284x Filetype XLSX File size 0.12 MB Source: www.sifma.org

Sheet 1: LoanFile_All_ Scenarios

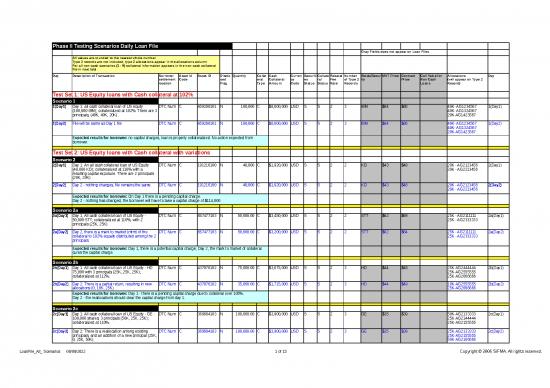

| Phase II Testing Scenarios Daily Loan File | ||||||||||||||||||||

| Gray Fields does not appear on Loan Files | ||||||||||||||||||||

| All values are rounded to the nearest whole number. Type 2 records are not included, type 2 allocations appear in the allocations column For all non-cash scenarios (3 - 9) collateral information appears in the non-cash collateral file in next tab) |

||||||||||||||||||||

| Day | Description of Transaction | Borrower settlement location | Asset Id Code | Asset ID | Disclosed Flag | Quantity | Collateral Type | Cash Collateral Amount | Currency Code | Securities Status | Collateral Status | Rebate/Fee Rate | Number of Type 2 Records | Stock/Security | MKT Price | Contract Price | Coll Value for Non Cash Loans | Allocations (will appear on Type 2 Record) |

Day | |

| Test Set 1: US Equity loans with Cash collateral at 102% | ||||||||||||||||||||

| Scenario 1 | ||||||||||||||||||||

| 1(Day1) | Day 1: all cash collateral loan of US equity (100,000 IBM); collateralized at 102%. There are 3 principals, (40K, 40K, 20K) . | DTC Num | C | 459200101 | N | 100,000 | C | $8,600,000 | USD | S | S | 2 | 3 | IBM | $84 | $86 | 40K- AG1234567 40K- AG1324567 20K-AG1423567 |

1(Day1) | ||

| 1(Day2) | File will be same as Day 1 file | DTC Num | C | 459200101 | N | 100,000 | C | $8,600,000 | USD | S | S | 2 | 3 | IBM | $84 | $86 | 40K- AG1234567 40K- AG1324567 20K-AG1423567 |

1(Day2) | ||

| Expected results for borrower: no capital charges, loan is properly collateralized. No action expected from borrower. | ||||||||||||||||||||

| Test Set 2: US Equity loans with Cash collateral with variations | ||||||||||||||||||||

| Scenario 2 | ||||||||||||||||||||

| 2(Day1) | Day 1: An all cash collateral loan of US Equity (40,000 KO); collateralized at 110% with a resulting capital exposure. There are 2 principals (20K, 20K). | DTC Num | C | 191216100 | N | 40,000 | C | $1,920,000 | USD | S | S | 2 | 2 | KO | $43 | $48 | 20K - AG2123456 20K - AG2213456 |

2(Day1) | ||

| 2(Day2) | Day 2 - nothing changes, file remains the same. | DTC Num | C | 191216100 | N | 40,000 | C | $1,920,000 | USD | S | S | 2 | 2 | KO | $43 | $48 | 20K - AG2123456 20K - AG2213456 |

2(Day2) | ||

| Expected results for borrower: On Day 1 there is a pending capital charge. Day 2 - nothing has changed, the borrower will have to take a capital charge of $114,000 |

||||||||||||||||||||

| Scenario 2a | ||||||||||||||||||||

| 2a(Day1) | Day 1, All cash collateral loan of US Equity - 50,000 STT; collateralized at 110%; with 2 principals (25K, 25K). |

DTC Num | C | 857477103 | N | 50,000.00 | C | $3,450,000 | USD | S | S | 2 | 2 | STT | $62 | $69 | 25K - AG2111111 25K - AG2333333 |

2a(Day1) | ||

| 2a(Day2) | Day 2, there is a mark to market (mtm) of the collateral to 102% equally distributed among the 2 principals. | DTC Num | C | 857477103 | N | 50,000.00 | C | $3,200,000 | USD | S | S | 2 | 2 | STT | $62 | $64 | 25K - AG2111111 25K - AG2333333 |

2a(Day2) | ||

| Expected results for borrower: Day 1, there is a potential capital charge; Day 2, the mark to market of collateral cures the capital charge. | ||||||||||||||||||||

| Scenario 2b | ||||||||||||||||||||

| 2b(Day1) | Day 1: All cash collateral loan of US Equity - HD 75,000 with 3 principals (25K, 25K, 25K); collateralized at 112%. | DTC Num | C | 437076102 | N | 75,000.00 | C | $3,675,000 | USD | S | S | 2 | 3 | HD | $44 | $49 | 25K-AG2444444 25K-AG2555555 25K-AG2666666 |

2b(Day1) | ||

| 2b(Day2) | Day 2: There is a partial return, resulting in new allocations (0, 10K, 25K). | DTC Num | C | 437076102 | N | 35,000.00 | C | $1,715,000 | USD | S | S | 2 | 3 | HD | $44 | $49 | 10K-AG2555555 25K-AG2666666 |

