295x Filetype XLSX File size 0.29 MB Source: www.eximguru.com

Sheet 1: GST Implementation Checklist

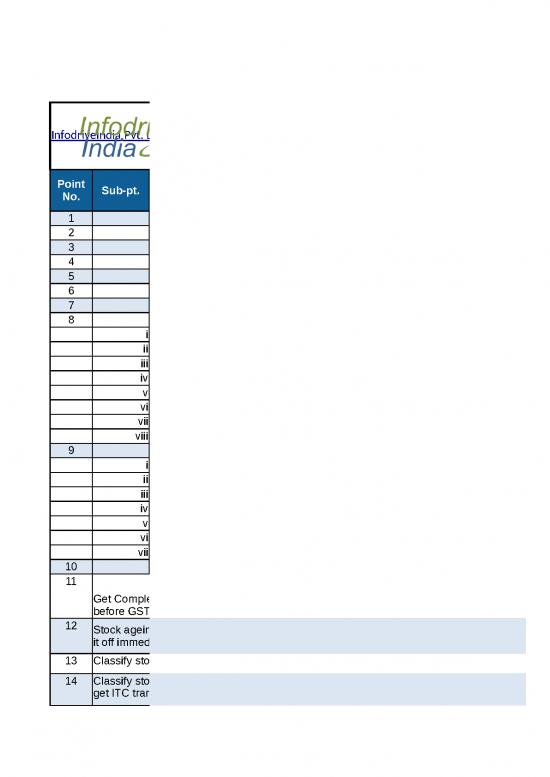

| GST IMPLEMENTATION CHECKLIST | ||||||

| InfodriveIndia Pvt. Ltd E-2, 3rd Floor, Kalkaji, New Delhi , India - 110019 Tel: 91-11-40703001, Email: mrktg@infodriveindia.com Web: http://www.infodriveindia.com | ||||||

| Point No. | Sub-pt. | Description | RC | Target Date | Actual Date | Remarks |

| 1 | Make a list of all group Companies / Firms / Proprietorhips | |||||

| 2 | Make a list of Locations that needs GST Registration | |||||

| 3 | Master Document folder for GST Registration | |||||

| 4 | List of Job Work parties and their locations | |||||

| 5 | Items pending with Job Worker | |||||

| 6 | Tools and Fixtures pending with Job Worker | |||||

| 7 | Job work reconciliation and scrap reconciliation at the end of Job Work | |||||

| 8 | Obtain GST number (KYC) for : | |||||

| i | Customers | |||||

| ii | Vendors for material and services | |||||

| iii | Job workers | |||||

| iv | Service Provider (Like Consultants, Advocates, Travel Agents etc ) | |||||

| v | Contractors | |||||

| vi | Transporters | |||||

| vii | AMC Provider | |||||

| viii | Other Vendors (Refer Profit & Loss Account and corresponding parties) | |||||

| 9 | HSN Code & GST Rate | |||||

| i | Raw Material | |||||

| ii | Semi Finished | |||||

| iii | Finished | |||||

| iv | Spares | |||||

| v | Consumables | |||||

| vi | Capital Items | |||||

| vii | Other Items (As per Profit & Loss Account) | |||||

| 10 | Inform your GST to all suppliers of Goods & Services | |||||

| 11 | Get Complete your working for Closing Stock for the period 31.3.2017 / 30.6.2017 before GST Implementation date. Allocate your such stock into quantative mode | |||||

| 12 | Stock ageing be made to ascertain if any stock is more than 1yr old. If yes then dispose it off immediately or sell it to your sister concern against Tax Invoice locally. | |||||

| 13 | Classify stock tax rate wise, purchased locally to get ITC into SGST | |||||

| 14 | Classify stock purchased on invoices bearing Duty Payment & non duty payments to get ITC transferred to CGST | |||||

| 15 | Keep Invoice Scan Copy for Stock as on 30.06.17 | |||||

| 16 | Identify Stock older than 1 year and make a detail | |||||

| 17 | VAT Refund Apply for non operational Companies | |||||

| 18 | Negotiate Rates (Rate reduced 2% to 5% for manufacturing and 10 to 11% in trading)(Logic Input Service Credit, Logistic, CST not there) | |||||

| 19 | Capex Purchase : 2016-17 Not to claim Depreciation on input credit | |||||

| 20 | Spares : Capitalise and not to claim depreciation on input credit | |||||

| 21 | Procurement policy - a) From Registered / Non registered Vendor Procurement | |||||

| 22 | E Way Bill Exceeding 50000 is must : Create Complete Process | |||||

| 23 | Finalise Inter Company Pricing | |||||

| 24 | IT : Accounting Softwares must be GST Compliant and training to team | |||||

| 25 | Warranty : To mention Price inclusive of warranty (Legal Language) | |||||

| 26 | Review Agreements to check GST clause | |||||

| i | C&F | |||||

| ii | Security | |||||

| iii | Contractor | |||||

| iv | Transporters | |||||

| v | Advocates | |||||

| vi | Consultants | |||||

| vii | AMC | |||||

| viii | Software Contracts | |||||

| ix | Data Centre Contract | |||||

| x | Online Contract | |||||

| 27 | Reconciliation and corrections of Accounts. Get account statement and clear debit / credit notes by 30.06.17 : | |||||

| i | Vendors | |||||

| ii | Customer | |||||

| 28 | Update Post GST Filing System (Hard Copies and Soft Copies) | |||||

| 29 | Rectify Mismatch of Purchases on VAT portal (if any) by 30.06.17 | |||||

| 30 | Revise returns by 30th June to correct any descrepancies of Returns | |||||

