255x Filetype XLS File size 0.08 MB Source: www.lesedilm.gov.za

Sheet 1: S D B I P

| PERFORMANCE SCORECARD top layer sdbip |

||||||||||||||||||||||||||

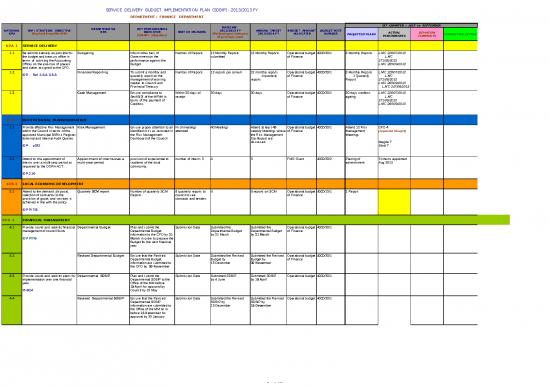

| SERVICE DELIVERY BUDGET IMPLEMENTATION PLAN (SDBIP) - 2013/2013 FY | ||||||||||||||||||||||||||

| DEPARTMENT : FINANCE DEPARTMENT | ||||||||||||||||||||||||||

| NATIONAL KPA | IDP / STRATEGIC OBJECTIVE (Derived from the IDP) |

DEPARTMENTAL KPA |

KEY PERFORMANCE INDICATOR (SMART Objective) |

UNIT OF MEASURE | BASELINE 2012/2013 FY (Performance Outcome of previous year) |

ANNUAL TARGET 2013/2014 FY |

BUDGET AMOUNT ALLOCATED | BUDGET VOTE NUMBER | 1ST QUARTER : JULY to SEPTEMBER | 2ND QUARTER : OCTOBER to DECEMBER | 3RD QUARTER : JANUARY to MARCH | 4TH QUARTER : APRIL to JUNE | RESPONSIBLE UNIT / POSITION |

CASCADED DOWN TO THE RELEVANT MANAGER | ||||||||||||

| PROJECTED PLANS | ACTUAL PERFORMANCE | DEVIATION COMMENTS | CORRECTIVE ACTION | PROJECTED PLANS | ACTUAL PERFORMANCE | DEVIATION COMMENTS | CORRECTIVE ACTION | PROJECTED PLANS | ACTUAL PERFORMANCE | DEVIATION COMMENTS | CORRECTIVE ACTION | PROJECTED PLANS | ACTUAL PERFORMANCE | DEVIATION COMMENTS | CORRECTIVE ACTION | |||||||||||

| KPA 1 | SERVICE DELIVERY | |||||||||||||||||||||||||

| 1.1 | Be administratively responsible for the budget and treasury office in terms of advising the Accounting Officer on the exercise of powers and duties assigned to the CFO. IDP : Ref 3.5.4- 3.5.5 |

Budgeting | Inform other tiers of Government on the performance against the Budget | Number of Reports | 12 Monthly Reports submitted | 12 Monthly Reports | Operational budget of Finance | 4000/20/1 | 3 Monthly Reports | L.MC 226/07/2013 L.MC 271/08/2013 L.MC 285/09/2013 | 3 Monthly Reports | 3 Monthly Reports | 3 Monthly Reports | CFO | Manager: Budget and Reporting | |||||||||||

| 1.2 | Financial Reporting | To submit a monthly and quarterly report on the management of working capital to Council and Provincial Treasury | Number of Reports | 12 reports per annum | 12 monthly reports 4 quarterly reports | Operational budget of Finance | 4000/20/1 | 3 Monthly Reports 1 Quarterly Report | L.MC 226/07/2013 L.MC 271/08/2013 L.MC 285/09/2013 L.MC 247/08/2013 | 3 Monthly Reports 1 Quarterly Report | 3 Monthly Reports 1 Quarterly Report | 3 Monthly Reports 1 Quarterly Report | CFO | Manager: Budget and Reporting | ||||||||||||

