251x Filetype XLSX File size 0.03 MB Source: www.sru.edu

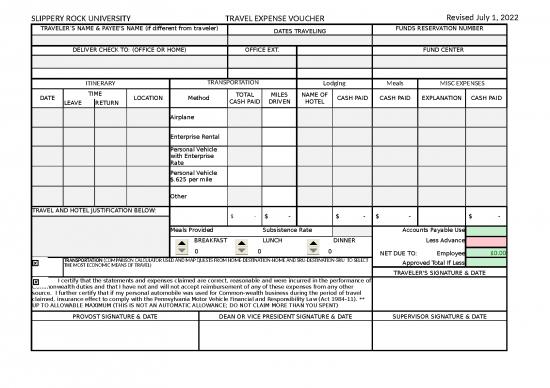

SLIPPERY ROCK UNIVERSITY TRAVEL EXPENSE VOUCHER Revised July 1, 2022

TRAVELER’S NAME & PAYEE'S NAME (if different from traveler) DATES TRAVELING FUNDS RESERVATION NUMBER

DELIVER CHECK TO: (OFFICE OR HOME) OFFICE EXT. FUND CENTER

ITINERARY TRANSPORTATION Lodging Meals MISC EXPENSES

TIME TOTAL MILES NAME OF

DATE LOCATION Method CASH PAID DRIVEN HOTEL CASH PAID CASH PAID EXPLANATION CASH PAID

LEAVE RETURN

Airplane

Enterprise Rental

Personal Vehicle

with Enterprise

Rate

Personal Vehicle

$.625 per mile

Other

TRAVEL AND HOTEL JUSTIFICATION BELOW:

$ - $ - $ - $ - $ -

Meals Provided Subsistence Rate Accounts Payable Use

BREAKFAST LUNCH DINNER Less Advance

0 0 0 NET DUE TO: Employee $0.00

TRANSPORTATION (COMPARISON CALCULATOR USED AND MAP QUESTS FROM HOME-DESTINATION-HOME AND SRU-DESTINATION-SRU TO SELECT

✘ THE MOST ECONOMIC MEANS OF TRAVEL) Approved Total If Less

TRAVELER'S SIGNATURE & DATE

I certify that the statements and expenses claimed are correct, reasonable and were incurred in the performance of

✘

Commonwealth duties and that I have not and will not accept reimbursement of any of these expenses from any other

source. I further certify that if my personal automobile was used for Common-wealth business during the period of travel

claimed, insurance effect to comply with the Pennsylvania Motor Vehicle Financial and Responsibility Law (Act 1984-11). **

UP TO ALLOWABLE MAXIMUM (THIS IS NOT AN AUTOMATIC ALLOWANCE; DO NOT CLAIM MORE THAN YOU SPENT)

PROVOST SIGNATURE & DATE DEAN OR VICE PRESIDENT SIGNATURE & DATE SUPERVISOR SIGNATURE & DATE

no reviews yet

Please Login to review.