214x Filetype XLS File size 0.11 MB Source: www.andrews.edu

Sheet 1: Blank

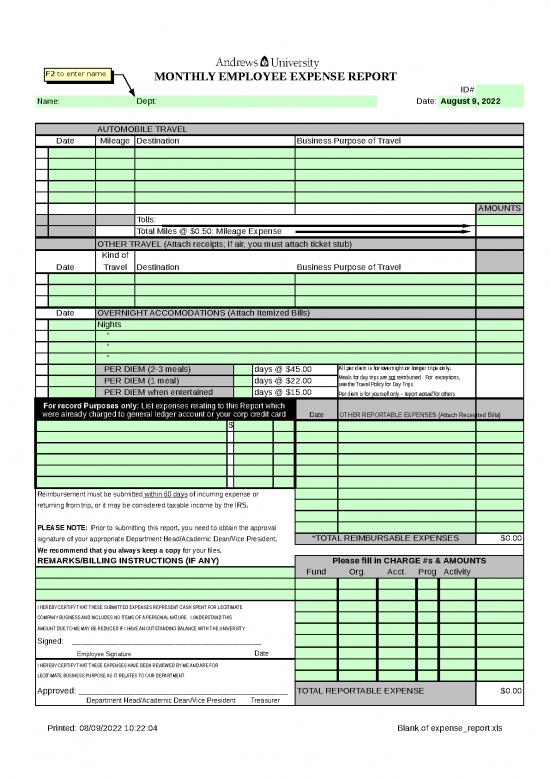

| USAGE INSTRUCTIONS | |||||||||||||||

| ID# | |||||||||||||||

|

|

Dept: | Date: | August 9, 2022 | ||||||||||||

| AUTOMOBILE TRAVEL | |||||||||||||||

| Date | Mileage | Destination | Business Purpose of Travel | ||||||||||||

| AMOUNTS | |||||||||||||||

| Tolls: | cents per mile | ||||||||||||||

| Total Miles @ $0.50: Mileage Expense | 0.50 | ||||||||||||||

| OTHER TRAVEL (Attach receipts; if air, you must attach ticket stub) | |||||||||||||||

| Kind of | |||||||||||||||

| Date | Travel | Destination | Business Purpose of Travel | ||||||||||||

| Date | OVERNIGHT ACCOMODATIONS (Attach Itemized Bills) | ||||||||||||||

| Nights | |||||||||||||||

| " | |||||||||||||||

| " | |||||||||||||||

| " | per diem | ||||||||||||||

| PER DIEM (2-3 meals) | days @ $45.00 | 45.00 | |||||||||||||

| PER DIEM (1 meal) | days @ $22.00 | 22.00 | |||||||||||||

| PER DIEM when entertained | days @ $15.00 | 15.00 | |||||||||||||

| For record Purposes only: List expenses relating to this Report which were already charged to general ledger account or your corp credit card | Date | OTHER REPORTABLE EXPENSES (Attach Receipted Bills) | |||||||||||||

| $ | |||||||||||||||

| Reimbursement must be submitted within 60 days of incurring expense or | |||||||||||||||

| returning from trip, or it may be considered taxable income by the IRS. | |||||||||||||||

| PLEASE NOTE: Prior to submitting this report, you need to obtain the approval | |||||||||||||||

| signature of your appropriate Department Head/Academic Dean/Vice President. | *TOTAL REIMBURSABLE EXPENSES | $0.00 | |||||||||||||

| We recommend that you always keep a copy for your files. | |||||||||||||||

| REMARKS/BILLING INSTRUCTIONS (IF ANY) | Please fill in CHARGE #s & AMOUNTS | ||||||||||||||

| Fund | Org. | Acct. | Prog | Activity | |||||||||||

| I HEREBY CERTIFY THAT THESE SUBMITTED EXPENSES REPRESENT CASH SPENT FOR LEGITIMATE | |||||||||||||||

| COMPANY BUSINESS AND INCLUDES NO ITEMS OF A PERSONAL NATURE. I UNDERSTAND THIS | |||||||||||||||

| AMOUNT DUE TO ME MAY BE REDUCED IF I HAVE AN OUTSTANDING BALANCE WITH THE UNIVERSITY | |||||||||||||||

| Signed: ____________________________________________ | |||||||||||||||

| Employee Signature | Date | ||||||||||||||

| I HEREBY CERTIFY THAT THESE EXPENSES HAVE BEEN REVIEWED BY ME AND ARE FOR | |||||||||||||||

| LEGITIMATE BUSINESS PURPOSE AS IT RELATES TO OUR DEPARTMENT | |||||||||||||||

| Approved: ____________________________________________ | TOTAL REPORTABLE EXPENSE | $0.00 | |||||||||||||

| Department Head/Academic Dean/Vice President Treasurer | |||||||||||||||

| * This amount may be reduced if there is an outstanding balance due to the university. | |||||||||||||||

| Attach ORIGINAL, itemized receipts showing detail of purchase and method of payment. Label each with business purpose and acct # to charge. | |||||||||||||||

| Do not submit Order Confirmations or Credit Card charge slip showing only the total as these are not adequate proof or enough detail of an expenditure | |||||||||||||||

no reviews yet

Please Login to review.