| 1.3 | Cash Management | Ensure compliance to Sec65(2) of the MFMA in terms of the payment of Creditors | Within 30 days of receipt | 30 days | 30 days | Operational budget of Finance | 4000/20/1 | 30 days creditors ageing | L.MC 226/07/2013 L.MC 271/08/2013 L.MC 285/09/2013 | 30 days creditors agieng | 30 days creditors agieng | 30 days creditors agieng | CFO | Manager: Expenditure | ||||||||||||

| KPA 2 | INSTITUTIONAL TRANSFORMATION | |||||||||||||||||||||||||

| 2.1 | Provide effective Risk Management within the Council in terms of the approved Municipal B9Risk Register, External and Internal Audit Queries IDP : p192 |

Risk Management | Ensure proper attention to all identified risks as recorded in the Risk Management Dashboard of the Council | Nr of meetings attended |

40 Meetings | Attend at least 45 weekly Meetings where the Risk Management Dashboard are discussed | Operational budget of Finance | 4000/20/1 | Attend 12 Risk Management Meetings |

CFO 4 (Appointed 13Aug13) Magda 7 Sindi 7 |

Attend 12 Risk Management Meetings |

Attend 12 Risk Management Meetings |

Attend 12 Risk Management Meetings |

CFO | All managers. | |||||||||||

| 2.2 | Attend to the appiontment of interns over a multi-year period as requered by the DORA ACT. IDP 2.10 |

Appiontment of Interns over a multi-year period | provision of experiential to studients of the local community. | number of interns 5 | 4 | 5 | FMG Grant | 4000/20/2 | Placing of advertisment | 5 Interns appointed Aug 2013 | Appointment of 5 interns | CFO | Manager: Expenditure | |||||||||||||

| KPA 3 | LOCAL ECONOMIC DEVELOPMENT | |||||||||||||||||||||||||

| 3.1 | Attend to the demand ,disposal, selection of contractor to the provision of goods and services is achieved in line with the policy IDP PI 7/8 |

Quartely SCM report | Number of quarterly SCM Reports | 4 quarterly reports to council to see contracts and tenders | 4 | 4 reports on SCM | Operational budget of Finance | 4000/15/1 | 1 Report | 1 Report | 1 Report | 1 Report | CFO | Manager: SCM | ||||||||||||

| KPA 4 | FINANCIAL MANAGEMENT | |||||||||||||||||||||||||

| 4.1 | Provide sound and realistic financial management of council funds IDP PI7/6 |

Departmental Budget | Plan and submit the Departmental Budget information to the CFO by 31 March in order to prepare the Budget for the next financial year |

Submission Date | Submitted the Departmental Budget by 31 March |

Submitted the Departmental Budget by 31 March |

Operational budget of Finance | 4000/20/1 | Submit the Departmental Budget to CFO by 31 March |

CFO | Manager: Budget and Reporting | |||||||||||||||

| 4.2 | Revised Departmental Budget | Ensure that the Revised Departmental Budget information are submitted to the CFO by 30 November | Submission Date | Submitted the Revised Budget by 15 December |

Submitted the Revised Budget by 30 November |

Operational budget of Finance | 4000/20/1 | Submit Revised Budget to CFO by 30 November | CFO | Manager: Budget and Reporting | ||||||||||||||||

| 4.3 | Provide sound and realistic plans for implementation over one financial year PI 8/24 |

Departmental SDBIP | Plan and submit the Departmental SDBIP to the Office of the MM before 15 April for approval by Council by 31 May |

Submission Date | Submitted SDBIP by 4 June |

Submitted SDBIP by 15 April |

Operational budget | 4000/20/1 | Submission Departmental SDBIP to PMS Unit by 15 April | CFO | With the assistance of all managers. | |||||||||||||||

| 4.4 | Revised Departmental SDBIP | Ensure that the Revised Departmental SDBIP information are submitted to the Office of the MM on or before 15 December for approval by 25 January | Submission Date | Submitted the Revised SDBIP by 15 December |

