313x Filetype XLSX File size 0.06 MB Source: popp.undp.org

Sheet 1: detailed cash flow projection

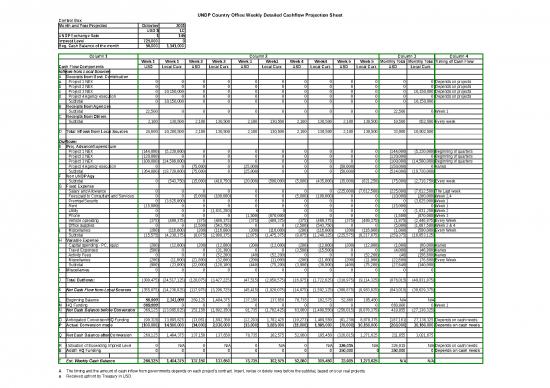

| UNDP Country Office Weekly Detailed Cashflow Projection Sheet | |||||||||||||||

| Control Box | |||||||||||||||

| Month and Year Projected | Octorber | 2001 | |||||||||||||

| USD $ | LC | ||||||||||||||

| UNDP Exchange Rate | 1 | 145 | |||||||||||||

| Imprest Level | 725,000 | 0 | |||||||||||||

| Beg. Cash Balance of the month | 56,000 | 1,141,000 | |||||||||||||

| Column 1 | Column 2 | Column 3 | Column 4 | ||||||||||||

| Cash Flow Components | Week 1 | Week 1 | Week 2 | Week 2 | Week 3 | Week3 | Week 4 | Week4 | Week 5 | Week 5 | Monthly Total | Monthly Total | Timing of Cash Flow | ||

| USD | Local Curr. | USD | Local Curr. | USD | Local Curr. | USD | Local Curr. | USD | Local Curr. | USD | Local Curr. | ||||

| Inflows from Local Sources: | |||||||||||||||

| A | Receipts from Govt. Contribution | ||||||||||||||

| a | Project 1 NEX | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | Depends on projects | |

| b | Project 2 NEX | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | Depends on projects | |

| c | Project 3 NEX | 0 | 10,150,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 10,150,000 | Depends on projects | |

| d | Project 4 Agency execution | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | Depends on projects | |

| Subtotal | 0 | 10,150,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 10,150,000 | |||

| B | Receipts from Agencies | ||||||||||||||

| Subtotal | 22,500 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 22,500 | 0 | Week 1 | ||

| C | Receipts from Others | ||||||||||||||

| Subtotal | 2,100 | 130,500 | 2,100 | 130,500 | 2,100 | 130,500 | 2,100 | 130,500 | 2,100 | 130,500 | 10,500 | 652,500 | Every week | ||

| D | Total Inflows from Local Sources | 24,600 | 10,280,500 | 2,100 | 130,500 | 2,100 | 130,500 | 2,100 | 130,500 | 2,100 | 130,500 | 33,000 | 10,802,500 | ||

| Outflows: | |||||||||||||||

| E | Proj. Advance/Expenditure | ||||||||||||||

| Project 1 NEX | (144,000) | (5,220,000) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (144,000) | (5,220,000) | Beginning of quarters | ||

| Project 2 NEX | (120,000) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (120,000) | 0 | Beginning of quarters | ||

| Project 3 NEX | (100,000) | (14,500,000) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (100,000) | (14,500,000) | Beginning of quarters | ||

| Project 4 Agency execution | 0 | 0 | (75,000) | 0 | (25,000) | 0 | 0 | 0 | (50,000) | 0 | (150,000) | 0 | Varies | ||

| Subtotal | (364,000) | (19,720,000) | (75,000) | 0 | (25,000) | 0 | 0 | 0 | (50,000) | 0 | (514,000) | (19,720,000) | |||

| F | Non UNDP Agy | ||||||||||||||

| Subtotal | 0 | (543,750) | (15,000) | (418,750) | (20,000) | (500,000) | (5,000) | (435,000) | (35,000) | (821,250) | (75,000) | (2,718,750) | Every week | ||

| G | Fixed Expense | ||||||||||||||

| Salary and Allowance | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (225,000) | (7,612,500) | (225,000) | (7,612,500) | The Last week | ||

