewith. | |||||||||

| It is also certified that all prior work and the work, labor and materials to be paid for under this request are satisfactory and are in | |||||||||

| accordance with contract drawings. | |||||||||

| Date_______________ | Borrower | ||||||||

| Date_______________ | CDA | ||||||||

| Date_______________ | CDA | ||||||||

no reviews yet

Please Login to review.