262x Filetype XLSX File size 0.65 MB Source: sudburys.co.nz

Sheet 1: By Unit %

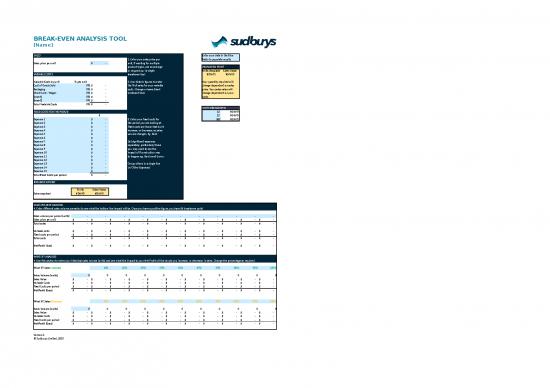

| BREAK-EVEN ANALYSIS TOOL | ||||||||||||

| [Name] | ||||||||||||

| SALES | Enter your data in the Blue | |||||||||||

| 1. Enter your sales price per | fields to populate results | |||||||||||

| Sales price per unit | $- | unit, if wanting for multiple | ||||||||||

| product types, use an average | BREAKEVEN POINT | |||||||||||

| or request our in-depth | Units Required | Sales Value | ||||||||||

| VARIABLE COSTS | breakeven tool. | #DIV/0! | #DIV/0! | |||||||||

| Variable Costs by unit | % per unit | 2. Use historic figures to enter | Your quantity required will | |||||||||

| Cost of Goods Sold | 0% | $- | the % of sales for your variable | change dependent on sales | ||||||||

| Packaging | 0% | $- | costs. Change or leave blank | price. Your sales value will | ||||||||

| Direct Cost - Wages | 0% | $- | irrelevant lines | change dependent on your | ||||||||

| [insert] | 0% | $- | costs. | |||||||||

| [insert] | 0% | $- | ||||||||||

| Total Variable Costs | 0% | $- | ||||||||||

| UNITS BREAKDOWN | ||||||||||||

| FIXED COSTS FOR THE PERIOD | 12 | #DIV/0! | ||||||||||

| $ | 52 | #DIV/0! | ||||||||||

| Expense 1 | $- | 3. Enter your fixed costs for | 363 | #DIV/0! | ||||||||

| Expense 2 | $- | the period you are looking at. | ||||||||||

| Expense 3 | $- | Fixed costs are those that don't | ||||||||||

| Expense 4 | $- | increase, or decrease, as sales | ||||||||||

| Expense 5 | $- | volume changes. Eg. Rent | ||||||||||

| Expense 6 | $- | |||||||||||

| Expense 7 | $- | List significant expenses | ||||||||||

| Expense 8 | $- | separately, particularly those | ||||||||||

| Expense 9 | $- | you may want to see the | ||||||||||

| Expense 10 | $- | impact of if a reduction was | ||||||||||

| Expense 11 | $- | to happen eg. Rent went down. | ||||||||||

| Expense 12 | $- | |||||||||||

| Expense 13 | $- | Group others in a single line | ||||||||||

| Expense 14 | $- | i.e 'Other Expenses' | ||||||||||

| Expense 15 | $- | |||||||||||

| Total Fixed Costs per period | $- | |||||||||||

| BREAKEVEN POINT | ||||||||||||

| Units | Sales Value | |||||||||||

| Sales required | #DIV/0! | #DIV/0! | ||||||||||

| SALES VOLUME ANALYSIS | ||||||||||||

| 4. Enter different sales volume scenarios to see what the bottom line impact will be. Once you have a positive figure, you have hit breakeven point | ||||||||||||

| Sales volume per period (units) | - | - | - | - | - | - | - | - | - | - | - | |

| Sales price per unit | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Total sales | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Variable costs | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Fixed costs per period | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Total costs | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Net Profit (loss) | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| WHAT IF? ANALYSIS | ||||||||||||

| 4. Use this section to enter your historical sales volume (units) and see what the impact to your Net Profit will be should you increase, or decrease, in sales. Change the percentage as required | ||||||||||||

| What if? Sales Increase | 10% | 20% | 30% | 40% | 50% | 60% | 70% | 80% | 90% | 100% | ||

