272x Filetype XLSX File size 0.04 MB Source: www.k-state.edu

Sheet 1: Spending Plan in School

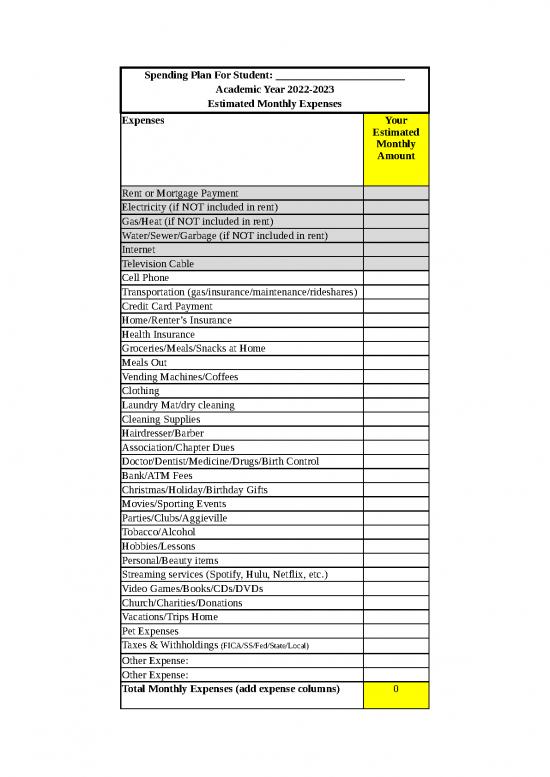

| Spending Plan For Student: ________________________ | ||

| Academic Year 2022-2023 | ||

| Estimated Monthly Expenses | ||

| Income (use gross income and indicate taxes withheld under expense category) | Expected Income for Next Month | |

| Expenses | Your Estimated Monthly Amount | |

| Rent or Mortgage Payment | ||

| Electricity (if NOT included in rent) | ||

| Gas/Heat (if NOT included in rent) | ||

| Water/Sewer/Garbage (if NOT included in rent) | ||

| Internet | ||

| Television Cable | ||

| Cell Phone | ||

| Transportation (gas/insurance/maintenance/rideshares) | ||

| Credit Card Payment | *Only enter if carry a balance monthly | |

| Home/Renter’s Insurance | ||

| Health Insurance | ||

| Groceries/Meals/Snacks at Home | ||

| Meals Out | ||

| Vending Machines/Coffees | ||

| Clothing | ||

| Laundry Mat/dry cleaning | ||

| Cleaning Supplies | ||

| Hairdresser/Barber | ||

| Association/Chapter Dues | ||

| Doctor/Dentist/Medicine/Drugs/Birth Control | ||

| Bank/ATM Fees | ||

| Christmas/Holiday/Birthday Gifts | ||

| Movies/Sporting Events | ||

| Parties/Clubs/Aggieville | ||

| Tobacco/Alcohol | ||

| Hobbies/Lessons | ||

| Personal/Beauty items | ||

| Streaming services (Spotify, Hulu, Netflix, etc.) | ||

| Video Games/Books/CDs/DVDs | ||

| Church/Charities/Donations | ||

| Vacations/Trips Home | ||

| Pet Expenses | ||

| Taxes & Withholdings (FICA/SS/Fed/State/Local) | ||

| Other Expense: | ||

| Other Expense: | ||

| Total Monthly Expenses (add expense columns) | 0 | |

| This spreadsheet will help you estimate the resources you might need to cover the estimated cost and expenses you might incur throughout your Vet Med program. This tool can also help you estimate the amount of student loans you might need and shows the effect that changes in monthly income, decreases in living expenses and scholarships can have on your finances. | |||||||||||||

| Follow the instructions in red. When a semester is over, review and record your actual expenses, income, and borrowed student loan amount. | |||||||||||||

| <Enter Student's Name> 's Kansas State University Veterinary Medicine School Financial Plan | |||||||||||||

