296x Filetype XLS File size 0.06 MB Source: www.core-ct.state.ct.us

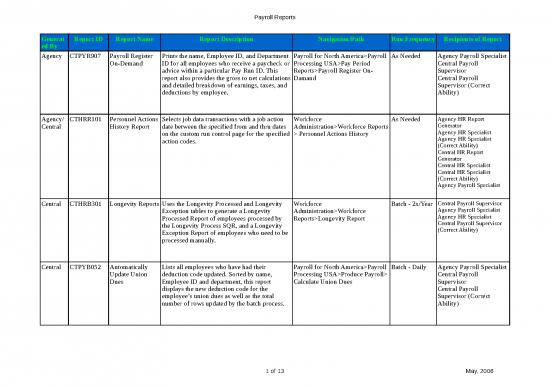

Payroll Reports

Generat Report ID Report Name Report Description Navigation/Path Run Frequency Recipients of Report

ed By

Agency CTPYR907 Payroll Register Prints the name, Employee ID, and Department Payroll for North America>Payroll As Needed Agency Payroll Specialist

On-Demand ID for all employees who receive a paycheck or Processing USA>Pay Period Central Payroll

advice within a particular Pay Run ID. This Reports>Payroll Register On- Supervisor

report also provides the gross to net calculations Damand Central Payroll

and detailed breakdown of earnings, taxes, and Supervisor (Correct

deductions by employee. Ability)

Agency/ CTHRR101 Personnel Actions Selects job data transactions with a job action Workforce As Needed Agency HR Report

Central History Report date between the specified from and thru dates Administration>Workforce Reports Generator

on the custom run control page for the specified > Personnel Actions History Agency HR Specialist

action codes. Agency HR Specialist

(Correct Ability)

Central HR Report

Generator

Central HR Specialist

Central HR Specialist

(Correct Ability)

Agency Payroll Specialist

Central CTHRB301 Longevity Reports Uses the Longevity Processed and Longevity Workforce Batch - 2x/Year Central Payroll Supervisor

Exception tables to generate a Longevity Administration>Workforce Agency Payroll Specialist

Processed Report of employees processed by Reports>Longevity Report Agency HR Specialist

the Longevity Process SQR, and a Longevity Central Payroll Supervisor

Exception Report of employees who need to be (Correct Ability)

processed manually.

Central CTPYB052 Automatically Lists all employees who have had their Payroll for North America>Payroll Batch - Daily Agency Payroll Specialist

Update Union deduction code updated. Sorted by name, Processing USA>Produce Payroll> Central Payroll

Dues Employee ID and department, this report Calculate Union Dues Supervisor

displays the new deduction code for the Central Payroll

employee’s union dues as well as the total Supervisor (Correct

number of rows updated by the batch process. Ability)

1 of 13 May, 2006

Payroll Reports

Generat Report ID Report Name Report Description Navigation/Path Run Frequency Recipients of Report

ed By

Central CTPYB061 Batch Parameter Creates an output report detailing the target run Payroll for North America>Payroll Batch - Daily Central Payroll

Update control records that have been processed by this Processing USA>Produce Payroll> Supervisor

program. This report indicates the run control Batch Parameter Update Central Payroll

table, process name, run control ID, and the Supervisor (Correct

various parameters attached to this record. Ability)

Central CTPYB467 Additional Pay Provides a detailed listing by employee of both Payroll for North America>Payroll Batch - Bi- Agency Payroll Specialist

Redistribution the original rows and the new rows inserted into Processing USA > Additional Pay weekly Central Payroll

the database when this program is executed. In Redistribution Supervisor

addition, this control report should have a sub- Central Payroll

total for the dollars contained in the rows Supervisor (Correct

deleted from PAY_ERN_DIST and the Ability)

redistributed rows. Then, the sub-totals should

be added together to reach a grand total. This

grand total is zero because the total dollars

deleted from PAY_ERN_DIST are the same as

the total hours redistributed and inserted into

the record.