| Sales Volume (units) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Sales Value | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Variable Costs | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Fixed Costs per period | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Net Profit (Loss) | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| What if? Sales Decrease | -10% | -20% | -30% | -40% | -50% | -60% | -70% | -80% | -90% | -100% | ||

| Sales Volume (units) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Sales Value | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Variable Costs | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Fixed Costs per period | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Net Profit (Loss) | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Version 2. | ||||||||||||

| © Sudburys Limited, 2020 | ||||||||||||

| BREAK-EVEN ANALYSIS TOOL | ||||||||||||

| [Name] | ||||||||||||

| SALES | Enter your data in the Blue | |||||||||||

| 1. Enter your sales price per | fields to populate results | |||||||||||

| Sales price per unit | $- | unit, if wanting for multiple | ||||||||||

| product types, use an average | BREAKEVEN POINT | |||||||||||

| or request our in-depth | Units Required | Sales Value | ||||||||||

| VARIABLE COSTS | breakeven tool. | - | $- | |||||||||

| Variable Costs by unit | $ per unit | 2. Enter the value per unit of | Your quantity required will | |||||||||

| Cost of Goods Sold | 0% | $- | your variable costs. Change or | change dependent on sales | ||||||||

| Packaging | 0% | $- | leave blank for ireelevant lines. | price. Your sales value will | ||||||||

| Direct Cost - Wages | 0% | $- | The % will calculate once a sales | change dependent on your | ||||||||

| [insert] | 0% | $- | price is entered. | costs. | ||||||||

| [insert] | 0% | $- | ||||||||||

| Total Variable Costs | 0% | $- | ||||||||||

| UNITS BREAKDOWN | ||||||||||||

| FIXED COSTS FOR THE PERIOD | 12 | 0 | ||||||||||

| $ | 52 | 0 | ||||||||||

| Expense 1 | $- | 3. Enter your fixed costs for | 363 | 0 | ||||||||

| Expense 2 | $- | the period you are looking at. | ||||||||||

| Expense 3 | $- | Fixed costs are those that don't | ||||||||||

| Expense 4 | $- | increase, or decrease, as sales | ||||||||||

| Expense 5 | $- | volume changes. Eg. Rent | ||||||||||

| Expense 6 | $- | |||||||||||

| Expense 7 | $- | List significant expenses | ||||||||||

| Expense 8 | $- | separately, particularly those | ||||||||||

| Expense 9 | $- | you may want to see the | ||||||||||

| Expense 10 | $- | impact of if a reduction was | ||||||||||

| Expense 11 | $- | to happen eg. Rent went down. | ||||||||||

| Expense 12 | $- | |||||||||||

| Expense 13 | $- | Group others in a single line | ||||||||||

| Expense 14 | $- | i.e 'Other Expenses' | ||||||||||

| Expense 15 | $- | |||||||||||

| Total Fixed Costs per period | $- | |||||||||||

| BREAKEVEN POINT | ||||||||||||

| Units | Sales Value | |||||||||||

| Sales required | - | $- | ||||||||||

| SALES VOLUME ANALYSIS | ||||||||||||

| 4. Enter different sales volume scenarios to see what the bottom line impact will be. Once you have a positive figure, you have hit breakeven point | ||||||||||||

| Sales volume per period (units) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Sales price per unit | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Total sales | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Variable costs | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Fixed costs per period | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Total costs | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Net Profit (loss) | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| WHAT IF? ANALYSIS | ||||||||||||

| 4. Use this section to enter your historical sales volume (units) and see what the impact to your Net Profit will be should you increase, or decrease, in sales. Change the percentage as required | ||||||||||||

| What if? Sales Increase | 10% | 20% | 30% | 40% | 50% | 60% | 70% | 80% | 90% | 100% | ||

| Sales Volume (units) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Sales Value | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Variable Costs | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Fixed Costs per period | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Net Profit (Loss) | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| What if? Sales Decrease | -10% | -20% | -30% | -40% | -50% | -60% | -70% | -80% | -90% | -100% | ||

| Sales Volume (units) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Sales Value | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Variable Costs | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Fixed Costs per period | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Net Profit (Loss) | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | |

| Version 2. | ||||||||||||

| © Sudburys Limited, 2020 | ||||||||||||

no reviews yet

Please Login to review.