203x Filetype XLSX File size 0.02 MB Source: www.idc.co.za

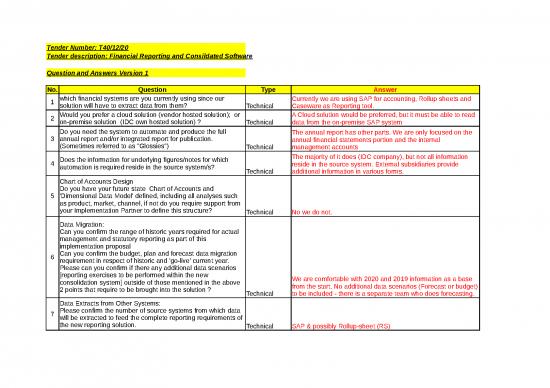

Tender Number: T40/12/20

Tender description: Financial Reporting and Consildated Software

Question and Answers Version 1

No. Question Type Answer

1 which financial systems are you currently using since our Currently we are using SAP for accounting, Rollup sheets and

solution will have to extract data from them? Technical Caseware as Reporting tool.

2 Would you prefer a cloud solution (vendor hosted solution); or A Cloud solution would be preferred, but it must be able to read

on-premise solution (IDC own hosted solution) ? Technical data from the on-premise SAP system

Do you need the system to automate and produce the full The annual report has other parts. We are only focused on the

3 annual report and/or integrated report for publication. annual financial statements portion and the internal

(Sometimes referred to as "Glossies") Technical management accounts

Does the information for underlying figures/notes for which The majority of it does (IDC company), but not all information

4 automation is required reside in the source system/s? reside in the source system. External subsidiaries provide

Technical additional information in various forms.

Chart of Accounts Design

Do you have your future state Chart of Accounts and

5 'Dimensional Data Model' defined, including all analyses such

as product, market, channel, if not do you require support from

your Implementation Partner to define this structure? Technical No we do not.

Data Migration:

Can you confirm the range of historic years required for actual

management and statutory reporting as part of this

implementation proposal

6 Can you confirm the budget, plan and forecast data migration

requirement in respect of historic and 'go-live' current year.

Please can you confirm if there any additional data scenarios

[reporting exercises to be performed within the new We are comfortable with 2020 and 2019 information as a base

consolidation system] outside of those mentioned in the above from the start. No additional data scenarios (Forecast or budget)

2 points that require to be brought into the solution ? Technical to be included - there is a separate team who does forecasting.

Data Extracts from Other Systems:

7 Please confirm the number of source systems from which data

will be extracted to feed the complete reporting requirements of

the new reporting solution. Technical SAP & possibly Rollup-sheet (RS)

Data Migration: What is the first period for which balance sheet

closing balances will be loaded. Generally this is the last period

of the year prior to that being referenced in the data migration

8 range of years for which fall population will be required

Please confirm if this is just the closing balances or the

complete income statement to be loaded? Full Income Statement for 2020 and 2019 - openeing balances

Technical as at 1 April 2019 as a minimum.

Management v Statutory

Is it envisaged that in order to achieve full integration of

management and statutory accounting, that separate discrete

9 entity hierarchies would be hosted within the reporting

application solution based upon unique parent groupings but The IDC Minigroup, IDC Company and Full Group (3

common base members. In respect of the IDC design which Hierarchies) should be hosted within the reporting application

entity hierarchies would be proposed ? Technical solution.

Entities

How many reporting entities are to be supported in the new

consolidation system ?

10 How many sub-divisions would form the total group ? How

many foreign entities and how many different countries ?

How many JV's/ Associates, How nmany Minorities ? The holding company and Five significant subsidiaries. No sub

Is the lowest level reporting unit a legal entity ? Are there divisions. One country. 140 associates entities. Less than 20

Branches or Sub-Legal Entities in the IDC organisation ? Technical minorities. IDC company is a legal entity. No branches.

