270x Filetype XLSX File size 0.08 MB Source: www2.gov.bc.ca

Sheet 1: Changes

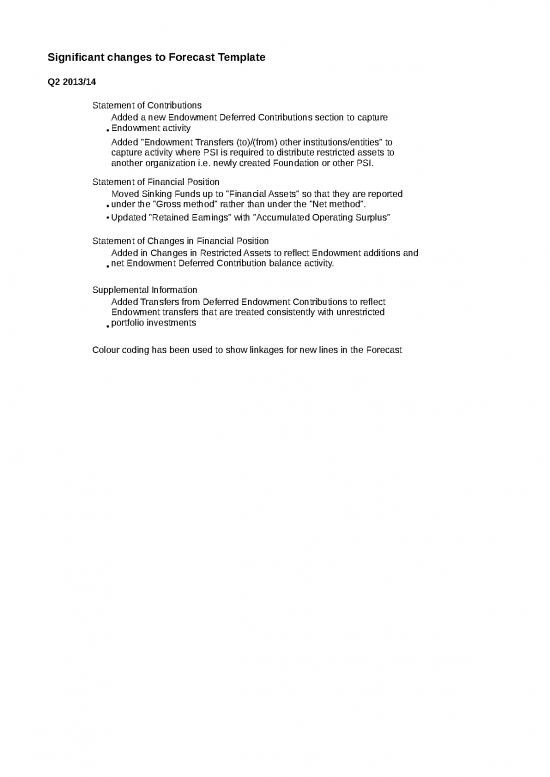

| Significant changes to Forecast Template | ||||||||

| Q2 2013/14 | ||||||||

| Statement of Contributions | ||||||||

| • | Added a new Endowment Deferred Contributions section to capture Endowment activity | |||||||

| Added "Endowment Transfers (to)/(from) other institutions/entities" to capture activity where PSI is required to distribute restricted assets to another organization i.e. newly created Foundation or other PSI. | ||||||||

| Statement of Financial Position | ||||||||

| • | Moved Sinking Funds up to "Financial Assets" so that they are reported under the "Gross method" rather than under the "Net method". | |||||||

| • | Updated "Retained Earnings" with "Accumulated Operating Surplus" | |||||||

| Statement of Changes in Financial Position | ||||||||

| • | Added in Changes in Restricted Assets to reflect Endowment additions and net Endowment Deferred Contribution balance activity. | |||||||

| Supplemental Information | ||||||||

| • | Added Transfers from Deferred Endowment Contributions to reflect Endowment transfers that are treated consistently with unrestricted portfolio investments | |||||||

| Colour coding has been used to show linkages for new lines in the Forecast | ||||||||

| Forecast Template Completion Instructions | |

| General | |

| • | Forecasts should be prepared on the same basis as data flows into the financial statements (e.g., not on a “modified cash” or other basis that may be required for institution's boards). |

| • | Forecasts should be based on ALL funds (not just operating). |

| Statement of Contributions | |

| • | Routine Capital - Record any operating dollars received for routine capital via electronic funds transfer (EFT) under DOC Provincial. |

| • | Record all Certificates of Approval (COAs) received under the Routine Capital funding envelope as DCC Provincial. |

| • | DCC Provincial should be recorded on the Statement of Contributions under From the Province: Cash. |

| • | DCC from Provincial Ministries (or Other Sources): Depreciable Assets should only be used if the institution actually received a tangible capital asset from the province or another source. |

| • | Endowment Deferred Contributions |

| -New Endowment Spend Contributions - this represents funds that are provided by the PSI for matching purposes. | |

| -Endowment Unrealized gains/(losses) include the Endowment portion of unrealized gains/losses | |

| -Endowment Realized gains/(losses) include the Endowment portion of realized gains/losses | |

| -Transfers (to)/from Capitalization are linked to Endowment Restricted assets as a mechanism to transfer funds in order to maintain/perserve purchasing power of Endowment. | |

| - Amortized/Transferred to revenue - These amounts are linked to the Statement of Operations and it is presumed that they offset endowment expenditures captured in various Expense lines in the Statement of Operations. | |

| -Balance at end of period is linked to Endowment Deferred Contributions liability balance on the Statement of Financial Position. Changes year over year are linked to the Statement of Changes. | |

| • | Externally Restricted Assets |

| - Contributions received in the current year - include new donations in the current year | |

| -Endowment transfers (to)/from other institutions/entities - include transfers of restricted assets to other organizations (i.e. other PSI's or newly created Foundations). | |