2b(Day2) | ||

| Expected results for borrower: Day 1 - there is a pending capital charge due to collateral over 105%. Day 2 - the reallocations should clear the capital charge from day 1. |

||||||||||||||||||||

| Scenario 2c | ||||||||||||||||||||

| 2c(Day1) | Day 1: All cash collateral loan of US Equity - GE - 100,000 shares; 3 principals (50K, 25K, 25K); collateralized at 110%. | DTC Num | C | 369604103 | N | 100,000.00 | C | $3,900,000 | USD | S | S | 2 | 3 | GE | $35 | $39 | 50K-AG2133333 25K-AG2144444 25K-AG2155555 |

2c(Day1) | ||

| 2c(Day2) | Day 2: There is a reallocation among existing principals, and an addition of a new principal (25K, 0, 25K, 50K). | DTC Num | C | 369604103 | N | 100,000.00 | C | $3,900,000 | USD | S | S | 2 | 3 | GE | $35 | $39 | 25K-AG2133333 25K-AG2155555 50K-AG2166666 |

2c(Day2) | ||

| Expected results for borrower: Day 1 - potential capital charge due to over collateralization. Day2: The exposure is partially cured by the reallocation. |

||||||||||||||||||||

| Scenario 2d | ||||||||||||||||||||

| 2d(Day1) | Day 1: All cash collateral loan of US Equity - JBLU - 100,000 shares, 2 principals (50K, 50K), collateralized at 130%. | DTC Num | C | 477143101 | N | 100,000 | C | $1,400,000 | USD | S | S | 2 | 2 | JBLU | $11 | $14 | 50K-AG2177777 50K-AG2188888 |

2d(Day1) | ||

| 2d(Day2) | Day 2: there is a full return of the loan, no Day 2 file. | 2d(Day2) | ||||||||||||||||||

| Expected results for borrower: Day 1: potential capital charge. Day 2: capital charge is cured by full return of the loan. |

||||||||||||||||||||

| Scenario 2e | ||||||||||||||||||||

| 2e(Day1) | Day 1: All cash collateral loan of US Equity, CSCO - 100,000 shares, 4 principals (25K, 25K, 25K, 25K); collateralized at 115%. | DTC Num | C | 17275R102 | N | 100,000 | C | $2,500,000 | USD | S | S | 2 | 4 | CSCO | $22 | $25 | 25K-AG2121111 25K-AG2122222 25K-AG2123333 25K-AG2124444 |

2e(Day1) | ||

| 2e(Day2) | Day 2: There is a mark down on the contract price to $23, and some reallocations (0, 50K, 15K, 25K, 10K). | DTC Num | C | 17275R102 | N | 100,000 | C | $1,150,000 | USD | S | S | 2 | 4 | CSCO | $22 | $23 | 50K-AG2122222 15K-AG2123333 25K-AG2124444 10K-AG2125555 |

2e(Day2) | ||

| Expected results for borrower: Day 1: potential capital charge Day 2: mark down of contract price, reducing collateral to 105% should cure capital charge from day 1. |

||||||||||||||||||||

| Test Set 3: US Equity loan with Non-cash securities collateral | ||||||||||||||||||||

| Scenario 3 | ||||||||||||||||||||

| 3(Day1) | Day 1: Non-cash collateral loan of US equity - MSFT - 100,000 shares, 1 principal. Collateralized with UST strip. Collateral is at 102% Coll-->Us Treasuries Strip $0.83 |

DTC Num | C | 594906109 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 1 | MSFT | $27.00 | $2,800,000 | 100K AG3121111 | 3(Day1) | ||

| 3(Day2) | Everything Stays the same | DTC Num | C | 594906109 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 1 | MSFT | $27.00 | $2,800,000 | 100K AG3121111 | 3(Day2) | ||

| Expected results for borrower: no capital charges, loan is properly collateralized. No action expected from borrower. | ||||||||||||||||||||

| Scenario 3a | ||||||||||||||||||||

| 3a(Day1) | Day 1: Non-cash collateral loan of US equity - GS - 100,000 shares, 1 principal; collateralized at 110%; collateral value $17m, 2 different securities used as collateral. Coll-->Us Treasuries Strip $0.95 Coll-->Us Treasuries Strip $0.99 |

DTC Num | C | 38141G104 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 1 | GS | $151 | $17,000,000 | 100K - AG3122222 |

3a(Day1) | ||

| 3a(Day2) | Day 2: There is a reduction in collateral for both securities. Loan file should remain the same, the change will be reflected on the non-cash file only. | DTC Num | C | 38141G104 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 1 | GS | $151 | $17,000,000 | 100K - AG3122222 |

3a(Day2) | ||

| Expected results for borrower: Day 1: potential capital charge Day2: Collateral price remains the same, but collateral quantity is reduced, resulting in a cure for the capital charge from day 1. |

||||||||||||||||||||

| Scenario 3b | ||||||||||||||||||||

| 3b(Day1) | Day 1: Non-cash collateral loan of US equity - BK - 100,000 shares, 1 principal, collateralized at 110%, collateral value is $3.9m, collateral is US treasuries strip, price $1.44 | DTC Num | C | 064057102 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 1 | BK | $35 | $3,900,000 | 100K AG3123333 |

3b(Day1) | ||

| 3b(Day2) | Day 2: there is a partial return of - 40,000 shares. Collateral goes down by 40%. | DTC Num | C | 064057102 | N | 60,000 | N | $0 | USD | S | S | 0.5 | 1 | BK | $35 | $2,340,000 | 60K AG3123333 | 3b(Day2) | ||

| Expected results for borrower: Day 1: potential capital charge Day 2: the return of 40,000 shares is a partial cure to the capital charge from day1. |

||||||||||||||||||||

| Scenario 3c | ||||||||||||||||||||

| 3c(Day1) | Day 1: Non-cash collateral loan of US equity - KKD - 100,000 shares, 1 principal, collateralized at 110%, with UST strip, price $1.00 | DTC Num | C | 501014104 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 1 | KKD | $9 | $1,100,000 | 100K AG3124444 | 3c(Day1) | ||

| 3c(Day2) | Day 2: There is a partial return of 40,000 shares and a collateral mark to market. | DTC Num | C | 501014104 | N | 60,000 | N | $0 | USD | S | S | 0.5 | 1 | $550,000 | 60K AG3124444 |

