302x Filetype XLSX File size 0.59 MB Source: reports.shell.com

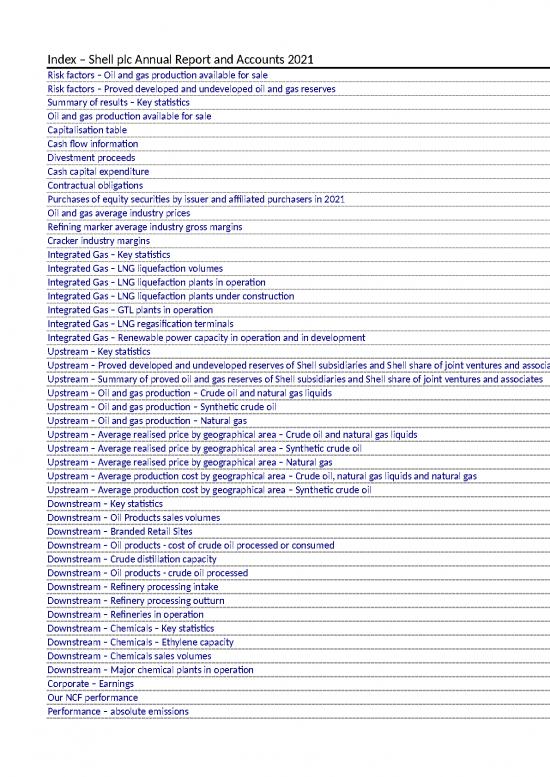

Sheet 1: Index

| Index – Shell plc Annual Report and Accounts 2021 |

| Back to index | |||

| Shell plc Annual Report and Accounts 2021 | |||

| Risk factors – Oil and gas production available for sale | |||

| Million boe [A] | |||

| 2021 | 2020 | 2019 | |

| Shell subsidiaries | 1,047 | 1,104 | 1,182 |

| Shell share of joint ventures and associates | 134 | 135 | 156 |

| Total | 1,181 | 1,239 | 1,338 |

| [A] Natural gas volumes are converted into oil equivalent using a factor of 5,800 scf per barrel. | |||

| Back to index | |||

| Shell plc Annual Report and Accounts 2021 | |||

| Risk factors – Proved developed and undeveloped oil and gas reserves | |||

| Million boe [C] | |||

| Dec 31, 2021 | Dec 31, 2020 | Dec 31, 2019 | |

| Shell subsidiaries | 8,456 | 8,222 | 9,980 |

| Shell share of joint ventures and associates | 909 | 902 | 1,116 |

| Total | 9,365 | 9,124 | 11,096 |

| Attributable to non-controlling interest of Shell subsidiaries | 267 | 322 | 304 |

| [A] We manage our total proved reserves base without distinguishing between proved reserves from subsidiaries and those from joint ventures and associates. | |||

| [B] Includes proved reserves associated with future production that will be consumed in operations. | |||

| [C] Natural gas volumes are converted into oil equivalent using a factor of 5,800 scf per barrel. | |||

no reviews yet

Please Login to review.