| Statement of Operations | |

| • | Investment earnings are distributed between four categories. |

| - Endowment earnings are linked to the Contributions worksheet. | |

| - Realized investment (gains)/losses are linked from the Supplemental Information worksheet. | |

| • | Sales of goods and services to the Province (including Contracts) - Includes all formalized contracts for program and/or service delivery where the Province is the beneficiary of goods or services provided by the institution. |

| • | Sales of goods and services to Crown corps & agencies (including Contracts) - Includes all formalized contracts for program and/or service delivery where the Crown Corp or Agency is the beneficiary of goods or services provided by the institution. |

| • | Sales of goods and services to others (Contract Sales) - Includes all formalized contracts for program and/or service delivery where a non-provincial entity is the beneficiary of goods or services provided by the institution. |

| • | Sales of goods and services to others (Ancillary Services) - Include all ancillary service revenues generated by business activities generally outside of instruction and research that provide goods and services to students, staff or others external to the organization (e.g., bookstore, parking, cafeteria, etc.). |

| • | Tuition and Mandatory Fees - Split between domestic and international (students paying a differential fee). |

| Mandatory Fees include (but are not limited to) the following items: recreation/athletics fees; student card fees; registration application fees; building fees; laboratory or art studio fees if not attached to course tuition; tool rental fees; transcript fees; and library access fees. | |

| • | Grants to third parties - Break out these values between Scholarships and payments to Foundations/others. |

| • | Unallocated Pressures - May be used by institutions in the first quarter only, to identify a financial pressure (for Ministry reporting purposes) which they expect to fully manage internally by year end (this line should not be used if an institution has deficit pressures that it will not be able to solve internally by year end). The Ministry would expect that by the second quarter the institution will have implemented any internal plans to mitigate the pressures (and can therefore attribute mitigation actions to specific revenue or expense lines). The Unallocated Pressures line may be used to highlight out-year pressures that the institution anticipates being able to resolve. The Ministry will roll the Unallocated Pressure into Other Operating Costs upon consolidation. |

| • | Current year total endowment principle impacts are brought into income below Operating Net (Income)/Loss (linked to Contributions worksheet). As per the relevant legislation, these amounts are excluded from financial results for Ministry accountability purposes. |

| Statement of Financial Position | |

| • | Please report Sinking Funds on the related line in "Financial Assets" so that they are reported on a Gross basis. |

| "Deferred income on externally restricted assets" would include impacts of endowment stabilization activities. | |

| Statement of Changes in Financial Position | |

| • | Ending Accumulated Surplus in 2013/14 should include ending Endowment balance. |

| • | Only approved Fiscal Agency Loans should be included in the new borrowings line. |

| • | Only approved new debt should be included in the New Borrowing of Other Debt line. |

| • | Total capital asset additions (CAAs) are sectioned into two separate reporting lines: |

| CAAs with provincial funding | |

| • Include the total value for all capital projects (including P3s) that have a provincial funding component (1%-100% provincial funding). This may include Certificates of Approval (COAs), BC Knowledge Development Fund (BCKDF) projects, minor capital and contributions from other sources (e.g., federal, internal/own source, donations, etc.). | |

| • The total on this line must match Project Cashflow on the institution's Quarterly Cashflow Projection, (provided to Capital Planning, AVED). If it does not, please provide an explanation of the variance in the Assumptions-Variance tab. | |

| CAAs without provincial funding | |

| • Include all capital projects (including P3s, assets under capital lease and minor capital) that do NOT have a provincial funding component. These would be projects the institution is 100% self-funding through federal grants, internal/own sources, borrowing, donations, etc. | |

| Supplemental Information | |

| • | Please complete the information requested in this tab in its entirety, and as applicable to your institution. |

| Assumptions-Variances | |

| • | Please complete the information requested in this tab in its entirety. |

| • | |

| Board Confirmation | |

| • | Confirmation of this forecast and underlying assumptions must be provided by either the board Chair or the Chair of the Audit and Finance Committee. A sample confirmation form may be found in this spreadsheet (Confirmation Form tab); or the institution may choose to submit its own documentation (please ensure it includes the information contained in the sample). Confirmations should be emailed to the contacts identified below. |

| Deficit Management | |

| • | Per the December 23, 2009 letter to board chairs, and subsequent legislative amendments, institutions are working to ensure annual bottom line (Net (Income) Loss for Ministry) results are balanced or in a surplus position. |

