233x Filetype XLSX File size 0.03 MB Source: bankaslovenije.blob.core.windows.net

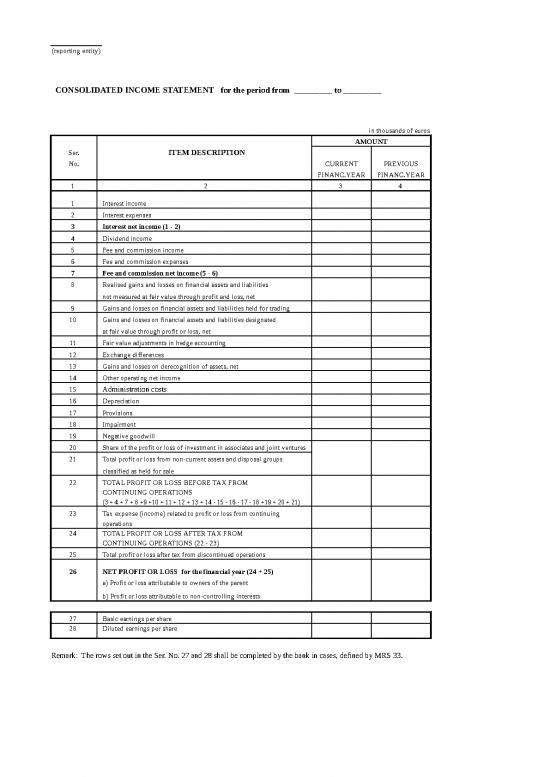

(reporting entity)

CONSOLIDATED INCOME STATEMENT for the period from _________ to _________

in thousands of euros

AMOUNT

Ser. ITEM DESCRIPTION

No. CURRENT PREVIOUS

FINANC.YEAR FINANC.YEAR

1 2 3 4

1 Interest income

2 Interest expenses

3 Interest net income (1 - 2)

4 Dividend income

5 Fee and commission income

6 Fee and commission expenses

7 Fee and commission net income (5 - 6)

8 Realised gains and losses on financial assets and liabilities

not measured at fair value through profit and loss, net

9 Gains and losses on financial assets and liabilities held for trading

10 Gains and losses on financial assets and liabilities designated

at fair value through profit or loss, net

11 Fair value adjustments in hedge accounting

12 Exchange differences

13 Gains and losses on derecognition of assets, net

14 Other operating net income

15 Administration costs

16 Depreciation

17 Provisions

18 Impairment

19 Negative goodwill

20 Share of the profit or loss of investment in associates and joint ventures

21 Total profit or loss from non-current assets and disposal groups

classified as held for sale

22 TOTAL PROFIT OR LOSS BEFORE TAX FROM

CONTINUING OPERATIONS

(3 + 4 + 7 + 8 +9 +10 + 11 + 12 + 13 + 14 - 15 - 16 - 17 - 18 +19 + 20 + 21)

23 Tax expense (income) related to profit or loss from continuing

operations

24 TOTAL PROFIT OR LOSS AFTER TAX FROM

CONTINUING OPERATIONS (22 - 23)

25 Total profit or loss after tax from discontinued operations

26 NET PROFIT OR LOSS for the financial year (24 + 25)

a) Profit or loss attributable to owners of the parent

b) Profit or loss attributable to non-controlling interests

27 Basic earnings per share

28 Diluted earnings per share

Remark: The rows set out in the Ser. No. 27 and 28 shall be completed by the bank in cases, defined by MRS 33.

no reviews yet

Please Login to review.