3c(Day2) | ||||

| Expected results for borrower: Day 1: potential capital charge Day 2: should see partial return, and a collateral mark to market, curing the capital charge from day 1. |

||||||||||||||||||||

| Scenario 3d | ||||||||||||||||||||

| 3d(Day1) | Non-cash collateral loan of US equity - BAC - 100,000 shares, 1 principal, collateralized at 105%, with a UST strip, price $0.67, resulting in a capital charge. | DTC Num | C | 060505104 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 1 | BAC | $47 | $5,200,000 | 100K AG3125555 |

3d(Day1) | ||

| 3d(Day2) | On Day 2, street side of loan (type 1) remains the same; there is a re-allocation to a new principal (reflected on type 2 record) & collateral reallocation. Collateral amount remains the same. | DTC Num | C | 060505104 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 1 | BAC | $47 | $5,200,000 | 100K AG3126666 |

3d(Day2) | ||

| Expected results for borrower: there should be a reduction in capital exposure due to the re-allocation | ||||||||||||||||||||

| Scenario 3e | ||||||||||||||||||||

| 3e(Day1) | Day 1: Non-cash collateral loan of US Equity - SPLS - 100,000 shares, 1 principal, collateralized at 110% with UST Strip, price $1.00. | DTC Num | C | 855030102 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 1 | SPLS | $25 | $2,800,000 | 100K AG3127777 |

3e(Day1) | ||

| 3e(Day2) | Day 2: collateral price goes down to $0.91. | DTC Num | C | 855030102 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 1 | SPLS | $25 | $2,548,000 | 100K AG3127777 |

3e(Day2) | ||

| Expected results for borrower: Day 1: potential capital exposure Day 2: decrease in coll. price cures capital charge |

||||||||||||||||||||

| Test Set 4: International Securities with Cash Pool Collateral | ||||||||||||||||||||

| Scenario 4 | ||||||||||||||||||||

| 4(Day1)-Loan 1 | Day 1: 3 Loans, of international securities, 100K each, with cash pool collateral. Collateralized at 102% or $6,324,000 (across all principals) 1st loan distribution - 60K, 40K |

INTL | S | 6900621 | N | 100,000 | P | $0 | USD | S | S | 0.5 | 2 | TOYOTA | $20 | $2,040,000 | 60K AG4412345 40K AG4412346 |

4(Day1)-Loan 1 | ||

| 4(Day1) -loan 2 | 2nd loan distribution - 70K, 30K | INTL | I | JP3104400001 | N | 100,000 | P | $0 | USD | S | 0.5 | 2 | AICHI TOKEI DENKI | $4 | $408,000 | 70K AG4454321 30K AG4464321 |

4(Day1) -loan 2 | |||

| 4(Day1) - loan 3 | 3rd loan distribution - 80K, 20K | INTL | S | 5964208 | N | 100,000 | P | $0 | USD | S | S | 0.5 | 2 | Thomson Corp. | $38 | $3,876,000 | 80K AG4432156 20K AG4433125 |

4(Day1) - loan 3 | ||

| 4(Day2) - Loan 1 |

Day 2: no changes to the loan | INTL | S | 6900621 | N | 100,000 | P | $0 | USD | S | S | 0.5 | 2 | TOYOTA | $20 | $2,040,000 | 60K AG4412345 40K AG4412346 |

4(Day2) - Loan 1 |

||

| 4(Day2) - Loan 2 |

Day 2 stays the same | INTL | I | JP3104400001 | N | 100,000 | P | $0 | USD | S | 0.5 | 2 | AICHI TOKEI DENKI | $4 | $408,000 | 70K AG4454321 30K AG4464321 |

4(Day2) - Loan 2 |

|||

| 4(Day2) - Loan 3 |

Day 2 stays the same | INTL | S | 5964208 | N | 100,000 | P | $0 | USD | S | S | 0.5 | 2 | Thomson Corp. | $38 | $3,876,000 | 80K AG4432156 20K AG4433125 |

4(Day2) - Loan 3 |

||

| Expected results for borrower: No capital charges, loan is properly collateralized. No action expected from borrower. | ||||||||||||||||||||

| Scenario 4a | ||||||||||||||||||||

| 4a(Day1)-Loan 1 | Day 1: 2 Loans, international securities, 100K each; 1st loan - RBC, cash pool collateral, 110% or $9,350,000 |

INTL | S | 5576647 | N | 100,000 | P | $0 | USD | S | S | 0.5 | 2 | RBC | $85 | $9,350,000 | 60K AG4444123 40K AG4444124 |

4a(Day1)-Loan 1 | ||

| 4a(Day1)-Loan 2 | Int'l securities - Volvo; cash pool collateral, 110% or $4,840,000 | INTL | S | 4937739 | N | 100,000 | P | $0 | USD | S | S | 0.5 | 2 | Volvo | $44 | $4,840,000 | 70K AG4444125 30K AG4444126 |

4a(Day1)-Loan 2 | ||

| 4a(Day2)- Loan 1 | Day 2, cash pool goes down to 103% or $8,755,000 | INTL | S | 5576647 | N | 100,000 | P | $0 | USD | S | S | 0.5 | 2 | RBC | $85 | $8,755,000 | 60K AG4444123 40K AG4444124 |

