209x Filetype XLSX File size 0.11 MB Source: portal.ct.gov

Sheet 1: Form DE-2017

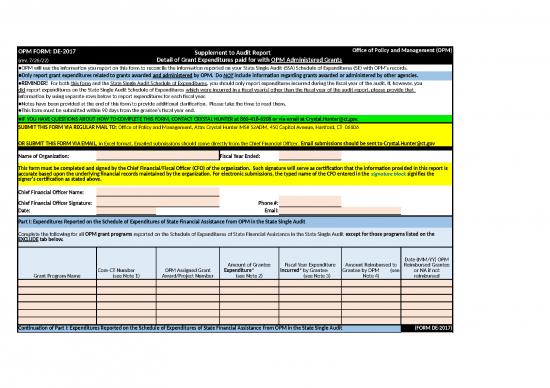

| OPM FORM: DE-2017 | Supplement to Audit Report | Office of Policy and Management (OPM) | |||||

| (rev. 7/26/22) | Detail of Grant Expenditures paid for with OPM Administered Grants | ||||||

| ●OPM will use the information you report on this form to reconcile the information reported on your State Single Audit (SSA) Schedule of Expenditures (SE) with OPM's records. | |||||||

| ●Only report grant expenditures related to grants awarded and administered by OPM. Do NOT include information regarding grants awarded or administered by other agencies. | |||||||

| ●REMINDER! For both this form and the State Single Audit Schedule of Expenditures, you should only report expenditures incurred during the fiscal year of the audit. If, however, you | |||||||

| did report expenditures on the State Single Audit Schedule of Expenditures which were incurred in a fiscal year(s) other than the fiscal year of the audit report, please provide that | |||||||

| information by using separate rows below to report expenditures for each fiscal year. | |||||||

| ●Notes have been provided at the end of this form to provide additional clarification. Please take the time to read them. | |||||||

| ●This form must be submitted within 90 days from the grantee’s fiscal year end. | |||||||

| ●IF YOU HAVE QUESTIONS ABOUT HOW TO COMPLETE THIS FORM, CONTACT CRYSTAL HUNTER at 860-418-6208 or via email at Crystal.Hunter@ct.gov. | |||||||

| SUBMIT THIS FORM VIA REGULAR MAIL TO: Office of Policy and Management, Attn: Crystal Hunter MS# 52ADM, 450 Capitol Avenue, Hartford, CT 06106 | |||||||

| OR SUBMIT THIS FORM VIA EMAIL, in Excel format. Emailed submissions should come directly from the Chief Financial Officer. Email submissions should be sent to Crystal.Hunter@ct.gov | |||||||

| Name of Organization: | Fiscal Year Ended: | ||||||

| This form must be completed and signed by the Chief Financial/Fiscal Officer (CFO) of the organization. Such signature will serve as certification that the information provided in this report is accurate based upon the underlying financial records maintained by the organization. For electronic submissions, the typed name of the CFO entered in the signature block signifies the signer's certification as stated above. | |||||||

| Chief Financial Officer Name: | |||||||

| Chief Financial Officer Signature: | Phone #: | ||||||

| Date: | Email: | ||||||

| Part I: Expenditures Reported on the Schedule of Expenditures of State Financial Assistance from OPM in the State Single Audit | |||||||

| Complete the following for all OPM grant programs reported on the Schedule of Expenditures of State Financial Assistance in the State Single Audit except for those programs listed on the EXCLUDE tab below. | |||||||

| Grant Program Name | Core-CT Number (see Note 1) | OPM Assigned Grant Award/Project Number | Amount of Grantee Expenditure* (see Note 2) | Fiscal Year Expenditure Incurred* by Grantee (see Note 3) | Amount Reimbursed to Grantee by OPM (see Note 4) | Date (MM/YY) OPM Reimbursed Grantee or NA if not reimbursed | |

| Continuation of Part I: Expenditures Reported on the Schedule of Expenditures of State Financial Assistance from OPM in the State Single Audit | (FORM DE-2017) | ||||||

| Grant Program Name | Core-CT Number (see Note 1) | OPM Assigned Grant Award/Project Number | Amount of Grantee Expenditure* (see Note 2) | Fiscal Year Expenditure Incurred* by Grantee (see Note 3) | Amount Reimbursed to Grantee by OPM (see Note 4) | Date (MM/YY) OPM Reimbursed Grantee or NA if not reimbursed | |

| Part II: Additional Information for Expenditures of State Financial Assistance from OPM related to Advance Payments | |||||||

| Complete the following if you have received and not fully expended ADVANCE funds from OPM. Advance funds expended in the fiscal year of the audit should be reported in Part I. | |||||||

| Grant Program Name | Core-CT Number (see Note 1) | OPM Assigned Grant Award/Project Number | Amount of Advance Payment from OPM | Date (MM/YY) of Advance Payment from OPM | Cumulative Amount of Advance Payment Expended as of End of Audit Period | Balance of Advance OPM Payment | |

| $0.00 | |||||||

| $0.00 | |||||||

| $0.00 | |||||||

| $0.00 | |||||||

| $0.00 | |||||||

| $0.00 | |||||||

| $0.00 | |||||||

| $0.00 | |||||||

| $0.00 | |||||||

| $0.00 | |||||||

| Note 1: The Core-CT number is usually an eighteen digit code representing the fund, state department and special identification number (SID) for the grant program. These numbers can be found at the bottom of your Notice of Grant Award or in the State Single Audit Compliance Supplement** under the Grant Program Name. If you cannot find a Core-CT number, please contact Crystal.Hunter@ct.gov or call her at 860-418-6208. | |||||||

| Note 2: The total of expenditures for each grant program listed in Part 1 of this report should match the total for the grant program listed on the State Single Audit Schedule of Expenditures of State Financial Assistance. | |||||||

| Note 3: "Incurred" is defined as the actual date on which the goods and/or services were physically received (regardless of when paid). | |||||||

| Note 4: Use separate rows if reporting more than one reimbursement. | |||||||

| *An "expenditure" is recognized ("incurred") on the actual date the goods and/or services were physically received (regardless of when paid). | |||||||

| **click this link to be directed to the State Single Audit Compliance Manual | |||||||

| DO NOT INCLUDE EXPENDITURES ASSOCIATED WITH THE FOLLOWING GRANT PROGRAMS ON FORM DE-2017 | |||||||||||||

| Mashantucket Pequot and Mohegan Fund Grant | |||||||||||||

| Muncipal Grants in Aid | |||||||||||||

| Muncipal Restructuring | |||||||||||||

| Municipal Revenue Sharing | |||||||||||||

| Municipal Stabilization | |||||||||||||

| Municipal Transition | |||||||||||||

| Payment in Lieu of Taxes (PILOT) on Exempt Property of Manufacturing Facilities in Distressed Municipalities | |||||||||||||

| Property Tax Relief for Elderly Homeowners - Freeze Program | |||||||||||||

| Property Tax Relief for Veterans | |||||||||||||

| Property Tax Relief on Property of Totally Disabled Persons | |||||||||||||

| Tiered Payment in Lieu of Taxes (PILOT) | |||||||||||||

| rev. 7/26/22 | |||||||||||||

no reviews yet

Please Login to review.