| 1st Year | 2nd Year | 3rd Year | 4th Year | TOTALS | |||||||||

| Fall | Spring | Summer | Fall | Spring | Summer | Fall | Spring | Summer | Fall | Spring | |||

|

|

$0 | $0 |

|

$0 | $0 |

|

$0 | $0 |

|

$0 | $0 | $0 |

|

| Required estimated campus fees** | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | Required campus fees** |

|

|

$0 | Books and supplies | |||||||||||

|

|

$0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

|

|||

| Total Expenses per Semester | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | Total Expenses | |||

|

|

$0 |

|

|||||||||||

|

|

$0 |

|

|||||||||||

|

|

$0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

|

|||

|

|

$0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

|

|||

|

|

$0 |

|

|||||||||||

| Total Resources per Semester | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | Total Resources | |||

|

|

$0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

|

|||

| *The annual total multiplies the per credit hour rate for in-state Vet Med students ($562.80) or out-of-state students ($1,276.20) by enrolled hours for the fall/spring semesters. Academic college/course fees, which vary by academic college and program, will need to be added below in the course/program fees cells. | Enter information for semester job | Summer | 1 | ||||||||||

| Income from job | Summer Savings | ||||||||||||

| Hourly Wage | Hourly wage | ||||||||||||

| Hours per week | Hours per week | ||||||||||||

| Tax Rate % | 10% | Months worked | |||||||||||

| Monthly total | $0 | Living Expenses | $0 | ||||||||||

| ^Grad (res $428.90/nonres $959.10) Vet Med (res $562.80/nonres $1,276.20) | Tax Rate % | 10% | |||||||||||

| **Include below student services fee (access to student health services, recreation complex and more). | Possible Savings | $0 | |||||||||||

| % used to pay school | 100% | ||||||||||||

| Savings toward school | $0 | ||||||||||||

| Input amount of credit hours then use chart below to add course/program fees | Summer | 2 | |||||||||||

| Tuition & Fees Cost Inputs | *Tuition Rates are published end of June for next year | Summer Savings | |||||||||||

| Vet Med per credit hour in-state | $562.80 | if non-resident change to $1,276.20/credit hour | Hourly wage | ||||||||||

| Student Services Fee per semester | $465.48 | if 12 credit hours or more ($51.72/credit hour for 1-8 hours) | Hours per week | ||||||||||

| Credits | Course/ Program Fees | *add from course/program fees listed at link below | Months worked | ||||||||||

| Fall 2022 | college of vet med courses = $16/credit | Living Expenses | $0 | ||||||||||

| Spring 2023 | college of vet med technology fee = $450/semester | Tax Rate % | 10% | ||||||||||

| Summer 2023 | Possible Savings | $0 | |||||||||||

| Fall 2023 | % used to pay school | 100% | |||||||||||

| Spring 2024 | Savings toward school | $0 | |||||||||||

| Summer 2024 | |||||||||||||

| Fall 2024 | Summer | 3 | |||||||||||

| Spring 2025 | Summer Savings | ||||||||||||

| Summer 2025 | Hourly wage | ||||||||||||

| Fall 2025 | Hours per week | ||||||||||||

| Spring 2026 | Months worked | ||||||||||||

| Total | 0 | 0 | Living Expenses | $0 | |||||||||

| Tax Rate % | 10% | ||||||||||||

| For updated fees & cost of attendance visit: | Possible Savings | $0 | |||||||||||

| https://www.k-state.edu/finsvcs/cashiers/costs/ | % used to pay school | 100% | |||||||||||

| Savings toward school | $0 | ||||||||||||

| Summer | 4 | ||||||||||||

| Summer Savings | |||||||||||||

| Hourly wage | |||||||||||||

| Hours per week | |||||||||||||

| Months worked | |||||||||||||

| Living Expenses | $0 | ||||||||||||

| Tax Rate % | 10% | ||||||||||||

| Possible Savings | $0 | ||||||||||||

| % used to pay school | 100% | ||||||||||||

| Savings toward school | $0 | ||||||||||||

no reviews yet

Please Login to review.