4a(Day2)-Loan 1 | ||

| 4a(Day2)- Loan 2 | Day 2, cash pool goes down to 103% or $4,532,000 | INTL | S | 4937739 | N | 100,000 | P | $0 | USD | S | S | 0.5 | 2 | Volvo | $44 | $4,532,000 | 70K AG4444125 30K AG4444126 |

4a(Day2)-Loan 2 | ||

| Expected results for borrower: Day 1: potential capital charge. Day 2: cash pool goes down to 103% or $13,287,000 cures the exposure. |

||||||||||||||||||||

| Scenario 4b | ||||||||||||||||||||

| 4b(Day1) | 1 Loan, int'l securities, 100K - Nikon - 3 principals (60K, 60K, 20K), cash pool at 110%, or $1,760,000. | INTL | S | 5725632 | N | 100,000 | P | $0 | USD | S | S | 0.5 | 3 | Nikon | $16 | $1,760,000 | 60K AG4444412 20K AG4444413 20K AG4444414 |

4b(Day1) | ||

| 4b(Day2) | Day 2, there is re-allocation among the existing principals and one new principal ( 30K, 20K, 20K, 30K). | INTL | S | 5725632 | N | 100,000 | P | $0 | USD | S | S | 0.5 | 3 | Nikon | $16 | $1,760,000 | 30K AG4444412 20K AG4444413 20K AG4444414 30K AG4444415 |

4b(Day2) | ||

| Expected results for borrower: reduction of capital exposure | ||||||||||||||||||||

| Scenario 4c | ||||||||||||||||||||

| 4c(Day1) | 1 Loan, int'l securities, 100K - Magna Int'l - 2 principals (80K, 20K), cash pool collateral 110%, or $8,250,000. | INTL | S | 5973033 | N | 100,000 | P | $0 | USD | S | S | 0.5 | 2 | Magna Int'l | $75 | $8,250,000 | 80k AG4444431 20k AG4444421 |

4c(Day1) | ||

| 4c(Day2) | Day 2, return of 30,000 securities. Distribution goes to 70K and 0; no mark on the collateral. | INTL | S | 5973033 | N | 70,000 | P | $0 | USD | S | S | 0.5 | 1 | Magna Int'l | $75 | $8,250,000 | 70K AG4444431 | 4c(Day2) | ||

| Expected results for borrower: borrower should take capital charge since there was no mark on the collateral. |

||||||||||||||||||||

| Scenario 4d | ||||||||||||||||||||

| 4d(day1) | Day 1: 1 Loan, int'l securities, 100K - BMO - 2 principals (75K, 25K), cash pool collateral 110%, or $6,050,000. | INTL | S | 5603631 | N | 100,000 | P | $0 | USD | S | S | 0.5 | 2 | BMO | $55 | $6,050,000 | 75k AG4444489 25k AG4444499 |

4d(day1) | ||

| 4d(day2) | Day 2, return of 10,000 securities, and reduction of cash pool to 102% or $5,049,000. Distribution goes to 65K and 25K; | INTL | S | 5603631 | N | 90,000 | P | $0 | USD | S | S | 0.5 | 2 | BMO | $55 | $5,049,000 | 65k AG4444489 25k AG4444499 |

4d(day2) | ||

| Expected results for borrower: Day 1: potential capital charge Day 2: capital charge is cured |

||||||||||||||||||||

| Test Set 5: Government Securities with Tri-Party Collateral | ||||||||||||||||||||

| Scenario 5 | ||||||||||||||||||||

| 5(day1) | Day 1: 1 Loan, USTN 4.125 5/15/2015, price: $0.96, collateralized at 102%, 2 principals (60K, 40K), no resulting capital charge. |

FEDW | C | 912828DV9 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 2 | USTN 4.125 5/15/2015 | $0.96 | $98,000 | 60K AG5551234 40K AG5551235 |

5(day1) | ||

| 5(day2) | Day 2 file will look the same as Day 1. | FEDW | C | 912828DV9 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 2 | USTN 4.125 5/15/2015 | $0.96 | $98,000 | 60K AG5551234 40K AG5551235 |

5(day2) | ||

| Expected results for borrower: no capital charges, loan is properly collateralized. No action expected from borrower. | ||||||||||||||||||||

| Scenario 5a | ||||||||||||||||||||

| 5a(Day1) | Day 1: 1 Loan, USTB 8.5 2/15/2020, price:$1.36, 2 principals (60K, 40K), 110% collateral; $150,000 tri-party collateral. |

FEDW | C | 912810EE4 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 2 | USTB 8.5 2/15/2020 | $1.36 | $150,000 | 60K AG5553124 40K AG5553241 |

5a(Day1) | ||

| 5a(Day2) | No Change | FEDW | C | 912810EE4 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 2 | USTB 8.5 2/15/2020 | $1.36 | $150,000 | 60K AG5553124 40K AG5553241 |

5a(Day2) | ||

| Expected results for borrower: Day 1: potential capital charge Day 2: no changes in the file, therefore borrower should take a capital charge. |

||||||||||||||||||||

| Scenario 5b | ||||||||||||||||||||

| 5b(Day1) | Day 1: 1 Loan, USTN 4.375 12/15/2010, price: $0.99, 3 principals (40K, 35K, 25K), tri-party collateral at 110% or $108,900; collateral is proportionally distributed among the three principals. |

FEDW | C | 912828EQ9 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 3 | USTN 4.375 12/15/2010 | $0.99 | $108,900 | 40K AG5554377 35K AG5553789 25K AG5559731 |

5b(Day1) | ||

| 5b(Day2) | Day 2: tri-party collateral goes down to 102% or $100,980 | FEDW | C | 912828EQ9 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 3 | USTN 4.375 12/15/2010 | $0.99 | $100,980 | 40K AG 5554377 35K AG 5553789 25K AG 5559731 |