Submitted the Revised SDBIP by 15 December |

Operational budget | 4000/20/1 | Submit the Revised SDBIP to the PMS Unit by 15 December |

CFO | With the assistance of all managers. | ||||||||||||||||

| 4.5 | Substandtially increase the income from internal and external sources while simultanesouly curbing unnecessary operational expenses to ensure growth in the capital budget IDP : Ref 3.4 |

Credit Control and Debt Collection | Ensure that a % of all metered and billed accounts per month are collected. | percentage % collected |

Out of 24994 total metered and billed accounts an average of 73% was collected | Out of the 25372 total metered and billed accounts collect an average of 80% | Operational budget of Finance | 4000/10/1 | An average of 80% of the 25372 billed accounts to be collected | An average of 87% of the 25372 billed accounts was collected | An average of 80% of the 25372 billed accounts to be collected | An average of 80% of the 25372 billed accounts to be collected | An average of 80% of the 25372 billed accounts to be collected | CFO | Manager: Revenue | |||||||||||

| 4.6 | Minimising of Water and Electricity Distribution Losses | Ensure that legal action are taken on all illegal connections. | Number of legal actions taken. In order to encourage the culture of payment for services, it was agreed with the AO that meter audits be undertaken and arrangements be made and sanctions through penalties be imposed on those found to have connected illegally. | 100% penalties imposed based on the list of illegal connections | Operational budget of Finance | 4000/10/1 | 100% penalties imposed based on the list of illegal connections | Penalties were imposed on those that were found in terms of the credit control policy. | 100% penalties imposed based on the list of illegal connections | 100% penalties imposed based on the list of illegal connections | 100% penalties imposed based on the list of illegal connections | CFO | CFO in conjuction with the Manager: Revenue | |||||||||||||

| KPA 5 | GOOD GOVERNANCE | |||||||||||||||||||||||||

| 5.1 | Obtain a measurement on the Municipal Performance as a whole as required by Chapter 6 of the Municipal Systems Act (Act 32 of 2000) IDP : Section 5 (Point 5.7) |

Performance Management System | Ensure that Performance Reviews between individuals and line managers are held to obtain the Departmental Performance Outcome | Number of One-on-One Performance Reviews held | 8 Performance Review Discussions during the 2nd & 4th Quarter | 8 Performance Review Discussions during the 2nd & 4th Quarter | Operational budget of Finance | 4000/10, 15,20,30/1 |

4 Performance Review Discussions | 4 Performance Review Discussions | CFO | |||||||||||||||

| 5.2 | Performance Reports | Ensure the submission of the following Departmental Performance Reports :- - Performance Feedback - Departmental Outcome |

Submission Date | 2 x Feedback Reports 2 x Dept Perf. Outcome |

2 Performance Feedback Reports for timeous submission 2 Departmental Performance Outcome Reports to be submitted timeously |

Operational budget of Finance | 4000/10, 15,20,30/1 |

Submission by 20 December 1 Dept Performance Feedback Report 1 Departmental Scorecard |

Submission by 20 June 1 Dept Performance Feedback Report 1 Departmental Scorecard |

CFO | Manager: Budget and Reporting | |||||||||||||||

| 5.3 | Report on the percentage (%) of households earning less than R2400 per month with access to free basic services IDP - Section 5 |

National General Indicator | Report on the percentage of households earning less than R2400 per month with access to free basic services | Percentage % | Existing Households in Lesedi = 29 668 3.5% of households earning less than R2400 per month with access to free basic services |

Existing Households in Lesedi = 29 668 17% of households earning less than R2400 pm with basic services |

