209x Filetype XLSX File size 2.10 MB Source: eba.europa.eu

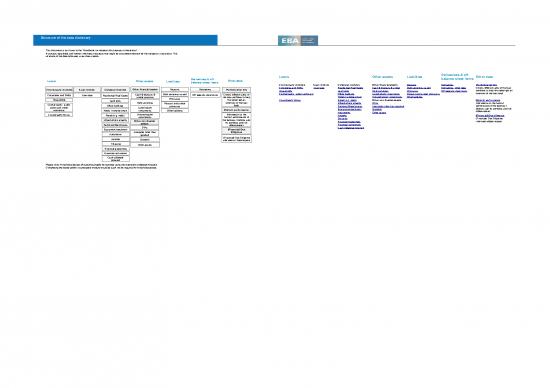

Structure of the data dictionary

This document is an Annex to the "Handbook on valuation for purposes of resolution".

It contains data fields and further information requests that might be considered relevant for the valuation in resolution. The

structure of the data dictionary is as shown below.

Loans Other assets Liabilities Derivatives & off- Other data

Derivatives & off- balance sheet items

Loans Other assets Liabilities balance sheet items Other data

Counterparty modules Loan module Collateral modules Other financial assets Deposits Derivatives Portfolio level info

Other financial assets Deposits Derivatives Corporates and SMEs Loan tape Residential Real Estate Cash & deposits & similar Debt securities issued Derivatives -other data Covers different splits of the loan

Counterparty modules Loan module Collateral modules Portfolio level info Households Land plots Debt securities Provisions Off-balance sheet items portfolios to help the valuer get an

Cash & deposits & Debt securities issued Off-balance sheet items Covers different splits of Central banks, public sector and credit institutions Office buildings Listed equity investments Pension and similar provisions overview of the loan book

Corporates and SMEs Loan tape Residential Real Estate

similar positions the loan portfolios to help Hotels / entertainment Unlisted equity investments Other liabilities

Households Provisions the valuer get an Counterparty Group Retail (e.g. malls) Other non-finacial assets Historic performance

Land plots overview of the loan

Debt securities Pension and similar Infrastructure projects DTAs Information on the historic

Central banks, public Office buildings provisions book Factories/Warehouses Intangible other than goodwill performance of the facilities /

sector and credit Listed equity debtors split by portfolios and risk

institutions Hotels / entertainment investments Other liabilities Historic performance Equipment/machinery Goodwill

Automotive Other assets differentiators

Counterparty Group Retail (e.g. malls) Unlisted equity Information on the Aircrafts (Financial) Due diligence

investments historic performance of Shipping (Financial) Due Diligence

Infrastructure projects Other non-finacial the facilities / debtors split Financial guarantees information/data request

assets by portfolios and risk

Factories/Warehouses differentiators Financial instruments

DTAs Cash collateral received

Equipment/machinery (Financial) Due

Intangible other than Diligence

Automotive goodwill

Aircrafts (Financial) Due Diligence

Goodwill information / data request

Shipping Other assets

Financial guarantees

Financial instruments

Cash collateral

received

Please note: Foreclosed assets should presumably be reported using the respective collateral modules.

Completing the facility and/or counterparty module would as such not be required for foreclosed assets.

Approach to link the counterparty, loan, collateral and other modules

Considering the unique identifiers:

The below approach can be used to link the different modules in this data dictionary. Such links would presumable be made in separate "linking tables", like in the examples below.

I.e. the links between e.g. loans and collaterals would not be made in neither the loan nor collateral table, but in separate tables, using identifiers of the different parts to be linked.

Unique identifier Description

Counterparty Identifier (ID) Institution's unique internal identifier for the counterparty, as reported in the applicable counterparty table.

A counterparty can be the counterparty of a loan, but also e.g. the tenant of a real estate asset, the provider of a guarantee or similar.

Counterparty Group Identifier (ID) Institution's unique internal identifier for the Counterparty Group, as reported in the Counterparty Group table.

Contract Identifier (ID) Institutions internal identifier for e.g. a loan (loan table) or for e.g. deposits held with third parties (table "Cash & deposits & similar").

The Contract ID is similarly applicable to commitments or financial guarantees provided (off balance sheet positions).

Collateral Identifier (ID) Institutions internal identifier for the collateral, as reported in the applicable collateral table

A guarantee received from a third party would similarly have a Collateral ID.

Unique internal identifier (ID) for a liability A deposit held with the institution would be identified through its internal identifier for respective liability.

Table 1: linking the Counterparty, Counterparty Group and loan (the latter identified through a Contract ID)

Relationship definitions:

- A contract (i.e. a loan, loan commitment provided, financial guarantee provided, deposit held with a third party) can have one or more counterparty/ies,

- one counterparty can have many loan or similar contracts (loans, deposit held with third parties, loan commitments or finanial guarantees provided),

- a counterparty can be, but does not have to be, part of a counterparty group.