| • | Per the June 1, 2010 letter from Mark Zacharias, Assistant Deputy Minister, institutions projecting deficits on an all-funds basis will be required to submit a Deficit Management Plan (DMP) to the Ministry. The DMP should include, but not be limited to: |

| 1. An explanation of the key deficit drivers; evidence to demonstrate if the deficit is the result of the legislative changes in Budget 2010 or the no deficit direction provided in December 2009; | |

| 2. How long the institution expects to be in a deficit position; | |

| 3. How the deficit will be mitigated (in the current fiscal and, if necessary, over a maximum of three years). Specifically: | |

| o The institutional policies and/or board directives that will be implemented in support of reducing the deficit; and | |

| o How these outlined strategies will improve the institution’s financial sustainability (e.g., estimated impact); and | |

| o If the institution is into year 2 or 3 of the deficit mitigation plan, provision of actual savings that resulted from the mitigation steps; and | |

| 4. Identification of any extraordinary impacts to students as a result of the mitigation plan. | |

| • | Note that institutions are not able to use net assets or other balance sheet reserve funds to offset deficits: deficits are based on annual income statement results excluding the impacts of unrealized gains or losses on investments and endowment contributions (as per legislation). |

| • | DMPs should be should be provided to the Ministry within one week of the forecast submission. |

| Due Dates and Submissions | |

| • | The schedule for submitting quarterly forecasts to the Ministry of Advanced Education may be accessed at: http://www.aved.gov.bc.ca/gre/dates.htm. |

| • | Forecasts, confirmations and DMPs (if necessary) should be emailed to the contacts listed below. |

| Overview of How Post-Secondary Institution Forecast Information is Used | |

| • | Every quarter as part of the budget cycle, each public post secondary institution (PSI) provides government with a multi-year financial forecast. These forecasts are published at a consolidated level and form an integral component of government’s quarterly reports and the budget and fiscal plan. A summary of these documents follow and may be access on the Ministry of Finance Website at http://www.gov.bc.ca/fin/. |

| • The Budget and Fiscal Plan is published in February each year and is where government publically announces the strategic and financial targets it has set for the year. Third quarter forecasts from the post-secondary institutions are used in the development of this plan. | |

| • Also in February, the Ministry's Service Plan is published which includes the post-secondary sector's performance budget for the year (based on third quarter forecasts). | |

| • Throughout the year each institution's quarterly Appendix C and forecast are rolled up centrally to determine mid-year projected impacts to government's fiscal targets. The consolidated institutional information is incorporated into the Minister of Finance's Quarterly Report. | |

| • At the end of each fiscal year Government produces the Public Accounts, which includes the Summary Financial Statements of all government reporting entities (including the SUCH sector). All institutions' audited financial statement results are consolidated into the Public Accounts. | |

| • Also at the end of the fiscal year, each Ministry publishes its Service Plan Report which highlights how it achieved the targets set out in the Service Plan, including post-secondary sector financial results. | |

| Template Last Revised: September 24, 2013 | |

| Contact Information | |

| Donna Friedlander, CMA | |

| A/Director, Post-Secondary Finance | |

| Ministry of Advanced Education | |

| Phone: 250.356.7742 | |

| Donna.Friedlander@gov.bc.ca | |

| Stephanie Leskiw | |

| Senior Financial Performance Analyst | |

| Ministry of Advanced Education | |

| Phone: 250.356.0374 | |

| Stephanie.Leskiw@gov.bc.ca | |

| Stefanie Singer, CA, BBA | |

| Senior Financial Performance Analyst | |

| Ministry of Advanced Education | |

| Phone: 250.387.9571 | |

| Stefanie.Singer@gov.bc.ca | |

| Please enter amounts received as positive amounts | Forecast | Projections | |||||

| and amounts amortized to revenue as negative. | 2013/14 | 2014/15 | 2015/16 | 2016/17 | |||

| Operating Contributions | |||||||

| From Ministries | |||||||

| Contributions deferred from previous years | - | - | - | ||||

| plus: Operating contributions from AVED | <-- | Positive amounts | |||||

| plus: Operating contributions from other Ministries | |||||||

| plus: Routine Capital (received through EFT) recognized as revenue | |||||||

| minus: Amounts amortized to revenue | <-- | Negative amounts | |||||

| Deferred contribution balance at the end of the year | - | - | - | - | |||

| From Other Service Delivery Agencies | |||||||

| Contributions deferred from previous years | - | - | - | ||||

| plus: Contributions received in the current year | <-- | Positive amounts | |||||

