356x Filetype XLSX File size 0.07 MB Source: www.iras.gov.sg

Sheet 1: P&L Statement-Appx 1A

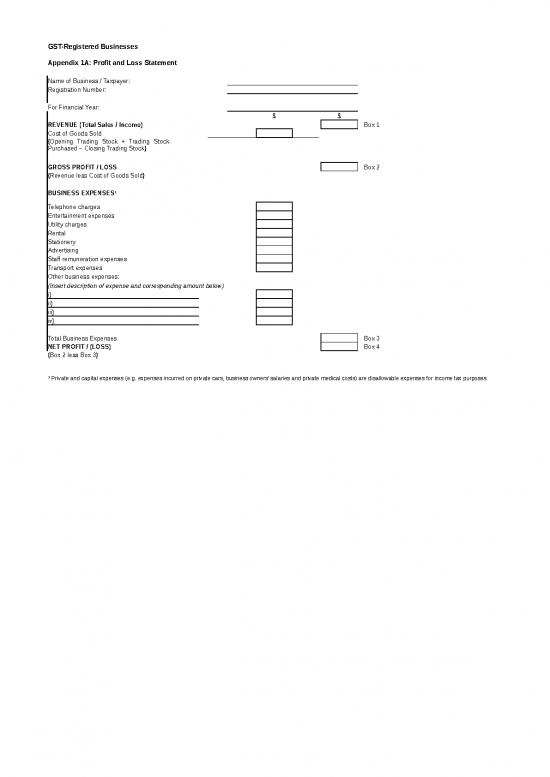

| Record Keeping Guide for GST-Registered Businesses |

|||||||

| Appendix 1A: Profit and Loss Statement | |||||||

| Name of Business / Taxpayer: | |||||||

| Registration Number: | |||||||

| For Financial Year: | |||||||

| $ | $ | ||||||

| REVENUE (Total Sales / Income) | Box 1 | ||||||

| Cost of Goods Sold | |||||||

| {Opening Trading Stock + Trading Stock Purchased – Closing Trading Stock} | |||||||

| GROSS PROFIT / LOSS | Box 2 | ||||||

| {Revenue less Cost of Goods Sold} | |||||||

| BUSINESS EXPENSES1 | |||||||

| Telephone charges | |||||||

| Entertainment expenses | |||||||

| Utility charges | |||||||

| Rental | |||||||

| Stationery | |||||||

| Advertising | |||||||

| Staff remuneration expenses | |||||||

| Transport expenses | |||||||

| Other business expenses: | |||||||

| (Insert description of expense and corresponding amount below) | |||||||

| i) | |||||||

| ii) | |||||||

| iii) | |||||||

| iv) | |||||||

| Total Business Expenses | Box 3 | ||||||

| NET PROFIT / (LOSS) | Box 4 | ||||||

| {Box 2 less Box 3} | |||||||

| 1 Private and capital expenses (e.g. expenses incurred on private cars, business owners’ salaries and private medical costs) are disallowable expenses for income tax purposes. | |||||||

| Record Keeping Guide for GST-Registered Businesses |

||||||||

| Appendix 1B: Balance Sheet (Sample below is for a sole-proprietorship) | ||||||||

| BALANCE SHEET AS AT DD MM YYYY | ||||||||

| $ | $ | $ | ||||||

| ASSETS | ||||||||

| NON-CURRENT | ||||||||

| Motor Vehicle | ||||||||

| Less: Accumulated Depreciation | 0 | |||||||

| Machinery | ||||||||

| Less: Accumulated Depreciation | 0 | 0 | ||||||

| 0 | Box 1 | |||||||

| CURRENT | ||||||||

| Trading Stock | ||||||||

| Trade Debtors | ||||||||

| Prepayments and Deposits | ||||||||

| Cash and Bank Balances | ||||||||

| 0 | Box 2 | |||||||

| TOTAL ASSETS | 0 | Box 3 | ||||||

| {Box 1 plus Box 2} | ||||||||

| LIABILITIES | ||||||||

| NON-CURRENT LIABILITIES | ||||||||

| Long-Term Loans | ||||||||

| 0 | Box 4 | |||||||

| Current LIABILITIES | ||||||||

| Trade Creditors | ||||||||

| Short-Term Loans | ||||||||

| 0 | Box 5 | |||||||

| TOTAL LIABILITES | 0 | Box 6 | ||||||

| {Box 4 plus Box 5} | ||||||||

| PROPRIETOR'S FUNDS | ||||||||

| Capital | ||||||||

| Retained Profits | ||||||||

| Current Year Profit | 0 | |||||||

| Less: Drawings | 0 | |||||||

| TOTAL PROPRIETOR'S FUNDS | 0 | Box 7 | ||||||

| TOTAL LIABILITIES AND PROPRIETOR'S FUNDS | 0 | Box 8 | ||||||

| {Box 6 plus Box 7} | ||||||||

| Note: | ||||||||

| Balance sheet should be prepared based on accepted accounting principles and standards. This is only a | ||||||||

| sample format to serve as a guide on how a balance sheet may be presented. | ||||||||

| Some pointers when preparing a balance sheet: | ||||||||

| • Stock value (if any) in the balance sheet should be same as closing stock reflected in profit and loss statement (P&L) | ||||||||