5b(Day2) | ||

| Expected results for borrower: Day 1: potential capital charge Day 2: reduction in tri-party collateral will be reflected on the non-cash loan, should cure exposure from day 1. |

||||||||||||||||||||

| Scenario 5c | ||||||||||||||||||||

| 5c(Day1) | Day 1: 1 Loan, US STRIP 11/15/2009, price $0.85, $85,000 2 principals (30K, 70K), 110% tri-party collateral or $93500. |

FEDW | C | 912833GF1 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 2 | US STRIP 11/15/2009 | $85 | $93,500 | 30K AG5555671 70K AG5555672 |

5c(Day1) | ||

| 5c(Day2) | Day 2 - reallocation, among existing principals and one new principal (20K, 70K, 10K). D2 no change in Tri-Party collateral, but some charges remain. | FEDW | C | 912833GF1 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 2 | US STRIP 11/15/2009 | $85 | $93,500 | 20K AG5555671 70K AG5555672 10K AG5555673 |

5c(Day2) | ||

| Expected results for borrower: Day 1: potential capital exposure Day 2: re-allocation partially cures the exposure, but some charges remain. |

||||||||||||||||||||

| Scenario 5d | ||||||||||||||||||||

| 5d(Day1) | 1 Loan, USTB 9/21/2006 $98, $98,000 2 principals (90K, 10K), 110% tri-party collateral or $107,800. |

FEDW | C | 912795XW6 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 2 | USTB 9/21/2006 | $98 | $107,800 | 90K AG5555333 10K AG5555444 |

5d(Day1) | ||

| 5d(Day2) | Day 2 - return of 10,000 shares and mark to market of tri-party collateral to 102% or $89,964. distribution becomes 90K, 0 | FEDW | C | 912795XW6 | N | 90,000 | N | $0 | USD | S | S | 0.5 | 1 | $89,964 | 90K AG5555333 | 5d(Day2) | ||||

| Expected results for borrower: Day 1: potential capital charge Day 2: return and mark to market should clear the capital charge. |

||||||||||||||||||||

| Test Set 6: Foreign Pre-Pay Cash Collateral | ||||||||||||||||||||

| Scenario 6 | ||||||||||||||||||||

| 6(Day1) | 1 Loan, 2 principals (70K, 30K); Day 1 pre-pay, 105% collateral; cash has settled, but securities have not settled. Collateral at 120% --->$600,000 | INTL | S | 5209073 | N | 100,000 | C | $600,000 | USD | P | S | 4 | 2 | HAG MEYER | $5 | $6 | 60K AG6661234 40K AG6661235 |

6(Day1) | ||

| 6(Day2) | Securities settle | INTL | S | 5209073 | N | 100,000 | C | $600,000 | USD | S | S | 4 | 2 | HAG MEYER | $5 | $6 | 60K AG6661234 40K AG6661235 |

6(Day2) | ||

| Expected results for borrower: Day 1: potential capital charge as securities are not received yet. Day 2: securities settle; but still over collateralized. Borrower has to take capital charge. |

||||||||||||||||||||

| Scenario 6a | ||||||||||||||||||||

| 6a(Day1) | 1 Loan, 2 principals (70K, 30K); Day 1 - pre-pay, 105% or $525,000 collateral; cash has settled, securities have not. | INTL | S | 5810367 | N | 100,000 | C | $525,000 | USD | P | S | 4 | 2 | COMPAL | $5 | 70K AG6662341 30K AG6662344 |

6a(Day1) | |||

| 6a(Day2) | Securities fail | INTL | S | 5810367 | N | 100,000 | C | $525,000 | USD | P | S | 4 | 2 | COMPAL | $5 | 70K AG6662341 30K AG6662344 |

6a(Day2) | |||

| Expected results for borrower: Day 1: potential capital charge as securities are not received yet. Day 2: securities fail; borrower should take capital charge for entire amount. |

||||||||||||||||||||

| Test Set 7: Loans of Non-US securities vs. cash, the loan is being returned - unsecured debit | ||||||||||||||||||||

| Scenario 7 | ||||||||||||||||||||

| 7(Day1) | This is an existing loan with 2 principals (80K, 20K); collateralized at 105% or $210,000. | INTL | S | 6710961 | N | 100,000 | C | $210,000 | USD | S | S | 4 | 2 | REPCO | $2 | $2.10 | 80K AG7712345 20K AG7712346 |

7(Day1) | ||

| 7(Day2) | Day 2 - borrower returns the loan, but lender fails to recognize the return and sends the same file as day 1. | INTL | S | 6710961 | N | 100,000 | C | $210,000 | USD | S | S | 4 | 2 | REPCO | $2 | $2.10 | 80K AG7712345 20K AG7712346 |

7(Day2) | ||

| Expected results for borrower: D2: Borrower is showing securities as returned, but has not received cash; the file coming from the lender will look the same as day 1; but it is wrong. This will be an unsecured debit to the borrower. |

||||||||||||||||||||

| Test Set 8: Loans of US equity vs. Letter of Credit (LOC) | ||||||||||||||||||||

| Scenario 8 | ||||||||||||||||||||

| 8(Day1) | US equity loan against an LOC, collateralized at approx. 102%; 2 principals (75K, 25K). | DTC Num | C | 844741108 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 2 | LUV | $18 | 75K AG8812345 25K AG8812346 |