Operational Budget | 4000 | 4.25% of households earning less than R2400 pm with basic services | 1027 (3.5%) indigent household were registered as at 30 September 2013. | In a process of procuring a service provider that would assist with the vetting of indigent applications. Mass registration campaigns to be conducted in the second half of the financial year. | 4.25% of households earning less than R2400 pm with basic services | 4.25% of households earning less than R2400 pm with basic services | 4.25% of households earning less than R2400 pm with basic services | CFO | Manager: Revenue Manager: Budget & Reporting | ||||||||||

| 5.4 | Report on the percentage (%) of the municipality's capital budget actually spent on capital projects identified for a particular financial year in terms of the municipality's integrated development plan IDP - Section 5 |

National General Indicator | Report on the percentage of the municipality's capital budget actually spent on capital projects identified for the financial year in discussion in terms of the IDP | Percentage % | 123% of Capital Budget Spent | 100% of Capital Budget to be Spent | Capital Budget | All Capital Budget Votes as per the approved Budget | 25% of Capital Budget to be Spent | 1.4% of Capital Budget was spent. | Contractors were appointed towards the end of the quarter and hence the spending is low. It is expected to start increasing mid year. | Contractors already appointed. | 25% of Capital Budget to be Spent | 25% of Capital Budget to be Spent | 25% of Capital Budget to be Spent | CFO | Manager: Budget and Reporting | |||||||||

| 5.5 | Report on the municipality's financial viability as expressed by the ratios for debt coverage, outstanding service debtors to revenue and cost coverage IDP - Section 5 |

National General Indicator | Report on the municipality's financial viability expressed by ratios for debt coverage | In Ratios | 52.3 times (2012/13 draft AFS) | 61.3 times of debt coverage | Operational Budget | Total Opex Revenue Opex Grants Dept Serv. Paym due within the FY |

This ratios cannot be measured quarterly as they distorted by certain factors during the year. They will be measured annually. | This ratios cannot be measured quarterly as they distorted by certain factors during the year. They will be measured annually. | This ratios cannot be measured quarterly as they distorted by certain factors during the year. They will be measured annually. | This ratios cannot be measured quarterly as they distorted by certain factors during the year. They will be measured annually. | CFO | Manager: Budget and Reporting | ||||||||||||

| 5.6 | National General Indicator | Report on the municipality's financial viability expressed by ratios for outstanding service debtors to revenue | In Ratios | 13.5% (2012/13 draft AFS) |

11.00% | Operational Budget | Total Outst.Ser.Debto. Ann.Rev.Receiv. for services rendered |

This ratios cannot be measured quarterly as they distorted by certain factors during the year. They will be measured annually. | This ratios cannot be measured quarterly as they distorted by certain factors during the year. They will be measured annually. | This ratios cannot be measured quarterly as they distorted by certain factors during the year. They will be measured annually. | This ratios cannot be measured quarterly as they distorted by certain factors during the year. They will be measured annually. | CFO | Manager: Revenue Manager: Budget & Reporting | |||||||||||||

| 5.7 | National General Indicator | Report on the municipality's financial viability expressed by ratios for outstanding cost coverage | In Ratios | 0.1 times Cost Cover (2012/2013 draft AFS) |

0.5 times | Operational Budget | Available Cash + Investments Monthly fixed OPEX Expenditure |

This ratios cannot be measured quarterly as they distorted by certain factors during the year. They will be measured annually. | This ratios cannot be measured quarterly as they distorted by certain factors during the year. They will be measured annually. | This ratios cannot be measured quarterly as they distorted by certain factors during the year. They will be measured annually. | This ratios cannot be measured quarterly as they distorted by certain factors during the year. They will be measured annually. | CFO | Manager: Budget and Reporting | |||||||||||||

| 5.8 | Have the Municipal Budget that is linked to IDP approved and submitted to Treasuries IDP PI7/6 |

Next 3 year budget | Ensure the approval of the next 3 year budget by not later than 31 May of the FY | By Date | 2013/2014 Budget was adopted by 31 May 13 | 2014/15 FY Budget to be adopted by 31 May | Operational budget of Finance | 4000/10, 15,20,30/1 |

