291x Filetype XLSX File size 0.69 MB Source: www.ato.gov.au

Sheet 1: Instructions

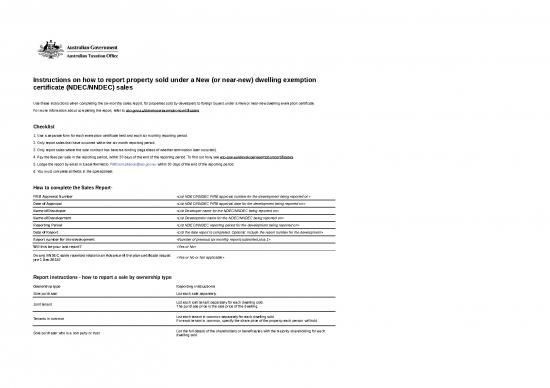

| Instructions on how to report property sold under a New (or near-new) dwelling exemption certificate (NDEC/NNDEC) sales | ||

| Use these instructions when completing the six-monthly sales report, for properties sold by developers to foreign buyers under a New or near-new dwelling exemption certificate. | ||

| For more information about completing the report, refer to ato.gov.au/developerexemptioncertificates | ||

| Checklist | ||

| 1. Use a separate form for each exemption certificate held and each six monthly reporting period. | ||

| 2. Only report sales that have occurred within the six-month reporting period. | ||

| 3. Only report sales where the sale contract has become binding (regardless of whether termination later occurred). | ||

| 4. Pay the fees per sale in the reporting period, within 30 days of the end of the reporting period. To find out how, see ato.gov.au/developerexemptioncertificates | ||

| 5. Lodge the report by email in Excel format to FIRBcompliance@ato.gov.au within 30 days of the end of the reporting period. | ||

| 6. You must complete all fields in the spreadsheet. | ||

| How to complete the Sales Report | ||

| FIRB Approval Number | <List NDEC/NNDEC FIRB approval number for the development being reported on> | |

| Date of Approval | <List NDEC/NNDEC FIRB approval date for the development being reported on> | |

| Name of Developer | <List Developer name for the NDEC/NNDEC being reported on> | |

| Name of Development | <List Development name for the NDEC/NNDEC being reported on> | |

| Reporting Period | <List NDEC/NNDEC reporting period for the development being reported on> | |

| Date of Report | <List the date report is completed. Optional: include the report number for the development> | |

| Report number for the development | <Number of previous six monthly reports submitted plus 1> | |

| Will this be your last report? | <Yes or No> | |

| Do any NNDEC sales reported relate to an Advance of the plan certificate issued pre 1 Dec 2015? | <Yes or No or Not applicable> | |

| Report instructions - how to report a sale by ownership type | ||

| Ownership type | Reporting instructions | |

| Sole purchaser | List each sale separately. | |

| Joint tenant | List each joint tenant separately for each dwelling sold. The purchase price is the sale price of the dwelling. |

|

| Tenants in common | List each tenant in common separately for each dwelling sold. For each tenant in common, specify the share price of the property each person will hold . |

|

| Sole purchaser who is a company or trust | List the full details of the shareholders or beneficiaries with the majority shareholding for each dwelling sold. | |

| End of worksheet | ||

no reviews yet

Please Login to review.