8(Day1) | |||

| 8(Day2) | No Day 2 file | 8(Day2) | ||||||||||||||||||

| Expected results for borrower: Day 1: take a capital charge (for testing purposes) |

||||||||||||||||||||

| Test Set 9: Various Mixed Loans of US equity | ||||||||||||||||||||

| Scenario 9 | ||||||||||||||||||||

| 9(Day1)-Position 1 | Day1: US equity loan, 2 positions, one vs. cash collateral and one vs. non cash, all with the same principal. 1st position is for 100,000 shares of Verizon, against cash at 102%; or 3,570,000 |

DTC Num | C | 92343V104 | N | 100,000 | C | $3,570,000 | USD | S | S | 3 | 1 | VZ | $35 | $36 | 100k AG9912345 |

9(Day1)-Position 1 | ||

| 9(Day1)-Position 2 | 2nd position is for 100,000 shares of HP against 107% collateral of UST Treasury, price $0.83, 4,254,200 shares or $3,531,000 |

DTC Num | C | 428236403 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 1 | HP | $33 | $3,531,000 | 100k AG9912345 |

9(Day1)-Position 2 | ||

| 9(Day2)-Position 1 | Same as Day 1 file | DTC Num | C | 92343V104 | N | 100,000 | C | $3,570,000 | USD | S | S | 3 | 1 | VZ | $35 | $36 | 100k AG9912345 |

9(Day2)-Position 1 | ||

| 9(Day2)-Position 2 | Same as Day 1 file | DTC Num | C | 428236403 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 1 | HP | $33 | $3,531,000 | 100k AG9912345 |

9(Day2)-Position 2 | ||

| Expected results for borrower: Day 1: potential capital charge Day 2: no changes in the file, therefore borrower will have to take capital charge on the 2nd position(HP) |

||||||||||||||||||||

| Scenario 9a | ||||||||||||||||||||

| 9a(Day1)-Position 1 | Day 1: US equity loan, multiple positions, multiple collateral types for the same principal. 1st position - 1,000,000 shares of Lucent vs. cash collateral, at 167% or $5m. |

DTC Num | C | 599463107 | N | 1,000,000 | C | $5,000,000 | USD | S | S | 3 | 1 | LU | $3 | $5 | 1M AG9954321 |

9a(Day1)-Position 1 | ||

| 9a(Day1)-Position 2 | 2nd position: 1,000,000 shares of Nortel vs. UST bond 10.625 08/15/2015 collateral, price $1.43, 3,496,500 shares or $5,000,000 | DTC Num | C | 656568102 | N | 1,000,000 | N | USD | S | S | 0.5 | 1 | NT | $3 | $5,000,000 | 1M AG9954321 |

9a(Day1)-Position 2 | |||

| 9a(Day2)- Position 1 |

file stays the same | DTC Num | C | 599463107 | N | 1,000,000 | C | $5,000,000 | USD | S | S | 3 | 1 | LU | $3 | $5 | 9a(Day2)- Position 1 |

|||

| 9a(Day2)- Position 2 |

file stays the same | DTC Num | C | 656568102 | N | 1,000,000 | N | USD | S | S | 0.5 | 1 | NT | $3 | $5,000,000 | 9a(Day2)- Position 2 |

||||

| Expected results for borrower: Day 1: potential capital charge Day 2: no change on the lender's file, borrower should take full capital charge. |

||||||||||||||||||||

| Scenario 9b | ||||||||||||||||||||

| 9b(Day1)-Position 1 | Day 1: US equity loan, multiple positions, multiple collateral type for the same principal; Position 1 - 100,000 shares of ATT against 110% cash collateral, or $3,000,000 |

DTC Num | C | 00206R102 | N | 100,000 | C | $3,000,000 | USD | S | S | 3 | 1 | ATT | $27 | $30 | 100k AG9998788 |

9b(Day1)-Position 1 | ||

| 9b(Day1)-Position 2 | Position 2 - 100,000 shares of British Telecom, against UST collateral at 105%; US Strip 11/15/2013 price $0.70, 6,000,000 shares | DTC Num | C | 05577E101 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 1 | BT | $40 | $4,200,000 | 100K AG9998788 |

9b(Day1)-Position 2 | ||

| 9b(Day2)-Position 1 | Mark to market ; collateral goes down to 104% or $2,800,000 | DTC Num | C | 00206R102 | N | 100,000 | C | $2,800,000 | USD | S | S | 3 | 1 | 100k AG9998788 | 9b(Day2)-Position 1 | |||||

| 9b(Day2)-Position 2 | No change, file remains the same as day 1 | DTC Num | C | 05577E101 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 1 | BT | $40 | $4,200,000 | 9b(Day2)-Position 2 | |||

| Expected results for borrower: Day 1: potential capital charge Day 2: mark to market on the cash contract cures capital exposure no change for the securities contract, no capital charge. |

||||||||||||||||||||

| Scenario 9c | ||||||||||||||||||||

| 9c(Day1)-Position 1 | US equity loan, multiple positions, 1 principal for both positions. 1st position: 100,000 shares of FD; cash collateral, Day 1 - collateral at 105% for the cash position; |

DTC Num | C | 31410H101 | N | 100,000 | C | $7,600,000 | USD | S | S | 3 | 1 | FD | $72 | $76 | 100K AG9994444 |

9c(Day1)-Position 1 | ||

| 9c(Day1)-Position 2 | 100,000 shares of LOW; 110% collateral $7,260,000. UST strip 5/15/2013 -Price $0.72, 10,084,000 shares |

DTC Num | C | 548661107 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 1 | LOW | $66 | $7,261,000 | 100K AG9994444 |

9c(Day1)-Position 2 | ||

| 9c(Day2)-Position 1 | No change in the cash position, Day 2 files stays the same | DTC Num | C | 31410H101 | N | 100,000 | C | $7,600,000 | USD | S | S | 3 | 1 | FD | $72 | $76 | 100K AG9994444 |