| • Current year profit/earnings in the balance sheet should be the same as net profit in the P&L | ||||||||

| • TOTAL ASSETS = TOTAL LIABILITIES AND PROPRIETOR’S FUND (i.e. Box 3 should be equal to Box 8) |

| Record Keeping Guide for GST-Registered Businesses |

|||||||||||||

| Appendix 2: Daily Revenue Record | |||||||||||||

| Name of Business : | ABC Pte Ltd | ||||||||||||

| Year: | 2022 | ||||||||||||

| Month | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 1 | $1,080 | $240 | $120 | $360 | $426 | $480 | $336 | $336 | $336 | $480 | $120 | $480 | |

| 2 | $960 | $300 | $120 | $336 | $636 | $426 | $372 | $372 | $372 | $414 | $120 | $426 | |

| 3 | $840 | $360 | $252 | $372 | $648 | $372 | $480 | $480 | $480 | $533 | $252 | $372 | |

| 4 | $1,020 | $336 | $186 | $480 | $480 | $480 | $426 | $426 | $426 | $226 | $186 | $480 | |

| 5 | $480 | $372 | $149 | $426 | $414 | $192 | $372 | $426 | $426 | $252 | $149 | $192 | |

| 6 | $600 | $480 | $226 | $372 | $533 | $600 | $480 | $372 | $372 | $199 | $226 | $600 | |

| 7 | $240 | $426 | $252 | $480 | $226 | $360 | $192 | $480 | $480 | $180 | $252 | $360 | |

| 8 | $300 | $372 | $199 | $192 | $252 | $480 | $600 | $192 | $192 | $180 | $199 | $480 | |

| 9 | $360 | $480 | $180 | $600 | $199 | $180 | $360 | $600 | $600 | $360 | $480 | $180 | |

| 10 | $336 | $426 | $180 | $360 | $180 | $180 | $480 | $360 | $360 | $180 | $192 | $180 | |

| 11 | $372 | $636 | $192 | $480 | $180 | $192 | $840 | $480 | $360 | $192 | $600 | $192 | |

| 12 | $480 | $648 | $600 | $840 | $192 | $960 | $960 | $840 | $509 | $960 | $360 | $960 | |

| 13 | $426 | $480 | $360 | $960 | $960 | $1,066 | $1,066 | $480 | $600 | $1,066 | $480 | $1,066 | |

| 14 | $636 | $414 | $480 | $1,066 | $1,066 | $932 | $336 | $192 | $799 | $932 | $840 | $932 | |

| 15 | $648 | $533 | $840 | $600 | $932 | $400 | $372 | $600 | $666 | $400 | $960 | $400 | |

| 16 | $480 | $420 | $960 | $960 | $400 | $799 | $480 | $360 | $508 | $509 | $1,066 | $799 | |

| 17 | $414 | $372 | $1,066 | $1,066 | $509 | $666 | $426 | $480 | $667 | $600 | $600 | $666 | |

| 18 | $533 | $276 | $932 | $932 | $600 | $508 | $426 | $840 | $929 | $372 | $960 | $508 | |

| 19 | $420 | $480 | $400 | $400 | $799 | $667 | $372 | $509 | $926 | $480 | $1,066 | $667 | |

| 20 | $648 | $600 | $509 | $509 | $666 | $929 | $480 | $600 | $797 | $192 | $932 | $929 | |

| 21 | $480 | $240 | $600 | $600 | $508 | $926 | $192 | $799 | $666 | $600 | $400 | $926 | |

| 22 | $414 | $276 | $799 | $799 | $509 | $797 | $600 | $666 | $600 | $360 | $509 | $797 | |

| 23 | $533 | $480 | $666 | $666 | $600 | $480 | $360 | $508 | $552 | $480 | $600 | $480 | |

| 24 | $420 | $600 | $508 | $508 | $799 | $600 | $480 | $667 | $372 | $840 | $360 | $600 | |

| 25 | $372 | $240 | $667 | $414 | $666 | $240 | $840 | $929 | $480 | $600 | $480 | $240 | |

| 26 | $276 | $300 | $929 | $533 | $508 | $300 | $192 | $926 | $192 | $360 | $840 | $300 | |

| 27 | $480 | $276 | $926 | $420 | $414 | $276 | $600 | $797 | $600 | $480 | $192 | $276 | |

| 28 | $600 | $480 | $797 | $648 | $533 | $480 | $360 | $666 | $360 | $840 | $600 | $480 | |

| 29 | $240 | $0 | $666 | $480 | $420 | $504 | $480 | $600 | $480 | $192 | $360 | $504 | |

| 30 | $300 | $0 | $600 | $414 | $648 | $666 | $840 | $552 | $840 | $600 | $840 | $666 | |

| 31 | $372 | $0 | $552 | $0 | $533 | $0 | $420 | $552 | $0 | $360 | $0 | $466 | |

| Total | $15,760 | $11,543 | 15,912.00 | 17,271.60 | 16,434.00 | 16,137.60 | 15,219.60 | 17,086.80 | 15,946.80 | 14,418.00 | 15,219.60 | 16,603.20 | |

| Grand Total | $187,552 | ||||||||||||

no reviews yet

Please Login to review.