265x Filetype XLS File size 0.06 MB Source: www.swlearning.com

A B C D E F G H I J K

1 7/5/2003

2

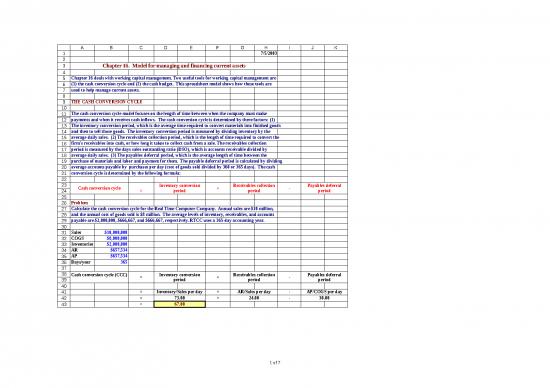

3 Chapter 16. Model for managing and financing current assets

4

5 Chapter 16 deals with working capital management. Two useful tools for working capital management are

6 (1) the cash conversion cycle and (2) the cash budget. This spreadsheet model shows how these tools are

7 used to help manage current assets.

8

9 THE CASH CONVERSION CYCLE

10

11 The cash conversion cycle model focuses on the length of time between when the company must make

12 payments and when it receives cash inflows. The cash conversion cycle is determined by three factors: (1)

13 The inventory conversion period, which is the average time required to convert materials into finished goods

14 and then to sell those goods. The inventory conversion period is measured by dividing inventory by the

15 average daily sales. (2) The receivables collection period, which is the length of time required to convert the

16 firm's receivables into cash, or how long it takes to collect cash from a sale. The receivables collection

17 period is measured by the days sales outstanding ratio (DSO), which is accounts receivable divided by

18 average daily sales. (3) The payables deferral period, which is the average length of time between the

19 purchase of materials and labor and payment for them. The payable deferral period is calculated by dividing

20 average accounts payable by purchases per day (cost of goods sold divided by 360 or 365 days). The cash

21 conversion cycle is determined by the following formula:

22

23 Inventory conversion Receivables collection Payables deferral

24 Cash conversion cycle = period + period - period

25

26 Problem

27 Calculate the cash conversion cycle for the Real Time Computer Company. Annual sales are $10 million,

28 and the annual cost of goods sold is $8 million. The average levels of inventory, receivables, and accounts

29 payable are $2,000,000, $666,667, and $666,667, respectively. RTCC uses a 365-day accounting year.

30

31 Sales $10,000,000

32 COGS $8,000,000

33 Inventories $2,000,000

34 AR $657,534

35 AP $657,534

36 Days/year 365

37

38 Cash conversion cycle (CCC) Inventory conversion Receivables collection Payables deferral

39 = period + period - period

40

41 = Inventory/Sales per day + AR/Sales per day - AP/COGS per day

42 = 73.00 + 24.00 - 30.00

43 = 67.00

1 of 7

A B C D E F G H I J K

44

45 It takes 73 days to make and then sell a computer, and another 24 days to collect cash after the sale, or a

46 total of 97 days between spending money and collecting cash. However, the company can delay payment for

47 parts and labor for 30 days. Therefore, the net days the firm must finance its labor and purchases is 97 - 30

48 = 67 days, which is the cash conversion cycle. Companies like to shorten their cash conversion cycles as

49 much as possible without adversely impacting operations. As noted in the chapter, Amazon.com and Dell

50 have been able to produce goods on demand, hence to reduce the inventory conversion period to close to zero.

51 In addition, since payments are made by credit card, the receivables collection period is also close to zero.

52 Then, if they pay suppliers after a 20 payables deferral period, they can end up with a NEGATIVE cash

53 conversion cycle. In that case, the faster the firms grow, the more cash they generate.

54

55 Disregarding profits, how much capital does RTCC have tied up in working capital?

56

57 Answer: (C of GS / day) * (CCC) = $ 21,918 * 67.00

58 = $ 1,468,493

59

60 If the cost of capital is 10%, then it costs RTCC $146,667 per year to carry working capital.

61

62 Question: If RTCC began selling on a credit card only basis, how would this affect its CCC, and what effect

63 would it have on the cost of carrying working capital?

