210x Filetype XLS File size 1.07 MB Source: ec.europa.eu

Sheet 1: 0 Guidelines

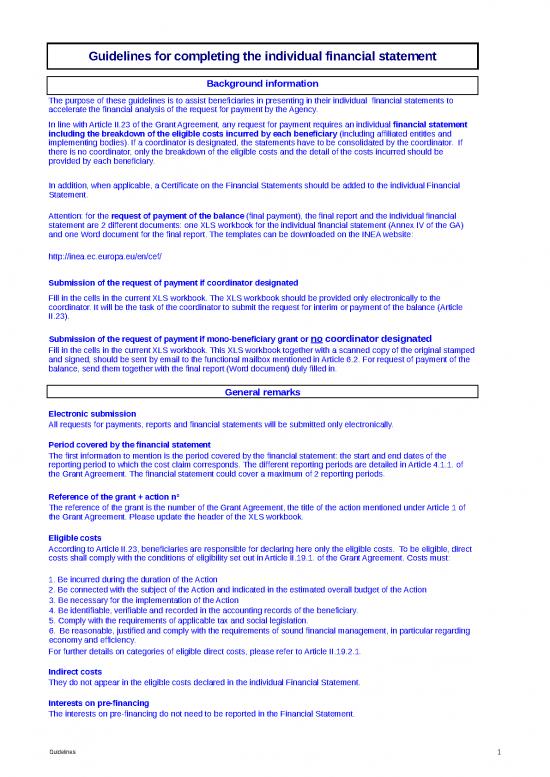

| Guidelines for completing the individual financial statement |

| Background information |

| The purpose of these guidelines is to assist beneficiaries in presenting in their individual financial statements to accelerate the financial analysis of the request for payment by the Agency. |

| In line with Article II.23 of the Grant Agreement, any request for payment requires an individual financial statement including the breakdown of the eligible costs incurred by each beneficiary (including affiliated entities and implementing bodies). If a coordinator is designated, the statements have to be consolidated by the coordinator. If there is no coordinator, only the breakdown of the eligible costs and the detail of the costs incurred should be provided by each beneficiary. |

| In addition, when applicable, a Certificate on the Financial Statements should be added to the individual Financial Statement. |

| Attention: for the request of payment of the balance (final payment), the final report and the individual financial statement are 2 different documents: one XLS workbook for the individual financial statement (Annex IV of the GA) and one Word document for the final report. The templates can be downloaded on the INEA website: |

| http://inea.ec.europa.eu/en/cef/ |

| Submission of the request of payment if coordinator designated |

| Fill in the cells in the current XLS workbook. The XLS workbook should be provided only electronically to the coordinator. It will be the task of the coordinator to submit the request for interim or payment of the balance (Article II.23). |

| Submission of the request of payment if mono-beneficiary grant or no coordinator designated |

| Fill in the cells in the current XLS workbook. This XLS workbook together with a scanned copy of the original stamped and signed, should be sent by email to the functional mailbox mentioned in Article 6.2. For request of payment of the balance, send them together with the final report (Word document) duly filled in. |

| General remarks |

| Electronic submission |

| All requests for payments, reports and financial statements will be submitted only electronically. |

| Period covered by the financial statement |

| The first information to mention is the period covered by the financial statement: the start and end dates of the reporting period to which the cost claim corresponds. The different reporting periods are detailed in Article 4.1.1. of the Grant Agreement. The financial statement could cover a maximum of 2 reporting periods. |

| Reference of the grant + action n° |

| The reference of the grant is the number of the Grant Agreement, the title of the action mentioned under Article 1 of the Grant Agreement. Please update the header of the XLS workbook. |

| Eligible costs |

| According to Article II.23, beneficiaries are responsible for declaring here only the eligible costs. To be eligible, direct costs shall comply with the conditions of eligibility set out in Article II.19.1. of the Grant Agreement. Costs must: |

| 1. Be incurred during the duration of the Action |

| 2. Be connected with the subject of the Action and indicated in the estimated overall budget of the Action |

| 3. Be necessary for the implementation of the Action |

| 4. Be identifiable, verifiable and recorded in the accounting records of the beneficiary. |

| 5. Comply with the requirements of applicable tax and social legislation. |

| 6. Be reasonable, justified and comply with the requirements of sound financial management, in particular regarding economy and efficiency. |

