307x Filetype XLSX File size 0.57 MB Source: artdesign.gsu.edu

Sheet 1: Instructions

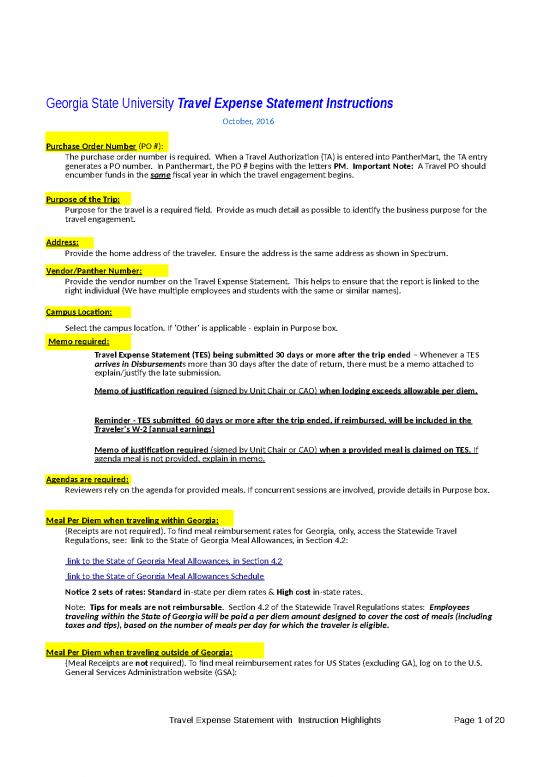

| Georgia State University Travel Expense Statement Instructions | |||||||||||

| October, 2016 | |||||||||||

| Purchase Order Number (PO #): | |||||||||||

| The purchase order number is required. When a Travel Authorization (TA) is entered into PantherMart, the TA entry generates a PO number. In Panthermart, the PO # begins with the letters PM. Important Note: A Travel PO should encumber funds in the same fiscal year in which the travel engagement begins. | |||||||||||

| Purpose of the Trip: | |||||||||||

| Purpose for the travel is a required field. Provide as much detail as possible to identify the business purpose for the travel engagement. | |||||||||||

| Address: | |||||||||||

| Provide the home address of the traveler. Ensure the address is the same address as shown in Spectrum. | |||||||||||

| Vendor/Panther Number: | |||||||||||

| Provide the vendor number on the Travel Expense Statement. This helps to ensure that the report is linked to the right individual (We have multiple employees and students with the same or similar names). | |||||||||||

| Campus Location: | |||||||||||

| Select the campus location. If 'Other' is applicable - explain in Purpose box. | |||||||||||

| Memo required: | |||||||||||

| - | Travel Expense Statement (TES) being submitted 30 days or more after the trip ended – Whenever a TES arrives in Disbursements more than 30 days after the date of return, there must be a memo attached to explain/justify the late submission. | ||||||||||

| - | Memo of justification required (signed by Unit Chair or CAO) when lodging exceeds allowable per diem. | ||||||||||

| - | Reminder - TES submitted 60 days or more after the trip ended, if reimbursed, will be included in the Traveler's W-2 [annual earnings] | ||||||||||

| - | Memo of justification required (signed by Unit Chair or CAO) when a provided meal is claimed on TES. If agenda meal is not provided, explain in memo. | ||||||||||

| Agendas are required: | |||||||||||

| Reviewers rely on the agenda for provided meals. If concurrent sessions are involved, provide details in Purpose box. | |||||||||||

| Meal Per Diem when traveling within Georgia: | |||||||||||

| (Receipts are not required). To find meal reimbursement rates for Georgia, only, access the Statewide Travel Regulations, see: link to the State of Georgia Meal Allowances, in Section 4.2: | |||||||||||

| link to the State of Georgia Meal Allowances, in Section 4.2 | |||||||||||

| link to the State of Georgia Meal Allowances Schedule | |||||||||||

| Notice 2 sets of rates: Standard in-state per diem rates & High cost in-state rates. | |||||||||||

| Note: Tips for meals are not reimbursable. Section 4.2 of the Statewide Travel Regulations states: Employees traveling within the State of Georgia will be paid a per diem amount designed to cover the cost of meals (including taxes and tips), based on the number of meals per day for which the traveler is eligible. | |||||||||||

| Meal Per Diem when traveling outside of Georgia: | |||||||||||

| (Meal Receipts are not required). To find meal reimbursement rates for US States (excluding GA), log on to the U.S. General Services Administration website (GSA): | |||||||||||