64

65 Answer: Receivables would go to zero, the CCC would fall to 43 days, and carrying costs would decline by

66

67 24.00 * $ 21,918 * 10% = 52,603

68

69 We could do sensitivity analysis to see how other changes would affect profitability.

70

71 THE CASH BUDGET

72

73 The cash budget is a statement that shows cash flows over a specified period of time. Generally, firms use a

74 monthly cash budget for the coming year, plus a more detailed daily or weekly cash budget for the coming

75 month. Monthly cash budgets are used for long-range planning, and daily or weekly budgets for actual cash

76 control. The following monthly cash budget examines MicroDrive Inc. for the last 6 months of 2003.

77

78 Input Data

79 Collections during month of sale 20% Assumed constant. Don't change.

80 Collections during 1st month after sale 70% Formula. Don't change.

81 Collections during 2nd month after sale 10% Allow this value to change to reflect slower collections.

82 Discount on first month collections 2%

83 Purchases as a % of next month's sales 70%

84 Lease payments $15

85 Construction cost for new plant (Oct) 100

86 Target cash balance $10

87 Sales adjustment factor 0.00

88

2 of 7

A B C D E F G H I J K

89 THE CASH BUDGET

90 May June July August September October November December

91 Collections and purchases worksheet

92 Sales (gross) $200 $250 $300 $400 $500 $350 $250 $200

93 Collections

94 During month of sale 59 78 98 69 49 39

95 During first month after sale 175 210 280 350 245 175

96 During second month after sale 20 25 30 40 50 35

97 Total collections $254 $313 $408 $459 $344 $249

98

99 Purchases

100 70% of next months sales $210 $280 $350 $245 $175 $140

101 Payments on last month's purchases $210 $280 $350 $245 $175 $140

102

103 Cash gain or loss for month

104 Collections $254 $313 $408 $459 $344 $249

105 Payments for purchases 210 280 350 245 175 140

106 Wages and salaries 30 40 50 40 30 30

107 Lease payments 15 15 15 15 15 15

108 Other expenses 10 15 20 15 10 10

109 Taxes 30 20

110 Payment for plant construction 100

111 Total payments $265 $350 $465 $415 $230 $215

112 Net cash gain (loss) during month ($11) ($37) ($57) $44 $114 $34

113

114 Loan requirement or cash surplus

115 Cash at start of month if no borrowing $ 15 $4 ($33) ($90) ($46) $68

116 Cumulative cash $4 ($33) ($90) ($46) $68 $102

117 Target cash balance $10 $10 $10 $10 $10 $10

118 Cumulative surplus cash or loans

119 outstanding to maintain $10 target cash balance ($6) ($43) ($100) ($56) $58 $92

120

121 Max loan: $100

122

123 Question: If the percent of customers who pay in the 2nd month after the sale increased due to poor credit

124 management, how would this affect the maximum required loan?

125

126 Answer: Do a sensitivity analysis.

127 Effect of Late Payment % on Loan Requirements

128 % paying Max Req'd Loan

129 late $ 100 $ 300

130 0% $ 80 t $ 250

n

131 10% $ 100 e

m $ 200

132 20% $ 120 e

r

i $ 150

30% $ 140 u

133 q

e $ 100

40% $ 160 R

134

n $ 50

135 50% $ 180 a

o

L $ 0

136 60% $ 206

137 70% $ 236 0% 10% 20% 30% 40% 50% 60% 70% 80%

% Paying Late

3 of 7

Effect of Late Payment % on Loan Requirements

$ 300

t$ 250

n

e

m$ 200

e

r

i$ 150

u

q

e$ 100

R

n $ 50

a

o

L $ 0

0% 10% 20% 30% 40% 50% 60% 70% 80%

A B C D E F G H I J K

138 80% $ 266 % Paying Late

139

4 of 7

no reviews yet

Please Login to review.