9c(Day2)-Position 1 | ||

| 9c(Day2)-Position 2 | Mark to market of bonds by 917,000 shares; new collateral value: $660,000 | DTC Num | C | 548661107 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 1 | LOW | $66 | $660,000 | 100K AG9994444 |

9c(Day2)-Position 2 | ||

| Expected results for borrowers: should see changes only on the non-cash collateral file with a mark down of the collateral shares. | ||||||||||||||||||||

| Scenario 9d | ||||||||||||||||||||

| 9d(Day1)-Position 1 | US Equity, 2 loans, multiple collateral. Day 1 - 1st loan - 100,000 shares of XOM against cash collateral; collateral is at 110% or $6.8m |

DTC Num | C | 30231G102 | N | 100,000 | C | $6,800,000 | USD | S | S | 3 | 1 | XOM | $62 | $68 | 100K AG9999333 |

9d(Day1)-Position 1 | ||

| 9d(Day1)-Position 2 | Day 1 - 2nd loan - 100,000 shares of BP, same principal as loan 1; collateral is UST strip 5/15/2017 -Price $0.59, 12,542,000 shares at 100% or $7.4m | DTC Num | C | 055622104 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 1 | BP | $70 | $74 | $7,400,000 | 100K AG9999333 |

9d(Day1)-Position 2 | |

| 9d(Day2)-Loan 1 | Reallocation on cash loan from 1 to 2 principals. | DTC Num | C | 30231G102 | N | 100,000 | C | $6,800,000 | USD | S | S | 3 | 2 | XOM | $62 | $68 | 60K AG9999333 40K AG9999111 |

9d(Day2)-Loan 1 | ||

| 9d(Day2)-Loan 2 | Non-cash loan stays the same as Day 1 | DTC Num | C | 055622104 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 1 | BP | $70 | $74 | $7,400,000 | 100K AG9999333 |

9d(Day2)-Loan 2 | |

| Expected results for borrowers: borrowers should see changes on the loan file for the 1st loan. The reallocation and addition of another principal will reduce the capital exposure from day 1. There should be no changes to the loan and non-cash coll. files for the 2nd loan. |

||||||||||||||||||||

| Scenario 9e | ||||||||||||||||||||

| 9e(Day1)-Loan 1 | US Equity, 2 loans against multiple types of collateral, same principal on both loans. Day 1, 1st loan of 100,000 shares of GM, against cash collateral of 110% or $2.4m, 1 principal allocation. |

DTC Num | C | 370442105 | N | 100,000 | C | $2,400,000 | USD | S | S | 3 | 1 | GM | $22 | $24 | 100K AG9999222 |

9e(Day1)-Loan 1 | ||

| 9e(Day1)-Loan 2 | Day 1, 2nd loan of 100,000 shares of Ford, against USTstrip2/12/2020 collateral, price $0.51, 16,667,000 shares, at 110%, 1 principal allocation (same as loan 1) |

DTC Num | C | 345370860 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 1 | F | $8 | $8.50 | 100K AG9999222 |

9e(Day1)-Loan 2 | ||

| 9e(Day2)-Loan 1 |

Cash loan stays the same | DTC Num | C | 370442105 | N | 100,000 | C | $2,400,000 | USD | S | S | 3 | 1 | GM | $22 | $24 | 100K AG9999222 | 9e(Day2)-Loan 1 |

||

| 9e(Day2) Loan 2 |

Day 2, loan 2, there is a reallocation and addition of a new principal, distribution becomes 70K, 30K; total collateral does not change; it's distribution changes on the non-cash file. | DTC Num | C | 345370860 | N | 100,000 | N | $0 | USD | S | S | 0.5 | 2 | F | $8 | $8.50 | 70K AG-9999222 30K AG-9999211 |

9e(Day2) Loan 2 |

||

| Expected results for borrowers: Day 1, loan 1 there is a capital exposure, pending charge for day 2. Day 2 loan 1, there is no cure to the exposure, borrower should take capital charge. Day 1, loan 2 - there is capital exposure. Day 2, loan 2 - total collateral amount remains the same, however there is a change at the principal level, resulting in a partial cure and a pending charge for the new principal. |

||||||||||||||||||||

| Non Cash Collateral File | |||||||

| US Equity with securities collateral | |||||||

| Description | Principal ID | Coll Type | Sec ID Type | Sec. ID | SEC Quantity | ||

| 3 | Day 1 | AG3121111 | S | C | 912833JU5 | 3,373,400 | |

| Day 2 | AG3121111 | S | C | 912833JU5 | 3,373,400 | ||

| 3a | Day 1 | AG3122222 | S | C | 912828AU4 | 10,526,500 | |

| Day 1 | AG3122222 | S | C | 912828DD9 | 7,070,700 | ||

| Day 2 | AG3122222 | S | C | 912828AU4 | 10,000,000 | ||

| Day 2 | AG3122222 | S | C | 912828DD9 | 6,060,600 | ||

| 3b | Day 1 | AG3123333 | S | C | 912810DS4 | 2,708,300 | |

| Day 2 | AG3123333 | S | C | 912810DS4 | 1,624,900 | ||

| 3c | Day 1 | AG3124444 | S | C | 91228CJ7 | 1,100,000 | |

| Day 2 | AG3124444 | S | C | 91228CJ7 | 550,000 | ||

| 3d | Day 1 | AG3125555 | S | C | 912833DG2 | 7,761,200 | |

| Day 2 | AG3126666 | S | C | 912833DG2 | 7,761,200 | ||

| 3e | Day 1 | AG3127777 | S | C | 3133XF3M6 | 2,800,000 | |

| Day 2 | AG3127777 | S | C | 3133XF3M6 | 2,800,000 | ||

| Cash Pool, International Security | |||||||

| Description | Principal ID | Coll Type | Cash Pool Amount(derived from Market Price times Allocated Quantity) | Cash Pool Currency | |||

