368x Filetype XLSX File size 0.04 MB Source: uwosh.edu

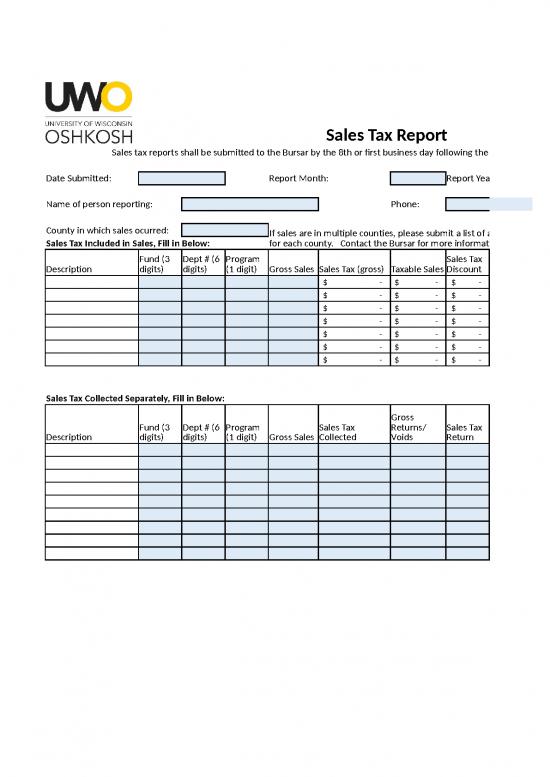

Sales Tax Report

Sales tax reports shall be submitted to the Bursar by the 8th or first business day following the 8th of each month.

Date Submitted: Report Month: Report Year:

Name of person reporting: Phone:

County in which sales ocurred: If sales are in multiple counties, please submit a list of all counties and the amount of sales

Sales Tax Included in Sales, Fill in Below: for each county. Contact the Bursar for more information.

Fund (3 Dept # (6 Program Sales Tax

Description digits) digits) (1 digit) Gross Sales Sales Tax (gross) Taxable Sales Discount

$ - $ - $ -

$ - $ - $ -

$ - $ - $ -

$ - $ - $ -

$ - $ - $ -

$ - $ - $ -

$ - $ - $ -

Sales Tax Collected Separately, Fill in Below:

Gross

Fund (3 Dept # (6 Program Sales Tax Returns/ Sales Tax

Description digits) digits) (1 digit) Gross Sales Collected Voids Return

Sales Tax Report

Sales tax reports shall be submitted to the Bursar by the 8th or first business day following the 8th of each month.

Report Year:

If sales are in multiple counties, please submit a list of all counties and the amount of sales

for each county. Contact the Bursar for more information.

Net Sales

Tax

$ -

$ -

$ -

$ -

$ -

$ -

$ -

Sales not

subject to Net Taxable Gross Sales Sales Tax Net Sales

tax Sales Tax Discount Tax

$ - $ - 0 $ -

$ - $ - 0 $ -

$ - $ - 0 $ -

$ - $ - 0 $ -

$ - $ - 0 $ -

$ - $ - 0 $ -

$ - $ - 0 $ -

$ - $ - 0 $ -

$ - $ - 0 $ -

no reviews yet

Please Login to review.