Accounting Standards

Are there any other accounting standards , other than IFRS and

FRS that would be required to be maintained ? Would any local

gaap reporting requirements or filing requirement be provided

11 from this consolidation system implementation.

Would all data be loaded under IFRS standards initially or in

Local Gaap i.e. would there be a requirement for

supplementary data/journal loads of 'adjustments to IFRS' No, only IFRS would be maintained. No GAAP requirements. All

data ? Technical journals are done in compliance with IFRS.

Dimensionality Requirements

Balance sheet movements - Are the current GL's and other

source systems at IDC capable of supporting the automatic or

manual upload of detailed balance sheet movements for the

key sections within the balance sheet [required to support

12 automated cash flow requirements]. How would balance sheet

movements be loaded/input if not available directly from the

source GL's, would users be able to do this via pre-configured

forms and uploaders ? Yes source systems are capable of supporting automation. We

Analytics - What are the key business performance drivers have in the past used upload sheets to capture External

within IDC ? Brand/Product/Market/Line of Business/Cost subsidiaries information and have exported internal IDC

Centre/Geographic etc. ? information for upoading. In terms of analytics, SBU(Industry),

Technical Region and Segment (IFRS 8)

Automated Calculation Scripts - Which calculations should the

reporting solution provide ? :

100% calculated cashflows at all reporting levels. Pleases

confirm if automated cashflows are required an dif so which

13 type/(s) i.e. statutory/management.

Opening balance B/Fwd on all balance sheet accounts Automated Cash Flows would be ideal. Cash flow utilises both

P&L to Balance Sheet movement feeds [i.e. net profit, Income statement items and Balance sheets movements and

depreciation, impairment etc] balances, and the reporting tool should be able to pull required

KPI's LFL and other key management reporting calculations fields that facilitate cash flow automation. Cash flow statements

Integrated acquisition and disposal accounting ? Technical should be similar for both Management and Statutory.

Consolidation -

Is automated elimination of Investments in Subs within the

group Holding Co's against the carrying 'Pre-Acq' value of

equity in the owned subsidiaries required as a primary

function ? Can IDC's existing data sets separate out Pre and

Post acquisition content of equity in order to support the

automated consolidation eliminations within the entity

hierarchy ?

Are fully automated eliminations by the reporting solution based

upon holding Co/Subsidiary ownership hierarchy and at the

strategic consolidation points in the hierarchy required as part

14 of the design ?

Is it only at the total group level that there is a requirement for Elimination is required.

external reporting or are there any external reporting Yes data is available for pre and post.

requirements at sub-group levels? Currently all elimination calculations happen outside of any

Does IDC's entity hierarchy contain JV's, Associates, system (Manually). Automated eliminations would be ideal.

Minorities ? If yes, Is full automated accounting eliminations External reporting requirements are required at Group level

and accounting consolidation processes required for all of these twice a year (JSE Listed Instruments), Monthly management

types within the reporting solution ? accounts (in line with IFRS) are required to adequately report on

For intercompany reporting, do the IDC's source systems loan covenants.

currently provide 100% intercompany partner identification for IDC Heirarchy has Subsidiaries, JV's, Associates, Partnerships

all of the intercompany enabled accounts, intended to be and Investments - consolidation processes are required.

hosted within the new system chart of accounts. IDC Sources systems currently do not provide 100%

Technical intercompany identification.

Translation -

The RFP states that translation is required within a multi-

currency app. How many currencies need to be supported. Is

the requirement for the system to work with average YTD or

average periodic rates to support the translation of income

statement and cash flow.

15 Is there a requirement to provide for historic rates on opening

equity, investment and goodwill [others].

Is there a requirement to provide automated CTA translation

calculations directly to a nominated CTA account within the

equity section of the balance sheet ?

Is there a requirement for constant rate translations i.e.

Budget/Forecast @ Actual rates to facilitate operational Less than 5 currencies, USD, Euro, Malawian Kwacha, Ethopian

variance reporting excl effects of FX Birr. Historic rates are required. Budget/Forecast rates not

Technical required.

no reviews yet

Please Login to review.