| http://www.gsa.gov/portal/content/104877 | |||||||||||

| Important Note: Use the GSA site for GA Lodging per diem. For GA Meal per diem, see above: Meal Per Diem when traveling in GA). | |||||||||||

| The following is an example of how to record the meal per diem for the location Tallahassee, Florida. Important to note, Georgia State agencies must us the (Federal) GSA webpage as a guide, only. Georgia does not allow travelers to use the $5 incidental fee in any calculations. | |||||||||||

| - | Effective 10/01/2016: When meals are provided, First/Last day meal per diem will be reimbursed at 75% of the total meal per diem LESS the full amount of any provided meal. AGENDA REQUIRED. | ||||||||||

| - | DAILY MEALS SHOULD BE BROKEN DOWN BY MEAL TYPE [Breakfast; Lunch; Dinner]. This includes FIRST/LAST days. | ||||||||||

| Lodging Per Diem (when traveling anywhere in the US, including GA: | |||||||||||

| (Lodging Receipts are required. Reasonable lodging expenses are reimbursed at actual cost). To find lodging reimbursement rates for all US States (including Georgia), log on to the U.S. General Services Administration website (GSA): | |||||||||||

| http://www.gsa.gov/portal/content/104877 | |||||||||||

| See the example for Tallahassee, above. The printout from the GSA webpage includes the per diem lodging rates for Tallahassee. For example: Tallahassee lodging per diem rate for May, 2014, is $83. | |||||||||||

| Conference lodging (lodging at the hotel where the conference takes place) may exceed allowable per diem. It is important to notate if the lodging is taking place at the conference site. Clearly state this in the “Purpose of the Trip” area, and/or attach a brief memo to explain. | |||||||||||

| Lodging – Tax Exemption (County and Municipal Excise Tax (including occupancy tax)). See Statewide Travel Regulations, Section 3.3, Page 15. When lodging in the State of Georgia, Employees and Students are exempt from: County and Municipal Excise Tax. However, travelers are required to submit a copy of the Hotel Exemption Occupancy Form upon registration at the hotel/motel. If the hotel refuses to accept the form at check-in, the traveler should attempt to resolve the issue with hotel management before checking out at the end of their stay. If the matter is not resolved by check-out time, the traveler should pay the tax. | |||||||||||

| Link to State Form | |||||||||||

| Link to GSU Form | |||||||||||

| Tips: | |||||||||||

| Tips for meals may not be claimed. | |||||||||||

| Miscellaneous Expense: | |||||||||||

| - If paid, reasonable tips may be claimed for transportation and lodging. | |||||||||||

| o Per the Statewide Travel Regulations, Section 4.1: In general, actual incidental expenses are reimbursed separately and include: fees and tips given to porters, baggage carriers, bellhops, hotel housekeeping, stewards or stewardesses, and hotel staff. | |||||||||||

| Receipts are required for reimbursement of Miscellaneous Travel Expenses of $25 or more. | |||||||||||

| Approval for Travel Expense Statement: | |||||||||||

| - | See “Approval for Travel” | ||||||||||

| Be sure to provide the printed name of the approver, along with the signature. | |||||||||||

| - | See “Important Information about Travel Expense Statement Reporting, Including Roles and Responsibilities” | ||||||||||

| Office of Disbursements | |||||||||||

| accountspayable@gsu.edu | |||||||||||

| GSU Travel Webpage | |||||||||||

| Georgia State University Travel Expense Statement | Travel Team Use Only - Voucher ID | |||||||||||

| EFFECTIVE - JANUARY 1, 2020 | ||||||||||||

| OUT-OF-STATE TRAVEL EXPENSE STATEMENT - EMPLOYEE AND STUDENT | ||||||||||||

| View State of GA-Statewide Travel Policy Here (Travel Policy Revised 10/01/2017) | ||||||||||||

| Indicate Status | Purchase Order # (required) | |||||||||||

| Today's Date (mm/dd/yyyy) | Does this report represent the FINAL Payment/Report? | |||||||||||

| Last Name of Traveler | If this report represent a PARTIAL Payment/Report, should we expect a final reporting at a later date? | |||||||||||

| First Name of Traveler | ||||||||||||

| Residence Address City, State, Zip |

CITY, STATE Purpose of the Trip and Comments | |||||||||||

| City, State, Zip | ||||||||||||

| Vendor/Panther Number | ||||||||||||

| Campus Location | ||||||||||||

| Traveler's Email Address | Date of Departure (mm/dd/yyyy) | |||||||||||

| Dept. Contact Name/Phone | Date of Return (mm/dd/yyyy) | |||||||||||

| Is Travel Expense Statement being submitted more than 30 days after the return of travel? (If yes, attach a memo to explain the late submission, signed by the approver) | ||||||||||||