| Fees paid to Consultant and Services | 0 | 0 | (5,000) | (100,000) | 0 | 0 | (5,000) | (100,000) | 0 | 0 | (10,000) | (200,000) | Week 2,4 | ||

| Premise/Security | 0 | (3,625,000) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (3,625,000) | Week 1 | ||

| Rent | (15,000) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (15,000) | 0 | Week 1 | ||

| Utility | 0 | 0 | 0 | (1,631,250) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (1,631,250) | Week 2 | ||

| Phone | 0 | 0 | 0 | 0 | (1,500) | (870,000) | 0 | 0 | 0 | 0 | (1,500) | (870,000) | Week 3 | ||

| Vehicle operating | (375) | (489,375) | (375) | (489,375) | (375) | (489,375) | (375) | (489,375) | (375) | (489,375) | (1,875) | (2,446,875) | Every Week | ||

| Office supplies | 0 | 0 | (2,500) | (543,750) | 0 | 0 | (2,500) | (543,750) | 0 | 0 | (5,000) | (1,087,500) | Week 2 & 4 | ||

| z | Miscellanies | (200) | (116,000) | (200) | (116,000) | (200) | (116,000) | (200) | (116,000) | (200) | (116,000) | (1,000) | (580,000) | Every Week | |

| Subtotal | (15,575) | (4,230,375) | (8,075) | (2,880,375) | (2,075) | (1,475,375) | (8,075) | (1,249,125) | (225,575) | (8,217,875) | (259,375) | (18,053,125) | |||

| H | Variable Expense | ||||||||||||||

| Capital spending - PC, equip | (200) | (12,000) | (200) | (12,000) | (200) | (12,000) | (200) | (12,000) | (200) | (12,000) | (1,000) | (60,000) | Varies | ||

| Travel Expenses | (500) | 0 | 0 | (31,300) | 0 | 0 | (3,500) | (15,500) | 0 | 0 | (4,000) | (46,800) | Varies | ||

| Activity Fees | 0 | 0 | 0 | (52,200) | (40) | (52,200) | 0 | 0 | 0 | (52,200) | (40) | (156,600) | Varies | ||

| Miscellanies | (200) | (11,000) | (21,800) | (32,600) | (200) | (11,000) | (200) | (11,000) | (200) | (11,000) | (22,600) | (76,600) | Every Week | ||

| Subtotal | (900) | (23,000) | (22,000) | (128,100) | (440) | (75,200) | (3,900) | (38,500) | (400) | (75,200) | (27,640) | (340,000) | |||

| I | Miscellanies | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||

| J | Total Outflows: | (380,475) | (24,517,125) | (120,075) | (3,427,225) | (47,515) | (2,050,575) | (16,975) | (1,722,625) | (310,975) | (9,114,325) | (876,015) | (40,831,875) | ||

| K | Net Cash Flow from Local Sources | (355,875) | (14,236,625) | (117,975) | (3,296,725) | (45,415) | (1,920,075) | (14,875) | (1,592,125) | (308,875) | (8,983,825) | (843,015) | (30,029,375) | ||

| L | Beginning Balance | 56,000 | 1,141,000 | 269,125 | 1,404,375 | 137,150 | 137,650 | 78,735 | 102,575 | 52,860 | 105,450 | N/A | N/A | ||

| M | HQ Funding | 669,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 669,000 | 0 | Week 1 | |

| N | Net Cash Balance before Conversion | 369,125 | (13,095,625) | 151,150 | (1,892,350) | 91,735 | (1,782,425) | 63,860 | (1,489,550) | (256,015) | (8,878,375) | 419,855 | (27,138,325) | ||

| O | Anticipated Conversion/HQ Funding | (90,315) | 13,095,625 | (13,051) | 1,892,350 | (12,293) | 1,782,425 | (10,273) | 1,489,550 | (61,230) | 8,878,375 | (187,161) | 27,138,325 | Depends on cash needs | |

| P | Actual Conversion made | (100,000) | 14,500,000 | (14,000) | 2,030,000 | (13,000) | 1,885,000 | (11,000) | 1,595,000 | (70,000) | 10,150,000 | (208,000) | 30,160,000 | Depends on cash needs | |

| Q | Net Cash Balance after Conversion | 269,125 | 1,404,375 | 137,150 | 137,650 | 78,735 | 102,575 | 52,860 | 105,450 | (326,015) | 1,271,625 | 211,855 | 3,021,675 | ||