| For further details on categories of eligible direct costs, please refer to Article II.19.2.1. |

| Indirect costs |

| They do not appear in the eligible costs declared in the individual Financial Statement. |

| Interests on pre-financing |

| The interests on pre-financing do not need to be reported in the Financial Statement. |

| Explanations about the detailed costs incurred |

| Drop-down menus |

| In several places, drop-down menus are used to standardise entries. |

| Beneficiary/implementing bodies/affiliated entities |

| Indicate which kind of entity is claiming the costs: it should be the beneficiary itself or an implementing body or an affiliated entity. |

| Type of procurement contract |

| It should be selected among the following: services OR supplies OR works OR not applicable (for example: staff costs). |

| Short description of the cost claimed |

| Provide a short description of the nature of the costs incurred in line with your accounting records. If an invoice concerns more than one activity, its value should be broken down and reported under each of the activities concerned, with a distinct accounting number for each activity. |

| Supplier |

| This refers to the supplier of services or works and supplies. Insert one line for every accounting entry. When there is no supplier and the task was performed by your own personnel, please describe the nature of the task. |

| Date of the invoice |

| This is the date indicated by the supplier on the invoice. When there is no external invoice (such as for tasks performed by its own staff), please report the date of registering the cost into the accounting system. |

| Unique Accounting number |

| This is a unique number identifying the invoice in your accounting records. |

| Internal reference of the procurement contract |

| If available, provide the internal reference of the procurement contract. |

| VAT (in EUR) |

| The VAT can be declared as eligible costs only if it cannot be deducted or recovered by the beneficiary under the applicable national VAT legislation. |

| Amount in EUR |

| Financial statements shall be drafted only in euro. The amounts mentioned in national currency are only given for information. For beneficiary not using euros, there is the obligation to use the average of the daily exchange rates published in the C series of OJEU, determined over the corresponding reporting period. Please refer to Article II.23.4 . of the Grant Agreement. http://ec.europa.eu/budget/contracts_grants/info_contracts/inforeuro/inforeuro_en.cfm |

| Receipts & certification by EU Member States |

| It should be only filled in for the payment of the balance. The certification does not apply for beneficiaries outside the European Union. |

| If you have any additional questions related to these guidelines and the template, please contact the Agency at to the functional mailbox mentioned in Article 6.2. |

| Individual financial statement (applicable for each request of payment) | ||||

| Period covered by this report: | From: | To: | ||

| 1. GENERAL INFORMATION (to be filled in by each beneficiary) | ||||

| Grant Agreement Nº | INEA/CEF/…. | |||

| Action Title | ||||

| Energy sector/ transport mode (if applicable) | ||||

| PCI (if applicable) | ||||

| Start date of the action: (as indicated in the GA) | End date of the action: (as indicated in the GA) | |||

| Author of the individual financial statement | ||||

| Name | ||||

| Position | ||||

| Beneficiary's Legal Name | ||||

| Telephone Nº | ||||

| Certification by the Beneficiary (only applicable if no coordinator or if mono-beneficiary grant) | ||||

| Name | ||||

| Position | ||||

| Entity | ||||

| Telephone Nº | ||||

| The Beneficiary certifies that: | ||||

| 1) the information provided in the request of payment is complete, reliable and true (Article II.23.2); | ||||

| 2) the costs declared are real and eligible in accordance with the Agreement and that the request for payment is substantiated by adequate supporting documents that can be produced in the context of the checks or audits described in Article II.27; | ||||

| 3) in case of payment of the balance, all the receipts referred to in the GA Article II.25.3.2 have been declared. | ||||

| Date and Signature | ||||

| Stamp (optional) | ||||

| 2. Details of the eligible costs incurred by each beneficiary (Article II.23.2) | ||||||||||

| National currency used by the beneficiary | ||||||||||

| Total direct costs claimed for all activities in EUR | 0.00 € | |||||||||

| Activity Nº according to the cost breakdown of the grant | Beneficiary/implementing bodies/affiliated entities | Type of procurement contract (services/supplies/works/not applicable) | Short description of the cost claimed | Supplier | Date of invoice | Unique Accounting number | Internal reference of the procurement contract | If applicable, amount in national currency (excl. VAT) | VAT (in EUR) | Amount in EUR (excl. VAT) |

no reviews yet

Please Login to review.