| If traveling with a group of students, attach a listing of student participants. | ||||||||||||

| Meal Per Diem Out of State | ||||||||||||

| Note 1: View GSA Per Diem Rates Here (for travel outside of GA) | ||||||||||||

| DAILY per Diem MAX | Date (MM//DD//YYYY) |

Location /Point Visited | Max Breakfast Per Diem $ | Max Lunch Per Diem $ | Max Dinner Per Diem $ | Total First/Last Day Meal Per Diem MAX $ |

||||||

| 0.00 | 0.00 | 0.00 | ||||||||||

| First day=75% | 0.00 | |||||||||||

| $- | ||||||||||||

| $- | ||||||||||||

| $- | ||||||||||||

| $- | ||||||||||||

| $- | ||||||||||||

| Last day=75% | 0.00 | |||||||||||

| Total Meal Per Diem = | $0.00 | |||||||||||

| Lodging Expense | ||||||||||||

| $ Per Diem Rate Amount $ | Number of Nights | |||||||||||

| $0.00 | ||||||||||||

| CHECK HERE IF LODGING WAS PRE-PAID by GSU | Total Lodging Expense = | $0.00 | ||||||||||

| Traveler Name: | , | Purchase Order Number: | PM00000000 | |||||||||

| Miscellaneous Travel Expenses | ||||||||||||

| * Receipt required for expense $25 or greater. | ||||||||||||

| Date (MM/DD/YYYY) |

Airfare or Car Rental $ | Parking $ | Tips for Transportation $ |

Tips for Lodging $ |

Carrier/Taxi Shuttle $ |

BAGGAGE FEES $ (Limited to 1 Bag/Trip) | Other Trvl Misc. Expense $ | Identify Other Misc Expense from previous column ( Internet, Toll...) | Total $ | |||

| $- | ||||||||||||

| $- | ||||||||||||

| $- | ||||||||||||

| $- | ||||||||||||

| $- | ||||||||||||

| $- | ||||||||||||

| $- | ||||||||||||

| Misc. Totals | $- | $- | $- | $- | $- | $- | $- | $- | ||||

| CHECK HERE IF AIRFARE OR CAR RENTAL WAS PRE-PAID by GSU: | Total Misc. Expense = | $0.00 | ||||||||||

| MILEAGE RECORD/REIMBURSEMENT **Total Daily or CONSECUTIVE DAYS Business Miles up to 50 miles: EXEMPT from CRCC** | ||||||||||||

| Campus to Campus Predetermined Mileage Chart | ||||||||||||

| Date | Points Visited | REPORT MILEAGE DAILY | Miles Traveled | |||||||||

| (MM/DD/YYYY) | From | To | Starting Odometer Reading -OR Zero/Blank if using Mapquest | Ending Odometer Reading OR MapQuest Miles | Total Miles | Commute/Personal Miles | State Use / Business Miles | |||||

| 0.0 | 0.0 | 0.00 | ||||||||||

| 0.0 | 0.0 | 0.00 | ||||||||||

| 0.0 | 0.0 | 0 | 0.00 | |||||||||

| Tier 1 Mileage Addendum Totals [see attached] | 0.0 | 0.0 | 0.00 | |||||||||

| Tier 2 Mileage Addendum Totals [see attached] | 0.0 | 0.0 | 0.00 | |||||||||

| Attach CRCC results. | If rental vehicle is recommended, mileage will be reimbursed at $0.20/mile | Total Reimbursable Miles = | 0.0 | $0.000 | ||||||||

| Current Reimb Rate ( Automobile Rate) |

$0.575 | 0.000 | $0.17 | $- | *Mileage Reimbursement = | $- | ||||||

| SUMMARY OF REIMBURSEMENT | ||||||||||||

| Food | $- | |||||||||||

| Lodging (Paid by Traveler): Attach Hotel Receipt and Proof / Method of Payment | $- | |||||||||||

| Miscellaneous Travel Expenses | $- | |||||||||||

| Mileage Reimbursement | $- | |||||||||||

| TOTAL TRAVEL EXPENDITURE | $- | |||||||||||

| LESS ADVANCE - Travel Advance / Study Abroad Travel Advance - (where applicable) | ||||||||||||

| LESS Airfare OR Car Rental - Paid directly by the University [ATTACH INVOICE] | ||||||||||||

| LESS Pre-Paid Lodging [ATTACH FOLIO] | ||||||||||||

| NET REIMBURSEMENT DUE TO TRAVELER: ---If a credit, see the Business Manager for deposit instructions. Attach receipt from deposit--- |