| R | Indication of Exceeding Imprest Level | 0 | N/A | 0 | N/A | 0 | N/A | 0 | N/A | 326,015 | N/A | 326,015 | N/A | Depends on cash needs | |

| S | Addt'l HQ Funding | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 350,000 | 0 | 350,000 | 0 | Depends on cash needs | |

| T | Est. Weekly Cash Balance | 269,125 | 1,404,375 | 137,150 | 137,650 | 78,735 | 102,575 | 52,860 | 105,450 | 23,985 | 1,271,625 | N/A | N/A | ||

| A | The timing and the amount of cash inflow from governments depends on each project's contract. Insert, revise or delete rows before the subtotal, based on your real projects. | ||||||||||||||

| a | Received upfront by Treasury in USD. | ||||||||||||||

| b | Received by CO in local currency annual installment in February | ||||||||||||||

| c | Received $140,000, or 50% by Treasury in USD, remaining in local currency 20,300,000 semi-annual installments in Apr and Oct. | ||||||||||||||

| d | Existing project with contributions received already. | ||||||||||||||

| B | Based on agreements with agencies on Cost Recovery for Common Services. CO should have a great degree of control when to collect the funds.Insert rows before the subtotal, based on real situation. | ||||||||||||||

| C | Input all other cash receipts in this category. Add rows for details before the subtotal if needed. | ||||||||||||||

| D | This is a formula adding up all of the previous subtotals. When inserting new inflow categories, make sure the formula stays relevant. | ||||||||||||||

| E | The disbursement for each project depends on its contact. Insert, revise, or delete rows before the subtotal, based on real projects. | ||||||||||||||

| F | CO should require UN and agencies provide monthly forecast for their Non-UNDP payment amounts, timing, etc. which can be fine tuned when actual payment requests are received. Add rows before subtotal if needed. | ||||||||||||||

| G | This is a example. The weekly amounts are based on the monthly estimated expenses and filled in the corresponding week. For simplicity sake, vehicle operating and miscellanious expenses are evenly disbursed in 5 weeks. | ||||||||||||||

| CO should have certain amount and timing for each component of its own fixed expenses due to recurring nature. | |||||||||||||||

| H | Based on estimated weekly number to be fine tuned with actual invoices received. | ||||||||||||||

| I | All other expenses other than the above ones should be input in this category. | ||||||||||||||

| J | This is a formula. If more breakdown on type of outflows is needed, simply incert more rows but make sure the formula stays relevant. | ||||||||||||||

| K | This is a formula adding total inflows and outflows from local sources. | ||||||||||||||

| L | The balance for week 1 should be keyed in according to the last month's cash books, which is in the control box Cell D7 and F7. The remaining columes are formula equal to previous week's estimated balance in Row 70. | ||||||||||||||

| M | This is a direct replenishment the CO receives from Treasury so the amount of funding is shown in week 1. $669,000 represents imprest level of $725,000 less previous month ending cashbook balance, rounded. | ||||||||||||||

| N | This is a fomula adding up all cash inflows and outflows. | ||||||||||||||

| O | When COs are short of cash (When LC accounts is negative in this example), they should transfer funding from their USD account to their LC account to cover the shortage. ) | ||||||||||||||

| P | This row shows the actual funds transferred from USD account to LC account, or "conversion", Which make the cash balance on LC account more than 0 but not exceeding 25% of weekly utilization level. | ||||||||||||||

| It's the row COs can manage based on their cash liquidity. | |||||||||||||||

| Q | This is a formula adding up Row 60 and 63. | ||||||||||||||

| R | Any anticipated difficiency (negative number in Row 65) flags that the CO either needs additional replenishment from the Treasury for exceeding the imprest level. Actively manage this can | ||||||||||||||

| avoid the delay in receiving additional replenishment or authorization. | |||||||||||||||

| S | Row 67 in the sample Model show the minimum amount COs should require from the Treasure to cover their cash shortage. However, we expect COs to round up the figure as shown in sample Model with amount of $350,000. COs | ||||||||||||||

