263x Filetype XLSX File size 0.20 MB Source: www.kumc.edu

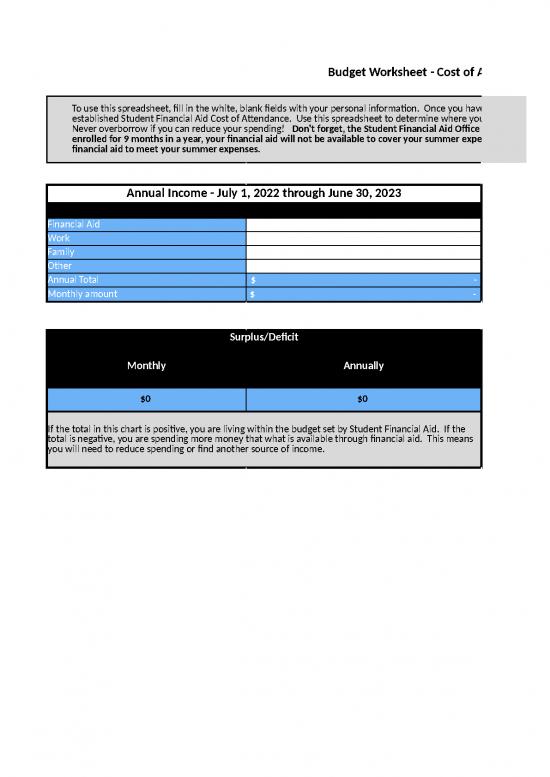

Budget Worksheet - Cost of Attendance vs. Actual Spending

To use this spreadsheet, fill in the white, blank fields with your personal information. Once you have completed your entries, the "Surplus/Deficit" chart will show you how well you are living within the

established Student Financial Aid Cost of Attendance. Use this spreadsheet to determine where you may be overspending, and how much more you may need to borrow to meet your educational needs.

Never overborrow if you can reduce your spending! Don't forget, the Student Financial Aid Office can only provide monthly living expenses for the number of months you are enrolled. If you are only

enrolled for 9 months in a year, your financial aid will not be available to cover your summer expenses. If you are not working, you may need to reduce your monthly spending to stretch out your

financial aid to meet your summer expenses.

Annual Income - July 1, 2022 through June 30, 2023

Financial Aid

Work

Family

Other

Annual Total $ -

Monthly amount $ -

Surplus/Deficit

Monthly Annually

$0 $0

If the total in this chart is positive, you are living within the budget set by Student Financial Aid. If the

total is negative, you are spending more money that what is available through financial aid. This means

you will need to reduce spending or find another source of income.

Budget Worksheet - Cost of Attendance vs. Actual Spending

To use this spreadsheet, fill in the white, blank fields with your personal information. Once you have completed your entries, the "Surplus/Deficit" chart will show you how well you are living within the

established Student Financial Aid Cost of Attendance. Use this spreadsheet to determine where you may be overspending, and how much more you may need to borrow to meet your educational needs.

Don't forget, the Student Financial Aid Office can only provide monthly living expenses for the number of months you are enrolled. If you are only

enrolled for 9 months in a year, your financial aid will not be available to cover your summer expenses. If you are not working, you may need to reduce your monthly spending to stretch out your

2022-23 Expenses

2021-22 Direct Educational Expenses (Annual)

CATEGORY EXPENSE

Tuition

Fees

Books

TOTAL $ -

Monthly Amount Available AFTER Direct Educational Expenses $ -

Monthly Expenses

2021-22 COA Your Actual Surplus/

CATEGORIES Monthly Monthly Shortage

Budget Expenses

Room/Board

Rent $743 $743

Food $500 $500

Utilities-Electric $83 $83

Utilities-Gas $63 $63

Utilities - Water/Trash $38 $38

Utilities - Phone $82 $82

Utilities - Internet Service $51 $51

Total Room/Board $1,560 $0 $1,560

Personal/Medical

Personal Care $53 $53

Personal Property Insurance $12 $12

Dental/Medical $83 $83

Laundry $19 $19

Health/Dental/Vision Insurance $190 $190

Miscellaneous $112 $112

Clothing $50 $50

Total Personal/Medical $519 $0 $519

Transportation

Car Insurance $95 $95

License/Registration $20 $20

Gasoline $103 $103

Repairs/Maintenance $90 $90

Parking $13 $13

Total Transportation $321 $0 $321

Optional Expenses (Not included in COA)

Credit Card Bills $0 $0

Car Payments $0 $0

Other $0 $0

Other $0 $0

Other $0 $0

Total Add'l Expenses $0 $0 $0

TOTAL LIVING EXPENSES $2,400 $0 $2,400

Surplus/Deficit Based on Income vs. Expenses $0

If the total in the "Surplus/Shortage" column is positive, you are living within the budget set by

Student Financial Aid. If the total is negative, you are spending more money that what is

available through financial aid. This means you will need to reduce spending or find another

source of income.

no reviews yet

Please Login to review.