| minus: Amounts amortized to revenue | <-- | Negative amounts | |||||

| Deferred contribution balance at the end of the year | - | - | - | - | |||

| From the Federal Government | |||||||

| Contributions deferred from previous years | - | - | - | ||||

| plus: Contributions received in the current year | <-- | Positive amounts | |||||

| minus: Amounts amortized to revenue | <-- | Negative amounts | |||||

| Deferred contribution balance at the end of the year | - | - | - | - | |||

| From Other Sources | |||||||

| Contributions deferred from previous years | - | - | - | ||||

| plus: Contributions received in the current year | <-- | Positive amounts | |||||

| minus: Amounts amortized to revenue | <-- | Negative amounts | |||||

| Deferred contribution balance at the end of the year | - | - | - | - | |||

| Endowment Deferred Contributions | |||||||

| Opening Balance | - | - | - | Must equal prior year reported closing balance | |||

| New endowment spend contribution (Endowment Matching) | <-- | Positive amounts | |||||

| Unrealized gains/(losses) | |||||||

| Realized gains/(losses) | Include reinvested dividends | ||||||

| Transfers (to)/from Capitalization | This is credited on the Stmt of Ops (endow contrib) | ||||||

| Transfers to Stmt of Remeasurement | This is credited on the Stmt Remsmt | ||||||

| Amortized/Transferred to revenue | <-- | Negative amounts This is credited on the Stmt of Ops (investments) |

|||||

| Balance at end of period | - | - | - | - | |||

| Deferred Capital Contributions | |||||||

| From Ministries: Cash | |||||||

| Contributions deferred from previous years | - | - | - | ||||

| plus: Certificates of Approval (COAs) received | <-- | Positive amounts | |||||

| plus: other (please specify nature in Notes) | |||||||

| minus: Amounts amortized to revenue | <-- | Negative amounts | |||||

| Deferred capital contribution balance at the end of the year | - | - | - | - | |||

| From Ministries: Depreciable Assets | |||||||

| Contributions deferred from previous years | - | - | - | ||||

| plus: Contributions received in the current year | <-- | Positive amounts | |||||

| minus: Amounts amortized to revenue | - | - | - | - | <-- | Negative amounts | |

| Deferred capital contribution balance at the end of the year | - | - | - | - | |||

| From the Federal Government: Cash | |||||||

| Contributions deferred from previous years | - | - | - | ||||

| plus: Contributions received in the current year | <-- | Positive amounts | |||||

| minus: Amounts amortized to revenue | <-- | Negative amounts | |||||

| Deferred contribution balance at the end of the year | - | - | - | - | |||

| From Other Sources: Cash | |||||||

| Contributions deferred from previous years | - | - | - | ||||

| plus: Contributions received in the current year | <-- | Positive amounts | |||||

| minus: Amounts amortized to revenue | <-- | Negative amounts | |||||

| Deferred capital contribution balance at the end of the year | - | - | - | - | |||

| From Other Sources: Depreciable Assets | |||||||

| Contributions deferred from previous years | - | - | - | ||||

| plus: Contributions received in the current year | - | - | - | - | <-- | Positive amounts | |

| minus: Amounts amortized to revenue | - | - | - | - | <-- | Negative amounts | |

| Deferred capital contribution balance at the end of the year | - | - | - | - | |||

| Contributed Surplus | |||||||

| Cash | |||||||

| Contributed surplus from previous years | - | - | - | ||||

| plus: Contributions received in the current year | <-- | Positive amounts | |||||

| minus: Amounts amortized to revenue | <-- | Negative amounts | |||||

| Contributed surplus balance at the end of the year | - | - | - | - | |||

| Non-depreciable Assets | |||||||

| Contributed surplus from previous years | - | - | - | ||||

| plus: Contributions received in the current year | <-- | Positive amounts | |||||

| minus: Amounts amortized to revenue | <-- | Negative amounts | |||||

| Contributed surplus balance at the end of the year | - | - | - | - | |||

| Externally Restricted Assets | |||||||

| Opening balance | - | - | - | ||||

| plus: Contributions received in the current year | <-- | Positive amounts Linked below the line on Stmt of Ops |

|||||

| Endowment transfers (to)/from other institutions/entities | |||||||

| Transfers to/(from) Deferred Endowment Contributions to Stmt of Remeasurement Gains/Losses | - | - | - | - | |||

| Transfers to/(from) Deferred Endowment Contribution (income permanently restricted for inflation protection) | - | - | - | - | |||

| Closing balance at the end of the year | - | - | - | - | |||

no reviews yet

Please Login to review.