To be adopted by 31 May 2014 | CFO | Manager: Budget and Reporting | |||||||||||||||

| 5.9 | Obtain a Clean Audit Report by 2014 PI8/10 |

Clean Audit for 2014 | Reduce the number of Audit Queries raised by Internal Audit / AG | Number of Audit Queries | 77 Audit Queries received | Clean Audit by 2014 | Operational budget of Finance | 4000/35/1 | Zero Internal Audit Queries | No finance related audit conducted during the quarter. | Zero Internal Audit Queries | Zero Internal Audit Queries | Zero Internal Audit Queries | CFO | All managers | |||||||||||

| 5.10 | Keep the Community informed on important council matters PI8/17 |

Update of the Municipal Website with financial information | All compliance Reports to be updated on the Municipal Website as required by legislation | Quarterly | as Section 75 of the MFMA | 4 reports on compliance of Sec 75 | Operational budget of Finance | 4000/20/1 | 1 Report | 1 Report | 1 Report | 1 Report | CFO | All managers | ||||||||||||

| 5.11 | Obtain an acknowledgement on the receipt of the Annual Financial Statements by the Auditor General IDP PI7/6 |

Submission of Financial Statement to Auditor General By 31 August | Acknowledgement of receipt of AFS by 31 August by AG | Obrain acknowledgement on the receipt of the AFS by the AG | 31-Aug | 31-Aug | Operational budget of Finance | 4000/20/1 | Submission of Annual Financial Statement for 2012/2013 | Submit to AG 30 Aug 2013 |

CFO | Manager: Budget and Reporting | ||||||||||||||

| SIGNATURE : | ||||||||||||||||||||||||||

| EXECUTIVE MANAGER : CHIEF FINANCIAL OFFICER | ||||||||||||||||||||||||||

| DATE : | ||||||||||||||||||||||||||

| XXXXXX - EXECUTIVE MANAGER : XXXXXX | |||||

| RATING SCALE | |||||

| 5 = OUTSTANDING PERFORMANCE | Performance far exceeds the standard expected of an employee at this level. The appraisal indicates that the employee has achieved above fully effective results against all performance criteria | ||||

| 4 = SIGNIFICANTLY ABOVE EXPECTATIONS | Performance is significantly higher than the sandard expected in the job. The appraisal indicates that the employee has achieved above fully effective resultsagainst more than half of the performance criteria. | ||||

| 3 = FULLY EFFECTIVE | Performance fully meets the standards expected in all areas of the job. The appraisal indicates that the employee has fully achieved effective results against all performance criteria. | ||||

| 2 = NOT FULLY EFFECTIVE | Performance is below the standard required for the job in key areas. Performance meets some of the standards expected for the job. The review / assessment indicates that the employee has achieved below fully effective results against more than half the key performance criteria | ||||

| 1 = UNACCEPTABLE PERFORMANCE | Performance does not meet the standard expected for the job. The review / assessment indicates that the employee has achieved below fully effective results against almost all of the performance criteria and indicators as specified in the Performance Plan. The employee has failed to demonstrate the commitment or ability to bring performance up to the level expected in the job despite management efforts to encourage improvement. | ||||

| NATIONAL KPA’s | WEIGHTING | 1st QUARTER SELF SCORE End September |

2nd QUARTER SELF SCORE End December |

3rd QUARTER SELF SCORE End March |

4th QUARTER SELF SCORE End June |

| SERVICE DELIVERY | 10% | 4 | |||

| MUNICIPAL INSTITUTIONAL DEVELOPMENT & TRANSFORMATION | 10% | 4 | |||

| LOCAL ECONOMIC DEVELOPMENT | 20% | 4 | |||

| MUNICIPAL FINANCIAL VIABILITY & MANAGEMENT | 30% | 3 | |||

| GOOD GOVERNANCE | 30% | 3 | |||

| TOTAL | 100% | 3.6 | |||

| CHIEF FINANCIAL OFFICER : Success Marota | |||||

| DATE : | |||||

no reviews yet

Please Login to review.