| should actively manage the amount of additional HQ Funding when the Net Cash Flow after Conversion (Row 65) starts to turn negative, to make sure the Est. Weekly Cash Balance (Row 70) keep positive in every | |||||||||||||||

| week. | |||||||||||||||

| T | The final estimated weekly cash balance which CO should have by projecting the above cash flow cautiously. | ||||||||||||||

| UNDP Country Office Simplified Weekly Cash Projection Sheet | ||||||||||||||

| Month and Year Projected | Octorber | 2001 | ||||||||||||

| USD $ | LC | |||||||||||||

| UNDP Exchange Rate | 1 | 145 | ||||||||||||

| Imprest Level | 725,000 | 0 | ||||||||||||

| Beg. Cash Balance of the month | 56,000 | 1,141,000 | ||||||||||||

| Cash Flow Components | Week 1 | Week 1 | Week 2 | Week 2 | Week 3 | Week3 | Week 4 | Week4 | Week 5 | Week 5 | Monthly Total | Monthly Total | ||

| USD | Local Curr. | USD | Local Curr. | USD | Local Curr. | USD | Local Curr. | USD | Local Curr. | USD | Local Curr. | |||

| Inflows from Local Sources: | ||||||||||||||

| A | Receipts from Govt. Contribution | 0 | 10,150,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 10,150,000 | |

| B | Receipts from Agencies | 22,500 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 22,500 | 0 | |

| C | Receipts from Others | 2,100 | 130,500 | 2,100 | 130,500 | 2,100 | 130,500 | 2,100 | 130,500 | 2,100 | 130,500 | 10,500 | 652,500 | |

| D | Total Inflows from Local Sources: | 24,600 | 10,280,500 | 2,100 | 130,500 | 2,100 | 130,500 | 2,100 | 130,500 | 2,100 | 130,500 | 33,000 | 10,802,500 | |

| Outflows: | ||||||||||||||

| E | Disbursement - Proj. Advance/Expenditure | (364,000) | (19,720,000) | (75,000) | 0 | (25,000) | 0 | 0 | 0 | (50,000) | 0 | (514,000) | (19,720,000) | |

| F | Disbursement - Non UNDP Agy | 0 | (543,750) | (15,000) | (418,750) | (20,000) | (500,000) | (5,000) | (435,000) | (35,000) | (821,250) | (75,000) | (2,718,750) | |

| G | Disbursement - Fixed Expense | (15,575) | (4,230,375) | (8,075) | (2,880,375) | (2,075) | (1,475,375) | (8,075) | (1,249,125) | (225,575) | (8,217,875) | (259,375) | (18,053,125) | |

| H | Disbursement - Variable Expense | (900) | (23,000) | (22,000) | (128,100) | (440) | (75,200) | (3,900) | (38,500) | (400) | (75,200) | (27,640) | (340,000) | |

| I | Misllanies | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| J | Total Outflows: | (380,475) | (24,517,125) | (120,075) | (3,427,225) | (47,515) | (2,050,575) | (16,975) | (1,722,625) | (310,975) | (9,114,325) | (876,015) | (40,831,875) | |

| K | Net Cash Flow from Local Sources | (355,875) | (14,236,625) | (117,975) | (3,296,725) | (45,415) | (1,920,075) | (14,875) | (1,592,125) | (308,875) | (8,983,825) | (843,015) | (30,029,375) | |

| L | Beginning Balance | 56,000 | 1,141,000 | 269,125 | 1,404,375 | 137,150 | 137,650 | 78,735 | 102,575 | 52,860 | 105,450 | N/A | N/A | |

| M | HQ Funding | 669,000 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 669,000 | 0 | |

| N | Net Cash Flow before Conversion | 369,125 | (13,095,625) | 151,150 | (1,892,350) | 91,735 | (1,782,425) | 63,860 | (1,489,550) | (256,015) | (8,878,375) | 419,855 | (27,138,325) | |

| O | Anticipated Conversion/HQ Funding | (90,315) | 13,095,625 | (13,051) | 1,892,350 | (12,293) | 1,782,425 | (10,273) | 1,489,550 | (61,230) | 8,878,375 | (187,161) | 27,138,325 | |

| P | Actual Conversion made | (100,000) | 14,500,000 | (14,000) | 2,030,000 | (13,000) | 1,885,000 | (11,000) | 1,595,000 | (70,000) | 10,150,000 | (208,000) | 30,160,000 | |