| 31 | Impact Analysis Working | |||||

| 32 | Finished Goods Pricing : New Price List | |||||

| 33 | Pending C Forms Collection | |||||

| 34 | Pending C Forms to be issued | |||||

| 35 | Calculations Files ready for ITC Carry forward. Make a separate file of those items which are shown in your Unsold stock as on 30.6.2017 e.g. Purchase Bills/ Bill of Entry/ Excise Paying Documents etc | |||||

| 36 | Apply for migration in all states if you have centralised registration under Service Tax | |||||

| 37 | Train your accountants for GST accounting and returns formats | |||||

| 38 | Analyse P and L and see which expenses are liable to RCM | |||||

| 39 | Detailed working of closing stock as on 30th June 2017 | |||||

| 40 | Apportion your closing stock into quantity and item rate per quantity | |||||

| 41 | Classify stock- rate, purchase interstate or intrastate, duty paid or exempted | |||||

| 42 | Compare your books with values shown by your debtors/ creditors as on 30th June 2017 | |||||

| 43 | Correct the mismatch reports of purchases under VAT Act and file revised returns for mismatch | |||||

| 44 | Collect Form-C, Form-H, and Form-I for the stocks on which ITC is to be claimed | |||||

| 45 | Finalize your Books of Accounts along with stock details provided to Banks/ Financial Institutions. | |||||

| 46 | Destock ageing stock, and sell all stock lying around for more than 12 months | |||||

| 47 | Destock ageing stock, and sell all stock lying around for more than 12 months | |||||

| 48 | Destock ageing stock, and sell all stock lying around for more than 12 months | |||||

| 49 | Make a list of rates under GST for all goods dealt with | |||||

| 50 | Make a list of all such on which reverse charge will be applicable | |||||

| 51 | Ensure that all debit/ credit notes are serially numbered | |||||

| 52 | Your existing accounting software is integrated with your GST return filing software | |||||

| 53 | Your existing accounting software is integrated with your GST return filing software | |||||

| 54 | Decide and prepare a list of Place of Supply for all your business activity | |||||

| STOCK DETAIL | ||||||||||||||||||

| InfodriveIndia Pvt. Ltd E-2, 3rd Floor, Kalkaji, New Delhi , India - 110019 Tel: 91-11-40703001, Email: mrktg@infodriveindia.com Web: http://www.infodriveindia.com | ||||||||||||||||||

| SN | HSN Code | Item Description | Category (RM, WIP, FG, Spare, Consumable, Packing, Other | Qty | Basic Rate | Amount | VAT 12.5% | VAT 5% | CST 12.5% | CST 2% | CST 1% | Excise | SAD | CVD | Others | Total (Rs.) | Age > 1 year | |

| IMPACT ANALYSIS | |||||||||||||||||||||||||||||||

| InfodriveIndia Pvt. Ltd E-2, 3rd Floor, Kalkaji, New Delhi , India - 110019 Tel: 91-11-40703001, Email: mrktg@infodriveindia.com Web: http://www.infodriveindia.com | |||||||||||||||||||||||||||||||

| Purchase (BOM) | Existing Tax Structure | SALE | Existing Tax Structure | ||||||||||||||||||||||||||||

| SN | HSN Code | Item Description | Qty | UOM | Basic Rate | Amount (Rs.) | VAT 12.5% | VAT 5% | CST 12.5% | CST 2% | CST 1% | Excise | SAD | CVD | Bill Amount (Rs.) | Bill Cost (Rs.) | Variation | HSN Code | Item Description | Qty | Basic Rate | Amount | VAT 12.5% | VAT 5% | CST 12.5% | CST 2% | CST 1% | Excise | Sale Bill (Total) | Sale (Rs.) | GP |

| 1 | 12345678 | Iron | 0.5 | Kgs | 2000 | 1000 | 50 | #NAME? | |||||||||||||||||||||||

| 2 | 12345679 | Plastic | 1 | Kgs | 300 | 300 | 37.5 | #NAME? | |||||||||||||||||||||||

| 3 | 12345680 | Fastners | 0.1 | Kgs | 500 | 50 | 1 | ||||||||||||||||||||||||

| 4 | 12345681 | Corrugated Box | 1 | Nos | 20 | 20 | 2.5 | 1 | |||||||||||||||||||||||

| 1370 | 40.0 | 50 | 0 | 1 | 79 | 1540 | 1450 | 90 | 12345678 | Item 1 | 1 | 2000 | 2000 | 250 | 2250 | 2000 | 550 | ||||||||||||||

| Purchase (BOM) | GST | SALE | GST | ||||||||||||||||||||||||||||

| SN | HSN Code | Item Description | Qty | UOM | Basic Rate | Amount (Rs.) | GST 18% | Bill Amount (Rs.) | Bill Cost (Rs.) | Variation | HSN Code | Item Description | Qty | Basic Rate | Amount | GST 18% | Sale Bill (Total) | Sale (Rs.) | GP | ||||||||||||

| 1 | 12345678 | Iron | 0.5 | Kgs | 2000 | 1000 | #NAME? | ||||||||||||||||||||||||

| 2 | 12345679 | Plastic | 1 | Kgs | 300 | 300 | #NAME? | ||||||||||||||||||||||||

| 3 | 12345680 | Fastners | 0.1 | Kgs | 500 | 50 | #NAME? | ||||||||||||||||||||||||

| 4 | 12345681 | Corrugated Box | 1 | Nos | 20 | 20 | #NAME? | ||||||||||||||||||||||||

| 1370 | 246.6 | 1617 | 1370 | 247 | 12345678 | Item 1 | 1 | 2000 | 2000 | 360 | 2360 | 2000 | 630 | ||||||||||||||||||

| -76 | 80 | -157 | -110 | 0 | -80 | ||||||||||||||||||||||||||

no reviews yet

Please Login to review.