211x Filetype PPT File size 2.02 MB Source: www.raymondjames.com

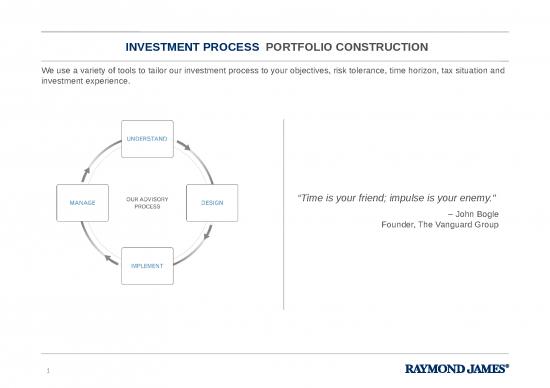

INVESTMENT PROCESS

We can build specific investments into your financial plan to help you achieve your financial goals.

2

INVESTMENT PROCESS VOLATILITY

Asset allocation decisions are among the most important factors affecting total portfolio volatility.

FACTORS IN PORTFOLIO VOLATILITY

Security Selection: 2.1%

Asset Allocation

Decisions: Market Timing: 4.6%

91.5%

Other: 1.8%

Source: Brinson, Beebower and Associates, “Determinants of Portfolio Return,” 1986, updated 1991 and 1995. “Does Asset Allocation Policy Explain 40, 90, or 100% of

Performance?” Ibbotson and Kaplan, Financial Analysts Journal, Jan./Feb. 2000. “The Equal Importance of Asset Allocation and Active Management,” Xiong, Ibbotson, Idzorek,

and Chen, Financial Analysts Journal, February 2010. Asset allocation does not ensure a profit or protect against a loss.

3

INVESTMENT PROCESS VOLATILITY OF RETURNS

Past performance is not indicative of future results. Investors cannot invest directly in an index.

Source: Standard & Poor’s, Russell, Dow Jones, Barclays Capital, U.S. Treasury and Morgan Stanley Capital International, as of 3/31/15.

4

INVESTMENT PROCESS VOLATILITY BENCHMARKS

Asset class and reference benchmarks:

Asset Class Benchmark Used

U.S. Equity Russell 3000

Non-U.S. Equity MSCI World, ex-U.S.

Fixed Income BC Aggregate

Real Estate FTSE EPRA NAREIT Global Real Estate

Commodities DJ UBS Commodity Index

Cash & Cash Alternatives Citi 3-Month T-Bill

There is no assurance that any investment strategy will be successful. Investing involves risk and investors may incur a profit or a loss. Asset allocation and diversification do not ensure a profit or

protect against a loss. Past performance is not indicative of future results.

There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income

prices rise.

International investing involves special risks, including currency fluctuations, different financial accounting standards , and possible political and economic volatility. Investing in emerging and

frontier markets can be riskier than investing in well-established foreign markets.

Investing in small- and mid-cap stocks generally involves greater risks, and therefore, may not be appropriate for every investor.

Commodities and currencies are generally considered speculative because of the significant potential for investment loss. They are volatile investments and should only form a small part of a

diversified portfolio. Markets for precious metals and other commodities are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising.

Specific-sector investing, such as real estate, can be subject to different and greater risks than more diversified investments. Declines in the value of real estate, economic conditions, property

taxes, tax laws and interest rates all present potential risks to real estate investments.

U.S. government bonds and Treasury bills are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. U.S. government bonds are

issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury bills are certificates reflecting short-term obligations of the U.S. government.

SM

The Dow Jones-UBS Commodity Indexes : Composed of exchange-traded commodity futures contracts rather than physical commodities.

Barclays Capital Aggregate Index: Measures changes in the fixed-rate debt issues rated investment grade or higher by Moody’s Investors Service, Standard & Poor’s, or Fitch Investor’s Service,

in that order. The Aggregate Index is comprised of the Government/Corporate, the Mortgage-Backed Securities and the Asset-Backed Securities indices.

BC Global Aggregate ex-U.S. Dollar Bond Index: Tracks an international basket of bonds that currently contains 65% government, 14% corporate, 13% agency and 8% mortgage-related bonds.

Citigroup 3-Month T-Bill Index: This is an unmanaged index of three-month Treasury bills.

FTSE EPRA/NAREIT Global Real Estate Index Series: Designed to represent general trends in eligible listed real estate stocks worldwide. Relevant real estate activities are defined as the

ownership, trading and development of income producing real estate.

MSCI All Country World Index Ex-U.S.: A market-capitalization-weighted index maintained by Morgan Stanley Capital International (MSCI) and designed to provide a broad measure of stock

performance throughout the world, with the exception of U.S.-based companies. It includes both developed and emerging markets.

5

THE COST OF MARKET TIMING

RISK OF MISSING THE BEST DAYS IN THE MARKET 1995 – 2014

10% 9.9%

Return

8

6 6.1%

4 3.6%

2 1.5%

0 -0.4% -2.2%

-2

-4 Invested for all 10 best days missed 20 best days missed 30 best days missed 40 best days missed 50 best days missed

5,040 trading days

Daily returns for all 5,040 trading days

10%

Return

5

0

-5

-10 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Past performance is no guarantee of future results. This is for illustrative purposes only and not indicative of any investment. An investment cannot be made directly in an index.

Licensed by Raymond James. © 2015 Morningstar. All Rights Reserved.

no reviews yet

Please Login to review.