| Q | Net Cash Flow after Conversion | 269,125 | 1,404,375 | 137,150 | 137,650 | 78,735 | 102,575 | 52,860 | 105,450 | (326,015) | 1,271,625 | 211,855 | 3,021,675 | |

| R | Indication of Exceeding Imprest Level | 0 | N/A | 0 | N/A | 0 | N/A | 0 | N/A | 326,015 | N/A | 326,015 | N/A | |

| S | Addt'l HQ Funding | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 350,000 | 0 | |||

| T | Est. Weekly Cash Balance | 269,125 | 1,404,375 | 137,150 | 137,650 | 78,735 | 102,575 | 52,860 | 105,450 | 23,985 | 1,271,625 | N/A | N/A | |

| A | The timing and the amount of cash inflow from governments depends on each project's contract. Insert, revise or delete rows before the subtotal, based on your real projects. | |||||||||||||

| B | Based on agreements with agencies on Cost Recovery for Common Services. CO should have a great degree of control when to collect the funds.Insert rows before the subtotal, based on real situation. | |||||||||||||

| C | Input all other cash receipts in this category. Add rows for details before the subtotal if needed. | |||||||||||||

| D | This is a formula adding up all of the previous subtotals. When inserting new inflow categories, make sure the formula stays relevant. | |||||||||||||

| E | The disbursement for each project depends on its contact. Insert, revise, or delete rows before the subtotal, based on real projects. | |||||||||||||

| F | CO should require UN and agencies provide monthly forecast for their Non-UNDP payment amounts, timing, etc. which can be fine tuned when actual payment requests are received. Add rows before subtotal if needed. | |||||||||||||

| G | This is a example. The weekly amounts are based on the monthly estimated expenses and filled in the corresponding week. For simplicity sake, vehicle operating and miscellanious expenses are evenly disbursed in 5 weeks. | |||||||||||||

| CO should have certain amount and timing for each component of its own fixed expenses due to recurring nature. | ||||||||||||||

| H | Based on estimated weekly number to be fine tuned with actual invoices received. | |||||||||||||

| I | All other expenses other than the above ones should be input in this category. | |||||||||||||

| J | This is a formula. If more breakdown on type of outflows is needed, simply incert more rows but make sure the formula stays relevant. | |||||||||||||

| K | This is a formula adding total inflows and outflows from local sources. | |||||||||||||

| L | The balance for week 1 should be keyed in according to the last month's cash books, which is in the control box Cell D7 and F7. The remaining columes are formula equal to previous week's estimated balance in Row 70. | |||||||||||||

| M | This is a direct replenishment the CO receives from Treasury so the amount of funding is shown in week 1. $669,000 represents imprest level of $725,000 less previous month ending cashbook balance, rounded. | |||||||||||||

| N | This is a fomula adding up all cash inflows and outflows. | |||||||||||||

| O | When COs are short of cash (When LC accounts is negative in this example), they should transfer funding from their USD account to their LC account to cover the shortage. ) | |||||||||||||

| P | This row shows the actual funds transferred from USD account to LC account, or "conversion", Which make the cash balance on LC account more than 0 but not exceeding 25% of weekly utilization level. | |||||||||||||

| It's the row COs can manage based on their cash liquidity. | ||||||||||||||

| Q | This is a formula adding up Row 60 and 63. | |||||||||||||

| R | Any anticipated difficiency (negative number in Row 65) flags that the CO either needs additional replenishment from the Treasury for exceeding the imprest level. Actively manage this can | |||||||||||||

| avoid the delay in receiving additional replenishment or authorization. | ||||||||||||||

| S | Row 67 in the sample Model show the minimum amount COs should require from the Treasure to cover their cash shortage. However, we expect COs to round up the figure as shown in sample Model with amount of $350,000. COs | |||||||||||||

| should actively manage the amount of additional HQ Funding when the Net Cash Flow after Conversion (Row 65) starts to turn negative, to make sure the Est. Weekly Cash Balance (Row 70) keep positive in every | ||||||||||||||

| week. | ||||||||||||||

| T | The final estimated weekly cash balance which CO should have by projecting the above cash flow cautiously. | |||||||||||||

no reviews yet

Please Login to review.