$- | |||||||||||

| Disbursements Use, Only - Amount Reimbursed | ||||||||||||

| SIGNATURES & SWORN STATEMENT | ||||||||||||

| Statement & Signature of Traveler | ||||||||||||

| I do solemnly swear, under criminal felony penalty for false statements subject to punishment by a fine of up to $1,000 or by imprisonment for not less that 1 year or more than 5 years, or both, that the above statements are true and the described expenses, per diem and mileage, were incurred in the discharge of official duties for the State and have not been reimbursed. I have not and will not file for reimbursement of these sums from any other source. | ||||||||||||

| Signature of Traveler (Above) | Print Name on Above Line | Date (MM/DD/YYYY) | ||||||||||

| Signature of Authorized Budget Approver | Print Name on Above Line | Date (MM/DD/YYYY) | ||||||||||

| Signature of Approver | Print Name on Above Line | Date (MM/DD/YYYY) | ||||||||||

| Signature of P.I. Approver (If Applicable) | Print Name on Above Line | Date (MM/DD/YYYY) | ||||||||||

| BEST VALUE: PERSONAL VEHICLE - Mileage Record Addendum TIER 1 ONLY | |||||||||||||

| If the Car Rental Cost Comparison [CRCC] determines that the Best Value option is a rental car, use the TIER 2 [$0.17] Addendum. Do NOT include Tier 1 and Tier 2 claims on the same Mileage Addendum. | Campus Locations: | ||||||||||||

| Traveler | PO # | Campus Location | ALP | Alpharetta | |||||||||

| ATL | Atlanta | ||||||||||||

| Report all Actual miles traveled and applicable commute/personal miles based on odometer readings OR online mapping service [i.e., MapQuest] by day. | BKH | Buckhead | |||||||||||

| Use Campus2Campus Mileage Chart in lieu of MapQuest. Support MapQuest miles with online MapQuest trip summary for non Campus2 Campus trips. | CKS | Clarkston | |||||||||||

| Campus2Campus Mileage Chart | DEC | Decatur | |||||||||||

| Date mm/dd/yy | Start Loc | Visited Loc | Ending Loc | Purpose | Total Miles MapQuest | Odometer Start | Odometer Ending | Odometer Total | Commute Miles | Business Miles | DUN | Dunwoody | |

| 01/07/20 | ATL | CKS | SITE VIST roundtrip | 34 | 0 | 34 | NWT | Newton | |||||

| 01/09/20 | Home | DUN - CKS | Residence | SITE VIST | 38 | 0 | 11 | 27 | ONL | Online | |||

| 01/10/20 | ATL | CKS | Residence | SITE VIST | 32 | 0 | 11 | 21 | OTH | Other | |||

| 01/11/20 | ATL | CKS | SITE VIST roundtrip | 34 | 0 | 34 | |||||||

| 01/12/20 | Residence | Atlanta H.S. | Residence | SITE VIST roundtrip | 50 | 0 | 50 | ||||||

| 07/15/20 | ATL | CKS | SITE VIST roundtrip | 34 | 0 | 34 | |||||||

| 07/16/20 | ATL | CKS | SITE VIST roundtrip | 34 | 0 | 34 | If reporting odometer | ||||||

| 07/17/20 | ATL | CKS | SITE VIST roundtrip | 34 | 0 | 34 | readings, attach commute | ||||||

| 0 | 0 | mileage printouts, if applicable. | |||||||||||

| 0 | 0 | ||||||||||||

| 0 | 0 | When entering the BUSINESS | |||||||||||

| 0 | 0 | MILES on the CRCC, you can now | |||||||||||

| 0 | 0 | enter '0' [zero] commute mileage | |||||||||||

| 0 | 0 | in the COMMUTE MILEAGE box, when applicable. | |||||||||||

| 0 | 0 | ||||||||||||

| 0 | 0 | ||||||||||||

| 0 | 0 | ||||||||||||

| 0 | 0 | ||||||||||||

| 0 | 0 | ||||||||||||

| 0 | 0 | ||||||||||||

| ENTER TOTAL REIMBURSABLE MILES on TES Page 2; [Mileage Section - Tier 1 Line] | 290 | 0 | 22 | ||||||||||

| Total Reimbursable Miles | 268 | ||||||||||||

| Once Mileage Totals are entered on TES - *Mileage Reimbursement updates. | Reimbursement @ Tier 1 Rate | 0.575 | $154.10 | ||||||||||

no reviews yet

Please Login to review.