Central CTPYI469 Direct Deposit Pre Allows Central Payroll and the agencies the Payroll for North America>Payroll Batch - Daily Central Payroll Report

Note Inbound ability to review the erroneous data that was Processing USA > Create Direct Generator

Interface sent to the bank by the Direct Deposit Deposits > Prenote Error Flag Central Payroll

Transmittal File process (DDP001). Process Supervisor

Central CTPYOI02B Employee Creates the XML deduction remittance files and Payroll for North America>Payroll Batch - Bi- Central Payroll

Deductions a report for each of the vendors that receive a Processing USA > Deduction weekly Supervisor

Remittance File file. This report is used to keep a record of the Remittance Outbound Central Payroll

and Report information contained in the XML files. Supervisor (Correct

Ability)

2 of 13 May, 2006

Payroll Reports

Generat Report ID Report Name Report Description Navigation/Path Run Frequency Recipients of Report

ed By

Central CTPYR058 Dual Retirement Verifies that a single employee is not set up to Payroll for North America>Payroll Batch - Bi- Central Payroll

Maintenance participate in multiple retirement plans that do Processing USA>Pay Period weekly Supervisor

not meet the exceptions described in this report. Reports > Dual Retirement Report Central Payroll

For every employee found with multiple Supervisor (Correct

retirement plans, the report lists their name, ID, Ability)

Department, and all retirement plans they are HR Auditor Functional

currently enrolled in.

Central CTPYR401 Detailed Provides detailed information on employee’s Payroll for North America>Payroll As Needed Central Payroll

Employee earnings, taxes, deductions and net pay per Processing USA>Pay Period Supervisor

Earnings Report period over a specific time line in order to Reports> Employee Detailed Central Payroll

compile this information for the requesting Earnings Supervisor (Correct

party. Ability)

Central Payroll Report

Generator

HR Auditor Functional

Central CTPYR452 Direct Deposit Displays the employee name, Employee ID, Payroll for North America>Payroll Batch - Bi- Central Payroll

Register check date, department ID, advice number, Processing USA > Create Direct weekly Supervisor

check amount, direct deposit account type, Deposits > Direct Deposit Register Central Payroll

transit #, account number, and deposit amount Supervisor (Correct

sorted by employee bank name. Totals are Ability)

provided for both the deposit amounts and the Central Payroll Report

penny pre-note transactions. A grand total Generator

section is also created at the end of the report to HR Auditor Functional

show the total deposit and pre-note amounts,

the total deposit amounts, and the total pre-note

amounts individually.

3 of 13 May, 2006

Payroll Reports

Generat Report ID Report Name Report Description Navigation/Path Run Frequency Recipients of Report

ed By

Central CTPYR455 Deductions in Summarizes information for employees with Payroll for North America>Payroll Batch - Daily Agency Payroll Specialist

Arrears Report deductions in arrears. Each deduction code, Processing USA>Pay Period after Pay Central Payroll

description, plan type, employee ID, benefit Reports > Deductions in Arrears Calculation/ Supervisor

record number, name, and arrears balance are Confirmation Central Payroll

listed. Separate totals are listed by each Supervisor (Correct

deduction code, department, company, and a Ability)

grand total for all companies processed in the Central Payroll Report

report. Generator

HR Auditor Functional

Central CTPYR456 Deductions Not Summarizes information for employees with Payroll for North America>Payroll Batch - Daily Agency Payroll Specialist

Taken deductions not taken for a pay period. If more Processing USA>Pay Period after Pay Central Payroll

than one pay period is being processed due to Reports> Deductions Not Taken Calculation/ Supervisor

multiple pay frequencies during a given pay Confirmation Central Payroll

cycle, there are separate totals for each unique Supervisor (Correct

pay end date. Each employee ID, name, Ability)

paygroup, deduction code, description, benefit Central Payroll Report

record number, amount not taken, added to Generator

arrears (yes or no), arrears balance, and check HR Auditor Functional

number are listed. Separate totals for the

Amounts not Taken and Arrears Balance

columns are listed by pay period, department,

company, and a grand total for all companies

processed in the report.

Central CTPYR458 Payroll Summary Summarizes, on separate pages, information for Payroll for North America>Payroll Batch - Daily Agency Payroll Specialist

paycheck amounts, regular earnings amounts, Processing USA>Pay Period after Pay Central Payroll

special accumulator amounts, employee Reports > Payroll Summary Calculation/ Supervisor

deduction amounts, employer contribution Confirmation Central Payroll

amounts, employee/employer tax amounts, and Supervisor (Correct

other earnings amounts. Ability)

4 of 13 May, 2006

no reviews yet

Please Login to review.