Example: Counterparties A and B are part of the same counterparty group and have each two loans.

Counterparty ID Counterparty Group Contract ID

Counterparty_A CG_4156 C_0011, C_3201

Counterparty_B CG_4156 C_2204, C_4002

Counterparty_C n/a C_5010

Example: The links between these identifiers could be reported in the following way in the linking table:

Counterparty ID Counterparty Group Contract ID

Counterparty_A CG_4156 C_0011

Counterparty_A CG_4156 C_3201

Counterparty_B CG_4156 C_2204

Counterparty_B CG_4156 C_4002

Counterparty_C n/a C_5010

Table 2: linking e.g. loans (i.e. Contract IDs) and collaterals (i.e. Collateral IDs), and at the same time considering an institution's lien position

Relationship definitions:

- A loan, loan commitment provided, financial guarantee provided or deposit held with a third party can have multiple collaterals,

- a collateral (e.g. a real estate asset) might be used as collateral for several contracts,

- how much of the collateral's value can "effectively" be used also depends on an institution's position in the waterfall in case it does not have a first lien position.

Example: Several loans are collaterallised by different collaterals. The institution does not have the first lien for all of these collaterals.

Contract ID Collateral ID

C_0011 Col_VVAA: first lien (100% of the collateral can be used by the bank), collateral used in full for this one loan

C_3201 Col_DDBB: second lien, 50% of the collateral's value (according to the waterfall) effectively collateralise 20% of the loan.

C_2204, C_4002 Col_KKQQ: first lien (100% of the collateral can be used by the bank); 100% of loan C_2204 and 20% of loan C_4002 are collateralised

C_5010 Col_PPRRR: first lien (100% of it can be used by the bank), collateral used in full for this loan (only 50% of the loan are collateralised)

C_5010 Col_TTTUU: second lien, 20% of the collateral's value (according to the waterfall) effectively collateralise the remaining 50% of the loan.

Example: The links between these identifiers could be reported in the following way in the linking table:

Facility ID Collateral ID Lien: waterfall position % of total loan are collateralised

C_0011 Col_VVAA 100% 100%

C_3201 Col_DDBB 50% 20%

C_2204 Col_KKQQ 100% 100%

C_4002 Col_KKQQ 100% 20%

C_5010 Col_PPRRR 100% 50%

C_5010 Col_TTTUU 20% 50%

Table 3: linking a guarantee received (i.e. Collateral ID) with the guarantor (i.e. the guarantor being a counterparty with a Counterparty ID)

Relationship definitions:

- A contract (here: a guarantee received) can only have one counterparty,

- one counterparty can have provided several guarantees,

- the assumptions regarding counterparty groups apply similarly to Table 1.

Example: Counterparties A and B are providers of guarantees.

Counterparty ID Collateral ID (here: guarantees received)

Counterparty_A G_5041, G_5045

Counterparty_B G_7011

Example: The links between these identifiers could be reported in the following way in the linking table:

Counterparty ID Collateral ID

Counterparty_A G_5041

Counterparty_A G_5045

Counterparty_B G_7011

Table 4: linking real estate assets (here: flats rented to third parties) with their tenants (i.e. the tenants as counterparties)

Relationship definitions:

- A flat (here: a guarantee received) can have one tenant as counterparty,

- one counterparty can rent several flats (and then sub-rent them or doing other business there),

- the assumptions regarding counterparty groups apply similarly to Table 1.

Example: Counterparties A and B are tenants of flats, which are collaterals received by the institution.

Counterparty ID Collateral ID (here: flat used as collateral)

Counterparty_A FL_1001

Counterparty_B FL_2001, FL_3001

Example: The links between these identifiers could be reported in the following way in the linking table:

Counterparty ID Collateral ID

Counterparty_A FL_1001

Counterparty_B FL_2001

Counterparty_B FL_3001

Table 5: linking loans (i.e. Contract IDs) with deposits (identified through the "unique internal identifier for the liability") in case of a netting agreement or similar

This example assumes that a client's deposit at the institution is considered as a guarantee for the loan provided to this (or another) client.

Institution's unique internal identifier for the liability

Relationship definitions:

- For instance a loan can be collateralised (or e.g. similarly considered as "netted") with one or several deposits at the institution,

- one deposit (i.e. Contract ID) might be used as collateral for several loans,

- the respective loans and deposits would not need to have the same counterparties (on linking loans and counterparties see Table 1),

Example: Loan contrats and deposit contracts, which could e.g. be netted (the deposit as such be a guarantee like instrument for respective loan).

Contract ID Unique internal identifier (ID) for the liability

C_00110 L_1001, L_2001

C_32010 L_3001

C_22040, C_40020 L_4001

Example: The links between these identifiers could be reported in the following way in the linking table:

Contract ID ID for the liability

C_00110 L_1001

C_00110 L_2001

C_32010 L_3001

C_22040 L_4001

C_40020 L_4001

no reviews yet

Please Login to review.