| 4 | Day 1 | AG4412345 | P | $1,224,000 | USD | ||

| AG4412346 | P | $816,000 | USD | ||||

| AG4454321 | P | $285,600 | USD | ||||

| AG4464321 | P | $122,400 | USD | ||||

| AG4432156 | P | $3,100,800 | USD | ||||

| AG4433125 | P | $775,200 | USD | ||||

| 4 | Day 2 | AG4412345 | P | $1,224,000 | USD | ||

| AG4412346 | P | $816,000 | USD | ||||

| AG4454321 | P | $285,600 | USD | ||||

| AG4464321 | P | $122,400 | USD | ||||

| AG4432156 | P | $3,100,800 | USD | ||||

| AG4433125 | P | $775,200 | USD | ||||

| 4a | Day 1 | AG4444123 | P | $5,610,000 | USD | ||

| AG4444124 | P | $3,740,000 | USD | ||||

| AG4444125 | P | $3,388,000 | USD | ||||

| AG4444126 | P | $1,452,000 | USD | ||||

| 4a | Day 2 | AG4444123 | P | $5,253,000 | USD | ||

| AG4444124 | P | $3,502,000 | USD | ||||

| AG4444125 | P | $3,172,400 | USD | ||||

| AG4444126 | P | $1,359,600 | USD | ||||

| 4b | Day 1 | AG4444412 | P | $1,056,000 | USD | ||

| AG4444413 | P | $352,000 | USD | ||||

| AG4444414 | P | $352,000 | USD | ||||

| 4b | Day 2 | AG4444412 | P | $528,000 | USD | ||

| AG4444413 | P | $352,000 | USD | ||||

| AG4444414 | P | $352,000 | USD | ||||

| AG4444415 | P | $528,000 | USD | ||||

| 4C | Day 1 | AG4444431 | P | $6,600,000 | USD | ||

| AG4444421 | P | $1,650,000 | USD | ||||

| Day 2 | AG4444431 | P | $5,775,000 | USD | |||

| 4d | Day 1 | AG4444489 | P | $4,537,500 | USD | ||

| AG4444499 | P | $1,512,500 | USD | ||||

| Day 2 | AG4444489 | P | $3,646,500 | USD | |||

| AG4444499 | P | $1,402,500 | USD | ||||

| Gov't Security loan, Tri-Party collateral | |||||||

| Prin ID | Coll Type | Tri Party Amount | Tri Party % | TriParty Currency | |||

| 5 | Day 1 | AG5551234 | T | $58,800 | 60% | USD | |

| AG5551235 | T | $39,200 | 40% | USD | |||

| 5a | Day 1 | AG5553214 | T | $90,000 | 60% | USD | |

| AG5553241 | T | $60,000 | 40% | USD | |||

| 5b | Day 1 | AG5554377 | T | $43,560 | 40% | USD | |

| AG5553789 | T | $38,115 | 35% | USD | |||

| AG5559731 | T | $27,225 | 25% | USD | |||

| Day 2 | AG5554377 | T | $40,392 | 40% | USD | ||

| AG5553789 | T | $35,343 | 35% | USD | |||

| AG5559731 | T | $25,245 | 25% | USD | |||

| 5c | Day 1 | AG5555671 | T | $28,050 | 30% | USD | |

| AG5555672 | T | $65,450 | 70% | USD | |||

| Day 2 | AG5555671 | T | $18,700 | 20% | USD | ||

| AG5555672 | T | $65,450 | 70% | USD | |||

| AG5555673 | T | $9,350 | 10% | USD | |||

| 5d | Day 1 | AG5555333 | T | $97,020 | 90% | USD | |

| AG5555444 | T | $10,780 | 10% | USD | |||

| Day 2 | AG5555333 | T | $89,964 | 100% | USD | ||

| US equity vs. LOC | |||||||

| Prin ID | Coll type | LOC amt | LOC currency | LOC Bank ID - DTCC | |||

| 8 | Day 1 | AG8812345 | L | $1,500,000 | USD | 901 | |

| AG8812346 | L | $500,000 | USD | 901 | |||

| Us equity. Multiple positions vs. cash coll. or securities collateral | |||||||

| Description | Principal ID | Collateral Type | Security ID Type | Security ID | Security Quantity | ||

| 9 | Day 1 | AG99912345 | S | C | 912833JU5 | 4,254,200 | |

| Day 2 | AG99912345 | S | C | 912833JU5 | 4,254,200 | ||

| 9a | Day 1 | AG9954321 | S | C | 912810DS4 | 3,496,500 | |

| Day 2 | AG9954321 | S | C | 912810DS4 | 3,496,500 | ||

| 9b | Day 1 | AG9998788 | S | C | 912833KB5 | 6,000,000 | |

| Day 2 | Same as D1 | ||||||

| 9C | Day 1 | AG9994444 | S | C | 912833KA7 | 10,084,000 | |

| Day 2 | AG9994444 | S | C | 912833KA7 | 9,167,000 | ||

| 9d | Day 1 | AG9999333 | S | C | 912833KMI | 12,542,000 | |

| Day 2 | AG9999333 | S | C | 912833KMI | 12,542,000 | ||

| 9e | Day 1 | AG9999222 | S | C | 912833KY5 | 16,667,000 | |

| Day 2 | AG9999222 | S | C | 912833KY5 | 11,667,000 | ||

| Day 2 | AG9999211 | S | C | 912833KY5 | 5,000,000 | ||

no reviews yet

Please Login to review.