347x Filetype XLSX File size 0.04 MB Source: www.dfa.ms.gov

Sheet 1: Instructions

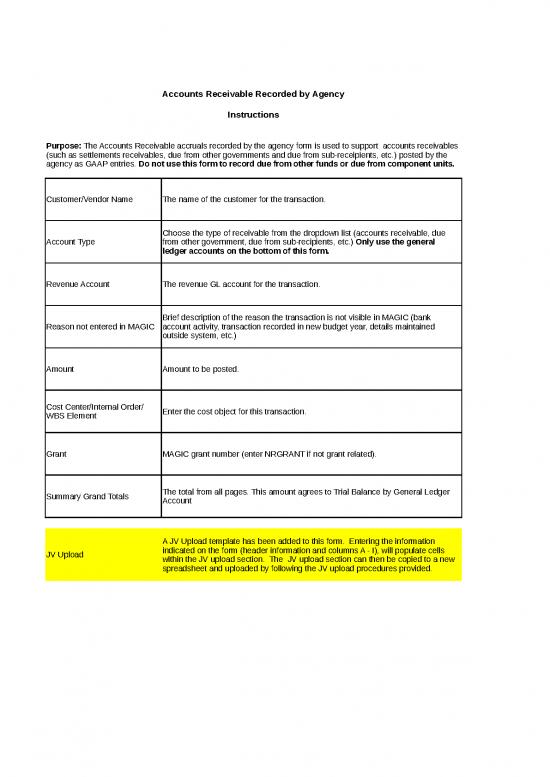

| Accounts Receivable Recorded by Agency | |

| Instructions | |

| Purpose: The Accounts Receivable accruals recorded by the agency form is used to support accounts receivables (such as settlements receivables, due from other governments and due from sub-receipients, etc.) posted by the agency as GAAP entries. Do not use this form to record due from other funds or due from component units. |

|

| Customer/Vendor Name | The name of the customer for the transaction. |

| Account Type | Choose the type of receivable from the dropdown list (accounts receivable, due from other government, due from sub-recipients, etc.) Only use the general ledger accounts on the bottom of this form. |

| Revenue Account | The revenue GL account for the transaction. |

| Reason not entered in MAGIC | Brief description of the reason the transaction is not visible in MAGIC (bank account activity, transaction recorded in new budget year, details maintained outside system, etc.) |

| Amount | Amount to be posted. |

| Cost Center/Internal Order/ WBS Element | Enter the cost object for this transaction. |

| Grant | MAGIC grant number (enter NRGRANT if not grant related). |

| Summary Grand Totals | The total from all pages. This amount agrees to Trial Balance by General Ledger Account |

| JV Upload | A JV Upload template has been added to this form. Entering the information indicated on the form (header information and columns A - I), will populate cells within the JV upload section. The JV upload section can then be copied to a new spreadsheet and uploaded by following the JV upload procedures provided. |

no reviews yet

Please Login to review.